Market Overview

The Israel Space Sensors and Actuators market current size stands at around USD ~ million, supported by sustained government-backed space activity and defense-driven satellite deployments. During the most recent period, steady investments in payload optimization, attitude control systems, and mission reliability enhanced component demand across multiple satellite classes. Procurement activity remained stable through consistent launch programs, growing adoption of microsatellites, and upgrades to legacy platforms. Technology advancement in sensing accuracy and actuator responsiveness continued to influence replacement cycles and system retrofitting programs.

The market is primarily concentrated in central and southern Israel, where aerospace infrastructure, defense establishments, and satellite integration facilities are located. Strong collaboration between government agencies, defense contractors, and space technology startups supports ecosystem maturity. Demand concentration aligns with national security programs, Earth observation missions, and communication satellite initiatives. Favorable regulatory support, export-oriented manufacturing, and established testing facilities further strengthen domestic production and system validation capabilities.

Market Segmentation

By Application

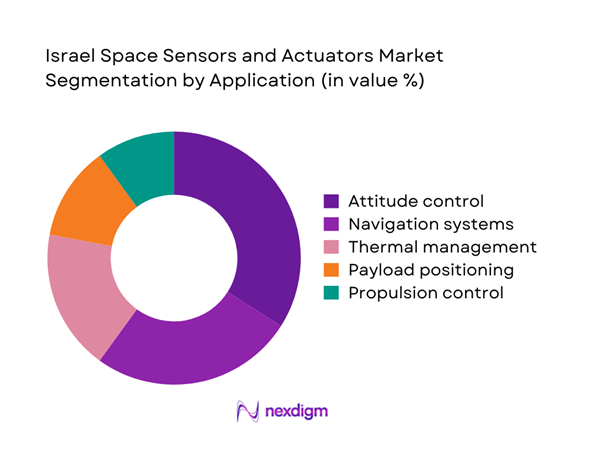

The application segment is dominated by attitude determination and control systems due to their essential role in satellite stability, orientation, and maneuvering accuracy. High reliance on sensors such as gyroscopes, star trackers, and accelerometers continues to drive sustained procurement volumes. Navigation and propulsion control applications follow closely, supported by increased deployment of small satellites and multi-mission platforms. Thermal management and payload positioning applications maintain steady demand, particularly in defense and observation satellites requiring high operational precision. Continuous innovation in miniaturization and onboard processing further strengthens application-level adoption across programs.

By End-Use Industry

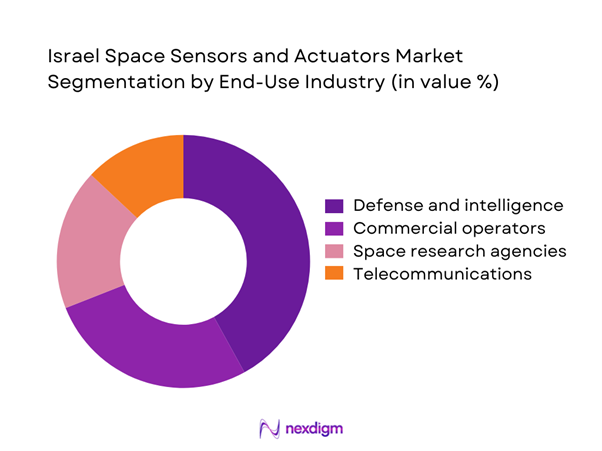

Defense and intelligence agencies represent the largest end-use segment due to sustained investment in surveillance, reconnaissance, and secure communication satellites. Commercial satellite operators follow, driven by demand for Earth observation and data relay services. Research institutions and space agencies contribute consistent demand through experimental missions and technology validation programs. Telecommunications providers increasingly integrate advanced sensors for orbit stability and service reliability. Growing collaboration between public and private entities continues to shape diversified end-use demand across mission profiles.

