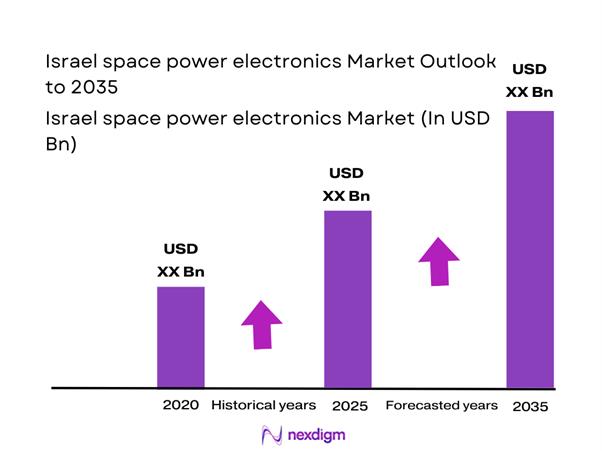

Market Overview

The Israel space power electronics market current size stands at around USD ~ million, reflecting sustained demand from satellite manufacturing and defense-driven space programs. Activity during 2024 and 2025 remained stable, supported by increasing satellite payload complexity and higher onboard power requirements. Domestic suppliers focused on radiation-tolerant power conversion systems, while international collaborations supported subsystem upgrades. Procurement cycles remained long, but order visibility improved due to multi-year mission planning. Technology upgrades and qualification investments continued despite supply chain constraints affecting component availability.

Israel’s market is concentrated around key aerospace and defense hubs, supported by strong integration between government agencies, defense contractors, and technology startups. Tel Aviv and central industrial corridors host most design, testing, and assembly activities. Demand is driven by national satellite programs, military reconnaissance platforms, and export-oriented payload manufacturing. A mature innovation ecosystem, strong engineering talent pool, and supportive policy environment continue to reinforce domestic capability development and system-level integration maturity.

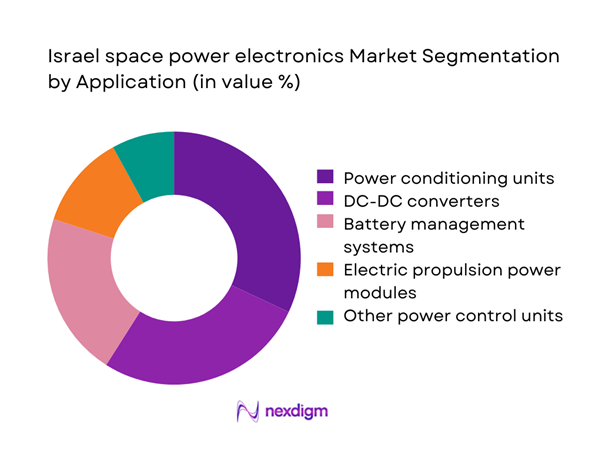

Market Segmentation

By Application

Power electronics demand is primarily driven by satellite subsystems requiring efficient energy conversion and reliable power management. Power conditioning units and DC-DC converters dominate usage due to their critical role in payload stability and onboard system protection. Battery management systems are increasingly integrated to support higher energy densities and longer mission durations. Electric propulsion power modules are gaining importance as satellite operators adopt electric thrusters to reduce launch mass. System redundancy requirements further elevate demand for fault-tolerant power architectures across mission classes.

By End-Use Industry

Defense and military space programs represent the largest share due to secure communications and surveillance missions. Commercial satellite operators increasingly invest in power-efficient electronics to improve payload performance and lifecycle economics. Civil and scientific missions contribute steadily, particularly for earth observation and research satellites. Emerging private launch and NewSpace companies are creating incremental demand for standardized, modular power electronics. Export-oriented production further supports volume stability across end-use categories.

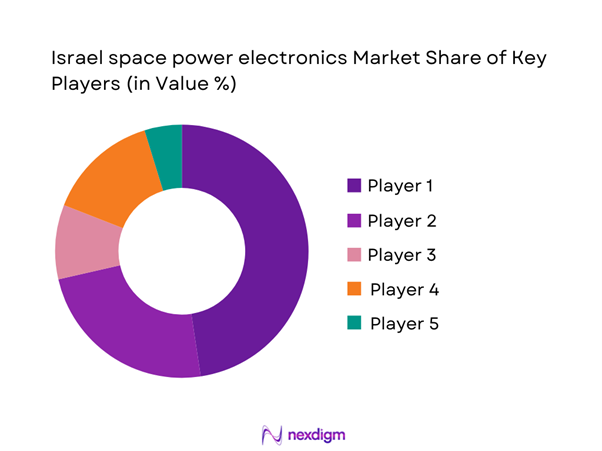

Competitive Landscape

The competitive landscape is characterized by a mix of domestic aerospace leaders and specialized international component suppliers. Companies compete primarily on radiation tolerance, reliability, customization capability, and long-term program experience. Entry barriers remain high due to qualification costs and mission-critical reliability standards.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1935 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Alenia Space | 1978 | France | ~ | ~ | ~ | ~ | ~ | ~ |

