Market Overview

The Israel Tanker Aircraft market current size stands at around USD ~ million, reflecting steady fleet activity and modernization investments. The market is shaped by sustained aerial refueling requirements, fleet readiness mandates, and integration with next-generation combat aircraft. In 2024 and 2025, platform utilization levels remained stable due to ongoing defense preparedness initiatives. Fleet upgrades, avionics retrofitting, and interoperability enhancements continued to influence demand patterns. Operational efficiency and mission endurance remain primary investment considerations. Procurement cycles are closely aligned with national defense planning timelines.

The market is primarily concentrated around central and southern regions hosting major airbases and maintenance facilities. Strong infrastructure, advanced aerospace engineering capabilities, and established defense ecosystems support sustained demand. Policy-driven defense spending and regional security considerations continue to reinforce tanker aircraft relevance. Israel’s mature defense manufacturing ecosystem enables high levels of system integration and lifecycle management. Proximity to operational zones further strengthens deployment requirements. Regulatory alignment and government oversight ensure consistent modernization momentum.

Market Segmentation

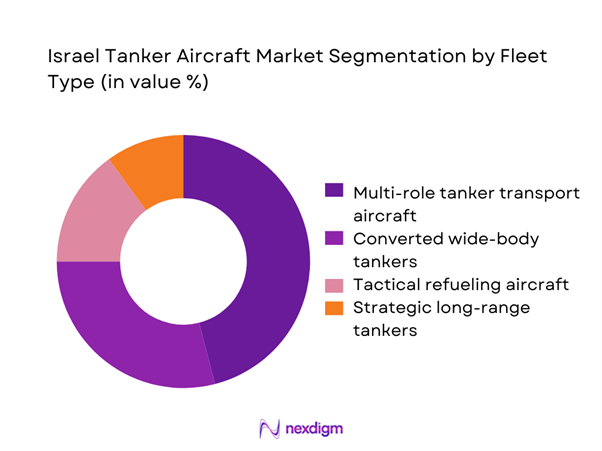

By Fleet Type

The fleet type segmentation is dominated by multi-role tanker transport aircraft due to their operational flexibility and compatibility with modern fighter platforms. These aircraft support extended mission durations and multi-domain operations, making them essential for long-range strike capabilities. Converted wide-body tankers hold significant share owing to cost-efficient retrofitting programs. Tactical refueling platforms are used selectively for specialized missions. Strategic platforms remain limited but critical for long-endurance operations. Fleet decisions are influenced by compatibility with allied aircraft and future combat doctrine.

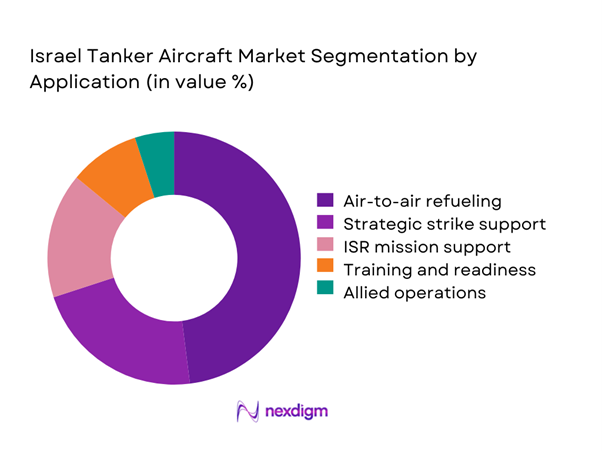

By Application

Air-to-air refueling represents the dominant application, driven by extended operational requirements and force projection needs. Strategic strike support remains a key contributor due to evolving regional security dynamics. ISR mission support continues expanding as intelligence integration becomes more critical. Training and readiness missions maintain steady demand due to pilot qualification cycles. Humanitarian and allied joint operations contribute modestly but consistently. Application trends reflect increased emphasis on mission flexibility and endurance.