Competitive Landscape

The competitive landscape is characterized by a mix of vertically integrated defense contractors and specialized component manufacturers. Companies compete on system reliability, flight heritage, customization capability, and compliance with strict qualification standards. Long-term government relationships and proven mission performance remain key differentiators. Continuous investment in R&D and in-house testing capabilities supports sustained competitive positioning.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Elta Systems | 1967 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Controp Precision Technologies | 1974 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

Israel Space Sensors and Actuators Market Analysis

Growth Drivers

Rising defense-led satellite deployments

Defense agencies continue expanding satellite fleets to enhance surveillance, intelligence, and communication resilience across operational theaters. Increased satellite launches in recent years have strengthened demand for precision sensors and reliable actuator systems. Modern defense doctrines prioritize persistent monitoring, increasing reliance on advanced onboard instrumentation. Sensor accuracy requirements have risen due to higher-resolution imaging and tracking mandates. Actuator reliability has become critical for maneuverability and orbital adjustments during extended missions. Procurement pipelines reflect consistent ordering patterns aligned with defense modernization initiatives. Domestic manufacturing capability further accelerates adoption across classified and non-classified programs. Long-term national security planning supports continued deployment momentum. Integration of multi-sensor payloads amplifies component demand across platforms. This sustained defense focus continues shaping overall market expansion.

Expansion of Israel’s small satellite programs

Small satellite programs have expanded significantly due to lower launch costs and flexible mission configurations. These platforms require compact, lightweight sensors and highly efficient actuator systems. Design optimization focuses on minimizing power consumption while maintaining performance accuracy. Increased university and private sector participation has accelerated development cycles. Small satellite constellations demand scalable component supply chains. Rapid prototyping and shorter mission timelines stimulate recurring procurement activity. Innovation in micro-electromechanical systems supports higher functional density. Government-backed initiatives further encourage commercialization of small satellite technologies. Integration simplicity remains a key selection criterion for subsystem suppliers. Overall, small satellite growth directly strengthens sensor and actuator demand.

Challenges

High qualification and testing costs

Space-grade sensors and actuators require extensive qualification to meet extreme environmental standards. Testing procedures involve thermal vacuum, vibration, and radiation endurance validation. These processes significantly extend development timelines and increase project expenditure. Smaller manufacturers face resource constraints meeting stringent certification requirements. Limited access to specialized testing infrastructure adds operational complexity. Requalification is often required for design modifications or new mission profiles. Cost pressures restrict rapid innovation cycles for emerging suppliers. Extended validation periods can delay program execution schedules. Budget limitations further constrain testing scalability. These factors collectively slow market responsiveness.

Long development and certification cycles

Development cycles for space-qualified components typically extend across multiple years due to rigorous validation protocols. Certification processes require adherence to strict reliability and redundancy standards. Design iterations are constrained by mission-specific qualification requirements. Program delays often arise from component-level redesigns or compliance updates. Certification dependencies between subsystems increase integration complexity. Limited flight heritage can delay acceptance of newer technologies. Regulatory reviews further extend approval timelines. Long cycles reduce flexibility for rapid technology adoption. Manufacturers must balance innovation with proven reliability. These constraints impact overall market agility.

Opportunities

Growth of commercial small satellite constellations

Commercial operators are rapidly deploying constellations for imaging, connectivity, and data services. These platforms demand cost-effective, scalable sensor and actuator solutions. Increased launch frequency supports recurring component demand. Standardization across satellite buses simplifies integration requirements. Commercial missions prioritize rapid deployment and shorter development cycles. This environment encourages adoption of modular and adaptable subsystems. Private investment accelerates technology maturation and production scalability. Demand for high-volume manufacturing continues to rise. Suppliers offering reliable performance at optimized cost gain competitive advantage. This trend creates sustained growth opportunities.

Increased international collaboration programs

International partnerships are expanding through joint missions and technology-sharing agreements. Collaborative programs increase demand for interoperable sensor and actuator systems. Cross-border projects require compliance with multiple technical standards. Shared development efforts reduce financial and technological risk. Collaborative launches create new integration opportunities for domestic suppliers. Technology exchange accelerates innovation cycles across participating entities. Joint research initiatives enhance component reliability and performance. Export-oriented programs increase global market exposure. Strategic alliances support long-term industry stability. These collaborations expand market reach beyond domestic boundaries.

