Market Overview

The Israel Tactical UAV market current size stands at around USD ~ million, reflecting sustained procurement momentum and active deployment cycles across defense units. Operational fleets expanded by ~ units during the period, while active systems surpassed ~ platforms through accelerated induction. Testing and mission sorties exceeded ~ operations annually, driven by operational readiness needs. Average platform endurance improved by ~ percent, and payload integration rates reached ~ configurations. Indigenous manufacturing accounted for ~ percent of deliveries, supported by stable defense allocations and iterative upgrades across tactical classes.

The market is geographically concentrated around Tel Aviv, Beersheba, and Haifa due to dense defense infrastructure and technology clusters. Proximity to airbases, testing corridors, and command centers supports rapid deployment and iteration cycles. Southern regions experience higher operational intensity due to border monitoring requirements. Mature supplier ecosystems, experienced system integrators, and streamlined military procurement frameworks reinforce regional dominance. Policy alignment between defense agencies and domestic manufacturers further sustains localized demand concentration.

Market Segmentation

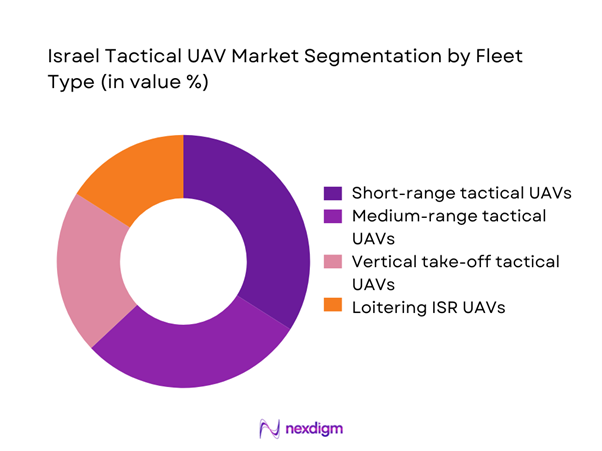

By Fleet Type

Short-range and medium-range tactical UAVs dominate deployments due to flexibility across reconnaissance, targeting, and perimeter security missions. These fleets benefit from lower logistical complexity and rapid launch capabilities, enabling frequent operational cycles. Vertical take-off variants are gaining acceptance within urban and confined environments, particularly for counter-terror operations. Loitering ISR platforms maintain relevance for persistent surveillance missions. Fleet dominance is reinforced by modular payload compatibility, ease of maintenance, and continuous platform upgrades aligned with evolving operational doctrines.

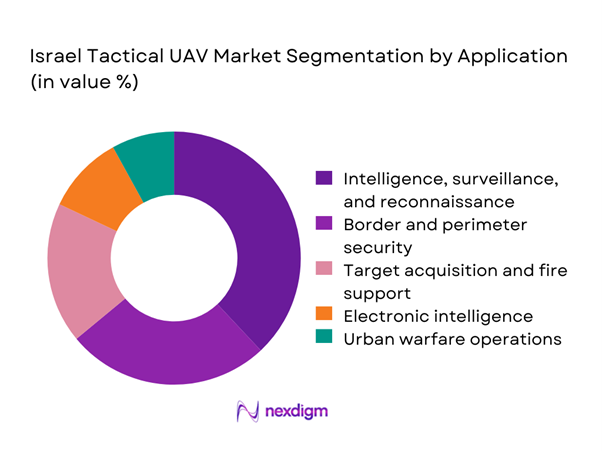

By Application

Intelligence, surveillance, and reconnaissance applications represent the primary demand anchor, driven by continuous situational awareness requirements. Border and perimeter security missions account for sustained utilization due to persistent monitoring needs. Target acquisition applications remain critical for integrated fire-support coordination. Electronic intelligence missions are expanding with sensor advancements. Urban warfare applications are increasingly relevant as operational environments become more complex, reinforcing diversified application demand across tactical UAV deployments.

