Market Overview

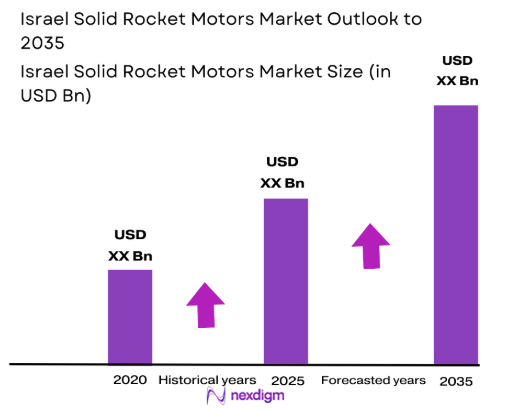

The Israel Solid Rocket Motors Market recorded a market size of USD ~ billion based on a recent historical assessment, reflecting sustained procurement across missile defense programs, tactical weapon systems, and space propulsion applications. Demand is driven by ongoing modernization of national defense capabilities, continuous upgrades to missile interception systems, and steady investments in indigenous aerospace manufacturing. Solid rocket motors remain critical due to their operational reliability, rapid ignition capability, long storage life, and reduced maintenance requirements, making them a preferred propulsion solution for both military and space-based platforms.

The market is dominated by Israel, with core activity concentrated in Tel Aviv, Haifa, and Beersheba due to the presence of major defense manufacturers, propulsion research centers, and advanced testing infrastructure. These cities benefit from close collaboration between government agencies, armed forces, and domestic industries, enabling accelerated development cycles and efficient system integration. Strong regulatory support, established supply chains, and a skilled engineering workforce further reinforce national dominance in solid rocket motor development and deployment across defense and aerospace programs.

Market Segmentation

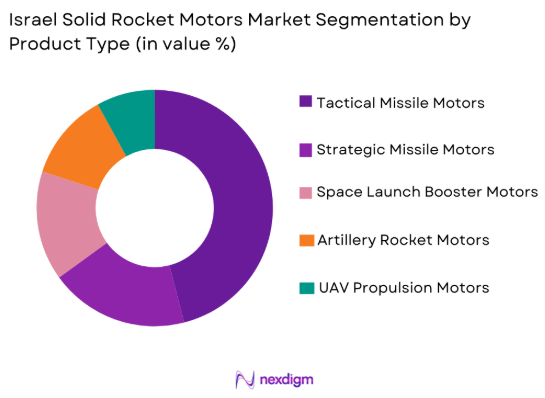

By Product Type

Israel Solid Rocket Motors market is segmented by product type into tactical missile motors, strategic missile motors, space launch booster motors, artillery rocket motors, and unmanned aerial vehicle propulsion motors. Recently, tactical missile motors have a dominant market share due to their extensive deployment across short- and medium-range missile systems designed for rapid response and high operational flexibility. These motors are widely used in air defense, surface-to-surface, and interceptor systems that require reliable propulsion under diverse environmental conditions. The dominance of tactical missile motors is further supported by consistent defense procurement cycles, emphasis on border security, and continuous upgrades to guidance and warhead technologies that depend on stable propulsion performance. Additionally, tactical systems benefit from lower unit costs, scalable production volumes, and faster development timelines compared to strategic or space-focused motors, reinforcing their leading position within the overall product segmentation.