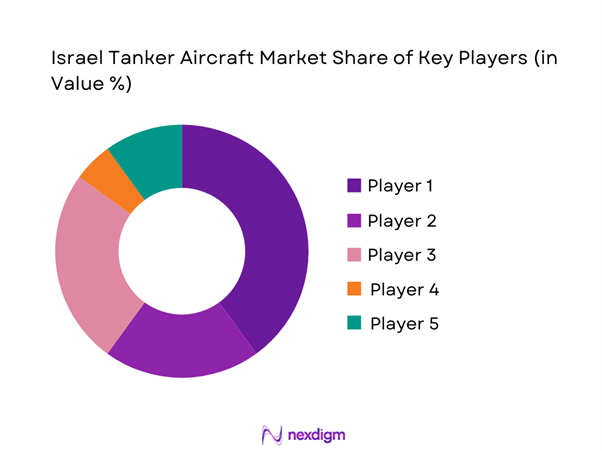

Competitive Landscape

The competitive landscape is characterized by a limited number of global aerospace manufacturers supported by specialized subsystem providers. Market participation is shaped by long-term defense contracts, technology transfer agreements, and platform interoperability standards. Competition centers on platform reliability, upgrade capability, and lifecycle support depth. Domestic integration capabilities play a critical role in vendor selection. Strategic partnerships influence long-term positioning.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Boeing Defense | 1916 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Airbus Defence | 2000 | Europe | ~ | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

Israel Tanker Aircraft Market Analysis

Growth Drivers

Rising demand for long-range strike capability

Rising demand for long-range strike capability continues to shape tanker aircraft procurement strategies across defense planning frameworks. Extended operational reach has become essential for maintaining deterrence and rapid response readiness. Modern combat doctrines increasingly rely on midair refueling to enhance mission flexibility. Operational planners emphasize sustained air dominance across extended distances. Integration with fifth-generation aircraft further elevates refueling requirements. Enhanced payload endurance enables complex multi-sortie missions. Regional security volatility reinforces the importance of aerial refueling capabilities. Force projection strategies increasingly depend on tanker availability. Mission planning complexity has increased across multiple operational theaters. This driver remains central to fleet expansion and modernization efforts.

Expansion of aerial refueling fleet modernization

Expansion of aerial refueling fleet modernization programs is accelerating due to aging platform replacement needs. Legacy aircraft face rising maintenance demands and operational inefficiencies. Modern platforms offer improved fuel transfer rates and digital integration. Defense planners prioritize aircraft with enhanced survivability and networked capabilities. Modernization ensures compliance with evolving operational doctrines. Enhanced avionics improve situational awareness and mission coordination. Interoperability with allied aircraft drives upgrade requirements. Maintenance optimization supports long-term cost efficiency. Fleet renewal cycles are increasingly synchronized with fighter acquisitions. Modernization remains a cornerstone of strategic air capability planning.

Challenges

High procurement and lifecycle costs

High procurement and lifecycle costs continue to challenge long-term tanker aircraft acquisition strategies. Acquisition programs require substantial capital commitments across multiple fiscal cycles. Maintenance, training, and upgrade costs add long-term financial pressure. Specialized infrastructure requirements increase operational expenditure. Advanced systems integration raises sustainment complexity. Cost overruns can delay procurement timelines significantly. Budgetary constraints limit fleet expansion flexibility. Lifecycle management demands specialized technical expertise. Cost efficiency remains a critical evaluation parameter. Financial planning constraints influence procurement pacing.

Long development and delivery timelines

Long development and delivery timelines pose significant constraints on fleet readiness and modernization schedules. Aircraft customization requirements extend production cycles considerably. Certification and compliance processes further prolong delivery timelines. Supply chain dependencies increase vulnerability to delays. Integration of advanced avionics requires extensive validation periods. Testing and acceptance protocols extend operational deployment schedules. Program delays impact force readiness planning. Synchronization with allied procurement cycles becomes challenging. Extended timelines increase project management complexity. Timely delivery remains a persistent operational concern.

Opportunities

Fleet replacement and modernization programs

Fleet replacement and modernization programs present strong opportunities for capability enhancement. Aging aircraft replacement cycles align with evolving defense doctrines. New platforms offer superior fuel efficiency and mission versatility. Digital integration improves operational effectiveness and data sharing. Modernization supports compliance with emerging interoperability standards. Replacement programs enable lifecycle cost optimization. Platform standardization improves training efficiency. Enhanced survivability features strengthen mission reliability. Long-term procurement planning supports industrial collaboration. Modernization initiatives remain a primary growth avenue.

Indigenous upgrade and MRO capabilities

Indigenous upgrade and MRO capabilities create opportunities for domestic aerospace ecosystem expansion. Localized maintenance reduces dependency on external service providers. Indigenous upgrades allow customization for specific mission profiles. Capability development strengthens operational self-reliance. MRO expansion supports long-term fleet sustainability. Local engineering expertise enables faster turnaround times. Upgrades extend platform service life significantly. Domestic capability development aligns with strategic autonomy goals. Skill development strengthens the defense industrial base. Indigenous programs support sustained operational readiness.

