Market Overview

The Israel Space Lander and Rover market current size stands at around USD ~ million, reflecting sustained development activity and mission-focused investments. The market shows stable momentum supported by increasing payload complexity, mission frequency growth, and advancements in autonomous navigation systems. During the observed period, multiple lunar and planetary initiatives contributed to steady hardware demand, with subsystem integration accounting for a major portion of value generation. Technological readiness improved significantly, driven by flight heritage accumulation and enhanced testing infrastructure. Development cycles remained long but increasingly structured, supporting gradual ecosystem maturation.

Israel’s market strength is concentrated around high-technology clusters centered in Tel Aviv, Haifa, and Beersheba, where aerospace engineering, robotics, and defense electronics converge. Government-backed research agencies and national space initiatives play a central role in shaping demand patterns. Strong collaboration between academic research centers and private aerospace firms accelerates innovation cycles. Export-oriented subsystem development and international mission partnerships further reinforce market depth. Regulatory clarity and national space strategy alignment continue to support sustained industry participation.

Market Segmentation

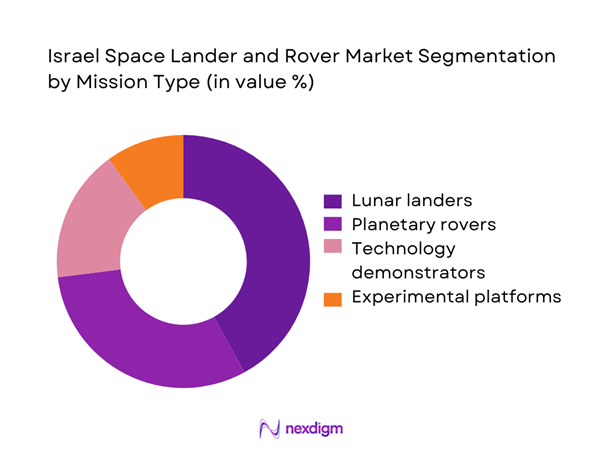

By Mission Type

The market is primarily driven by lunar lander missions, followed by rover-based exploration platforms designed for surface mobility and scientific instrumentation deployment. Technology demonstration missions contribute significantly to early-stage validation efforts, while experimental platforms support navigation, power management, and autonomous operations testing. Government-sponsored missions dominate the segment, but commercial participation is increasing as private entities seek payload delivery opportunities. Mission complexity and duration strongly influence system architecture decisions, with modular payload integration becoming increasingly common. Rising interest in long-duration surface exploration further strengthens rover-centric development initiatives.

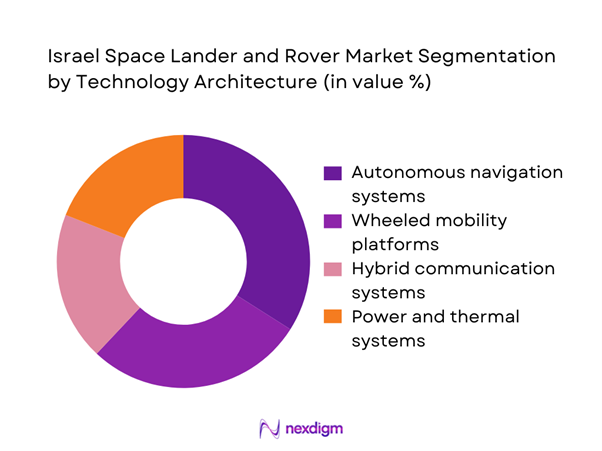

By Technology Architecture

Technology architecture segmentation highlights dominance of autonomous navigation and AI-assisted guidance systems, reflecting mission reliability requirements. Wheeled mobility platforms remain prevalent due to terrain adaptability and energy efficiency. Hybrid communication systems are increasingly adopted to ensure redundancy and real-time data transmission. Power systems emphasizing solar integration and energy optimization play a critical role in mission endurance. Structural materials optimized for radiation resistance and thermal control further define technology investment priorities across missions.