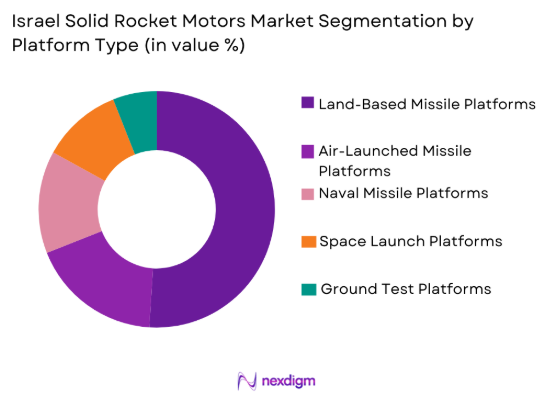

By Platform Type

Israel Solid Rocket Motors market is segmented by platform type into land-based missile platforms, air-launched missile platforms, naval missile platforms, space launch platforms, and ground test platforms. Recently, land-based missile platforms have a dominant market share due to their central role in national defense architecture and widespread deployment across fixed and mobile systems. These platforms support air defense, surface-to-surface, and anti-missile applications that require dependable propulsion and rapid readiness. The dominance of land-based platforms is reinforced by established testing ranges, integration facilities, and logistical infrastructure optimized for terrestrial systems. Government focus on territorial defense readiness, layered missile defense networks, and rapid response capabilities sustains higher procurement volumes for land-based systems compared to naval or space platforms, consolidating their leading position.

Competitive Landscape

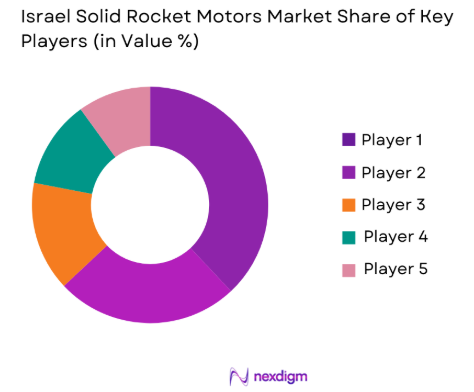

The Israel Solid Rocket Motors Market is characterized by a concentrated competitive landscape dominated by a small number of vertically integrated defense manufacturers with strong government linkages. Market consolidation is evident through long-term defense contracts, limited entry of new players, and high technological barriers related to propulsion chemistry, safety certification, and testing requirements. Major players leverage proprietary technologies, in-house research capabilities, and close collaboration with defense agencies to maintain competitive positioning and secure recurring procurement programs.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ |

| IMI Systems | 1933 | Israel | ~ | ~ | ~ | ~ | ~ |

| Aeronautics Group | 1997 | Israel | ~ | ~ | ~ | ~ | ~ |

Israel Solid Rocket Motors Market Analysis

Growth Drivers

Indigenous Missile Defense Modernization Programs

Indigenous missile defense modernization programs are a primary growth driver for the Israel Solid Rocket Motors Market as national defense priorities emphasize self-reliance, rapid deployment, and system reliability across multiple threat environments. Continuous upgrades to interceptor systems, air defense networks, and tactical missile platforms require advanced solid propulsion units capable of delivering consistent thrust and precise performance. These programs prioritize domestically developed rocket motors to ensure security of supply, reduce dependence on foreign technologies, and maintain operational secrecy. Investments in research, testing, and manufacturing infrastructure further support the development of high-energy propellants and lightweight motor casings. As missile defense systems expand in complexity and coverage, demand for specialized solid rocket motors increases across short-range, medium-range, and interceptor applications. The integration of new guidance technologies and payload enhancements also necessitates propulsion systems with higher performance margins. Long-term procurement contracts and multi-year defense budgets provide stable revenue visibility for manufacturers. This sustained policy-driven demand underpins consistent market growth and reinforces the strategic importance of solid rocket motors within national defense planning.

Expansion of Space Launch and Satellite Programs

Expansion of space launch and satellite programs significantly contributes to growth in the Israel Solid Rocket Motors Market by increasing demand for reliable booster and upper-stage propulsion systems. National investments in satellite deployment for communication, surveillance, and navigation require solid rocket motors that offer predictable ignition, structural simplicity, and operational safety. Solid propulsion remains essential for launch vehicle stages and auxiliary boosters supporting orbital insertion missions. Growth in small satellite launches and responsive space capabilities further amplifies the need for compact, high-performance motors. Domestic space initiatives encourage local manufacturing and testing of propulsion systems, fostering technological advancement and industrial capability. Collaboration between space agencies, defense organizations, and private aerospace firms accelerates innovation in propellant chemistry and motor design. These developments support repeated launch cycles and long-term mission planning. As space infrastructure becomes increasingly strategic, propulsion reliability and availability drive sustained market demand.

