Market Overview

The Israel surface radars market current size stands at around USD ~ million, supported by sustained defense modernization and border surveillance investments. Deployment volumes increased steadily across 2024 and 2025, driven by air defense integration and ground surveillance requirements. The market reflects strong domestic manufacturing participation and consistent procurement cycles. Technology upgrades focus on multi-mission radar, electronic countermeasure resistance, and improved detection accuracy. Adoption remains concentrated within defense and homeland security frameworks. Demand momentum continues due to evolving threat environments and regional security priorities.

Market activity is concentrated around defense hubs and coastal surveillance zones where infrastructure density and operational readiness remain highest. Southern and northern operational belts drive continuous radar deployment due to border monitoring needs. Urban defense networks and strategic installations create sustained demand for advanced surface radar coverage. Strong government backing and integrated defense planning shape procurement consistency. Local manufacturing ecosystems enhance system integration and lifecycle management. Regulatory alignment supports long-term deployment stability across critical zones.

Market Segmentation

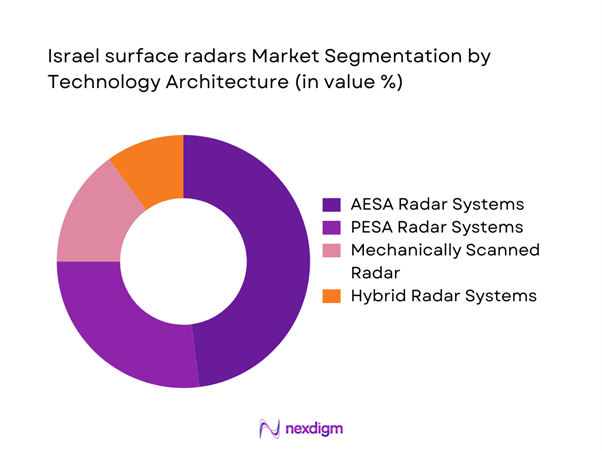

By Technology Architecture

The technology architecture segment is dominated by active electronically scanned array systems due to superior detection accuracy, electronic counter-countermeasure capability, and rapid beam steering performance. AESA platforms are increasingly preferred for border surveillance and missile detection applications. Passive and mechanically scanned systems continue serving legacy installations and lower-cost deployments. Integration of digital signal processing enhances multi-target tracking efficiency. Technological upgrades are largely driven by interoperability requirements with national air defense systems. This segment remains innovation-driven with strong emphasis on resilience and adaptability.

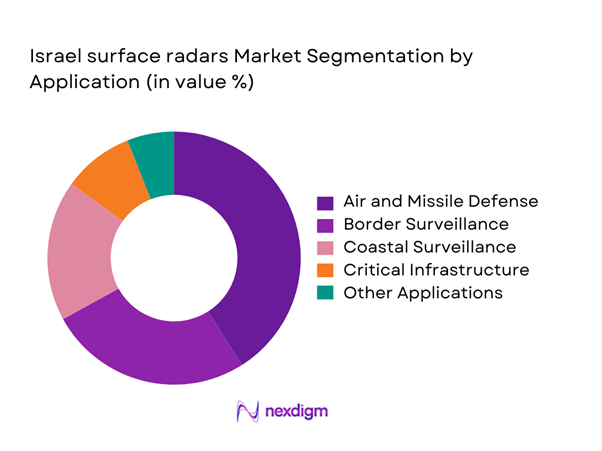

By Application

The application landscape is primarily led by air and missile defense usage, reflecting Israel’s strategic defense posture. Border surveillance represents a significant share due to continuous monitoring requirements and terrain complexity. Coastal and maritime surveillance maintains steady adoption to secure economic zones. Critical infrastructure protection contributes moderate demand through fixed installations. Emerging applications include counter-UAS and battlefield situational awareness systems. Application growth aligns closely with national security modernization programs and layered defense doctrines.

