Market Overview

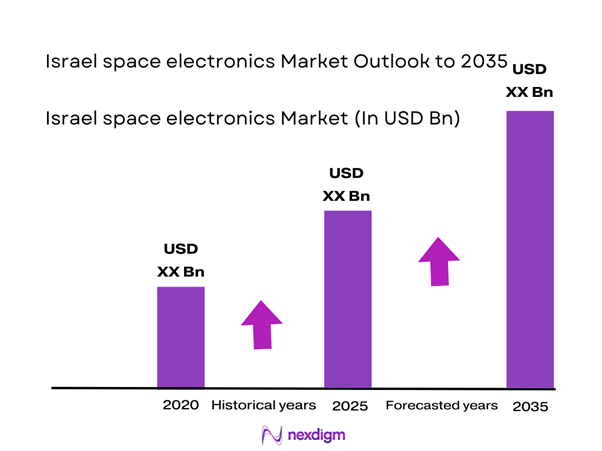

The Israel space electronics market current size stands at around USD ~ million and reflects sustained expansion driven by defense and commercial satellite investments. During 2024 and 2025, rising satellite launches, avionics upgrades, and secure communication programs supported consistent demand for radiation-hardened electronics. Increasing domestic manufacturing capacity and system-level integration capabilities further strengthened market stability. Government-backed innovation programs and defense modernization initiatives supported continuous development of payload electronics, onboard computing, and power management solutions. The market also benefited from steady procurement cycles and long-term space mission planning.

The market is concentrated around key aerospace and defense hubs with strong infrastructure, skilled engineering talent, and established supply chains. Tel Aviv and central Israel host most design, integration, and testing facilities, supported by close proximity to defense agencies. Southern regions contribute through manufacturing and testing infrastructure. Strong collaboration between government agencies, system integrators, and research institutions supports ecosystem maturity. Regulatory alignment and national security priorities further shape market structure and participation levels.

Market Segmentation

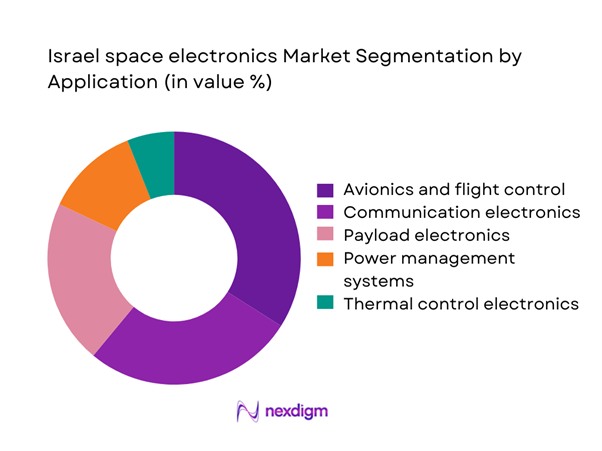

By Application

The application segmentation is dominated by avionics, communication payloads, and power management systems used across military and commercial missions. Avionics accounts for the highest adoption due to critical flight control, navigation, and data handling requirements. Communication electronics follow closely, driven by secure data transmission and ISR missions. Payload electronics benefit from increased Earth observation activity, while thermal control and onboard processing continue expanding. Growing satellite miniaturization and mission complexity are shifting demand toward integrated and modular electronic systems, strengthening multi-application adoption across new satellite platforms.

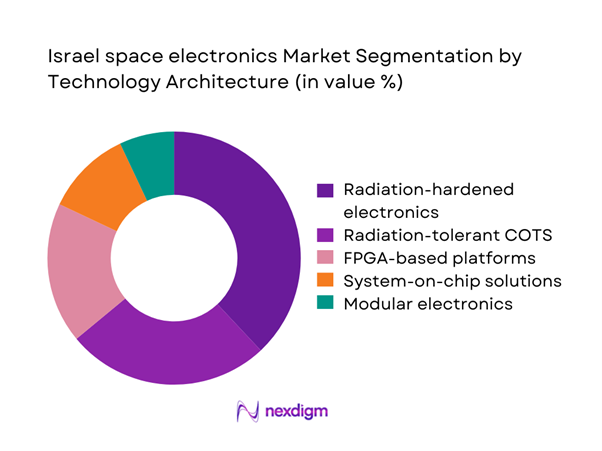

By Technology Architecture

Technology architecture segmentation is led by radiation-hardened systems due to high reliability requirements in defense and long-duration missions. Radiation-tolerant commercial components are increasingly adopted to reduce costs while maintaining performance. FPGA-based platforms gain traction for flexibility and in-orbit reconfigurability. System-on-chip architectures support miniaturization trends in small satellites. Modular electronics platforms are gaining acceptance due to reduced integration time and easier upgrades, supporting evolving mission profiles across defense and commercial applications.

