Market Overview

The Israel Surface to Surface Missiles market current size stands at around USD ~ million, reflecting steady procurement activity across national defense modernization programs and long-term strategic deterrence initiatives. Development activity remained consistent during 2024 and 2025, supported by sustained government allocations, operational readiness requirements, and increasing emphasis on indigenous missile development programs. Demand patterns are influenced by evolving threat scenarios, technological upgrades, and the need to maintain credible strike capabilities. Domestic manufacturing capacity and integration of advanced guidance technologies continue to shape procurement strategies.

The market is primarily concentrated around central and southern Israel, where defense manufacturing clusters, testing ranges, and command infrastructure are established. High defense spending intensity, mature supplier ecosystems, and strong coordination between military and industrial stakeholders drive regional dominance. Policy-driven prioritization of self-reliance and export controls further influences deployment patterns. Advanced testing facilities, research institutions, and system integrators support continuous innovation and lifecycle management across missile platforms.

Market Segmentation

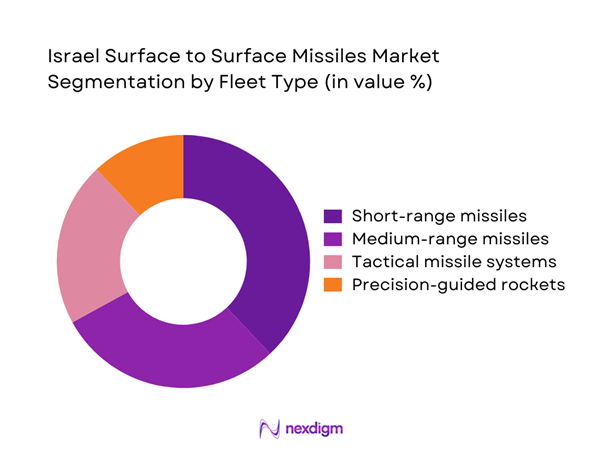

By Fleet Type

The fleet type segmentation is dominated by tactical and short-range surface to surface missile systems due to their operational flexibility and rapid deployment capabilities. These platforms are widely adopted across defense formations for precision strike and deterrence operations. Medium-range systems maintain a strategic role, particularly for extended reach missions and layered defense strategies. Fleet modernization programs initiated during 2024 and 2025 emphasized mobility, accuracy, and survivability, driving balanced demand across categories. Integration with advanced command systems and compatibility with multiple launch platforms further supports diversified fleet procurement across operational units.

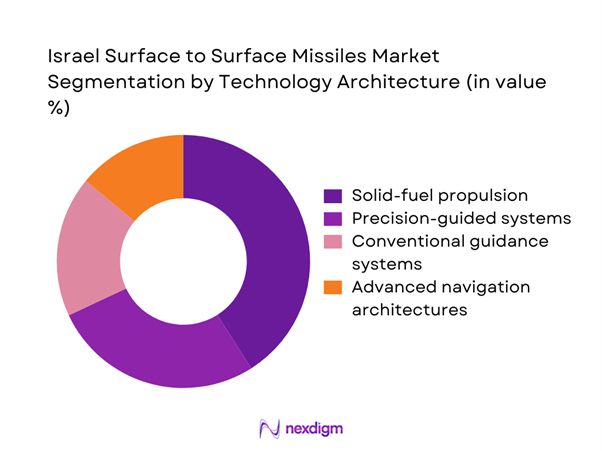

By Technology Architecture

Technology architecture segmentation is shaped by increasing adoption of precision guidance, digital navigation, and advanced propulsion systems. Solid-fuel propulsion remains dominant due to reliability and storage advantages, while guidance upgrades enhance accuracy and mission flexibility. During 2024 and 2025, investments focused on improving strike precision, electronic countermeasure resistance, and autonomous targeting capabilities. Modular design architectures also gained prominence, enabling easier upgrades and lifecycle cost optimization. Integration of advanced sensors and data links continues to define procurement priorities across operational commands.

