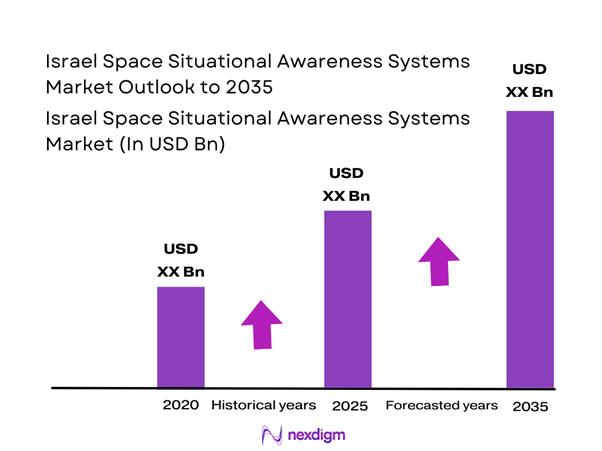

Market Overview

The Israel Space Situational Awareness Systems market current size stands at around USD ~ million, reflecting strong institutional investments during recent defense modernization cycles. Deployment levels expanded across military and civil agencies, supported by increased satellite launches and orbital monitoring needs. Demand intensified as space congestion risks grew, encouraging broader adoption of surveillance technologies. Technological upgrades in radar, optical, and data fusion systems supported operational efficiency. Program funding remained stable through 2024 and 2025, reflecting long-term strategic commitment. Integration with national security infrastructure continued expanding across defense and intelligence operations. Local manufacturing participation increased through government-backed innovation initiatives. System upgrades focused on resilience, accuracy, and response time improvements.

Israel’s market concentration is strongest around Tel Aviv, Haifa, and Be’er Sheva due to defense infrastructure density. These regions host major aerospace facilities, command centers, and satellite control operations. Government-backed research clusters support system development and testing activities. High-security installations drive sustained demand for advanced monitoring solutions. Collaboration between military, civil agencies, and private developers strengthens ecosystem maturity. Regulatory oversight and national security policies further centralize adoption within established defense corridors.

Market Segmentation

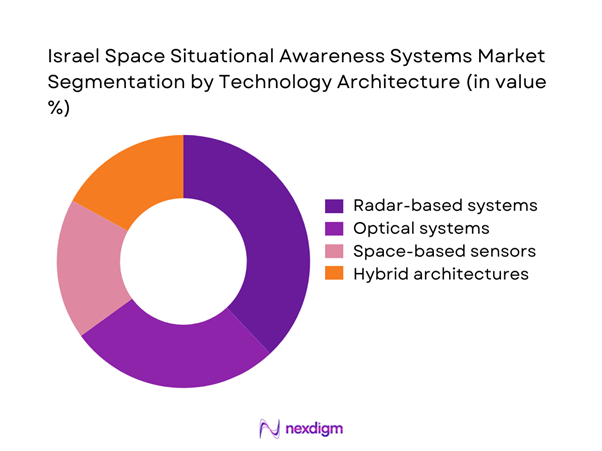

By Technology Architecture

Radar-based and electro-optical architectures dominate Israel’s space situational awareness deployments due to operational reliability. Radar systems remain preferred for all-weather detection and long-range surveillance across orbital regimes. Optical and electro-optical platforms are increasingly adopted for high-resolution tracking and object characterization. Hybrid architectures integrating sensors with AI analytics enhance detection accuracy and response speed. Space-based sensors complement ground systems by expanding coverage and reducing latency. Continuous investment in fusion platforms improves situational awareness across defense and civil applications.

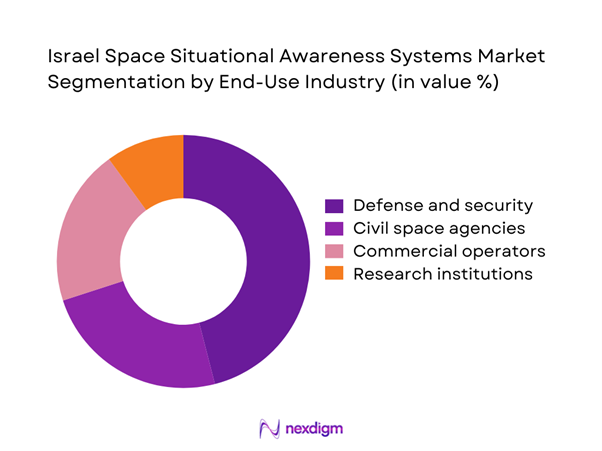

By End-Use Industry

Defense and national security organizations represent the dominant end-user segment due to strategic surveillance requirements. Civil space agencies follow, driven by satellite traffic management and collision avoidance responsibilities. Commercial satellite operators increasingly adopt SSA systems to protect high-value orbital assets. Research institutions contribute through technology testing and data analysis initiatives. Demand concentration reflects mission-critical reliance on uninterrupted space operations. Government funding ensures sustained adoption across defense and civil sectors.