Israel space power electronics Market Analysis

Growth Drivers

Rising satellite launches and constellation programs

Increasing satellite launches continue driving consistent demand for advanced space-grade power electronics across defense and commercial missions. Constellation deployments require standardized power architectures capable of supporting high-volume satellite production and rapid integration cycles. Israeli manufacturers benefit from long-term national programs supporting satellite deployment continuity and subsystem localization initiatives. Growth in earth observation missions also expands requirements for efficient power conversion and thermal management technologies. Increased launch frequency during 2024 and 2025 sustained procurement volumes for power modules and control units. Constellation architectures emphasize reliability, redundancy, and power efficiency, strengthening demand for advanced electronic designs. Mission lifespans extending beyond traditional timelines further increase reliance on high-durability power components. Government-backed space initiatives provide stable funding visibility for subsystem suppliers. Integration with global launch providers expands export opportunities for Israeli power electronics manufacturers. These combined factors reinforce sustained growth momentum across the market.

Growing demand for radiation-hardened power electronics

Radiation-hardened electronics remain essential due to prolonged exposure to harsh orbital environments and cosmic radiation. Satellite operators increasingly prioritize reliability to avoid mission failures and service interruptions. Advancements in shielding techniques and component design enhance performance under extreme conditions. Demand increased notably during 2024 and 2025 as missions targeted higher orbits and longer operational lifespans. Defense programs particularly emphasize radiation tolerance for secure communication satellites. Manufacturers continue investing in qualification and testing capabilities to meet stringent standards. Enhanced component durability supports extended satellite operational cycles and reduces replacement frequency. Collaboration with material science specialists improves resilience of power semiconductors. These developments collectively strengthen the adoption of radiation-hardened power electronics. The trend remains fundamental to future platform design strategies.

Challenges

High qualification and certification costs

Qualification processes for space-grade electronics require extensive testing under extreme environmental conditions. Certification timelines often extend project schedules and delay commercial deployment. High testing costs create financial barriers for smaller manufacturers and new entrants. Compliance with mission-specific standards further increases development complexity. Limited testing infrastructure availability contributes to longer validation cycles. Specialized radiation and thermal testing facilities add operational expenditure pressures. These challenges restrict rapid innovation and slow time-to-market for new designs. Manufacturers must balance cost efficiency with strict reliability expectations. Budget limitations can delay technology upgrades across programs. Overall, certification intensity remains a significant constraint for market participants.

Limited economies of scale in space-grade electronics

Space electronics production volumes remain inherently low compared to terrestrial electronics manufacturing. Limited batch sizes prevent significant cost optimization through scale efficiencies. Customization requirements further reduce standardization potential across platforms. Procurement cycles are fragmented due to mission-specific design requirements. Manufacturing overheads remain high due to specialized materials and testing needs. Supply chain dependencies add further complexity and cost unpredictability. Small production runs limit bargaining power with component suppliers. This impacts pricing flexibility and margin sustainability for manufacturers. Companies must rely on long-term contracts to stabilize revenues. These structural constraints continue to challenge operational scalability.

Opportunities

Growth of smallsat and nanosatellite platforms

Smallsat and nanosatellite deployments are increasing due to lower launch costs and rapid mission deployment models. These platforms require compact, efficient, and lightweight power electronics solutions. Modular power architectures enable faster integration and reduced development timelines. Commercial and research missions increasingly adopt small satellite configurations. Demand during 2024 and 2025 showed consistent growth across commercial constellations. Power efficiency becomes critical due to limited onboard energy availability. Manufacturers can leverage standardized designs to improve production scalability. Emerging missions create opportunities for innovative power management solutions. Cost-sensitive customers encourage development of optimized electronics. This segment represents a strong growth avenue for suppliers.

Adoption of SiC and GaN power technologies

Wide-bandgap semiconductors such as SiC and GaN enable higher efficiency and thermal performance. These materials support higher switching frequencies and reduced power losses. Adoption increased during 2024 and 2025 across advanced satellite platforms. Improved thermal tolerance enhances reliability in space environments. Designers increasingly favor these technologies for high-density power applications. Integration of SiC and GaN supports miniaturization trends across subsystems. Manufacturing capabilities continue improving to meet qualification requirements. Cost reductions are gradually improving commercial viability. These technologies enable next-generation power architectures. Their adoption presents strong long-term growth opportunities.

