Market Overview

The Israel Space Debris Monitoring and Removal Market current size stands at around USD ~ million, supported by increasing orbital activity and national security priorities. The market recorded consistent operational expansion during 2024 and 2025, driven by rising satellite deployments and debris tracking missions. Government-backed programs accelerated system deployments across surveillance and mitigation domains. Technological investments strengthened radar, optical, and analytics capabilities. Private participation expanded through service contracts and collaborative missions. Market activity remains closely linked to defense and space sustainability objectives.

Israel’s market development is concentrated around established aerospace clusters and defense innovation corridors. Strong integration between military agencies, research institutes, and commercial operators supports rapid capability deployment. The ecosystem benefits from advanced sensor manufacturing, software development expertise, and secure data infrastructure. Policy alignment with international space safety frameworks further encourages adoption. Government procurement mechanisms ensure stable demand across monitoring and removal services. Collaborative international programs also enhance operational exposure and technology validation.

Market Segmentation

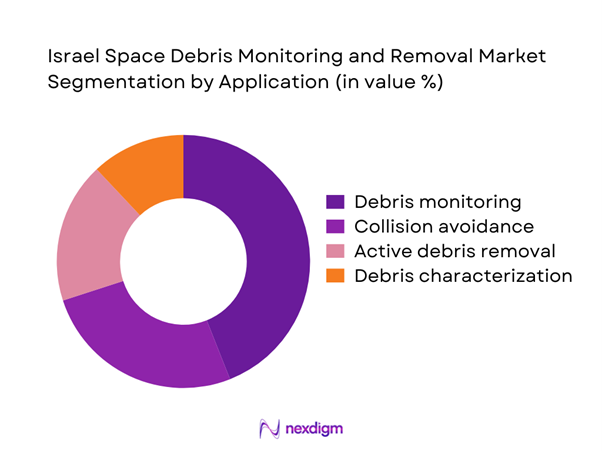

By Application

Active debris monitoring dominates the market due to continuous satellite traffic growth and collision risk management requirements. Surveillance-based applications account for the largest deployment share as operators prioritize tracking accuracy and real-time alert systems. Removal missions remain fewer but are expanding steadily due to regulatory pressure and mission demonstration programs. Collision avoidance services see consistent adoption among defense and commercial operators. Data analytics and debris characterization are increasingly integrated into mission planning. Application diversification continues as new orbital servicing models emerge.

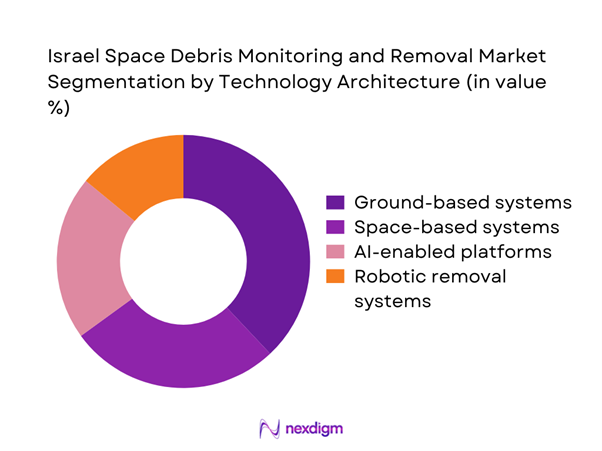

By Technology Architecture

Ground-based radar and optical systems currently dominate due to proven reliability and lower deployment complexity. Space-based monitoring platforms are expanding as sensor miniaturization improves coverage efficiency. AI-enabled tracking systems are gaining traction through enhanced predictive accuracy. Robotic capture and tether technologies remain in early adoption stages but show strong future potential. Integration of multi-layer architectures improves tracking continuity and response time. Technology selection is strongly influenced by mission duration and orbital range.

Competitive Landscape

The competitive environment is shaped by defense-led innovation, government contracts, and specialized aerospace engineering capabilities. Companies compete on technological reliability, mission success rates, and system integration depth. Strategic partnerships and government collaborations strongly influence positioning.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| ImageSat International | 1997 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Astroscale | 2013 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

Israel Space Debris Monitoring and Removal Market Analysis

Growth Drivers

Rising satellite launches and orbital congestion

The increasing number of satellite launches has intensified orbital congestion across low Earth orbit regions. This congestion raises collision probability and elevates operational risk for satellite operators. Government agencies emphasize continuous monitoring to ensure mission continuity and asset protection. Commercial satellite operators increasingly integrate debris monitoring into mission planning processes. Technological improvements enable higher tracking accuracy and faster threat detection. National security priorities further strengthen demand for real-time space situational awareness. Regulatory pressure reinforces the need for compliant debris mitigation practices. Advanced analytics support predictive modeling for orbital object movement. These factors collectively accelerate market adoption across monitoring solutions. Sustained launch activity continues driving long-term market momentum.

Government investment in space situational awareness

Public sector investment plays a central role in expanding monitoring and removal capabilities. Defense and space agencies allocate budgets toward orbital safety infrastructure development. National security strategies emphasize protection of space-based assets. Funding supports sensor upgrades and data processing enhancements. Collaborative programs promote technology validation through demonstration missions. Public-private partnerships improve commercialization pathways for advanced systems. Policy frameworks increasingly mandate debris tracking compliance. Government-backed research accelerates innovation cycles and deployment readiness. These investments stabilize demand and reduce commercialization risk. Long-term institutional commitment ensures sustained market growth.