Competitive Landscape

The competitive landscape is characterized by a concentrated group of defense manufacturers with strong technological depth and long-standing relationships with national defense authorities. Companies compete primarily on system reliability, integration capability, and compliance with defense standards, while maintaining strict regulatory alignment.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| MBDA | 2001 | France | ~ | ~ | ~ | ~ | ~ | ~ |

Israel Surface to Surface Missiles Market Analysis

Growth Drivers

Rising regional security threats and deterrence requirements

Rising regional security threats continue driving sustained demand for surface to surface missile readiness across Israel and operational preparedness. Geopolitical tensions and evolving threat perceptions increased procurement activity during 2024 and 2025 periods across national defense planning cycles. Border security complexities reinforced the importance of credible strike capabilities for strategic deterrence effectiveness. Military doctrine increasingly emphasizes rapid response and precision engagement against emerging asymmetric threats. Continuous regional instability necessitates modernization of missile inventories to maintain operational superiority. Strategic defense planning prioritizes deterrence strength through advanced missile deployment programs. Increased joint-force exercises further validate the importance of surface strike readiness. Defense planners emphasize maintaining technological parity with regional adversaries through consistent capability upgrades. Operational scenarios increasingly rely on missile-based deterrence for conflict de-escalation strategies. These factors collectively reinforce sustained demand across the domestic missile ecosystem.

Modernization of missile arsenals and replacement cycles

Modernization initiatives continue driving replacement of legacy missile systems with advanced precision platforms. Aging inventories identified during readiness assessments accelerated procurement cycles across multiple defense units. Technology obsolescence prompted upgrades in guidance, propulsion, and targeting subsystems. Defense planners prioritize lifecycle extension through modular system upgrades and enhanced reliability standards. Replacement programs initiated during 2024 and 2025 focus on operational efficiency improvements. Indigenous manufacturing capabilities support faster modernization and reduced external dependency. Integration of digital fire control systems enhances operational effectiveness across platforms. Replacement cycles are aligned with evolving battlefield requirements and doctrine updates. Continuous testing programs validate performance improvements before large-scale deployment decisions. Modernization efforts remain central to sustaining long-term missile effectiveness.

Challenges

High development and lifecycle costs

High development and lifecycle costs remain a significant constraint within missile program planning frameworks. Advanced materials, testing infrastructure, and compliance requirements increase overall program expenditures. Long development timelines further elevate financial commitment across multiple fiscal cycles. Maintenance and system upgrades add to total ownership costs over operational lifespans. Budget prioritization challenges emerge when balancing missile programs with other defense initiatives. Specialized workforce requirements contribute to elevated operational expenditures. Supply chain complexity increases costs for critical components and subsystems. Testing and certification protocols require extensive resource allocation. Cost control mechanisms remain critical for sustaining long-term program viability. Financial constraints influence procurement phasing and deployment schedules.

Export restrictions and international compliance requirements

Export restrictions and international compliance frameworks limit market expansion opportunities significantly. Regulatory oversight affects technology transfer and cross-border collaboration initiatives. Compliance with international arms control agreements imposes strict documentation requirements. Licensing procedures extend procurement timelines and increase administrative burdens. Export approval processes often restrict potential commercial partnerships. Political considerations influence approval outcomes across international markets. Compliance obligations require continuous monitoring and reporting mechanisms. Restrictions limit economies of scale for domestic manufacturers. International alignment requirements shape product design and configuration decisions. Regulatory complexity remains a persistent operational challenge.

Opportunities

Next-generation precision strike development

Next-generation precision strike development presents significant opportunities for technological advancement and capability enhancement. Investments focus on improved accuracy, reduced collateral impact, and extended operational range. Research initiatives emphasize integration of advanced sensors and targeting algorithms. Development programs prioritize adaptability to evolving battlefield environments. Precision strike capabilities enhance deterrence effectiveness and operational flexibility. Domestic innovation ecosystems support rapid prototyping and iterative development. Collaboration between defense agencies and industry accelerates technology maturation. Precision improvements align with modern warfare requirements and engagement rules. Future systems emphasize interoperability across land, air, and naval platforms. These developments strengthen long-term strategic positioning.

Integration of AI and advanced guidance systems

Integration of AI and advanced guidance systems offers transformative potential for missile operations. AI-enabled targeting improves decision-making speed and accuracy during engagements. Advanced algorithms enhance navigation reliability under contested environments. Autonomous features reduce operator workload and improve mission success rates. Integration efforts focus on real-time data processing and adaptive guidance. Development programs prioritize secure and resilient software architectures. AI-based systems support predictive maintenance and performance optimization. Enhanced guidance capabilities improve effectiveness against dynamic targets. Research initiatives continue expanding AI applications within missile systems. These advancements represent a critical opportunity for future capability enhancement.

