Market Overview

The Israel Target Unmanned Aerial Vehicles market current size stands at around USD ~ million, reflecting stable defense procurement activity and sustained training requirements across air and missile defense units. During 2024 and 2025, operational demand remained consistent due to ongoing modernization initiatives, with fleet utilization rates increasing across multiple testing environments. Procurement volumes showed moderate expansion supported by recurring defense allocations, while technology refresh cycles influenced replacement demand. The market continues to demonstrate resilience driven by domestic development programs and defense readiness priorities.

Israel’s target UAV ecosystem is concentrated around established aerospace clusters with strong defense integration. Activity remains centered in regions hosting air force testing ranges, missile defense facilities, and unmanned systems research centers. High levels of technical expertise, mature supplier networks, and structured defense procurement processes support sustained demand. Government-backed innovation frameworks and close coordination between military units and domestic manufacturers further strengthen the ecosystem, enabling consistent deployment, maintenance, and lifecycle management of target UAV platforms.

Market Segmentation

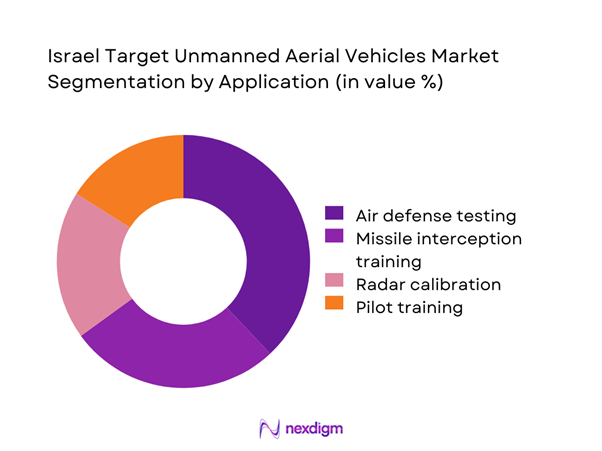

By Application

The application landscape is dominated by air defense and missile system validation, where target UAVs are extensively used to simulate real-world aerial threats. Training and testing requirements have increased as defense systems become more complex and layered. Radar calibration and interceptor testing represent a significant share, driven by continuous upgrades of detection and tracking systems. Training-focused deployments are also expanding due to higher pilot proficiency requirements and multi-domain operational readiness. The application mix remains heavily defense-oriented, with limited spillover into civilian or research use due to regulatory constraints and operational sensitivity.

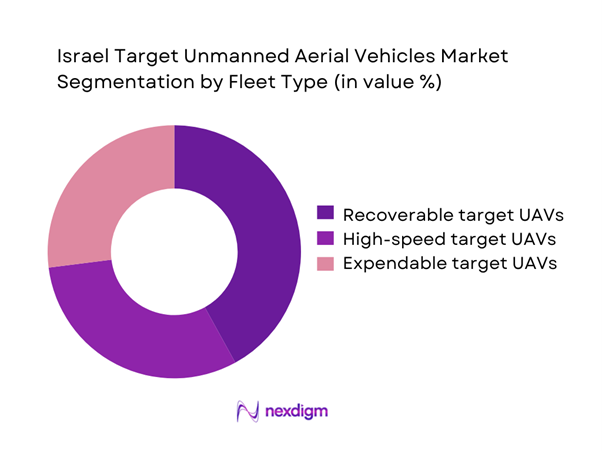

By Fleet Type

Fleet composition is shaped by mission complexity and recovery requirements. Recoverable target UAVs dominate due to cost efficiency and repeated usability in training cycles. High-speed target drones are increasingly adopted for advanced threat simulation, particularly in missile defense exercises. Expendable platforms continue to serve niche applications requiring realistic destruction scenarios. Fleet modernization trends favor modular designs that allow rapid reconfiguration, improving operational flexibility and lowering lifecycle burdens across defense testing programs.

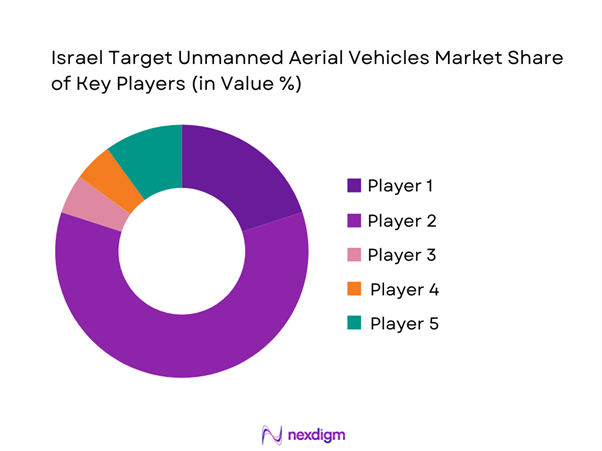

Competitive Landscape

The competitive environment is characterized by a limited number of technologically advanced manufacturers with deep integration into national defense programs. Companies compete primarily on system reliability, flight performance, and compliance with military testing standards. Long-term defense relationships, indigenous manufacturing capabilities, and secure supply chains play a decisive role in contract awards. Continuous investment in autonomous flight systems and telemetry accuracy further differentiates leading participants.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Aeronautics Group | 1997 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| UVision Air | 2014 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

