Market Overview

The Israel Surface to Air Missiles market current size stands at around USD ~ million, reflecting sustained defense modernization and layered air defense investments. Recent procurement cycles supported steady interceptor production volumes and system upgrades across multiple deployment environments. Operational demand increased due to persistent aerial threats and evolving regional security dynamics. Spending levels remained consistent, supported by defense allocation prioritization and long-term system sustainment programs. Indigenous manufacturing and domestic integration capabilities continued expanding to reduce dependency risks. Technology refresh cycles contributed to stable procurement momentum across multiple defense branches.

The market is concentrated around strategic defense hubs with established command infrastructure and integrated radar coverage. Deployment density remains higher near sensitive borders, urban defense zones, and critical infrastructure corridors. Strong domestic defense ecosystems support rapid system upgrades and operational readiness. Policy emphasis on self-reliance strengthens local manufacturing and system lifecycle management. Coordinated military planning ensures alignment between operational needs and acquisition strategies. Mature procurement frameworks enable consistent system upgrades and fleet expansion.

Market Segmentation

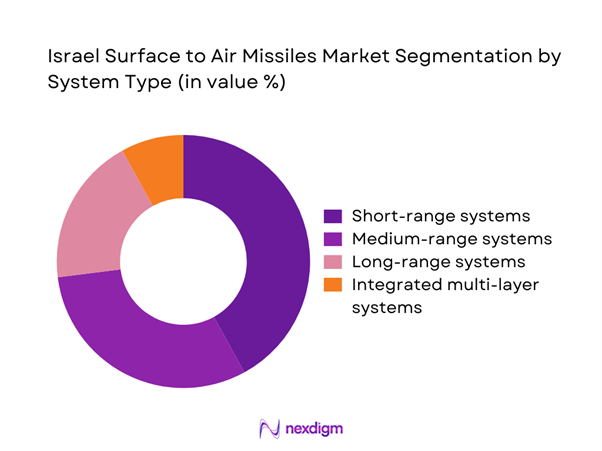

By System Type

Short and medium range interceptor systems dominate deployments due to their flexibility against rockets, drones, and low-altitude threats. These systems benefit from frequent operational usage, continuous upgrades, and integration with national air defense networks. Long-range missile defense systems maintain strategic importance but represent lower deployment density due to higher complexity and cost. Multi-layered architectures enable seamless engagement across threat categories, supporting layered defense doctrines. Demand remains strong for modular systems allowing rapid deployment and scalable coverage across operational theaters.

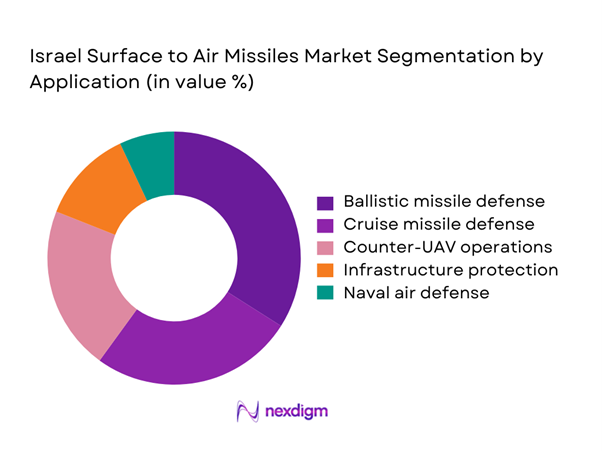

By Application

Ballistic and cruise missile interception accounts for the highest utilization due to persistent regional threats. Counter-UAV applications have expanded rapidly, driven by asymmetric warfare dynamics and increasing drone incursions. Infrastructure and asset protection remains a core application supported by fixed-site deployments. Mobile air defense units support expeditionary and border operations. Naval air defense applications remain niche but strategically relevant for offshore asset protection.