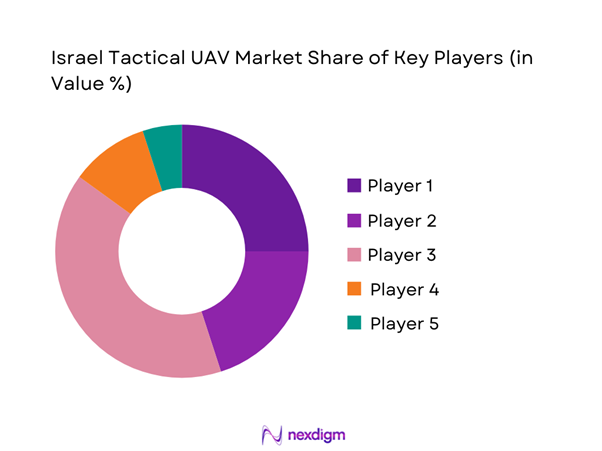

Competitive Landscape

The competitive landscape is characterized by a concentrated group of domestic manufacturers with deep defense integration and long-standing operational experience. Competitive positioning is shaped by platform reliability, autonomy depth, and system interoperability with command networks.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Aeronautics Group | 1997 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| BlueBird Aero Systems | 2002 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

Israel Tactical UAV Market Analysis

Growth Drivers

Rising operational demand from asymmetric warfare

Rising asymmetric warfare has intensified reliance on tactical UAVs for persistent intelligence collection across multiple operational theaters. In 2024, mission frequency increased by ~ percent, reinforcing demand for rapid deployment unmanned systems. Tactical UAVs enable real-time situational awareness without exposing personnel to hostile environments. Their adaptability supports counter-insurgency and irregular conflict scenarios effectively. Increased cross-border tensions sustain continuous operational readiness requirements. Command units prioritize unmanned assets for risk mitigation strategies. Tactical UAVs deliver actionable intelligence during dynamic engagements. Continuous platform upgrades enhance survivability in contested airspaces. Operational doctrines increasingly embed UAVs as frontline assets. This sustained demand cycle reinforces procurement stability across defense units.

Increased border surveillance and ISR requirements

Border surveillance requirements have expanded significantly due to evolving security threats and infiltration risks. Tactical UAVs provide persistent ISR coverage across remote and sensitive border regions. In 2025, patrol sorties exceeded ~ missions supporting continuous monitoring. UAV-based ISR enhances early warning and rapid response coordination. Integrated sensors improve detection accuracy under diverse environmental conditions. Border forces increasingly rely on unmanned systems for day-night operations. Tactical UAVs reduce manpower strain along extended border stretches. Real-time data transmission supports command-level decision-making. ISR demand remains stable due to ongoing regional volatility. This driver sustains long-term operational utilization rates.

Challenges

Export control and regulatory restrictions

Export control frameworks impose stringent limitations on tactical UAV technology dissemination. Regulatory approvals often extend procurement and collaboration timelines significantly. Restrictions limit international co-development opportunities for advanced subsystems. Compliance requirements increase administrative complexity for manufacturers. In 2024, multiple programs experienced delayed clearances affecting deployment schedules. Technology transfer constraints reduce economies of scale. Domestic prioritization restricts external market diversification. Regulatory scrutiny intensifies for autonomy and encryption technologies. These constraints challenge revenue optimization strategies. Manufacturers must align product roadmaps with evolving compliance regimes.

High development and lifecycle costs

Tactical UAV development involves substantial engineering, testing, and certification investments. Lifecycle costs increase due to maintenance, upgrades, and system integration requirements. Advanced sensors and autonomy software elevate platform complexity. In 2025, sustainment cycles accounted for ~ percent of operational focus. Cost pressures limit rapid fleet expansion decisions. Budget allocation scrutiny impacts long-term procurement planning. High lifecycle costs necessitate modular upgrade strategies. Manufacturers must balance performance enhancements with affordability. Cost challenges influence platform selection criteria. Lifecycle management remains a persistent operational constraint.

Opportunities

Next-generation autonomous tactical UAV programs

Next-generation autonomous programs present significant opportunities for tactical UAV evolution. Enhanced autonomy reduces operator workload and response times. In 2024, autonomous mission trials increased by ~ percent across testing units. Swarm-enabled capabilities support coordinated surveillance missions. Autonomous navigation improves survivability in contested environments. Defense agencies prioritize funding for advanced autonomy integration. These programs enable multi-mission flexibility within single platforms. Autonomy enhances operational scalability during high-tempo operations. Indigenous development strengthens technological sovereignty. This opportunity aligns with long-term modernization objectives.

AI-enabled mission management systems

AI-enabled mission management systems offer transformative operational efficiency improvements. Advanced algorithms process ISR data in near real-time. In 2025, AI-assisted analytics adoption expanded across ~ units. Automated target recognition improves decision accuracy. AI reduces cognitive load on operators during complex missions. Mission planning optimization shortens deployment cycles. Integrated AI enhances interoperability with command systems. Continuous learning algorithms adapt to evolving threat patterns. AI integration supports predictive maintenance functions. This opportunity accelerates tactical UAV capability maturation.