Market Challenges

High Development and Certification Complexity

High development and certification complexity presents a significant challenge in the Israel Solid Rocket Motors Market due to stringent safety, reliability, and performance standards required for defense and aerospace applications. Solid rocket motors must undergo extensive testing across thermal, mechanical, and environmental conditions before deployment. Certification processes involve multiple regulatory bodies and prolonged validation timelines, increasing development costs and delaying commercialization. Any design modification requires requalification, limiting rapid innovation cycles. The handling and storage of energetic materials impose additional safety protocols and compliance requirements. Manufacturers must invest heavily in specialized facilities and skilled personnel to meet these standards. These barriers restrict new entrants and place financial pressure on existing players. As propulsion systems become more advanced, certification complexity continues to intensify, constraining market agility.

Supply Chain and Material Constraints

Supply chain and material constraints challenge the Israel Solid Rocket Motors Market due to dependence on specialized raw materials, energetic compounds, and composite structures with limited global suppliers. Disruptions in material availability can delay production schedules and increase costs. Strict quality requirements limit supplier diversification, increasing vulnerability to logistical disruptions. Geopolitical factors and export controls further complicate access to critical inputs. Manufacturers must maintain inventory buffers, raising working capital requirements. Developing alternative materials requires extensive testing and requalification. These constraints reduce operational flexibility and can impact delivery commitments. Sustained supply chain resilience remains a critical concern for market participants.

Opportunities

Advanced Solid Propellant and Lightweight Casing Innovation

Advanced solid propellant and lightweight casing innovation represents a major opportunity for the Israel Solid Rocket Motors Market as defense and space programs increasingly demand higher performance within compact system envelopes. Continuous research into high-energy propellant formulations enables improved thrust efficiency, extended range, and enhanced payload capacity without increasing motor size. Lightweight composite casings and filament-wound structures further reduce overall system mass, improving maneuverability and launch flexibility across tactical and interceptor platforms. These innovations support next-generation missile defense architectures and responsive space launch requirements. Domestic investment in materials science strengthens intellectual property creation and reduces reliance on external suppliers. As performance benchmarks rise, manufacturers that successfully commercialize advanced propellant chemistry and casing technologies can secure long-term procurement contracts and potential export opportunities.

Expansion of International Defense and Space Collaboration Programs

Expansion of international defense and space collaboration programs offers a strong growth opportunity for the Israel Solid Rocket Motors Market by broadening demand beyond domestic procurement cycles. Joint missile defense initiatives, cooperative space missions, and co-development agreements increase the need for interoperable and certified solid propulsion systems. Participation in multinational programs allows manufacturers to share development costs, access complementary expertise, and accelerate technology validation. Collaborative frameworks also facilitate entry into allied markets where domestic suppliers may be restricted. As geopolitical alliances emphasize collective defense and space situational awareness, demand for reliable propulsion components rises. These partnerships support production scale-up, revenue diversification, and long-term market resilience while reinforcing Israel’s position as a trusted propulsion technology partner.

Future Outlook

The Israel Solid Rocket Motors Market is expected to experience steady growth over the next five years driven by sustained defense modernization, expanding space programs, and continued investment in propulsion innovation. Technological advancements in materials and manufacturing will enhance performance and efficiency. Regulatory support for indigenous production will remain strong. Demand-side momentum from missile defense and satellite deployment will underpin market stability.