Competitive Landscape

The competitive environment is shaped by vertically integrated manufacturers, advanced R&D capabilities, and strong government alignment. Market participants focus on system reliability, rapid response capability, and integration with national defense networks. Long-term defense programs and technology partnerships influence competitive positioning.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

Israel Surface to Air Missiles Market Analysis

Growth Drivers

Rising regional missile and UAV threat landscape

Regional security volatility continues to intensify demand for layered air defense systems across multiple operational domains. Increased frequency of aerial threats has elevated readiness requirements across defense units nationwide. Continuous monitoring and rapid interception capabilities are now operational necessities rather than strategic options. Threat diversity has expanded from traditional missiles to drones and loitering munitions. This diversification has driven accelerated procurement of adaptable interceptor systems. Defense planners prioritize resilience and redundancy to counter saturation attacks effectively. Interceptor deployment density has increased across critical zones and urban perimeters. Enhanced sensor fusion improves response accuracy under complex threat conditions. Operational doctrine increasingly emphasizes rapid response and high interception success rates. These dynamics collectively sustain consistent investment momentum across missile defense programs.

Expansion of layered air defense doctrine

Layered defense strategies integrate multiple interception tiers for comprehensive aerial threat coverage. This approach enables optimized engagement across varying altitudes and threat speeds. Integration between radar, command, and interceptor systems remains central to operational effectiveness. Defense authorities continue upgrading command architectures to support multi-layer coordination. The doctrine emphasizes seamless transition between detection and interception phases. Advanced data fusion enhances target discrimination under dense threat environments. Layered architectures reduce system saturation risks during high-volume attacks. Continuous testing validates interoperability across platforms and subsystems. Operational training increasingly focuses on multi-layer engagement scenarios. This doctrine underpins long-term system deployment and modernization priorities.

Challenges

High development and interceptor replacement costs

Advanced interceptor development requires sustained investment in testing, validation, and manufacturing infrastructure. High replacement rates following live engagements create logistical and financial pressure. Maintaining sufficient interceptor inventory levels remains an operational challenge. Cost-intensive components limit rapid scalability of production lines. Technology upgrades further increase lifecycle management complexity. Budget prioritization must balance modernization with operational readiness. Replacement timelines can strain procurement planning cycles. Continuous system upgrades require parallel investments in training and maintenance. Supply chain dependencies increase vulnerability to component shortages. These factors collectively constrain long-term cost efficiency.

Limited export flexibility due to geopolitical constraints

Export controls and geopolitical sensitivities restrict market expansion beyond select allied nations. Regulatory approvals often extend procurement timelines and limit deal volumes. Technology transfer limitations reduce customization flexibility for international customers. Strategic considerations frequently override commercial export opportunities. Compliance with international defense agreements adds procedural complexity. Political alignment heavily influences export feasibility across regions. Market diversification remains constrained by diplomatic frameworks. This limits revenue expansion through international sales channels. Export approval uncertainty affects long-term production planning. These restrictions shape overall market scalability.

Opportunities

Development of next-generation hypersonic interceptors

Emerging hypersonic threats create demand for advanced interception technologies. Research initiatives increasingly focus on high-speed tracking and engagement capabilities. Integration of artificial intelligence improves response accuracy and reaction times. Development programs emphasize adaptability to evolving threat profiles. Investment in sensor fusion enhances detection reliability under extreme conditions. Collaborative research accelerates technology maturation cycles. Testing environments simulate complex engagement scenarios. Next-generation systems promise improved interception probabilities. Capability advancements support long-term defense readiness objectives. These innovations present significant modernization opportunities.

Export of proven systems to allied nations

Proven combat performance strengthens international interest in domestic air defense systems. Allied nations seek reliable solutions with demonstrated operational effectiveness. Strategic partnerships enable co-development and localized manufacturing opportunities. Export agreements support long-term maintenance and upgrade contracts. Interoperability with allied defense systems enhances adoption potential. Training and support packages add value to export offerings. Regional security partnerships facilitate technology sharing frameworks. Demand growth is supported by rising global missile threats. Export success reinforces domestic industrial sustainability. These dynamics create favorable expansion pathways.

Future Outlook

The Israel Surface to Air Missiles market is expected to maintain steady growth driven by evolving threat environments and continuous technological advancements. Ongoing investments in layered defense architectures and interceptor modernization will shape future deployments. Emphasis on automation, sensor integration, and rapid response capabilities will define system evolution. Strategic collaboration and domestic innovation are likely to sustain long-term market resilience.