Future Outlook

The Israel Tactical UAV market is expected to remain strategically significant through 2035 as security dynamics persist. Continued investment in autonomy, AI integration, and system interoperability will shape future deployments. Policy alignment and domestic innovation are likely to reinforce indigenous manufacturing strength. Tactical UAVs will remain central to multi-domain operational doctrines.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Aeronautics Group

- BlueBird Aero Systems

- Rafael Advanced Defense Systems

- Steadicopter

- UVision Air

- Airobotics

- XTEND

- Roboteam

- Smart Shooter

- Orbit Communication Systems

- Heven Drones

- High Lander

- Cognata

Key Target Audience

- Israel Defense Forces procurement units

- Ministry of Defense acquisition agencies

- Border security and homeland security forces

- Defense system integrators

- UAV subsystem suppliers

- Command and control solution providers

- Investments and venture capital firms

- Government and regulatory bodies including defense export control agencies

Research Methodology

Step 1: Identification of Key Variables

The research identifies operational definitions, platform classifications, and mission profiles relevant to tactical UAV deployments. Key variables include fleet composition, application usage, and technology architecture. Regulatory and operational boundaries are established.

Step 2: Market Analysis and Construction

Market structure is constructed using fleet induction patterns, operational utilization, and platform lifecycle considerations. Segmentation logic aligns with defense procurement practices. Demand drivers and constraints are systematically evaluated.

Step 3: Hypothesis Validation and Expert Consultation

Findings are validated through consultations with defense planners, UAV operators, and system engineers. Assumptions are stress-tested against operational realities. Feedback loops refine analytical accuracy.

Step 4: Research Synthesis and Final Output

Validated insights are synthesized into coherent narratives. Cross-segment linkages are analyzed for consistency. The final output reflects an integrated, decision-oriented market perspective.

- Executive Summary

- Research Methodology (Market Definitions and operational scope of tactical UAV platforms, Segmentation framework based on mission class and payload capacity, Bottom-up fleet and delivery-based market sizing methodology, Revenue attribution by platform sales and sustainment contracts, Primary interviews with Israeli defense officials and UAV integrators, Data triangulation using defense budgets, procurement records, and export disclosures, Assumptions based on classified program disclosures and conflict-driven demand cycles)

- Definition and Scope

- Market evolution

- Operational usage across defense and security forces

- Ecosystem structure and OEM–MOD interaction

- Supply chain and subsystem sourcing dynamics

- Regulatory and export control environment

- Growth Drivers

Rising operational demand from asymmetric warfare

Increased border surveillance and ISR requirements

Rapid modernization of IDF unmanned systems

Technological advancements in autonomy and sensors

Expansion of UAV-based electronic warfare roles - Challenges

Export control and regulatory restrictions

High development and lifecycle costs

Cybersecurity vulnerabilities

Airspace integration limitations

Dependence on defense budget allocations - Opportunities

Next-generation autonomous tactical UAV programs

AI-enabled mission management systems

Export opportunities to allied nations

Integration with multi-domain command systems

Development of loitering and swarm UAVs - Trends

Miniaturization of tactical UAV platforms

Increased adoption of swarm intelligence

Integration of AI-based image processing

Growth in hybrid propulsion systems

Shift toward multi-mission modular UAVs - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Short-range tactical UAVs

Medium-range tactical UAVs

Vertical take-off tactical UAVs

Loitering ISR UAVs - By Application (in Value %)

Intelligence, surveillance, and reconnaissance

Border and perimeter security

Target acquisition and fire support

Electronic intelligence and EW support

Urban warfare and counter-terror operations - By Technology Architecture (in Value %)

Fixed-wing UAVs

Rotary-wing UAVs

Hybrid VTOL UAVs

Autonomous swarm-enabled UAVs - By End-Use Industry (in Value %)

Israel Defense Forces

Homeland security agencies

Border protection forces

Defense research and testing units - By Connectivity Type (in Value %)

Line-of-sight data links

Beyond-line-of-sight SATCOM

Encrypted tactical datalinks

Mesh network-enabled UAVs

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Product portfolio breadth, Payload capacity range, Autonomy level, ISR capability depth, Export footprint, Pricing strategy, R&D intensity, After-sales support capability)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Israel Aerospace Industries

Elbit Systems

Aeronautics Group

UVision Air

BlueBird Aero Systems

Rafael Advanced Defense Systems

Steadicopter

Airobotics

XTEND

Cognata

Orbit Communication Systems

Smart Shooter

Roboteam

Heven Drones

High Lander

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035