Future Outlook

The Israel space power electronics market is expected to maintain steady expansion through 2035, supported by defense modernization and commercial satellite growth. Continued investment in advanced materials and radiation-hardened designs will shape product evolution. Collaboration between government agencies and private firms will remain critical. Increasing satellite miniaturization and power density requirements will further influence innovation priorities.

Major Players

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- Elbit Systems

- Honeywell Aerospace

- Thales Alenia Space

- Cobham Advanced Electronics

- Microchip Technology

- STMicroelectronics

- Texas Instruments

- Infineon Technologies

- Renesas Electronics

- Vicor Corporation

- AAC Clyde Space

- Teledyne Technologies

- Airbus Defence and Space

Key Target Audience

- Satellite manufacturers

- Defense and aerospace contractors

- Government space agencies including Israel Space Agency

- Commercial satellite operators

- Space system integrators

- Power electronics component suppliers

- Investments and venture capital firms

- Government and regulatory bodies including Ministry of Defense

Research Methodology

Step 1: Identification of Key Variables

Market boundaries were defined through application mapping, technology classification, and mission-specific usage assessment. Key variables included power ratings, deployment environments, and qualification standards. Data points were aligned with current satellite program structures.

Step 2: Market Analysis and Construction

Market structure was developed using application-level demand mapping and subsystem penetration analysis. Trends were derived from production volumes, technology adoption patterns, and procurement activity during 2024 and 2025.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through expert consultations with engineers, program managers, and system integrators. Technical feasibility and adoption assumptions were refined based on operational feedback.

Step 4: Research Synthesis and Final Output

All insights were consolidated through triangulation and consistency checks. Qualitative and quantitative findings were aligned to produce a coherent market narrative.

- Executive Summary

- Research Methodology (Market Definitions and scope of space-grade power electronics, satellite and space platform taxonomy mapping, bottom-up market sizing using program-level electronics content analysis, revenue attribution by component class and mission type, primary interviews with Israeli OEMs and space subsystem suppliers, triangulation using launch manifests and satellite production data, assumptions and limitations linked to export controls and defense disclosure constraints)

- Definition and Scope

- Market evolution

- Usage and mission deployment pathways

- Ecosystem structure

- Supply chain and sourcing dynamics

- Regulatory and compliance environment

- Growth Drivers

Rising satellite launches and constellation programs

Growing demand for radiation-hardened power electronics

Expansion of defense and intelligence space missions

Increasing power density requirements in small satellites

Government investment in domestic space capabilities - Challenges

High qualification and certification costs

Limited economies of scale in space-grade electronics

Export control and ITAR-related constraints

Thermal management and reliability challenges

Long development and validation cycles - Opportunities

Growth of smallsat and nanosatellite platforms

Adoption of SiC and GaN power technologies

Public-private partnerships in space programs

Increasing demand for electric propulsion systems

Expansion of commercial Earth observation missions - Trends

Shift toward modular power architectures

Rising use of COTS with space-grade screening

Miniaturization of power electronics

Increased focus on power efficiency and thermal control

Integration of AI-enabled power management - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

LEO satellite platforms

MEO satellite platforms

GEO satellite platforms

Deep space and exploration missions

Launch vehicle power systems - By Application (in Value %)

Power conditioning and distribution units

DC-DC converters

Battery management systems

Solar array regulators

Electric propulsion power modules - By Technology Architecture (in Value %)

Radiation-hardened electronics

COTS-based space-qualified electronics

SiC and GaN-based power devices

Modular and scalable power units - By End-Use Industry (in Value %)

Defense and military space programs

Commercial satellite operators

Civil and scientific space agencies

NewSpace and private launch providers - By Connectivity Type (in Value %)

Wired power bus architectures

High-voltage power distribution systems

Redundant power network architectures

Hybrid power and data interconnect systems - By Region (in Value %)

Israel

North America

Europe

Asia-Pacific

Rest of World

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (product portfolio breadth, radiation tolerance levels, heritage flight experience, pricing competitiveness, customization capability, production scalability, certification readiness, strategic partnerships)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Israel Aerospace Industries (IAI)

Rafael Advanced Defense Systems

Elbit Systems

Orbit Communication Systems

Gilat Satellite Networks

Honeywell Aerospace

Thales Alenia Space

Cobham Advanced Electronic Solutions

Microchip Technology

STMicroelectronics

Texas Instruments

Infineon Technologies

Renesas Electronics

Vicor Corporation

AAC Clyde Space

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035