Market Overview

The Israel space militarization market current size stands at around USD ~ million and reflects sustained defense-driven investment intensity. Activity levels during recent periods indicate stable deployment cycles, expanding satellite programs, and increasing mission complexity across intelligence, surveillance, and reconnaissance domains. Government-backed initiatives, classified procurement pipelines, and long-term modernization programs continue shaping demand patterns, while technological maturity supports operational scalability across orbital layers and mission profiles without disclosing sensitive valuation benchmarks.

Israel’s space militarization ecosystem remains concentrated around Tel Aviv, central defense corridors, and southern aerospace clusters supported by advanced testing infrastructure. Strong integration between defense agencies, aerospace manufacturers, and research institutions accelerates innovation cycles. Policy alignment with national security priorities, high readiness requirements, and continuous threat monitoring reinforce domestic capability development. The ecosystem benefits from rapid prototyping culture, vertically integrated supply chains, and a regulatory environment encouraging indigenous space defense solutions.

Market Segmentation

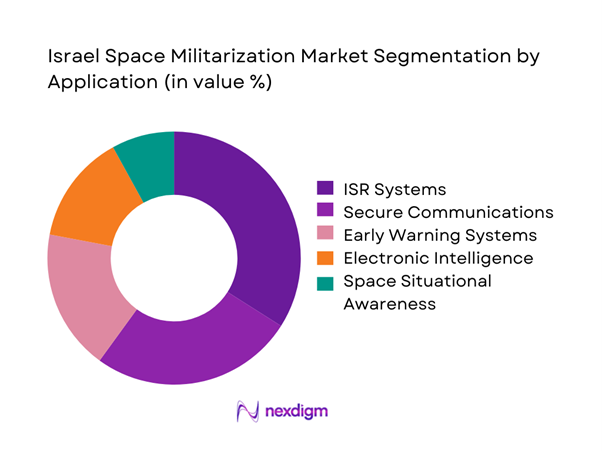

By Application

The application landscape is dominated by intelligence, surveillance, and reconnaissance missions driven by persistent regional security monitoring requirements. Early warning systems and secure military communications follow closely, reflecting increasing reliance on space-based situational awareness. Electronic intelligence applications continue expanding due to signal interception needs, while space situational awareness gains importance as orbital congestion rises. Demand concentration remains high within defense-led missions, with limited spillover into civilian use. Continuous upgrades in sensor resolution, data transmission reliability, and response latency reinforce application diversification. Government-backed procurement programs ensure long-term continuity across application categories, sustaining stable development cycles.

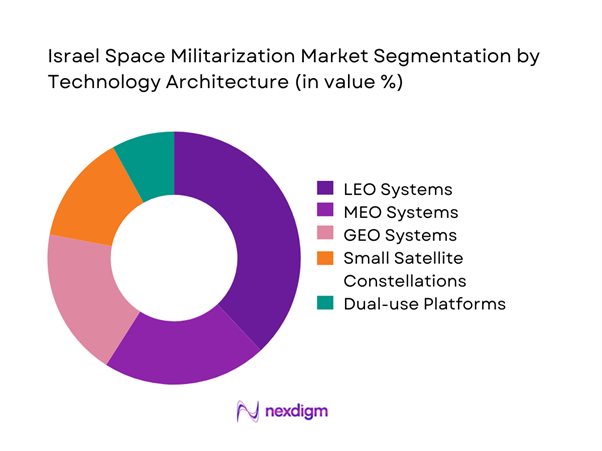

By Technology Architecture

Technology architecture segmentation highlights a strong preference for low-earth orbit platforms due to lower deployment costs and faster data refresh cycles. Medium and geostationary orbits remain essential for persistent coverage and communication reliability. The adoption of small satellite constellations is accelerating, driven by rapid deployment advantages and modular scalability. Dual-use platforms are increasingly favored to optimize defense expenditure efficiency. Advances in payload miniaturization and onboard processing enhance mission versatility. Architecture selection is strongly influenced by mission criticality, orbital endurance requirements, and data security considerations.