Competitive Landscape

The competitive landscape is characterized by strong domestic manufacturing capabilities supported by advanced research ecosystems. Companies compete on radar performance, system integration depth, and long-term maintenance capabilities. Partnerships with defense agencies play a critical role in product deployment. Export-oriented product design also influences competitive positioning. Continuous innovation and system reliability remain key differentiators.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| HENSOLDT | 2017 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

Israel surface radars Market Analysis

Growth Drivers

Rising border security and threat detection requirements

Growing regional instability increases reliance on advanced radar surveillance systems across borders and sensitive zones. Defense agencies expanded radar deployments during 2024 to strengthen detection reliability. Advanced sensors improve real-time threat assessment accuracy significantly. Surveillance coverage expansion supports early warning and rapid response mechanisms. Radar upgrades enhance detection of low-altitude and slow-moving threats. Continuous monitoring strengthens national security resilience across critical regions. Investments prioritize multi-layer detection capabilities across operational theaters. Integrated radar systems support coordinated defense strategies effectively. Surveillance intensity continues increasing due to evolving threat complexity. This driver remains central to sustained procurement momentum.

Increased defense spending and radar modernization programs

Defense modernization programs accelerated radar upgrades during 2024 and 2025. Budget allocations prioritized sensor modernization over legacy system maintenance. Modern radar platforms enable improved tracking and data fusion capabilities. Multi-mission systems replaced older single-purpose radars. Defense modernization aligns with long-term national security strategies. Procurement cycles emphasize lifecycle performance and system reliability. Integration with air defense networks drives sustained demand. Technology refresh cycles shorten due to evolving electronic warfare threats. Government initiatives promote domestic system development. Modernization remains a long-term structural driver.

Challenges

High development and integration costs

Advanced radar systems require complex engineering and extensive testing processes. Development costs remain elevated due to sophisticated hardware requirements. Integration with command networks adds further cost complexity. Customization needs increase deployment expenses significantly. Budget limitations restrict procurement volume despite strategic importance. High system complexity raises maintenance expenditures. Lifecycle support requires skilled technical resources. Cost pressures affect procurement timelines and system scaling. Financial planning becomes critical for long-term deployment. Cost management remains a persistent operational challenge.

Long procurement and approval cycles

Procurement cycles involve extensive testing and regulatory approvals. Multi-stage evaluation delays system deployment timelines. Budgetary approvals extend acquisition durations significantly. Inter-agency coordination adds procedural complexity. Custom specifications lengthen tender processes. Technology validation requirements increase approval timelines. Contract negotiations involve multiple compliance checks. Deployment delays impact operational readiness planning. Long cycles reduce flexibility in technology adoption. Procurement inefficiencies remain a structural challenge.

Opportunities

Upgrades of legacy radar systems

Legacy radar installations require modernization to meet current threat profiles. Upgrade programs focus on digital processing and sensor fusion. Retrofitting offers cost-effective performance improvements. Modernization extends operational life of existing infrastructure. Integration with new command systems enhances effectiveness. Upgrade demand remains consistent across defense sectors. Technology refresh programs support continuous revenue streams. System interoperability upgrades improve multi-domain coordination. Incremental modernization reduces replacement costs. Upgrade initiatives represent strong near-term opportunities.

Integration with AI and advanced analytics

Artificial intelligence enhances target detection and classification accuracy. AI integration improves predictive threat assessment capabilities. Automated data processing reduces operator workload significantly. Advanced analytics enable faster decision-making cycles. AI-enabled radars improve situational awareness efficiency. Integration supports real-time threat prioritization. Software-driven upgrades extend system relevance. AI adoption improves operational responsiveness. Analytics improve mission planning accuracy. This opportunity drives next-generation radar development.

Future Outlook

The Israel surface radars market is expected to maintain steady expansion through 2035 driven by modernization initiatives and evolving defense needs. Increased adoption of intelligent radar systems will enhance surveillance efficiency. Integration with digital defense ecosystems will continue strengthening system capabilities. Demand will remain stable across defense and homeland security applications. Long-term investments will focus on advanced detection technologies.

