Market Overview

The Israel spacecraft market current size stands at around USD ~ million, reflecting steady activity across defense, commercial, and scientific missions. During 2024 and 2025, satellite launches, platform upgrades, and payload development volumes increased, driven by national security priorities and commercial observation demand. Growth has remained stable due to consistent government procurement, rising private participation, and expanding downstream data usage. The market structure reflects high technological intensity, long development cycles, and strong integration between manufacturing, software, and mission operations.

Israel’s spacecraft ecosystem is concentrated around major aerospace clusters with strong defense linkages and research infrastructure. Tel Aviv and central Israel dominate system design, payload engineering, and mission control activities. Demand is supported by advanced space policy frameworks, military modernization programs, and collaboration with international space agencies. A mature supplier base, strong R&D culture, and vertically integrated production environment reinforce market stability and long-term technological competitiveness.

Market Segmentation

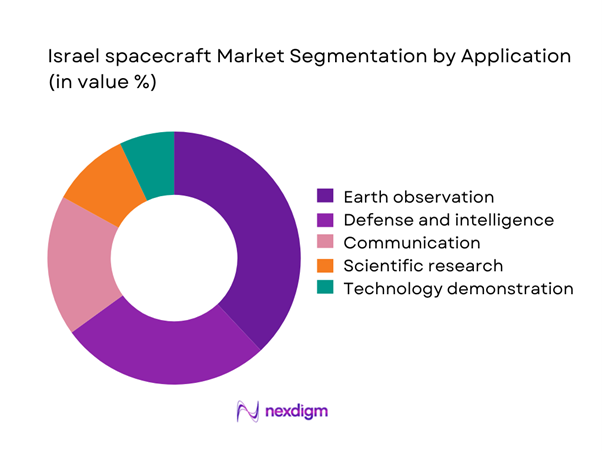

By Application

Earth observation remains the dominant application due to persistent national security requirements and expanding commercial imaging demand. Defense and intelligence missions account for a substantial share, driven by surveillance, border monitoring, and early-warning needs. Scientific and technology demonstration missions continue to gain relevance as Israel increases participation in international research initiatives. Communication satellites maintain steady adoption for secure data transmission and redundancy. The growing relevance of dual-use payloads has further strengthened application diversity, enabling cross-sector utilization and higher asset efficiency.

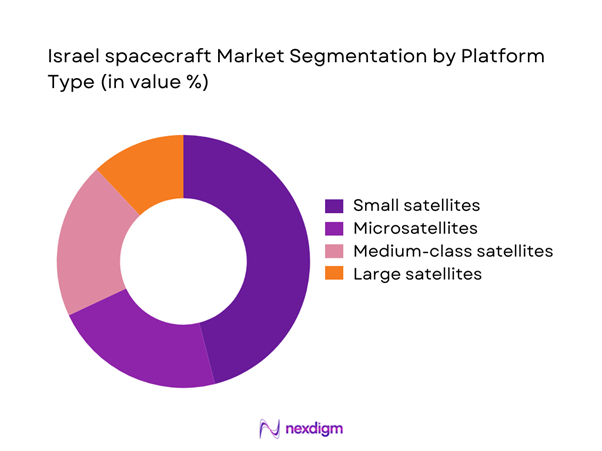

By Platform Type

Small satellites dominate platform deployment due to lower development timelines and flexible launch compatibility. CubeSats and microsatellites are increasingly used for technology validation and commercial observation missions. Medium-class satellites continue to support defense and secure communication requirements. Larger platforms are limited but remain critical for specialized payloads requiring higher power and endurance. Platform standardization and modular architectures have improved deployment efficiency while enabling faster mission customization across applications.