Competitive Landscape

The competitive landscape is characterized by a mix of established defense contractors and specialized space electronics developers. Companies compete on technology reliability, mission heritage, and compliance with national security standards. Strong government relationships and vertically integrated capabilities remain critical competitive advantages.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Orbit Communication Systems | 1950 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Gilat Satellite Networks | 1987 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

Israel space electronics Market Analysis

Growth Drivers

Rising defense and intelligence satellite deployment

Rising defense and intelligence satellite deployment continues to stimulate consistent demand for advanced space-grade electronic subsystems. Governments increased mission frequency during 2024 and 2025 to enhance surveillance and secure communication capabilities. These missions require high reliability avionics, radiation-hardened processors, and secure data handling electronics. Increased geopolitical uncertainties further accelerated procurement of space-based intelligence assets. Long mission durations necessitate durable electronics with minimal maintenance requirements. Defense agencies prioritize indigenous sourcing to reduce dependency risks. This trend directly strengthens domestic manufacturing and system integration activities. Continuous satellite replenishment cycles sustain recurring electronics demand. Enhanced payload complexity increases electronics content per satellite. Collectively these factors reinforce sustained growth momentum across the space electronics ecosystem.

Increasing indigenous satellite manufacturing programs

Increasing indigenous satellite manufacturing programs significantly influence domestic electronics demand and innovation intensity. National programs emphasize local design, assembly, and testing capabilities to strengthen strategic autonomy. During 2024 and 2025, multiple satellite platforms entered development using domestically produced subsystems. This approach accelerates knowledge transfer and skill development within the local supply chain. Indigenous programs reduce reliance on imported components and improve schedule control. Government funding supports research into miniaturized and radiation-resilient electronics. System integrators increasingly collaborate with local semiconductor and electronics firms. These partnerships drive customization and performance optimization. Local manufacturing also improves lifecycle management and after-launch support capabilities. Overall, indigenous production strengthens long-term market sustainability.

Challenges

High development and qualification costs

High development and qualification costs remain a significant barrier for space electronics manufacturers. Extensive testing requirements increase engineering time and financial commitments for every component. Radiation testing, thermal cycling, and vibration validation add complexity to development cycles. Smaller suppliers face difficulties absorbing high upfront investment burdens. Qualification delays can impact mission schedules and contractual obligations. Specialized facilities required for testing are limited and expensive to access. Cost pressures restrict rapid innovation and limit experimentation with new designs. These challenges affect competitiveness against international suppliers. Budget constraints further intensify cost sensitivity among procurement agencies. Consequently, cost management remains a critical operational challenge.

Strict export control and compliance requirements

Strict export control and compliance requirements significantly influence market operations and international collaboration. Regulatory frameworks impose limitations on technology transfer and component sourcing. Compliance procedures increase documentation, approval timelines, and administrative burden. Companies must align products with national security and international export laws. These restrictions limit participation in certain global programs and partnerships. Compliance costs affect pricing flexibility and contract competitiveness. Smaller firms face greater difficulty navigating complex regulatory structures. Export approvals often extend project timelines unpredictably. This environment necessitates dedicated compliance teams and legal oversight. Overall, regulatory constraints shape strategic decision-making across the industry.

Opportunities

Expansion of small satellite constellations

Expansion of small satellite constellations creates strong opportunities for scalable electronics production. Commercial and government operators increasingly deploy constellation-based architectures for communication and observation. These missions require compact, energy-efficient, and reliable electronic subsystems. Standardized satellite buses increase repeat demand for similar electronics configurations. Shorter mission lifecycles encourage continuous hardware refresh cycles. Manufacturers benefit from higher production volumes compared to traditional satellites. Design optimization for mass production improves cost efficiency. Small satellites also accelerate innovation adoption across electronic subsystems. Growing constellation programs strengthen long-term revenue visibility. This trend significantly expands addressable market potential.

Increased collaboration with global space agencies

Increased collaboration with global space agencies enhances technology exchange and development opportunities. Joint missions encourage adoption of internationally compatible electronic standards. Collaborative programs improve access to advanced testing facilities and expertise. Partnerships enable participation in larger and more complex missions. Shared development reduces individual project risks and costs. Cross-border cooperation enhances innovation in avionics and communication systems. Israeli firms gain exposure to diverse mission requirements. These collaborations strengthen global credibility and technical capability. Expanded cooperation also supports export opportunities under regulated frameworks. Overall, partnerships contribute positively to long-term industry growth.