Israel Target Unmanned Aerial Vehicles Market Analysis

Growth Drivers

Rising air defense modernization programs

Rising air defense modernization programs continue to stimulate demand for advanced target unmanned aerial vehicles across defense testing environments. Defense forces increased allocation toward layered interception systems during 2024, requiring frequent simulation of evolving aerial threats. Target UAV deployments expanded to validate radar sensitivity, interceptor accuracy, and command system responsiveness under realistic conditions. Modernization initiatives emphasized indigenous testing platforms to reduce dependency on foreign training systems. Integration of multi-sensor environments further increased reliance on adaptable target UAV configurations. Training exercises conducted across multiple regions reinforced the need for consistent target availability. Technological upgrades in detection systems created additional testing cycles annually. Operational readiness assessments increasingly mandated live target engagements. These dynamics collectively strengthened sustained procurement demand. The modernization trend remains structurally embedded within long-term defense planning.

Increased missile interception testing

Increased missile interception testing significantly accelerated utilization rates of target unmanned aerial vehicles during recent defense cycles. Expanded interceptor inventories required continuous validation against diverse aerial threat profiles. Testing frequency rose across naval and ground-based defense platforms simultaneously. Target UAVs enabled accurate replication of speed, altitude, and maneuvering characteristics. Defense agencies prioritized repeatable testing to refine interception algorithms and engagement timing. Enhanced missile accuracy standards further intensified demand for high-fidelity targets. Integration of real-time telemetry increased operational data requirements. Testing programs increasingly emphasized reliability under varied environmental conditions. Coordinated drills between air and missile units amplified usage volumes. These factors collectively strengthened the operational relevance of target UAV systems.

Challenges

High development and certification costs

High development and certification costs continue to constrain rapid expansion of target unmanned aerial vehicle programs. Advanced propulsion, telemetry, and control systems require extensive validation before operational deployment. Certification processes involve multiple defense authorities, extending development timelines significantly. Engineering costs increased due to stringent safety and performance benchmarks. Limited production volumes restrict economies of scale for manufacturers. Testing failures can lead to costly redesign cycles and delays. Budgetary scrutiny intensified during procurement evaluations. Smaller developers face barriers entering regulated defense programs. Lifecycle maintenance expenses further elevate total ownership costs. These financial pressures limit rapid fleet diversification across defense units.

Restricted export regulations

Restricted export regulations present persistent challenges for market participants seeking international collaboration opportunities. Defense export controls limit cross-border sales of target UAV platforms and subsystems. Approval timelines often extend beyond commercial planning cycles. Compliance requirements vary across destination markets, increasing administrative complexity. Sensitive payload restrictions further narrow exportable configurations. Export uncertainty discourages large-scale production investments. International partnerships require extensive governmental clearances. Regulatory alignment challenges restrict technology transfer initiatives. These constraints reduce economies of scale for manufacturers. Export limitations continue to shape strategic planning decisions across the sector.

Opportunities

Integration with AI-enabled threat simulation

Integration with AI-enabled threat simulation offers significant growth potential for target unmanned aerial vehicle platforms. Artificial intelligence enables dynamic flight pattern generation replicating advanced aerial threats. Adaptive behavior modeling enhances realism during interception exercises. Defense agencies increasingly prioritize AI-supported testing environments. Data-driven simulation improves accuracy of weapon system evaluation processes. Autonomous decision-making capabilities reduce operator workload during exercises. Integration with digital twins enhances predictive performance assessments. AI-enabled platforms support multi-target swarm simulation scenarios. Continuous learning algorithms improve test fidelity over repeated missions. These advancements position AI integration as a major opportunity area.

Export-oriented co-development programs

Export-oriented co-development programs present opportunities for expanding technological capabilities and market reach. Collaborative development reduces financial burden associated with advanced system design. Joint programs enable access to complementary engineering expertise and testing infrastructure. Shared development frameworks improve interoperability standards across allied forces. Co-production agreements support localized manufacturing and customization. Such partnerships enhance long-term program sustainability. Shared certification processes reduce duplication of regulatory efforts. Export-oriented collaboration strengthens geopolitical defense relationships. These programs enable scaling beyond domestic demand limitations. Long-term contracts stabilize production pipelines for manufacturers.