Competitive Landscape

The competitive landscape is characterized by a mix of state-backed aerospace organizations and specialized private firms. Market participation is shaped by long-term defense contracts, technological specialization, and export-oriented development strategies. Companies compete on mission reliability, payload integration capability, and system customization. Strong government involvement ensures stable demand, while emerging private players are driving innovation in miniaturization, onboard processing, and rapid deployment solutions.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Israel Aerospace Industries | 1953 | Lod | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Haifa | ~ | ~ | ~ | ~ | ~ | ~ |

| ImageSat International | 1997 | Tel Aviv | ~ | ~ | ~ | ~ | ~ | ~ |

| Gilat Satellite Networks | 1987 | Petah Tikva | ~ | ~ | ~ | ~ | ~ | ~ |

Israel spacecraft Market Analysis

Growth Drivers

Rising defense and intelligence satellite demand

Rising geopolitical tensions have increased demand for persistent surveillance and secure intelligence gathering capabilities across national defense programs. Satellite-based reconnaissance enables real-time situational awareness and strategic monitoring across borders and maritime zones. Defense agencies expanded satellite usage during 2024 to enhance early warning and threat detection coverage. Increased reliance on space-based intelligence has strengthened procurement pipelines for observation platforms. Multi-mission spacecraft designs have improved cost efficiency and operational flexibility across defense missions. Integration of advanced imaging payloads has enhanced resolution and data reliability. Intelligence agencies increasingly prefer domestically developed systems for security assurance. High revisit frequency requirements continue driving constellation-based deployments. Collaboration between defense agencies and manufacturers has accelerated deployment timelines. These factors collectively reinforce sustained demand growth across defense-focused spacecraft programs.

Government-backed space programs and funding

Government-backed programs have provided stable funding support for spacecraft research and development activities. National space strategies emphasize technological sovereignty and long-term capability development. Public funding enabled multiple satellite programs during 2024 and 2025 across observation and communication domains. Institutional support reduced financial risk for private manufacturers and startups. Long-term procurement frameworks improved production planning and investment confidence. Space policy alignment strengthened coordination between civil and defense stakeholders. Government-backed testing facilities accelerated payload qualification processes. Strategic roadmaps encouraged international collaboration and technology transfer initiatives. Public investment also stimulated workforce development and specialized engineering talent. These measures collectively reinforced market resilience and long-term expansion.

Challenges

High development and launch costs

Spacecraft development requires substantial capital allocation across design, testing, and validation stages. High component precision standards increase manufacturing complexity and project timelines. Launch service expenses remain a significant constraint for frequent deployment cycles. Limited economies of scale restrict cost optimization across small production volumes. Budget constraints affect program continuity for commercial operators. Risk mitigation requirements further increase project expenditures. Extended development timelines delay return on investment realization. Cost pressures reduce participation of smaller private entities. Funding volatility can disrupt long-term mission planning. These challenges collectively limit rapid market scalability.

Limited domestic launch infrastructure

Israel’s limited domestic launch infrastructure constrains scheduling flexibility and mission frequency. Dependence on external launch providers increases logistical complexity and coordination requirements. Launch window limitations affect deployment timelines for time-sensitive missions. Geographical constraints restrict orbital insertion options. Foreign launch reliance introduces regulatory and diplomatic considerations. Transportation and integration logistics add operational overhead. Delays in launch availability impact constellation deployment strategies. Infrastructure limitations reduce responsiveness to urgent mission needs. Capacity constraints affect long-term planning for commercial operators. These factors collectively restrict operational agility.

Opportunities

Miniaturization and smallsat constellations

Miniaturization trends enable deployment of cost-efficient and scalable satellite constellations. Advances in electronics have improved payload capability within reduced form factors. Smallsats support rapid deployment for Earth observation and communication missions. Lower manufacturing complexity shortens development cycles significantly. Constellation architectures enhance data redundancy and revisit frequency. Commercial adoption continues rising across environmental monitoring applications. Modular designs improve upgrade flexibility across mission lifecycles. Integration with launch aggregation services improves cost efficiency. Private sector participation accelerates innovation cycles. These developments create strong growth opportunities across multiple applications.

Commercial Earth observation demand growth

Commercial demand for high-resolution imagery has expanded across agriculture, infrastructure, and security sectors. Data-driven decision-making increasingly relies on satellite-derived insights. Private analytics firms utilize imagery for monitoring and predictive analysis. Increased availability of downstream services enhances value chain depth. Subscription-based data models improve revenue stability for operators. Cloud integration supports faster data processing and delivery. Commercial customers seek higher revisit rates and improved resolution. Demand diversification reduces reliance on defense contracts. Technological improvements lower entry barriers for service providers. These dynamics support sustained commercial expansion.