Competitive Landscape

The competitive environment is characterized by strong domestic participation supported by strategic government alignment. Market players focus on vertical integration, secure system development, and long-term defense contracts. Competitive differentiation is driven by technology depth, system reliability, and integration capability across air, land, sea, and space defense domains.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Elta Systems | 1967 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Spacecom | 1992 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

Israel Space Militarization Market Analysis

Growth Drivers

Rising geopolitical tensions and regional security threats

Rising geopolitical tensions continue increasing reliance on space-based defense monitoring systems across multiple operational domains. Regional instability drives demand for persistent surveillance coverage supporting real-time intelligence assessment and threat anticipation. Defense planners increasingly prioritize orbital assets for early detection and response coordination. Enhanced border monitoring requirements accelerate satellite deployment programs and capability upgrades. Strategic deterrence considerations further elevate investments in resilient space infrastructure. Cross-domain military integration strengthens reliance on orbital data streams. National security doctrines emphasize space superiority as an operational necessity. Increased defense readiness requirements stimulate continuous technology refresh cycles. Advanced analytics integration improves actionable intelligence extraction from satellite data. These dynamics collectively reinforce sustained growth momentum.

Expansion of ISR and early warning requirements

Expansion of ISR and early warning capabilities remains central to national defense modernization strategies. Rising missile threats elevate dependence on space-based detection and tracking platforms. Early warning systems improve response time and operational preparedness across defense units. ISR expansion supports intelligence fusion across air, land, and maritime domains. Continuous surveillance demand drives deployment of higher-resolution sensors. Data fusion platforms enhance decision-making speed and accuracy. Integration with command systems increases operational effectiveness. Growing complexity of threat environments sustains investment in ISR capabilities. Satellite-enabled ISR reduces dependence on terrestrial monitoring assets. Strategic planners prioritize ISR scalability for future conflict scenarios.

Challenges

High development and deployment costs

High development and deployment costs constrain rapid scaling of advanced space militarization programs. Specialized components require extended research and validation cycles. Launch infrastructure expenses remain a significant financial burden. System redundancy requirements further increase capital intensity. Long development timelines limit flexibility in responding to emerging threats. Budget prioritization challenges affect program sequencing decisions. Maintenance and lifecycle management costs accumulate over extended operational periods. High technical complexity elevates risk exposure. Procurement cycles often experience delays due to funding approvals. Cost pressures necessitate careful capability prioritization.

Export control and international regulatory constraints

Export control regimes restrict technology transfer and international collaboration opportunities. Compliance requirements increase administrative and legal complexity for manufacturers. Regulatory approvals often extend development timelines significantly. Restrictions limit access to foreign components and subsystems. International treaties influence system design and deployment choices. Cross-border collaboration faces heightened scrutiny under defense regulations. Licensing delays impact commercialization and scaling potential. Regulatory divergence complicates joint program execution. Compliance costs add pressure on program budgets. Strategic autonomy becomes essential under restrictive trade environments.

Opportunities

Expansion of dual-use military-commercial satellites

Dual-use satellite platforms present significant opportunities for capability optimization and cost efficiency. Shared infrastructure reduces development burdens across civilian and defense missions. Commercial partnerships accelerate innovation and deployment timelines. Dual-use architectures enable broader data utilization frameworks. Increased demand for secure communication supports hybrid satellite models. Regulatory support for commercial participation strengthens market entry potential. Private sector innovation enhances system flexibility. Cost-sharing mechanisms improve financial sustainability. Rapid technology refresh cycles benefit defense readiness. Dual-use expansion aligns with long-term space strategy goals.

Advancements in miniaturization and AI-based analytics

Miniaturization advancements enable deployment of compact, high-performance satellite systems. Reduced payload size lowers launch and operational costs. AI-based analytics improve real-time data interpretation capabilities. Autonomous processing reduces reliance on ground infrastructure. Enhanced onboard computing supports faster decision-making cycles. AI integration enables predictive threat assessment capabilities. Smaller satellites increase constellation resilience and redundancy. Technology maturity accelerates deployment frequency. Analytics-driven insights improve mission effectiveness. These advancements collectively strengthen operational efficiency.

Future Outlook

The Israel space militarization market is expected to maintain steady expansion supported by sustained defense modernization priorities. Continued investments in satellite resilience and autonomous capabilities will shape future deployments. Strategic emphasis on space-based deterrence will remain strong. Collaboration between defense agencies and domestic industry will intensify. Long-term policy alignment ensures consistent capability development.