Competitive Landscape

The competitive landscape is characterized by a mix of government-backed organizations and private aerospace innovators. Companies compete on mission reliability, system integration capability, and technological maturity. Strategic collaborations with international space agencies and commercial launch providers shape competitive positioning. Intellectual property strength and mission heritage remain key differentiators across participants.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| SpaceIL | 2011 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| OHB System | 1981 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

Israel Space Lander and Rover Market Analysis

Growth Drivers

Expansion of National Lunar Exploration Programs

National lunar exploration programs have expanded significantly, driving sustained demand for indigenous lander and rover platforms. Government-backed missions increased steadily across 2023 and 2024, supporting technology validation and payload testing. Strategic alignment with international exploration objectives strengthened funding continuity and technical collaboration frameworks. Increased focus on scientific payload deployment elevated requirements for precision landing and autonomous mobility. Infrastructure investments supported advanced simulation and mission rehearsal capabilities. These developments collectively enhanced confidence among stakeholders and accelerated development timelines. Mission complexity increased steadily, necessitating higher system reliability standards. Program continuity enabled accumulation of operational experience and engineering expertise. Public sector commitment reduced financial uncertainty for long-term projects. Overall, national mission expansion remains a primary catalyst for sustained market momentum.

Rising Demand for Autonomous Surface Operations

Autonomous surface operation demand increased due to limited communication windows and extended mission durations. Advanced navigation algorithms improved rover mobility across uneven extraterrestrial terrains. Integration of artificial intelligence enhanced real-time decision-making during surface exploration tasks. Growing emphasis on data-driven science missions increased reliance on onboard autonomy. Reduced dependence on ground control lowered operational risk and communication delays. Hardware-software co-development accelerated performance optimization across mission profiles. Testing environments increasingly simulated real planetary conditions for validation. Demand for resilient autonomous systems expanded across both government and commercial missions. Technological maturity improved reliability under extreme environmental conditions. These trends collectively strengthened long-term adoption of autonomous rover platforms.

Challenges

High Development Complexity and Mission Risk

Space lander and rover development involves complex system integration and extended testing cycles. Engineering challenges increase with mission duration and environmental uncertainty. Minor subsystem failures can result in complete mission loss. Validation requirements significantly extend development timelines and costs. Limited launch opportunities constrain testing frequency and design iteration. Environmental unpredictability increases mission planning complexity. Integration of multiple subsystems introduces reliability risks. Supply chain dependencies affect component availability and qualification. Risk mitigation demands extensive simulation and redundancy planning. These factors collectively restrain rapid market scaling.

Limited Commercial Mission Frequency

Commercial mission frequency remains limited due to high capital requirements and technical barriers. Private participation depends heavily on government collaboration and funding stability. Payload demand from non-government entities remains relatively low. Revenue visibility is constrained by irregular mission schedules. Long development cycles reduce return predictability for private investors. Regulatory approvals add additional procedural delays. Market entry barriers remain high for new participants. Limited launch availability restricts deployment opportunities. Commercial scalability remains constrained by operational risk exposure. These limitations continue to moderate overall market expansion.

Opportunities

International Collaboration and Payload Partnerships

International collaboration offers expanded mission access and shared development costs. Joint missions allow technology exchange and risk distribution across partners. Payload-sharing models enhance utilization efficiency and mission viability. Cross-border research initiatives increase scientific output and funding access. Collaboration enables access to advanced launch infrastructure and tracking networks. Shared data platforms improve mission transparency and scientific value. Policy alignment facilitates smoother regulatory approvals. Cooperative missions enhance global credibility and technological standing. Shared resources reduce financial burden on individual programs. These partnerships present strong growth opportunities.

Advancements in Miniaturization and Modular Design

Miniaturization enables reduced mass and improved payload efficiency for space missions. Modular architecture allows faster customization and integration across mission profiles. Smaller systems reduce launch constraints and associated costs. Advances in materials science enhance durability under extreme conditions. Standardized interfaces simplify component replacement and upgrades. Modular designs improve scalability for future mission variants. Development cycles shorten due to reusable platform architectures. Testing efficiency improves with interchangeable subsystems. Cost optimization becomes achievable through design standardization. These advancements significantly expand market potential.

