Market Overview

The Israel Software Defined Radio market was valued at USD ~ billion based on a recent historical assessment, supported by defense modernization budgets, secure communications demand, and sustained procurement of advanced tactical radios. Market expansion is driven by military digitization initiatives, encrypted battlefield communications, integration of SDRs across air, land, and naval platforms, and rising requirements for interoperability among allied forces. Strong domestic defense manufacturing, continuous upgrades of legacy communication infrastructure, and high adoption of network-centric warfare concepts continue to sustain procurement momentum across programs.

Israel’s dominance in the Software Defined Radio market is centered around cities such as Tel Aviv, Haifa, and Beersheba due to their concentration of defense R&D facilities, military command centers, and advanced electronics manufacturing ecosystems. The country’s leadership is reinforced by close collaboration between the defense ministry, armed forces, and domestic technology firms, alongside strong export-oriented production capabilities. Advanced testing infrastructure, skilled engineering talent, and sustained government backing for indigenous communication technologies further strengthen national leadership.

Market Segmentation

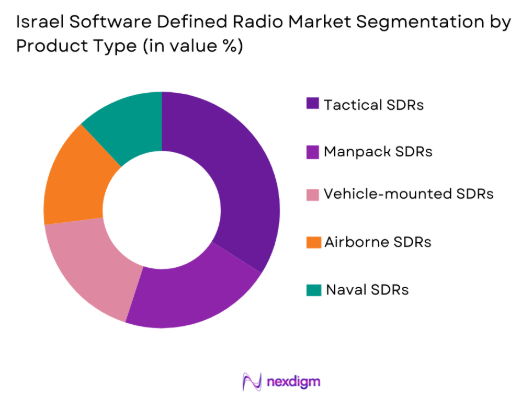

By Product Type

Israel Software Defined Radio market is segmented by product type into tactical SDRs, manpack SDRs, vehicle-mounted SDRs, airborne SDRs, and naval SDRs. Recently, tactical SDRs have a dominant market share due to widespread deployment across infantry units, armored formations, and command networks requiring secure, real-time voice and data transmission. Tactical SDRs benefit from high replacement cycles, continuous software upgrades, and compatibility with multiple waveforms used across joint operations. Their dominance is further reinforced by adaptability to electronic warfare environments, integration with situational awareness systems, and extensive domestic production aligned with operational doctrines emphasizing battlefield mobility and survivability.

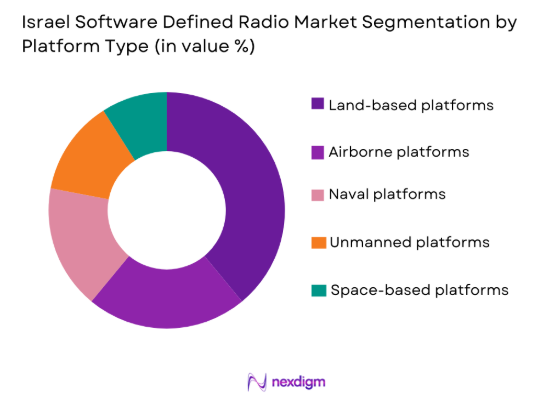

By Platform Type

Israel Software Defined Radio market is segmented by platform type into land-based, airborne, naval, space-based, and unmanned platforms. Recently, land-based platforms dominate the market due to extensive deployment across ground forces, border security units, and homeland defense operations. Land-based SDRs are prioritized because they support large-scale troop communications, resilient mesh networks, and integration with command-and-control architectures. Their dominance is supported by continuous upgrades, multi-role usage across combat and security missions, and sustained procurement programs focused on ground force readiness and interoperability.