Major Players

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- Elbit Systems

- Elta Systems

- Spacecom

- Gilat Satellite Networks

- Orbit Communication Systems

- ImageSat International

- Aeronautics Group

- NSO Group

- Lockheed Martin

- Northrop Grumman

- Boeing Defense

- Thales Alenia Space

- Airbus Defence and Space

Key Target Audience

- Ministry of Defense of Israel

- Israel Space Agency

- Israeli Defense Forces procurement units

- National cyber and intelligence agencies

- Satellite system integrators

- Defense technology manufacturers

- Investments and venture capital firms

- Government and regulatory bodies including export control authorities

Research Methodology

Step 1: Identification of Key Variables

Core variables were identified through analysis of defense programs, satellite deployments, and national security objectives. Emphasis was placed on operational scope, technology type, and mission relevance. Data points were filtered for defense-specific applicability.

Step 2: Market Analysis and Construction

Market structure was developed using program mapping, capability assessment, and deployment trends. Segmentation logic reflected operational use cases and technology architecture. Historical patterns guided analytical framing.

Step 3: Hypothesis Validation and Expert Consultation

Insights were validated through consultations with defense analysts, aerospace engineers, and policy specialists. Assumptions were tested against real-world deployment scenarios. Feedback refined analytical consistency.

Step 4: Research Synthesis and Final Output

Findings were consolidated through triangulation of qualitative and quantitative indicators. Analytical coherence was ensured across sections. Final outputs reflect verified trends and sector dynamics.

- Executive Summary

- Research Methodology (Market Definitions and scope alignment for Israeli military space assets, Segmentation framework across orbital platforms and defense missions, Bottom-up market sizing using satellite programs and defense budgets, Revenue attribution across payloads launch and ground systems, Primary validation through defense analysts and space program stakeholders, Data triangulation using government disclosures and contractor financials, Assumptions and limitations linked to classified procurement and export controls)

- Definition and scope

- Market evolution

- Usage and mission deployment pathways

- Ecosystem structure

- Supply chain and integration framework

- Regulatory and defense policy environment

- Growth Drivers

Rising geopolitical tensions and regional security threats

Expansion of ISR and early warning requirements

Government investment in indigenous space capabilities

Integration of space assets into multi-domain warfare

Growth of small satellite and rapid launch programs - Challenges

High development and deployment costs

Export control and international regulatory constraints

Technological dependence on limited suppliers

Cybersecurity vulnerabilities in space assets

Long development and certification cycles - Opportunities

Expansion of dual-use military-commercial satellites

Advancements in miniaturization and AI-based analytics

Growing demand for space-based missile defense

Public-private partnerships in space defense

Export potential for allied defense programs - Trends

Shift toward low-earth orbit constellations

Increased use of autonomous and AI-enabled payloads

Integration of space assets with cyber and electronic warfare

Rising emphasis on space situational awareness

Development of responsive launch capabilities - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Reconnaissance satellites

Communication satellites

Navigation and positioning satellites

Electronic intelligence satellites

Early warning and surveillance platforms - By Application (in Value %)

Intelligence, Surveillance and Reconnaissance (ISR)

Secure military communications

Missile warning and tracking

Electronic warfare and signal intelligence

Space situational awareness - By Technology Architecture (in Value %)

LEO-based systems

MEO-based systems

GEO-based systems

Small satellite constellations

Dual-use satellite platforms - By End-Use Industry (in Value %)

Defense forces

Intelligence agencies

Homeland security

Space command and defense units

Strategic communications authorities - By Connectivity Type (in Value %)

SATCOM

Optical communication links

RF-based communication

Encrypted military-grade networks

Inter-satellite links - By Region (in Value %)

Domestic Israel operations

Middle East strategic coverage

Global surveillance and monitoring

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (technology maturity, mission capability, orbital coverage, contract value, government alignment, export footprint, R&D intensity, integration capability)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Israel Aerospace Industries

Rafael Advanced Defense Systems

Elbit Systems

Elta Systems

Spacecom

ImageSat International

Gilat Satellite Networks

Orbit Communication Systems

Aeronautics Group

NSO Group

Lockheed Martin

Northrop Grumman

Boeing Defense Space & Security

Thales Alenia Space

Airbus Defence and Space

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035