Future Outlook

The market is expected to experience steady expansion supported by continued defense investments and growing commercial satellite activity. Advancements in miniaturization, system integration, and autonomous control will define technology evolution. International partnerships and private sector participation are expected to strengthen market resilience through the forecast period.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Rafael Advanced Defense Systems

- Elta Systems

- Controp Precision Technologies

- SCD Semiconductor Devices

- CI Systems

- NSLComm

- Gilat Satellite Networks

- Orbit Communication Systems

- Ramon.Space

- ImageSat International

- Accubeat

- Astroscale Israel

- TSG Aerospace

Key Target Audience

- Satellite manufacturers

- Defense procurement agencies

- Space research organizations

- Commercial satellite operators

- System integrators

- Payload developers

- Investments and venture capital firms

- Israel Space Agency and Ministry of Defense

Research Methodology

Step 1: Identification of Key Variables

Market parameters were defined based on platform types, subsystem categories, and application areas. Technology scope and operational boundaries were established through domain-specific mapping. Data points were aligned with space mission architectures.

Step 2: Market Analysis and Construction

Demand patterns were assessed through procurement activity, deployment trends, and technology adoption. Segmentation logic was developed using application relevance and system integration depth.

Step 3: Hypothesis Validation and Expert Consultation

Industry inputs were obtained from engineers, program managers, and technical consultants. Assumptions were validated through cross-verification with operational benchmarks.

Step 4: Research Synthesis and Final Output

Findings were consolidated through triangulation of qualitative and quantitative inputs. Final outputs were structured to reflect market dynamics, competitive positioning, and growth outlook.

- Executive Summary

- Research Methodology (Market Definitions and Scope Framing for Space Sensors and Actuators, Platform-Level Segmentation and Payload Taxonomy Mapping, Bottom-Up Market Sizing Using Program-Level Procurement Data, Revenue Attribution Across Sensor and Actuator Subsystems, Primary Validation with Satellite OEMs and Defense Integrators, Triangulation Using Launch Manifests and Government Budget Allocations)

- Definition and Scope

- Market evolution

- Usage and mission profiles across civil and defense space programs

- Ecosystem structure and value chain integration

- Supply chain and sourcing dynamics

- Regulatory and export control environment

- Growth Drivers

Rising defense-led satellite deployments

Expansion of Israel’s small satellite programs

Growing demand for high-precision attitude control

Increased investment in space-based ISR systems

Miniaturization of satellite platforms

Government-backed space innovation funding - Challenges

High qualification and testing costs

Long development and certification cycles

Export control and regulatory restrictions

Limited production scalability

Dependence on government procurement cycles

Stringent reliability and redundancy requirements - Opportunities

Growth of commercial small satellite constellations

Increased international collaboration programs

Adoption of AI-enabled sensor fusion systems

Expansion of deep-space and lunar missions

Rising demand for agile and responsive satellites

Commercialization of dual-use space technologies - Trends

Shift toward miniaturized and low-power sensors

Integration of smart actuators with onboard AI

Higher use of radiation-hardened components

Modular satellite architecture adoption

Increased in-orbit servicing compatibility

Growth in autonomous attitude control systems - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

LEO satellites

MEO satellites

GEO satellites

Deep space and exploration missions

Military and intelligence satellites - By Application (in Value %)

Attitude determination and control

Navigation and guidance

Thermal control

Payload positioning and stabilization

Propulsion and thrust vector control - By Technology Architecture (in Value %)

Electromechanical actuators

MEMS-based sensors

Optical and infrared sensors

Reaction wheels and control moment gyros

Magnetometers and star trackers - By End-Use Industry (in Value %)

Defense and intelligence

Commercial satellite operators

Space research organizations

Earth observation service providers

Telecommunication operators - By Connectivity Type (in Value %)

Wired onboard systems

Wireless sensor networks

Hybrid connectivity architectures - By Region (in Value %)

Central Israel

Southern Israel

Northern Israel

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Product portfolio breadth, Space heritage and flight qualification, Manufacturing scale, Technology readiness level, Customization capability, Pricing competitiveness, Government contract exposure, Export reach)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Israel Aerospace Industries (IAI)

Elbit Systems

Rafael Advanced Defense Systems

ELTA Systems

Elbit Systems Electro-Optics (ELOP)

SCD Semiconductor Devices

Controp Precision Technologies

CI Systems

NSLComm

Gilat Satellite Networks

Orbit Communication Systems

Ramon.Space

ImageSat International

Accubeat

Astroscale Israel

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035