Future Outlook

The market is expected to maintain steady expansion through 2035 driven by defense modernization and satellite deployment programs. Continued investments in indigenous manufacturing and system integration will strengthen domestic capabilities. Advancements in miniaturization, radiation tolerance, and onboard processing will shape future product development. Collaboration with international space programs will further enhance technology maturity and market reach.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Rafael Advanced Defense Systems

- Orbit Communication Systems

- Gilat Satellite Networks

- Ramon.Space

- Tower Semiconductor

- Elta Systems

- NSLComm

- Aitech Systems

- Honeywell Israel

- L3Harris Israel

- Spacecom

- Astroscale Israel

- SemiConductor Devices

Key Target Audience

- Defense procurement agencies

- National space agencies

- Satellite manufacturers and integrators

- Space technology startups

- Telecommunications operators

- System integrators and OEMs

- Investments and venture capital firms

- Government and regulatory bodies including Israel Space Agency

Research Methodology

Step 1: Identification of Key Variables

Market boundaries were defined through analysis of satellite platforms, electronic subsystems, and application scope. Key performance and adoption indicators were identified based on mission requirements and system architecture trends.

Step 2: Market Analysis and Construction

Market structure was developed using bottom-up assessment of applications, technologies, and end-use segments. Demand drivers and constraints were evaluated across defense and commercial programs.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through expert interactions with engineers, procurement specialists, and industry stakeholders. Assumptions were refined based on technical feasibility and deployment trends.

Step 4: Research Synthesis and Final Output

All qualitative and quantitative insights were consolidated, normalized, and analyzed to ensure consistency. Final outputs reflect validated trends, opportunities, and competitive dynamics.

- Executive Summary

- Research Methodology (Market Definitions and scope of space-grade electronic systems in Israeli space programs, Platform and subsystem-level segmentation framework, Bottom-up market sizing using program-level electronics spend, Revenue attribution by payload class and mission type, Primary interviews with Israeli OEMs integrators and defense agencies, Data triangulation using launch manifests defense budgets and export filings, Assumptions and limitations related to ITAR and national security constraints)

- Definition and Scope

- Market evolution

- Usage and mission integration landscape

- Ecosystem structure

- Supply chain and manufacturing flow

- Regulatory and export control environment

- Growth Drivers

Rising defense and intelligence satellite deployment

Increasing indigenous satellite manufacturing programs

Miniaturization and proliferation of small satellites

Government funding for space technology development

Growth in ISR and secure communications demand - Challenges

High development and qualification costs

Strict export control and compliance requirements

Limited domestic supplier base for rad-hard components

Long development and certification cycles

Dependency on global semiconductor supply chains - Opportunities

Expansion of small satellite constellations

Increased collaboration with global space agencies

Advancements in radiation-hardened electronics

Dual-use technology commercialization

Growing private space startups ecosystem - Trends

Shift toward modular avionics architectures

Adoption of AI-enabled onboard processing

Increased use of COTS with radiation mitigation

Focus on low power and high reliability systems

Vertical integration by prime contractors - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

LEO satellites

MEO satellites

GEO satellites

Deep space and exploration missions

Defense and intelligence spacecraft - By Application (in Value %)

Avionics and flight control electronics

Power management and distribution

Payload electronics

Communication and data handling

Thermal control electronics - By Technology Architecture (in Value %)

Radiation-hardened electronics

Radiation-tolerant COTS-based systems

System-on-chip and FPGA-based platforms

Modular and scalable avionics - By End-Use Industry (in Value %)

Defense and intelligence

Commercial satellite operators

Space research organizations

Telecommunication service providers

Earth observation and analytics - By Connectivity Type (in Value %)

RF-based systems

Optical and laser communication systems

Hybrid connectivity architectures - By Region (in Value %)

Central Israel

Southern Israel

Northern Israel

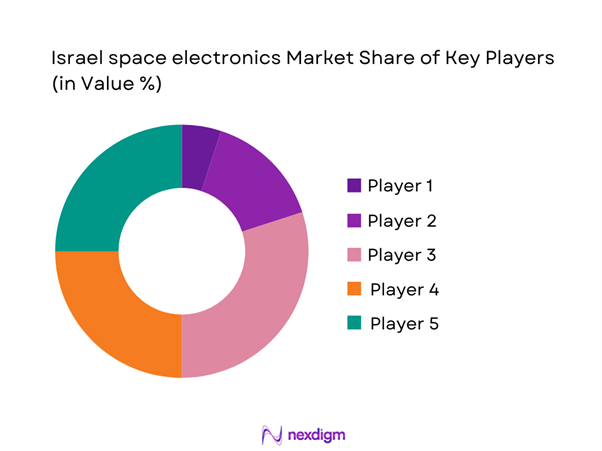

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (product portfolio breadth, space qualification capability, program heritage, manufacturing scale, R&D intensity, pricing competitiveness, government relationships, export compliance strength)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Israel Aerospace Industries (IAI)

Elbit Systems

Rafael Advanced Defense Systems

Orbit Communication Systems

Gilat Satellite Networks

Ramon.Space

Tower Semiconductor

SemiConductor Devices (SCD)

NSLComm

Spacecom

Elta Systems

Honeywell Israel

L3Harris Israel

Astroscale Israel

Aitech Systems

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035