Major Players

- Rafael Advanced Defense Systems

- Israel Aerospace Industries

- Elbit Systems

- Raytheon Technologies

- Lockheed Martin

- MBDA

- Northrop Grumman

- Boeing Defense

- Thales Group

- BAE Systems

- Leonardo S.p.A.

- Kongsberg Defence & Aerospace

- Diehl Defence

- Rheinmetall Defence

- Aselsan

Key Target Audience

- Ministry of Defense procurement divisions

- Air force and air defense commands

- Missile defense program offices

- Defense system integrators

- Homeland security agencies

- Strategic infrastructure operators

- Investments and venture capital firms

- Government and regulatory bodies including defense acquisition agencies

Research Methodology

Step 1: Identification of Key Variables

Core system classifications, deployment types, and operational use cases were identified based on defense frameworks. Threat profiles and system performance parameters were mapped to define analytical boundaries.

Step 2: Market Analysis and Construction

Data was structured using program-level assessment and deployment intensity indicators. Demand drivers and technology adoption patterns were evaluated across operational layers.

Step 3: Hypothesis Validation and Expert Consultation

Insights were validated through consultations with defense analysts and technical specialists. Assumptions were refined based on operational feasibility and deployment trends.

Step 4: Research Synthesis and Final Output

Findings were consolidated through triangulation of technical, strategic, and operational inputs. Final outputs were structured to ensure clarity, consistency, and analytical depth.

- Executive Summary

- Research Methodology (Market Definitions and operational scope of surface-to-air missile systems in Israel, Platform and interceptor segmentation logic across short range to long range SAMs, Bottom-up and top-down defense budget based market sizing approach, Program-wise revenue attribution and contract value normalization, Primary interviews with Israeli defense officials and missile system integrators, Cross-validation using procurement data, threat assessments, and production disclosures)

- Definition and Scope

- Market evolution

- Usage and deployment doctrine

- Ecosystem structure

- Supply chain and domestic production framework

- Regulatory and defense procurement environment

- Growth Drivers

Rising regional missile and UAV threat landscape

Expansion of layered air defense doctrine

Continuous modernization of Iron Dome and David’s Sling

Increased defense budget allocation for missile defense

Growing emphasis on indigenous defense manufacturing

Integration of AI and sensor fusion in air defense - Challenges

High development and interceptor replacement costs

Limited export flexibility due to geopolitical constraints

Interceptor inventory replenishment pressure

Technological saturation in dense conflict environments

System interoperability and integration complexity - Opportunities

Development of next-generation hypersonic interceptors

Export of proven systems to allied nations

Integration of laser-based air defense layers

Upgrades of legacy systems with AI and automation

Joint development programs with allied defense forces - Trends

Shift toward multi-layered air and missile defense architecture

Increasing use of AI-driven threat prioritization

Growth of mobile and rapidly deployable SAM units

Rising investment in counter-UAS capabilities

Convergence of air defense with space-based sensing - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Unit Cost, 2020–2025

- By Fleet Type (in Value %)

Short-range air defense systems

Medium-range air defense systems

Long-range air and missile defense systems

Multi-layer integrated air defense systems - By Application (in Value %)

Ballistic missile interception

Cruise missile defense

UAV and loitering munition interception

Aircraft and helicopter defense

Critical infrastructure protection - By Technology Architecture (in Value %)

Radar-guided interceptor systems

Infrared-guided interceptor systems

Active radar homing systems

Network-centric and AI-enabled interception systems - By End-Use Industry (in Value %)

Israeli Air Force

Israeli Army Air Defense Command

Naval air defense units

Homeland and strategic infrastructure defense - By Connectivity Type (in Value %)

Standalone fire control systems

Network-centric integrated air defense systems

C4ISR-linked defense architecture - By Region (in Value %)

Northern Command

Southern Command

Central Command

Naval and offshore zones

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (system range, interception altitude, radar capability, interceptor speed, kill probability, integration capability, cost per interceptor, deployment mobility)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Rafael Advanced Defense Systems

Israel Aerospace Industries

Elbit Systems

Raytheon Technologies

Lockheed Martin

MBDA

Northrop Grumman

Boeing Defense

Thales Group

BAE Systems

Leonardo S.p.A.

Kongsberg Defence & Aerospace

Diehl Defence

Rheinmetall Defence

Aselsan

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Unit Cost, 2026–2035