Future Outlook

The Israel spacecraft market is expected to maintain steady growth through 2035, supported by defense modernization and commercial expansion. Continued investment in small satellite platforms and data-driven applications will strengthen market resilience. International collaborations and private sector participation are likely to expand. Policy stability and technological innovation will remain central to long-term development.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Rafael Advanced Defense Systems

- ImageSat International

- Gilat Satellite Networks

- SpaceIL

- NSLComm

- Ramon.Space

- SatixFy

- Astroscale Israel

- Aeronautics Group

- Elta Systems

- Helios

- Spacecom

- IAI MBT Space Division

Key Target Audience

- Defense and security agencies

- Israel Space Agency

- Ministry of Defense and affiliated bodies

- Satellite manufacturing companies

- Satellite data service providers

- Launch service integrators

- Investments and venture capital firms

- Commercial Earth observation operators

Research Methodology

Step 1: Identification of Key Variables

Market scope, platform categories, application areas, and demand drivers were identified through industry mapping and policy review. Key technological and operational parameters were defined to ensure accurate segmentation.

Step 2: Market Analysis and Construction

Market structure was developed using program-level assessment, deployment trends, and technology adoption patterns. Data consistency was maintained across applications and platform types.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through consultations with industry professionals, engineers, and program managers. Insights were cross-checked for technical accuracy and market relevance.

Step 4: Research Synthesis and Final Output

All qualitative and quantitative inputs were consolidated into a structured framework. Analytical consistency was ensured through iterative review and validation processes.

- Executive Summary

- Research Methodology (Market Definitions and spacecraft scope delineation for Israel, Satellite and space platform taxonomy mapping, Bottom-up program-level market sizing using contract and launch data, Revenue attribution across manufacturing integration and services, Primary interviews with Israeli aerospace OEMs and defense stakeholders, Triangulation using government budgets export data and launch manifests)

- Definition and scope

- Market evolution

- Usage and mission profiles

- Ecosystem structure

- Supply chain and integration framework

- Regulatory and national space policy environment

- Growth Drivers

Rising defense and intelligence satellite demand

Government-backed space programs and funding

Growing need for ISR and geospatial intelligence

Expansion of small satellite missions

Increasing international collaboration and exports - Challenges

High development and launch costs

Limited domestic launch infrastructure

Export control and regulatory constraints

Long development and qualification cycles

Dependence on government procurement - Opportunities

Miniaturization and smallsat constellations

Commercial Earth observation demand growth

Dual-use satellite technology adoption

International co-development programs

Private investment in space startups - Trends

Shift toward small and agile satellite platforms

Increased use of AI-enabled payloads

Growth in synthetic aperture radar missions

Rising role of private space companies

Emphasis on rapid deployment capabilities - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Earth observation satellites

Communication satellites

Scientific and research spacecraft

Military and intelligence spacecraft

Technology demonstration satellites - By Application (in Value %)

Defense and intelligence

Commercial communications

Earth observation and remote sensing

Scientific research

Technology validation - By Technology Architecture (in Value %)

Small satellites and CubeSats

Medium-class satellites

High-resolution optical platforms

SAR-based platforms

Hosted payload systems - By End-Use Industry (in Value %)

Defense and homeland security

Telecommunications

Space research organizations

Commercial satellite operators

Academic and research institutions - By Connectivity Type (in Value %)

RF-based communication systems

Optical and laser communication systems

Hybrid connectivity platforms - By Region (in Value %)

Domestic Israel programs

North America partnerships

Europe collaborations

Asia-Pacific export programs

Middle East cooperation initiatives

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Product portfolio breadth, Mission specialization, Technological capability, Government contract exposure, Export footprint, Pricing strategy, Integration capability, R&D intensity)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Israel Aerospace Industries

Elbit Systems

Rafael Advanced Defense Systems

Gilat Satellite Networks

ImageSat International

SpaceIL

NSLComm

Spacecom

ELTA Systems

Ramon.Space

Astroscale Israel

Helios

Aeronautics Group

SatixFy

IAI MBT Space Division

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035