Challenges

High technological complexity and system integration challenges

Space debris monitoring requires advanced sensor fusion and precision engineering capabilities. Integration across ground and space platforms presents operational complexities. System interoperability remains difficult due to diverse data formats. Development cycles are prolonged due to extensive testing requirements. Reliability standards increase engineering and certification burdens. Limited availability of specialized components affects deployment timelines. High technical entry barriers restrict new market participants. Continuous system upgrades are necessary to maintain accuracy. Integration challenges elevate operational risk during mission execution. These factors collectively restrain rapid scalability.

Regulatory uncertainty and liability concerns

Global regulatory frameworks for debris removal remain fragmented and evolving. Liability attribution for debris interaction lacks universal clarity. Operators face legal risks associated with active removal missions. Cross-border orbital operations complicate jurisdictional compliance. Insurance coverage remains limited due to operational uncertainties. Regulatory delays slow commercial deployment approvals. Policy misalignment creates hesitation among private investors. Compliance costs increase operational complexity for service providers. Absence of standardized enforcement mechanisms limits adoption. Regulatory uncertainty remains a key market constraint.

Opportunities

Expansion of commercial debris removal services

Growing orbital congestion creates strong demand for commercial debris mitigation solutions. Satellite operators increasingly outsource removal and monitoring functions. Service-based business models reduce capital investment burdens. Demonstration missions validate technical feasibility and operational safety. Emerging standards support commercialization of debris remediation services. Insurance providers encourage proactive debris management practices. Commercial contracts enhance revenue visibility for service providers. International collaborations expand addressable mission scope. Technological maturity improves mission success probability. This creates strong long-term market opportunity.

Adoption of AI-enabled tracking and analytics platforms

Artificial intelligence enhances object detection and trajectory prediction accuracy. Automated analytics reduce manual intervention requirements significantly. AI-driven platforms enable faster threat assessment and response planning. Integration with sensor networks improves situational awareness quality. Machine learning models adapt to evolving orbital environments. Operational efficiency increases through predictive maintenance capabilities. Data-driven insights support mission optimization strategies. AI adoption reduces long-term operational costs. Advanced analytics attract both government and commercial clients. This trend accelerates technological differentiation.

Future Outlook

The market is expected to experience sustained growth through expanding satellite deployments and increasing regulatory enforcement. Technological advancements will enhance tracking precision and mission reliability. Greater private sector participation is anticipated as commercial models mature. International collaboration will strengthen operational coverage and compliance alignment. Long-term demand will remain supported by orbital sustainability initiatives.

Major Players

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- Elbit Systems

- ImageSat International

- Astroscale

- Lockheed Martin

- Northrop Grumman

- ClearSpace

- LeoLabs

- OHB SE

- Telespazio

- Airbus Defence and Space

- Thales Alenia Space

- GMV Aerospace

- Blue Origin

Key Target Audience

- Government space agencies and defense ministries

- National space regulatory authorities

- Satellite operators and fleet owners

- Space situational awareness service providers

- Aerospace and defense system integrators

- Commercial space infrastructure developers

- Investments and venture capital firms

- International space safety and coordination agencies

Research Methodology

Step 1: Identification of Key Variables

Market boundaries, application scope, and technology categories were defined through domain analysis. Operational parameters and deployment models were mapped. Key demand drivers were identified through industry consultations.

Step 2: Market Analysis and Construction

Data was structured using deployment trends, program activity, and service adoption patterns. Segmentation logic was applied based on technology and application relevance.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through discussions with industry professionals and technical experts. Assumptions were refined using operational feedback and project data.

Step 4: Research Synthesis and Final Output

Insights were consolidated through triangulation and consistency checks. Final outputs were aligned with market realities and future outlook considerations.

- Executive Summary

- Research Methodology (Market Definitions and orbital debris classification framework, Segmentation based on surveillance assets and removal mission taxonomy, Bottom-up market sizing using mission contracts and platform deployment data, Revenue estimation through service contracts and government program analysis, Primary validation with space agency officials and satellite operators, Data triangulation using launch records, SSA databases, and defense procurement disclosures)

- Definition and scope

- Market evolution

- Usage and operational mission profiles

- Ecosystem structure

- Supply chain and capability stack

- Regulatory and policy environment

- Growth Drivers

- Challenges

- Opportunities

- Trends

- Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Revenue per Mission, 2020–2025

- By Fleet Type (in Value %)

Ground-based surveillance systems

Space-based monitoring satellites

Active debris removal spacecraft

Hybrid monitoring-removal platforms - By Application (in Value %)

Collision avoidance and tracking

Debris characterization and mapping

Active debris capture and deorbiting

Post-mission disposal services - By Technology Architecture (in Value %)

Radar-based tracking systems

Optical and electro-optical systems

AI-enabled space situational awareness platforms

Robotic and tether-based removal systems - By End-Use Industry (in Value %)

Defense and national security

Commercial satellite operators

Space agencies and research institutions

Launch service providers - By Connectivity Type (in Value %)

Ground-to-space communication

Inter-satellite links

Hybrid connectivity networks - By Region (in Value %)

Israel

North America

Europe

Asia Pacific

Rest of World

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (technology maturity, mission success rate, orbital coverage, contract value, government alignment, integration capability, pricing model, scalability)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Israel Aerospace Industries (IAI)

Rafael Advanced Defense Systems

Elbit Systems

ImageSat International

NSLComm

UVision Air

Asteria Aerospace

OHB Israel

Telespazio Israel

Israel Space Agency-affiliated startups

Lockheed Martin

Northrop Grumman

Astroscale

ClearSpace

LeoLabs

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Revenue per Mission, 2026–2035