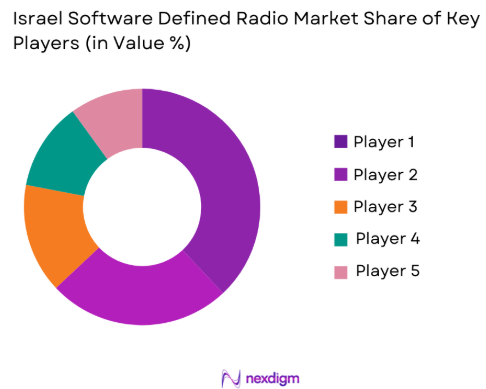

Competitive Landscape

The Israel Software Defined Radio market is moderately consolidated, dominated by a small group of domestic defense primes with strong system integration capabilities and long-term government contracts. These players leverage proprietary waveforms, cybersecurity expertise, and export relationships to maintain competitive advantage. Smaller firms operate in niche software, subsystems, and upgrades, while high entry barriers, security regulations, and procurement cycles limit new entrants and reinforce incumbent positioning across military communication programs.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Defense Specialization |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Lod, Israel | ~ | ~ | ~ | ~ | ~ |

| Tadiran Communications | 1962 | Holon, Israel | ~ | ~ | ~ | ~ | ~ |

| Orbit Communication Systems | 1950 | Netanya, Israel | ~ | ~ | ~ | ~ | ~ |

Israel Software Defined Radio Market Analysis

Growth Drivers

Defense Communication Modernization Programs

Defense communication modernization programs are a primary growth driver because armed forces increasingly depend on secure, high-capacity, and interoperable communication systems across all operational domains. Israel’s military doctrine emphasizes real-time intelligence sharing, rapid command execution, and resilient battlefield connectivity, which directly accelerates adoption of advanced software defined radios. Continuous replacement of legacy analog radios with software-centric platforms enables flexible waveform deployment, encryption upgrades, and seamless interoperability with allied systems. Modernization programs also prioritize network-centric warfare, where SDRs function as the backbone for data fusion, situational awareness, and command-and-control operations. The ability to reconfigure radios through software reduces lifecycle costs and extends operational relevance, encouraging sustained procurement. Integration of SDRs with sensors, unmanned systems, and electronic warfare assets further reinforces demand. Government-backed funding ensures long-term program continuity. Export-driven production aligned with modernization initiatives sustains industrial growth. These factors collectively reinforce market expansion.

Electronic Warfare and Secure Communications Demand

Rising electronic warfare threats and spectrum congestion significantly drive demand for advanced software defined radios capable of adaptive, jam-resistant communications. Israel’s operational environment requires radios that dynamically shift frequencies, employ advanced encryption, and maintain connectivity under hostile conditions. SDRs support cognitive radio capabilities that detect interference and optimize spectrum usage in real time. Secure communications are critical for protecting sensitive intelligence and operational data across joint missions. Increasing integration of SDRs into cyber-resilient defense architectures further accelerates adoption. Interoperability with allied forces mandates compliance with multiple encryption standards and waveforms. Continuous software upgrades address evolving threat vectors. This security-driven demand sustains high procurement intensity. Strategic emphasis on communication dominance reinforces long-term growth.

Market Challenges

High System Complexity and Certification Barriers

High system complexity and certification barriers pose a significant challenge for the Israel Software Defined Radio market because SDR platforms require simultaneous coordination of advanced hardware, embedded software, encryption protocols, and waveform adaptability. Defense-grade radios must comply with stringent military communication standards, electromagnetic compatibility requirements, and cybersecurity certifications, all of which extend development and qualification timelines. Continuous software reconfiguration, which is a core advantage of SDRs, paradoxically increases validation workload because each update requires rigorous security and performance testing. Integration with legacy communication systems further complicates deployment, as older platforms often lack the processing capacity or interface compatibility needed for modern SDR architectures. These technical hurdles elevate development costs, slow time-to-fielding, and place pressure on procurement schedules, particularly for large-scale defense programs.

