Market Overview

The Israel UAS Warfare market current size stands at around USD ~ million, supported by sustained defense modernization and active operational deployment cycles. The market demonstrates stable demand driven by ongoing aerial intelligence missions, tactical strike requirements, and surveillance operations. System upgrades, sensor integration, and autonomous mission capabilities continue to shape procurement priorities. Fleet renewal activities and replacement of legacy platforms contribute to consistent platform induction. Export-linked production further reinforces domestic manufacturing throughput and system lifecycle investments across multiple operational categories.

Israel’s UAS warfare ecosystem is concentrated around advanced defense manufacturing clusters with strong military integration. Urban defense hubs support research, testing, and command integration activities. Demand remains highest near operational command zones and intelligence centers. Strong collaboration between armed forces and domestic suppliers accelerates technology validation. Regulatory oversight supports rapid deployment while ensuring compliance with export control frameworks. Mature supply chains and system integration capabilities reinforce Israel’s leadership in advanced unmanned warfare technologies.

Market Segmentation

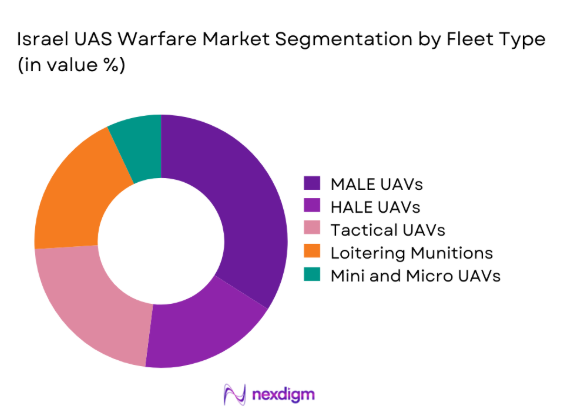

By Fleet Type

The fleet type segmentation is dominated by medium-altitude long-endurance and loitering munition platforms due to sustained operational requirements. Tactical UAVs continue to see high utilization for border monitoring and rapid intelligence missions. Mini and micro UAVs support urban and close-range surveillance needs. High-altitude platforms are selectively deployed for strategic reconnaissance. The increasing use of modular payloads enables cross-mission adaptability, enhancing fleet utilization efficiency across multiple defense units.

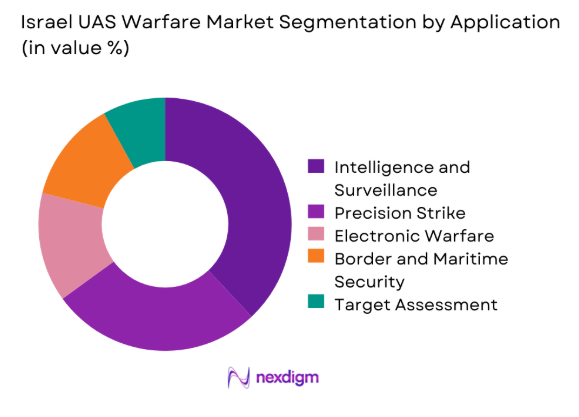

By Application

Application segmentation is led by intelligence and surveillance operations driven by persistent regional security requirements. Precision strike missions represent a growing share due to expanded adoption of loitering systems. Electronic warfare usage continues to increase as countermeasure complexity rises. Maritime and border surveillance remain essential for territorial monitoring. Target acquisition and damage assessment applications are expanding due to real-time battlefield intelligence integration and sensor fusion advancements.