Future Outlook

The Israel target unmanned aerial vehicles market is expected to maintain steady growth driven by defense modernization and evolving threat simulation requirements. Continued investment in autonomous technologies and integrated testing environments will shape future procurement strategies. Policy support for domestic defense manufacturing is likely to strengthen supply chain resilience. The market outlook remains stable with sustained demand across training, testing, and evaluation applications.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Rafael Advanced Defense Systems

- Aeronautics Group

- UVision Air

- BlueBird Aero Systems

- Top I Vision

- Steadicopter

- Xtend Defense

- Cando Drones

- Kratos Defense & Security Solutions

- QinetiQ

- Northrop Grumman

- Leonardo

- BAE Systems

Key Target Audience

- Israeli Ministry of Defense

- Israeli Air Force procurement divisions

- Missile defense program offices

- Defense system integrators

- Unmanned systems manufacturers

- Defense testing and evaluation agencies

- Investments and venture capital firms

- Government and regulatory bodies including defense export authorities

Research Methodology

Step 1: Identification of Key Variables

The study identified operational, technological, and procurement-related variables influencing target UAV deployment. Defense usage patterns, testing frequency, and platform capabilities were mapped. Regulatory and operational boundaries were also established. Market scope definitions were finalized during this phase.

Step 2: Market Analysis and Construction

Data was structured around application, fleet type, and operational deployment models. Qualitative and quantitative indicators were aligned to reflect real-world usage patterns. Demand-side and supply-side factors were evaluated concurrently.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts, defense engineers, and procurement specialists were consulted to validate assumptions. Feedback loops ensured accuracy in technology trends and adoption patterns. Insights were cross-verified across multiple defense domains.

Step 4: Research Synthesis and Final Output

Findings were consolidated into a structured analytical framework. Consistency checks ensured alignment with defense procurement realities. Final outputs were reviewed for logical coherence and practical relevance.

- Executive Summary

- Research Methodology (Market Definitions and target UAV classification framework, defense application-based segmentation logic, bottom-up market sizing using procurement and delivery data, revenue attribution by platform and contract type, primary validation through defense procurement officials and OEM interviews, triangulation using export records and defense budget analysis, market limitations based on classified program disclosure constraints)

- Definition and scope

- Market evolution

- Operational usage and training integration

- Ecosystem structure

- Supply chain and procurement channels

- Regulatory and defense compliance environment

- Growth Drivers

Rising air defense modernization programs

Increased missile interception testing

Expansion of indigenous UAV development

Growing emphasis on live-fire training realism

Rising defense budget allocation for unmanned systems - Challenges

High development and certification costs

Restricted export regulations

Operational risks during live-fire exercises

Limited domestic supplier base

Dependence on defense budget cycles - Opportunities

Integration with AI-enabled threat simulation

Export-oriented co-development programs

Demand for reusable target platforms

Growth in naval and missile defense testing

Advancements in autonomous flight technologies - Trends

Shift toward high-speed and jet-powered targets

Increased use of autonomous flight profiles

Adoption of modular payload architectures

Growing use of swarm-based target simulation

Integration of digital twin and telemetry analytics - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Aerial target drones

High-speed target drones

Recoverable target UAVs

Expendable target UAVs - By Application (in Value %)

Air defense system testing

Missile and radar calibration

Pilot training and simulation

Weapon system validation - By Technology Architecture (in Value %)

Jet-powered UAVs

Propeller-driven UAVs

Autonomous navigation systems

Remotely piloted systems - By End-Use Industry (in Value %)

Air force and air defense units

Naval defense forces

Defense R&D agencies

Private defense contractors - By Connectivity Type (in Value %)

Line-of-sight communication

Beyond visual line-of-sight

Satellite-assisted control

Hybrid communication systems - By Region (in Value %)

Central Israel

Northern Israel

Southern Israel

Defense testing zones

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (product range, technology maturity, pricing strategy, customization capability, defense certifications, production capacity, export footprint, after-sales support)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Israel Aerospace Industries (IAI)

Elbit Systems

Rafael Advanced Defense Systems

UVision Air

Aeronautics Group

BlueBird Aero Systems

Top I Vision

Steadicopter

Xtend Defense

Cando Drones

Kratos Defense & Security Solutions

QinetiQ

Northrop Grumman

Leonardo

BAE Systems

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035