Competitive Landscape

The competitive landscape is characterized by strong domestic defense manufacturers supported by government-backed innovation programs. Companies focus on advanced sensing technologies, system integration, and secure data processing capabilities. Competitive differentiation depends on technological depth, deployment reliability, and compliance with national security standards.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Orbit Communication Systems | 1950 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Gilat Satellite Networks | 1987 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

Israel Space Situational Awareness Systems Market Analysis

Growth Drivers

Rising national security focus on space domain awareness

Rising national security priorities have increased governmental focus on space domain awareness capabilities across defense planning frameworks and strategic coordination. Defense agencies expanded orbital monitoring programs to protect satellite infrastructure from emerging geopolitical and technological threats. Increased satellite dependency has amplified risks related to congestion, interference, and hostile activities in space. Authorities enhanced investments in real-time tracking systems to ensure continuous operational visibility. Collaboration between military branches strengthened intelligence-sharing mechanisms supporting situational awareness objectives. Policy emphasis encouraged integration of SSA capabilities within broader national defense strategies. Technology modernization initiatives improved detection accuracy and response speed across operational environments. Heightened geopolitical uncertainty reinforced prioritization of space domain monitoring systems. Cross-agency coordination improved data exchange between surveillance and command units. These combined factors sustained consistent demand growth across national security-driven deployments.

Expansion of Israeli satellite constellations

Expansion of Israeli satellite constellations increased operational complexity requiring enhanced space situational awareness capabilities. Growth in communication and observation satellites intensified monitoring and collision avoidance requirements. Orbital congestion necessitated precise tracking for asset protection and mission continuity. Satellite fleet diversification demanded scalable and interoperable SSA platforms. Increased launch activity elevated the importance of preemptive risk assessment systems. Operators required continuous updates on orbital positioning and potential conjunction events. Advanced analytics supported efficient management of expanding satellite networks. Integration of SSA systems improved mission planning and satellite lifecycle management. Government-backed programs supported constellation expansion initiatives. These developments reinforced sustained demand for advanced situational awareness infrastructure.

Challenges

High development and deployment costs

High development and deployment costs create barriers for rapid expansion of space situational awareness infrastructure. Advanced sensor systems require significant capital investment and long development cycles. Specialized components increase manufacturing complexity and operational expenses. Budget constraints limit adoption among smaller operators and research institutions. System maintenance and upgrades further elevate lifecycle costs. Integration with existing defense networks demands additional technical resources. Long procurement timelines delay system deployment and modernization. Cost pressures restrict experimentation with emerging technologies. Financial limitations impact scalability across multiple orbital regimes. These factors collectively challenge widespread SSA system implementation.

Limited orbital slots and spectrum constraints

Limited orbital slots and spectrum availability complicate effective space situational awareness planning and operations. Increasing satellite density intensifies competition for available orbital pathways. Spectrum congestion affects communication reliability and tracking accuracy. Regulatory coordination becomes more complex with growing international participation. Operators face restrictions on maneuverability due to limited orbital options. Spectrum allocation processes slow system deployment timelines. Cross-border coordination challenges hinder seamless information exchange. Regulatory compliance increases operational overhead for SSA providers. These constraints limit flexibility in managing expanding satellite fleets. Addressing congestion requires advanced coordination mechanisms and policy alignment.

Opportunities

Integration of AI and machine learning

Integration of AI and machine learning presents significant opportunities for enhancing space situational awareness capabilities. Automated data processing improves detection speed and anomaly identification accuracy. Machine learning algorithms enable predictive analysis for collision avoidance scenarios. AI-driven platforms reduce human intervention in routine monitoring tasks. Enhanced analytics support real-time decision-making across defense operations. Adaptive systems improve performance through continuous learning from orbital data. AI integration supports scalable management of increasing satellite volumes. Automation reduces operational workload and response times. Advanced modeling enhances threat assessment accuracy. These developments position AI as a critical enabler of next-generation SSA systems.

Growth of commercial satellite operations

Growth of commercial satellite operations creates expanding demand for reliable space situational awareness solutions. Private operators require accurate tracking to protect revenue-generating assets. Increasing satellite launches elevate collision and interference risks. Commercial missions demand cost-effective monitoring and data-sharing capabilities. SSA services support insurance, compliance, and mission optimization needs. Growing constellations amplify the importance of coordinated space traffic management. Private sector participation drives innovation in monitoring technologies. Partnerships between commercial and defense entities enhance data coverage. Market expansion encourages development of modular SSA platforms. These trends create long-term growth opportunities across the commercial space sector.

Future Outlook

The Israel Space Situational Awareness Systems market is expected to advance steadily through 2035, driven by sustained defense investments and expanding satellite activity. Continued modernization of surveillance infrastructure will support operational resilience. Integration of AI and data analytics will redefine system capabilities. Collaboration between government and private stakeholders will further strengthen market development.