Major Players

- Rafael Advanced Defense Systems

- Israel Aerospace Industries

- Elbit Systems

- IMI Systems

- Aeronautics Group

- Tomer Ltd

- Ashot Ashkelon Industries

- SCD Semiconductor Devices

- BIRD Aerosystems

- Orbit Communication Systems

- Gilat Satellite Networks

- BlueBirdAero Systems

- ContropPrecision Technologies

- Rotem Industries

- Silver Arrow

Key Target Audience

- Defense manufacturers

- Aerospace companies

- Missile system integrators

- Space agencies

- Government and regulatory bodies

- Investments and venture capitalist firms

- Defense procurement agencies

- Strategic technology investors

Research Methodology

Step 1: Identification of Key Variables

Key variables such as propulsion type, application area, procurement patterns, and regulatory frameworks were identified. Market boundaries were clearly defined. Data sources were mapped. Assumptions were validated.

Step 2: Market Analysis and Construction

Market structure was analyzed using secondary data and industry reports. Segmentation frameworks were constructed. Demand drivers were evaluated. Supply-side dynamics were assessed.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses were validated through expert interviews and industry consultations. Technical insights were incorporated. Assumptions were refined. Data consistency was verified.

Step 4: Research Synthesis and Final Output

Findings were synthesized into a structured framework. Insights were cross-validated. Final narratives were developed. Quality checks ensured accuracy.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for indigenous missile and rocket propulsion systems

Expansion of national missile defense and strike capabilities

Continuous modernization of tactical and strategic weapons

Increased investment in space launch and satellite programs

Focus on propulsion performance, reliability, and safety - Market Challenges

High development and testing costs for advanced motor systems

Strict regulatory and safety compliance requirements

Limited availability of specialized raw materials

Complexity in scaling production for diverse applications

Export restrictions and geopolitical sensitivities - Market Opportunities

Advancements in high-energy propellant formulations

Growing demand for lightweight composite motor casings

Collaboration with international defense and space programs - Trends

Shift toward modular and scalable motor designs

Integration of advanced simulation and digital twin technologies

Increased use of composite and filament-wound casings

Emphasis on extended shelf life and storage stability

Adoption of automated and precision manufacturing processes - Government Regulations & Defense Policy

Strengthening of domestic defense manufacturing mandates

Enhanced safety and environmental regulations for propellants

Policy support for indigenous missile and space propulsion programs

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Tactical missile solid rocket motors

Strategic missile solid rocket motors

Launch vehicle booster motors

Artillery and rocket-assisted projectile motors

Unmanned aerial vehicle propulsion motors - By Platform Type (In Value%)

Land-based missile platforms

Naval-launched missile systems

Air-launched missile systems

Space launch platforms

Ground-based test and evaluation platforms - By Fitment Type (In Value%)

Original equipment manufacturer fitment

Retrofit and upgrade fitment

Prototype and development fitment

Maintenance and refurbishment fitment

Export-oriented system integration fitment - By End User Segment (In Value%)

Defense forces and armed services

Government research and space agencies

Domestic missile manufacturers

Aerospace and propulsion R&D institutions

Strategic defense program offices - By Procurement Channel (In Value%)

Direct government contracts

Defense ministry procurement programs

Strategic long-term supply agreements

Indigenous development initiatives

International collaborative procurement - By Material / Technology (in Value %)

Composite propellant technology

Double-base propellant technology

Case-bonded motor technology

Carbon fiber motor casing technology

Additive manufacturing enabled components

- Market share snapshot of major players

- Cross Comparison Parameters (thrust range, propellant type, casing material, motor size, application range, production capacity, technological maturity, compliance standards, integration capability)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Rafael Advanced Defense Systems

Israel Aerospace Industries

Elbit Systems

Tomcar Technologies

Aeronautics Group

IMI Systems

BIRD Aerosystems

Rotem Industries

SCD Semiconductor Devices

Controp Precision Technologies

Orbit Communication Systems

Gilat Satellite Networks

Ashot Ashkelon Industries

Silver Arrow

BlueBird Aero Systems

- Defense forces prioritize reliability and rapid deployment capability

- Space agencies focus on thrust efficiency and mission flexibility

- Manufacturers emphasize cost optimization and production scalability

- Research institutions drive innovation in propellant chemistry

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035