Future Outlook

The market is expected to progress steadily through increased mission frequency and expanding international collaboration. Continued government support and technological advancements will strengthen platform reliability and mission success rates. Growing private sector participation will enhance innovation depth and commercial viability. Integration of autonomous systems will further improve operational efficiency. Overall market outlook remains positive with sustained long-term development momentum.

Major Players

- Israel Aerospace Industries

- SpaceIL

- Rafael Advanced Defense Systems

- Elbit Systems

- OHB System

- Airbus Defence and Space

- Lockheed Martin Space

- Northrop Grumman

- Thales Alenia Space

- Blue Origin

- Astrobotic Technology

- Intuitive Machines

- ispace

- Honeybee Robotics

- Sierra Space

Key Target Audience

- Government space agencies including Israel Space Agency

- Defense and aerospace procurement bodies

- Commercial space exploration companies

- Satellite and payload integrators

- Robotics and autonomous system developers

- Launch service providers

- Investments and venture capital firms

- National regulatory and licensing authorities

Research Methodology

Step 1: Identification of Key Variables

Core variables including mission types, technology architectures, and operational models were identified through structured industry mapping. Emphasis was placed on differentiating lander and rover functional requirements. Market boundaries were defined based on mission relevance and hardware scope.

Step 2: Market Analysis and Construction

Market structure was developed through analysis of mission deployments, program timelines, and system integration patterns. Segmentation logic was validated using deployment trends and technology adoption rates. Demand drivers and constraints were mapped across application areas.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through consultation with aerospace engineers, mission planners, and program managers. Technical feasibility and adoption assumptions were reviewed against ongoing project developments. Feedback loops ensured consistency across analytical layers.

Step 4: Research Synthesis and Final Output

All qualitative and quantitative insights were consolidated into a unified framework. Data consistency checks ensured alignment across sections. Final outputs were structured to support strategic decision-making and market evaluation.

- Executive Summary

- Research Methodology (Market Definitions and mission-class scope mapping, Payload and rover taxonomy development for Israeli lunar and planetary programs, Bottom-up mission cost and hardware value estimation, Revenue attribution across government-funded and commercial programs, Primary interviews with Israeli space agencies, primes, and subsystem suppliers, Data triangulation using mission manifests, launch schedules, and budget disclosures)

- Definition and scope

- Market evolution

- Mission deployment and usage pathways

- Ecosystem structure

- Supply chain and manufacturing flow

- Regulatory and national space policy environment

- Growth Drivers

- Challenges

- Opportunities

- Trends

- Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Platforms, 2020–2025

- By Average Mission Cost, 2020–2025

- By Fleet Type (in Value %)

Lunar landers

Planetary rovers

Technology demonstrators

Autonomous mobility platforms - By Application (in Value %)

Scientific exploration

Technology validation

Commercial payload delivery

Defense and strategic research - By Technology Architecture (in Value %)

Wheeled rover systems

Hopper-based landers

Autonomous navigation systems

AI-based guidance and control - By End-Use Industry (in Value %)

Government space agencies

Defense and security organizations

Academic and research institutions

Commercial space enterprises - By Connectivity Type (in Value %)

Direct-to-Earth communication

Relay satellite communication

Hybrid communication systems - By Region (in Value %)

Israel

North America

Europe

Asia-Pacific

Rest of World

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (technology readiness, mission heritage, payload capacity, autonomy level, cost efficiency, launch compatibility, partnership ecosystem, geographic reach)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Israel Aerospace Industries (IAI)

SpaceIL

Rafael Advanced Defense Systems

Elbit Systems

Israel Space Agency

Astroscale

OHB System AG

Airbus Defence and Space

Lockheed Martin Space

Northrop Grumman

Thales Alenia Space

Blue Origin

ispace

Astrobotic Technology

Intuitive Machines

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Platforms, 2026–2035

- By Average Mission Cost, 2026–2035