Major Players

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- Elbit Systems

- Orbit Communication Systems

- Gilat Satellite Networks

- Elta Systems

- ImageSat International

- SpacePharma

- UVision Air

- BlueBird Aero Systems

- Tadiran Telecommunications

- Aeronautics Group

- NSO Group Technologies

- Stellar Space Industries

- Israel Space Agency

Key Target Audience

- Ministry of Defense of Israel

- Israel Space Agency

- Defense procurement authorities

- Satellite operators and service providers

- Aerospace and defense manufacturers

- Space technology integrators

- Investments and venture capital firms

- Government regulatory and licensing bodies

Research Methodology

Step 1: Identification of Key Variables

Key market variables were identified through analysis of defense programs, satellite deployments, and SSA technology adoption trends. Focus was placed on operational scope, system types, and end-user applications.

Step 2: Market Analysis and Construction

Market structure was developed using segmentation by application, technology, and end use. Data consistency was ensured through cross-verification of operational deployments and program activity.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through expert interactions across defense, aerospace, and satellite operations. Feedback refined market direction and technology adoption assessment.

Step 4: Research Synthesis and Final Output

Insights were consolidated into a structured framework ensuring alignment with industry realities, regulatory conditions, and technological evolution patterns.

- Executive Summary

- Research Methodology (Market Definitions and Israel SSA operational scope mapping, Platform and sensor-based segmentation framework, Bottom-up market sizing using program budgets and contract values, Revenue attribution by system type and deployment model, Primary validation through defense agencies and space operators interviews, Triangulation using satellite launch data and defense procurement disclosures)

- Definition and Scope

- Market evolution

- Usage and mission-critical applications

- Ecosystem structure

- Supply chain and system integration framework

- Regulatory and national security environment

- Growth Drivers

Rising national security focus on space domain awareness

Expansion of Israeli satellite constellations

Increasing space debris and collision risks

Growing reliance on space-based ISR capabilities

Government investments in space defense infrastructure

Advancements in radar and optical sensing technologies - Challenges

High development and deployment costs

Limited orbital slots and spectrum constraints

Data security and cyber vulnerability risks

Complex integration with legacy defense systems

Export restrictions and regulatory barriers

Limited skilled workforce in SSA analytics - Opportunities

Integration of AI and machine learning in SSA analytics

Growth of commercial satellite operations

International space situational data-sharing partnerships

Development of space traffic management systems

Expansion of dual-use SSA technologies

Emergence of space-based SSA platforms - Trends

Shift toward autonomous SSA systems

Increased use of AI-driven predictive analytics

Growing adoption of multi-sensor fusion platforms

Integration with missile defense and ISR systems

Rising public-private collaboration in space monitoring

Emphasis on real-time space domain awareness - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Military satellites

Civil and commercial satellites

Dual-use space assets

Ground-based tracking assets - By Application (in Value %)

Space object tracking and cataloging

Collision avoidance and conjunction assessment

Space debris monitoring

Threat detection and space defense

Mission planning and orbit determination - By Technology Architecture (in Value %)

Radar-based SSA systems

Optical and electro-optical systems

Space-based SSA sensors

AI-enabled data fusion platforms

Hybrid SSA architectures - By End-Use Industry (in Value %)

Defense and national security

Civil space agencies

Commercial satellite operators

Research and academic institutions - By Connectivity Type (in Value %)

Ground-to-space communication systems

Inter-satellite data links

Secure military communication networks

Cloud-enabled SSA platforms - By Region (in Value %)

Northern Israel

Central Israel

Southern Israel

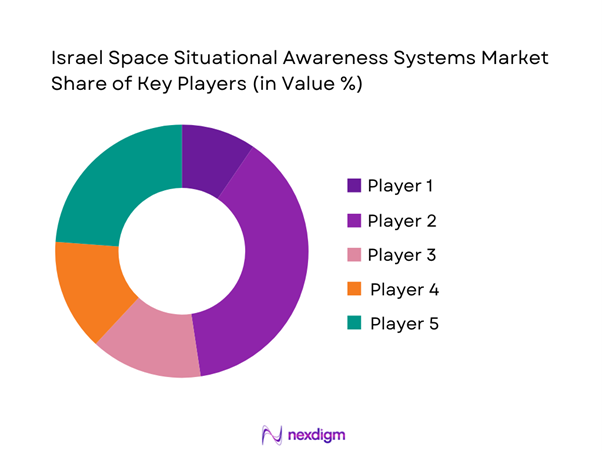

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Technology maturity, System accuracy, Integration capability, Data processing capacity, Defense certification level, Pricing model, Local manufacturing presence, After-sales support)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Israel Aerospace Industries (IAI)

Rafael Advanced Defense Systems

Elbit Systems

Israel Space Agency

Tadiran Telecommunications

Aeronautics Group

UVision Air

NSO Group Technologies

Orbit Communication Systems

Gilat Satellite Networks

Elta Systems

ImageSat International

SpacePharma

Stellar Space Industries

BlueBird Aero Systems

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035