Supply Chain Dependence and Technology Access Constraints

Supply chain dependence and technology access constraints represent another critical challenge affecting the Israel Software Defined Radio market, particularly due to reliance on advanced semiconductors, RF components, and specialized processors that are subject to global supply volatility. Many SDR components require military-grade or radiation-hardened specifications, which limits supplier availability and increases procurement risk. Geopolitical restrictions and export control regulations can delay access to critical technologies, impacting production schedules and system upgrades. Long lead times for key components complicate inventory planning and raise overall system costs. Additionally, dependence on foreign suppliers exposes manufacturers to currency fluctuations and regulatory uncertainties, reducing flexibility in long-term program execution. These constraints collectively restrict scalability, elevate financial risk, and challenge manufacturers’ ability to meet evolving defense communication requirements within fixed timelines.

Opportunities

AI-Enabled Cognitive and Adaptive Radio Architectures

AI-enabled cognitive and adaptive radio architectures represent a significant opportunity for the Israel Software Defined Radio market as defense forces increasingly prioritize autonomous, self-optimizing communication systems capable of operating in highly contested electromagnetic environments. The integration of artificial intelligence and machine learning into SDR platforms enables real-time spectrum sensing, dynamic waveform selection, predictive interference mitigation, and automated network optimization without direct human intervention. These capabilities align closely with Israel’s operational focus on rapid decision-making, multi-domain operations, and electronic warfare superiority. AI-driven SDRs can enhance mission resilience by maintaining secure connectivity under jamming, spoofing, or spectrum congestion conditions, which are increasingly common in modern conflict scenarios. Domestic strengths in AI research, cybersecurity, and defense electronics provide a strong foundation for accelerated development and deployment of such systems. Government-backed innovation programs and military experimentation units further support the transition from conventional SDRs to intelligent communication nodes. Additionally, AI-enabled SDRs offer export potential to allied nations seeking advanced, future-ready communication solutions, positioning Israeli manufacturers favorably in global defense markets. Over time, software-centric AI upgrades can extend system lifecycles, improve cost efficiency, and create recurring revenue streams through software licensing and support, reinforcing long-term market expansion.

Expansion Through Defense Exports and International Collaboration Programs

Expansion through defense exports and international collaboration programs presents another major opportunity for the Israel Software Defined Radio market, driven by growing global demand for secure, interoperable, and combat-proven military communication systems. Many countries are modernizing their armed forces and seeking SDR solutions that can integrate seamlessly with NATO and allied communication standards, creating strong demand for adaptable Israeli technologies. Israel’s established reputation in secure communications, electronic warfare, and battlefield networking enhances trust among international customers. Participation in joint development programs, offset agreements, and government-to-government defense deals enables local manufacturers to access new markets while sharing development risks. Customizable software architectures allow SDR platforms to be tailored to specific operational doctrines, frequency regulations, and security requirements of partner nations, increasing adoption potential. International collaboration also facilitates technology exchange, supply chain diversification, and scalability of production. As geopolitical uncertainties drive nations to invest in resilient communication infrastructure, export-oriented SDR programs can reduce reliance on domestic procurement cycles and stabilize revenues. Over the medium term, expanding global footprints through partnerships, licensed production, and system integration agreements can significantly strengthen competitive positioning, enhance economies of scale, and support sustained growth for the Israel Software Defined Radio market.

Future Outlook

The Israel Software Defined Radio market is expected to demonstrate sustained growth over the next five years, supported by continued defense modernization, rising electronic warfare threats, and increasing reliance on secure digital communications. Advancements in cognitive radio technologies, artificial intelligence integration, and software-centric upgrades will enhance system adaptability and operational resilience. Strong government backing for indigenous defense electronics, coupled with expanding export opportunities and international collaborations, is likely to reinforce market stability. Demand from land, airborne, and unmanned platforms will remain strong, while regulatory emphasis on interoperability and cybersecurity will further shape future procurement priorities.