Competitive Landscape

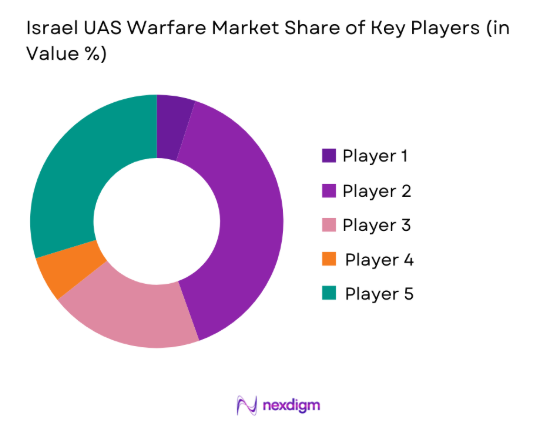

The Israel UAS warfare market is characterized by strong domestic players supported by defense-driven innovation and operational testing. Companies compete on technological maturity, autonomy capabilities, and system integration depth. Long-term defense contracts and export relationships play a critical role in shaping competitive positioning.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Aeronautics Group | 1997 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| BlueBird Aero Systems | 2002 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

Israel UAS Warfare Market Analysis

Growth Drivers

Rising asymmetric warfare and border security threats

Persistent regional instability has increased reliance on unmanned systems for continuous monitoring and rapid tactical response operations. Security agencies increasingly deploy UAVs to manage asymmetric threats along sensitive borders and conflict-prone zones. Advanced ISR missions require persistent aerial presence without risking human pilots. Enhanced sensor integration allows real-time data acquisition across contested territories. Border surveillance requirements continue expanding due to evolving threat vectors. UAVs offer scalable deployment options suitable for varied terrain and mission profiles. Defense planners prioritize aerial platforms capable of long-endurance operations. Operational flexibility supports rapid mission reconfiguration based on threat assessments. Continuous innovation strengthens situational awareness and tactical readiness. These factors collectively sustain consistent procurement momentum across defense programs.

Expansion of loitering munition doctrine

Loitering munitions have gained prominence due to precision strike capabilities and lower operational risk profiles. Defense forces increasingly integrate these systems for time-sensitive target engagement scenarios. Their ability to remain airborne enhances mission effectiveness across dynamic battlefields. Modular warhead configurations improve mission adaptability across multiple threat environments. Real-time targeting improves strike accuracy while minimizing collateral damage risks. Operational doctrines increasingly emphasize autonomous strike decision support. Training programs now integrate loitering systems as standard operational assets. Their cost-effectiveness compared to traditional munitions drives wider adoption. Enhanced guidance systems improve engagement success rates. This shift continues to reshape tactical warfare strategies.

Challenges

Export control and ITAR restrictions

Export control regulations impose limitations on international sales of advanced UAS technologies. Compliance requirements increase documentation and approval timelines for overseas deliveries. Restrictions influence component sourcing and subsystem integration decisions. Some technologies remain restricted for strategic security reasons. Export licensing delays affect contract execution and revenue realization cycles. Collaborative development projects face regulatory complexities. Restrictions can limit market expansion into certain regions. Compliance costs increase administrative burdens for manufacturers. Technology transfer limitations affect joint venture structures. These constraints require continuous regulatory alignment and strategic planning.

High R&D and system integration costs

Advanced UAV systems require sustained investment in research, testing, and system validation activities. Development cycles are extended due to evolving mission requirements and technology upgrades. Integration of sensors, communications, and autonomy increases engineering complexity. Testing environments must replicate combat conditions, raising development expenditure. Certification processes further extend timelines. Continuous innovation demands skilled engineering resources. Cost pressures impact smaller manufacturers more significantly. Budget constraints influence procurement pacing. Balancing performance with affordability remains challenging. These factors collectively impact scalability and commercialization speed.

Opportunities

Next-generation autonomous strike platforms

Autonomous strike platforms present significant growth potential through enhanced mission independence and reduced operator workload. Artificial intelligence enables real-time decision support and adaptive targeting. Autonomous navigation improves survivability in contested airspaces. Defense agencies are prioritizing next-generation autonomy research programs. Integration with network-centric warfare systems enhances battlefield coordination. Autonomous systems reduce response times during critical operations. Ongoing trials validate operational effectiveness across varied environments. Increased computing power supports advanced onboard analytics. These advancements open opportunities for platform modernization initiatives. Long-term procurement strategies increasingly favor autonomous capabilities.