Future Outlook

The Israel tanker aircraft market is expected to maintain steady development through 2035 driven by modernization programs and evolving mission requirements. Fleet upgrades and platform replacements will remain central to procurement strategies. Increased integration with advanced combat aircraft will shape future demand. Technological advancements and indigenous capabilities will further influence market direction.

Major Players

- Boeing Defense

- Airbus Defence and Space

- Israel Aerospace Industries

- Lockheed Martin

- Northrop Grumman

- Elbit Systems

- Rafael Advanced Defense Systems

- L3Harris Technologies

- Collins Aerospace

- Safran

- Rolls-Royce

- GE Aerospace

- Marshall Aerospace

- Cobham Mission Systems

- Leonardo Aerospace

Key Target Audience

- Israeli Ministry of Defense procurement divisions

- Israeli Air Force operational command

- Defense aerospace manufacturers

- Maintenance, repair, and overhaul providers

- Defense system integrators

- Strategic defense contractors

- Government and regulatory bodies including MOD acquisition directorates

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Key variables including fleet size, mission requirements, and platform utilization were identified through defense planning frameworks and operational benchmarks.

Step 2: Market Analysis and Construction

Market structure was developed using fleet composition analysis, platform lifecycle assessment, and operational deployment trends.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through consultations with defense analysts, aviation experts, and procurement specialists familiar with tanker aircraft programs.

Step 4: Research Synthesis and Final Output

Data triangulation and qualitative assessment were applied to produce coherent market insights and strategic conclusions.

- Executive Summary

- Research Methodology (Market Definitions and operational scope alignment, Fleet classification and mission-based segmentation logic, Bottom-up aircraft fleet and utilization-based market sizing, Revenue attribution across procurement retrofit and MRO streams, Primary interviews with defense officials OEMs and integrators, Cross-verification using defense budgets contracts and flight activity data, Assumptions and constraints linked to classified procurement programs)

- Definition and Scope

- Market evolution

- Operational and mission usage framework

- Ecosystem and value chain structure

- Supply chain and integration landscape

- Regulatory and defense procurement environment

- Growth Drivers

Rising demand for long-range strike capability

Expansion of aerial refueling fleet modernization

Increasing regional security threats

Integration of fifth-generation fighter fleets

Shift toward force projection and rapid response

Growing interoperability with allied forces - Challenges

High procurement and lifecycle costs

Long development and delivery timelines

Dependence on foreign OEMs

Integration complexity with legacy aircraft

Regulatory and export control constraints

Limited domestic production capacity - Opportunities

Fleet replacement and modernization programs

Indigenous upgrade and MRO capabilities

Strategic defense collaborations

Integration of digital and autonomous systems

Expansion of tanker-based ISR roles

Lifecycle service and retrofit contracts - Trends

Adoption of multi-role tanker platforms

Increased use of wide-body conversion aircraft

Focus on survivability and self-protection systems

Integration of advanced avionics and sensors

Shift toward modular refueling architectures

Rising emphasis on operational readiness - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Multi-role tanker transport aircraft

Converted wide-body refueling aircraft

Tactical aerial refueling aircraft

Strategic long-range refueling platforms - By Application (in Value %)

Air-to-air refueling

Strategic strike support

Extended ISR operations

Force projection and deterrence missions - By Technology Architecture (in Value %)

Boom refueling systems

Probe-and-drogue systems

Hybrid refueling configurations

Advanced fuel management systems - By End-Use Industry (in Value %)

Air force and defense aviation

Special mission aviation units

Joint military operations

Allied force interoperability programs - By Connectivity Type (in Value %)

Line-of-sight communication systems

SATCOM-enabled platforms

Link-16 and tactical data links

Network-enabled refueling systems - By Region (in Value %)

Central Israel

Southern Israel

Northern Israel

Overseas deployment bases

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (fleet size, refueling capability, platform range, payload capacity, upgrade flexibility, lifecycle cost, delivery timelines, support ecosystem)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Boeing Defense, Space & Security

Airbus Defence and Space

Israel Aerospace Industries (IAI)

Lockheed Martin

Northrop Grumman

Elbit Systems

Rafael Advanced Defense Systems

L3Harris Technologies

Collins Aerospace

Safran

Rolls-Royce

GE Aerospace

Marshall Aerospace

Cobham Mission Systems

Leonardo Aerospace

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035