Major Players

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- Elbit Systems

- HENSOLDT

- Thales Group

- Lockheed Martin

- Raytheon Technologies

- Leonardo

- Saab AB

- Northrop Grumman

- BAE Systems

- ASELSAN

- L3Harris Technologies

- Terma Group

- Indra Sistemas

Key Target Audience

- Defense ministries and armed forces

- Homeland security agencies

- Border security authorities

- Naval and coastal surveillance agencies

- Air defense command units

- Infrastructure protection agencies

- Investments and venture capital firms

- Government and regulatory bodies including Ministry of Defense

Research Methodology

Step 1: Identification of Key Variables

Market scope, radar classifications, operational applications, and deployment environments were defined. Technology segmentation and end-use mapping were established. Data parameters were standardized to ensure consistency.

Step 2: Market Analysis and Construction

Demand indicators, deployment trends, and technology adoption patterns were analyzed. Market structure was constructed using operational deployment data and defense procurement cycles.

Step 3: Hypothesis Validation and Expert Consultation

Industry specialists, defense analysts, and system integrators validated assumptions. Feedback was incorporated to refine market behavior and trend interpretation.

Step 4: Research Synthesis and Final Output

All findings were consolidated, cross-verified, and structured into analytical insights. Outputs were aligned with industry dynamics and strategic outlook considerations.

- Executive Summary

- Research Methodology (Market Definitions and operational radar scope mapping, platform and mission-based segmentation logic for surface radar systems, bottom-up market sizing using delivery and deployment data, revenue attribution by system type and contract value, primary interviews with Israeli defense OEMs and procurement officials, triangulation using defense budgets and radar installation databases, assumptions based on threat perception and modernization cycles)

- Definition and scope

- Market evolution and modernization timeline

- Operational usage across defense and civil domains

- Ecosystem structure and OEM–integrator relationships

- Supply chain and localization dynamics

- Regulatory and defense procurement framework

- Growth Drivers

Rising border security and threat detection requirements

Increased defense spending and radar modernization programs

Growing demand for integrated air and missile defense systems

Technological advancements in AESA and digital beamforming

Expansion of coastal and maritime surveillance infrastructure

Export-oriented development of radar technologies - Challenges

High development and integration costs

Long procurement and approval cycles

Dependence on government defense budgets

Export control and regulatory constraints

System interoperability challenges

Rapid technology obsolescence - Opportunities

Upgrades of legacy radar systems

Integration with AI and advanced analytics

Growth in counter-UAS and low-altitude detection systems

Export opportunities to allied nations

Multi-domain radar deployment programs

Dual-use radar applications - Trends

Shift toward software-defined radar architectures

Increased adoption of multi-mission radar platforms

Miniaturization and mobility enhancements

Integration with missile defense ecosystems

Focus on electronic warfare resilience

Rising use of predictive maintenance analytics - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Ground-based fixed radar systems

Mobile and transportable radar systems

Naval surface surveillance radars

Coastal and border surveillance radars - By Application (in Value %)

Air and missile defense

Border and perimeter surveillance

Coastal and maritime monitoring

Ground movement detection

Critical infrastructure protection - By Technology Architecture (in Value %)

Active electronically scanned array (AESA)

Passive electronically scanned array (PESA)

Conventional mechanically scanned radar

Multi-function radar systems - By End-Use Industry (in Value %)

Defense and armed forces

Homeland security and border control

Aviation and air traffic management

Maritime authorities

Critical infrastructure operators - By Connectivity Type (in Value %)

Standalone radar systems

Networked and integrated C4ISR systems

AI-enabled sensor fusion platforms - By Region (in Value %)

Northern Israel

Central Israel

Southern Israel

Coastal regions

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (technology maturity, system range capability, integration flexibility, pricing strategy, after-sales support, domestic manufacturing share, export presence, R&D intensity)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Israel Aerospace Industries (ELTA Systems)

Rafael Advanced Defense Systems

Elbit Systems

HENSOLDT

Thales Group

Lockheed Martin

Raytheon Technologies

Leonardo

Saab AB

Northrop Grumman

BAE Systems

ASELSAN

L3Harris Technologies

Terma Group

Indra Sistemas

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035