Future Outlook

The Israel Surface to Surface Missiles market is expected to maintain steady momentum through the forecast period driven by sustained security priorities. Continued modernization programs and technological upgrades will support long-term demand stability. Strategic emphasis on indigenous development will further strengthen domestic capabilities. Evolving threat dynamics and defense planning frameworks are expected to guide procurement strategies. Innovation and system integration will remain central to future market direction.

Major Players

- Rafael Advanced Defense Systems

- Israel Aerospace Industries

- Elbit Systems

- IMI Systems

- Lockheed Martin

- MBDA

- Raytheon Technologies

- Northrop Grumman

- Boeing Defense

- L3Harris Technologies

- Kongsberg Defence & Aerospace

- Hanwha Defense

- Roketsan

- Bharat Dynamics Limited

- Saab AB

Key Target Audience

- Ministry of Defense procurement divisions

- Israel Defense Forces strategic command units

- Defense system integrators

- Missile system manufacturers

- Government and regulatory bodies including export control authorities

- Defense research and development agencies

- Investments and venture capital firms

- National security policy planners

Research Methodology

Step 1: Identification of Key Variables

Market scope was defined through analysis of missile categories, deployment types, and operational use cases across defense programs. Key technical, regulatory, and operational parameters were identified to establish study boundaries.

Step 2: Market Analysis and Construction

Data was analyzed using defense procurement patterns, program timelines, and technology adoption trends. Segmentation was developed based on fleet type, technology architecture, and application relevance.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through structured consultations with defense experts, engineers, and procurement specialists. Assumptions were refined using operational insights and program-level evaluations.

Step 4: Research Synthesis and Final Output

All insights were consolidated through triangulation of qualitative and quantitative inputs. The final analysis reflects realistic market behavior, constraints, and future development pathways.

- Executive Summary

- Research Methodology (Market Definitions and operational scope alignment, platform-based missile classification and taxonomy design, bottom-up and top-down defense expenditure modeling, program-level revenue attribution and contract value mapping, primary validation through defense officials and industry experts, triangulation using procurement data and export disclosures, assumption modeling based on indigenous production and import controls)

- Definition and Scope

- Market evolution

- Operational and strategic usage landscape

- Defense industrial ecosystem structure

- Supply chain and manufacturing framework

- Regulatory and export control environment

- Growth Drivers

Rising regional security threats and deterrence requirements

Modernization of missile arsenals and replacement cycles

Increased defense budget allocation to precision strike systems

Advancements in guidance and propulsion technologies

Emphasis on indigenous defense manufacturing

Operational lessons from regional conflicts - Challenges

High development and lifecycle costs

Export restrictions and international compliance requirements

Technology transfer limitations

Geopolitical sensitivities impacting procurement

Long development and testing timelines

Budgetary trade-offs with other defense programs - Opportunities

Next-generation precision strike development

Integration of AI and advanced guidance systems

Export opportunities to allied nations

Upgrades and life extension programs

Interoperability with air and naval strike systems

Domestic manufacturing expansion - Trends

Shift toward precision-guided munitions

Increased focus on survivability and countermeasures

Integration with network-centric warfare systems

Development of longer-range tactical missiles

Emphasis on rapid deployment capabilities

Enhanced indigenous R&D investments - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Short-range ballistic missiles

Medium-range ballistic missiles

Tactical surface-to-surface missiles

Precision-guided rocket systems - By Application (in Value %)

Strategic deterrence

Tactical battlefield strike

Counterforce operations

Area denial and suppression - By Technology Architecture (in Value %)

Solid-fuel propulsion systems

Guided missile systems

Precision strike and GPS-aided systems

Conventional warhead platforms - By End-Use Industry (in Value %)

Defense forces

Homeland security agencies

Strategic command units - By Connectivity Type (in Value %)

Standalone guidance systems

Network-enabled command and control integrated systems - By Region (in Value %)

Northern Israel

Central Israel

Southern Israel

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (product range, missile range capability, guidance technology, production capacity, R&D intensity, export footprint, contract value, system integration capability)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Rafael Advanced Defense Systems

Israel Aerospace Industries

Elbit Systems

IMI Systems

Tomahawk Defense Systems

Lockheed Martin

MBDA

Raytheon Technologies

Boeing Defense

Northrop Grumman

L3Harris Technologies

Kongsberg Defence & Aerospace

Hanwha Defense

Roketsan

Bharat Dynamics Limited

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase support and lifecycle management expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035