Major Players

- Elbit Systems

- Rafael Advanced Defense Systems

- Israel Aerospace Industries

- TadiranCommunications

- Orbit Communication Systems

- Commtact

- Aeronautics Group

- Elta Systems

- Gilat Satellite Networks

- Ceragon Networks

- Radwin

- Ewave Mobile

- Bittium Israel

- Silicom

- Camero Tech

Key Target Audience

- Defense ministries

- Armed forces procurement agencies

- Homeland security agencies

- Intelligence organizations

- Defense system integrators

- Communication equipment manufacturers

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Key technical, operational, and procurement variables were identified to define the scope of the Israel Software Defined Radio market. Demand drivers, regulatory factors, and technology trends were mapped. Data points were aligned with defense communication requirements. Variables were validated through secondary sources.

Step 2: Market Analysis and Construction

Collected data was structured to analyze market dynamics and segmentation. Defense spending patterns and procurement programs were evaluated. Competitive positioning was assessed across product categories. Market structure was constructed accordingly.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were validated through expert consultations and defense industry insights. Assumptions were refined based on feedback. Technology adoption trends were cross-verified. Risk factors were reassessed.

Step 4: Research Synthesis and Final Output

Validated insights were synthesized into a coherent market framework. Quantitative and qualitative findings were integrated. Conclusions were structured to meet research objectives. Final outputs were reviewed for consistency.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Modernization of military communication networks

Rising demand for secure and interoperable communications

Increased adoption of network centric warfare concepts

Integration of SDRs in unmanned and autonomous platforms

Government investment in indigenous defense electronics - Market Challenges

High system development and integration costs

Complex certification and security compliance requirements

Interoperability issues across legacy communication systems

Dependence on advanced semiconductor supply chains

Long procurement and approval cycles - Market Opportunities

Expansion of SDR deployment in homeland security operations

Development of export oriented advanced waveform solutions

Integration of artificial intelligence for adaptive communications - Trends

Shift toward cognitive and adaptive radio systems

Increased use of software upgradability over hardware replacement

Growing focus on cyber resilient communication architectures

Miniaturization of SDR systems for portable platforms

Convergence of military and public safety communication standards - Government Regulations & Defense Policy

Emphasis on secure military communication standards

Support for domestic defense electronics manufacturing

Policies promoting interoperability across allied forces

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Tactical software defined radios

Vehicle mounted software defined radios

Manpack software defined radios

Base station software defined radios

Naval and airborne software defined radios - By Platform Type (In Value%)

Land based platforms

Naval platforms

Airborne platforms

Space and satellite platforms

Unmanned systems platforms - By Fitment Type (In Value%)

New installation fitment

Retrofit and upgrade fitment

Platform integration fitment

Mission specific fitment

Network expansion fitment - By End User Segment (In Value%)

Defense forces

Homeland security agencies

Intelligence and surveillance agencies

Public safety organizations

Critical infrastructure operators - By Procurement Channel (In Value%)

Direct government procurement

Defense prime contractors

System integrators

Technology partnerships and alliances

Government funded R&D programs - By Material / Technology (in Value %)

Wideband RF modules

Cognitive radio architectures

FPGA based processing units

AI enabled signal processing software

Secure encryption and waveform technology

- Market share snapshot of major players

- Cross Comparison Parameters (System performance, waveform flexibility, encryption capability, interoperability level, platform compatibility, upgradeability, lifecycle cost, regulatory compliance, delivery timelines)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Elbit Systems

Rafael Advanced Defense Systems

Israel Aerospace Industries

Orbit Communication Systems

Tadiran Communications

Commtact

Aeronautics Group

Bittium Israel

Elta Systems

Camero Tech

Radwin

Gilat Satellite Networks

Ceragon Networks

Ewave Mobile

Silicom

- Defense forces prioritize secure and jam resistant communication links

- Homeland security users focus on interoperability and rapid deployment

- Intelligence agencies demand high bandwidth and encrypted data transfer

- Public safety organizations require scalable and resilient systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035