Swarm-enabled combat systems

Swarm technology enables coordinated multi-platform operations with increased tactical flexibility. Distributed UAV swarms complicate adversary defense systems through saturation effects. Cooperative targeting enhances mission success rates. Swarm algorithms improve real-time coordination without centralized control. Defense forces are investing in swarm experimentation and validation programs. Cost-effective units allow scalable deployment strategies. Redundancy within swarms improves mission resilience. Networked operations enhance situational awareness. Swarm deployment supports both offensive and defensive missions. These capabilities represent a significant evolution in modern warfare doctrine.

Future Outlook

The Israel UAS warfare market is expected to maintain steady growth driven by continued modernization and evolving threat environments. Increasing autonomy, artificial intelligence integration, and swarm deployment concepts will reshape operational doctrines. Export opportunities are expected to expand under controlled regulatory frameworks. Domestic innovation and defense collaboration will remain central to capability development. Long-term outlook remains positive with sustained investment in next-generation unmanned systems.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Rafael Advanced Defense Systems

- Aeronautics Group

- BlueBird Aero Systems

- UVision Air

- Xtend

- Steadicopter

- Airobotics

- Percepto

- Sentrycs

- Skylock Systems

- General Atomics

- Lockheed Martin

- Northrop Grumman

Key Target Audience

- Israeli Ministry of Defense

- Israeli Air Force Procurement Division

- Defense Export Control Agency

- Border Security and Surveillance Units

- Defense System Integrators

- UAV Component Manufacturers

- Investments and venture capital firms

- Government and regulatory bodies including SIBAT

Research Methodology

Step 1: Identification of Key Variables

Key operational, technological, and procurement variables were identified through defense framework analysis and system classification mapping.

Step 2: Market Analysis and Construction

Market structure was built using platform deployment trends, application mapping, and procurement cycle evaluation across defense programs.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through consultations with defense analysts, system integrators, and domain specialists with operational exposure.

Step 4: Research Synthesis and Final Output

Data points were synthesized through triangulation, consistency checks, and expert validation to ensure analytical accuracy.

- Executive Summary

- Research Methodology (Market Definitions and operational scope of military UAS warfare platforms, platform and mission-based segmentation framework, bottom-up defense budget and procurement-based market sizing, revenue attribution across domestic programs and export contracts, primary interviews with Israeli defense officials and UAS system integrators, triangulation using defense spending data and delivery schedules, assumptions based on classified program disclosures and export control limitations)

- Definition and Scope

- Market evolution

- Usage and operational deployment framework

- Ecosystem structure

- Supply chain and system integration landscape

- Regulatory and export control environment

- Growth Drivers

Rising asymmetric warfare and border security threats

Expansion of loitering munition doctrine

Integration of AI and autonomous targeting

Increased defense budget allocations

Export demand for combat-proven UAV systems - Challenges

Export control and ITAR restrictions

High R&D and system integration costs

Electronic warfare vulnerability

Regulatory and airspace restrictions

Supply chain dependency on advanced electronics - Opportunities

Next-generation autonomous strike platforms

Swarm-enabled combat systems

AI-based ISR analytics

International defense collaborations

Upgrades and lifecycle management contracts - Trends

Shift toward loitering munitions and kamikaze drones

Increased use of AI-enabled decision systems

Integration with multi-domain operations

Growth of counter-UAS technologies

Rising demand for low-cost attritable UAVs - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

MALE UAVs

HALE UAVs

Tactical UAVs

Loitering Munitions

Mini and Micro ISR Drones - By Application (in Value %)

Intelligence Surveillance and Reconnaissance

Precision Strike and Loitering Attack

Electronic Warfare and SIGINT

Border and Maritime Security

Target Acquisition and Battle Damage Assessment - By Technology Architecture (in Value %)

Fixed-Wing Platforms

Rotary-Wing Platforms

Hybrid VTOL Systems

Autonomous and AI-Enabled Systems - By End-Use Industry (in Value %)

Israeli Air Force

Israeli Ground Forces

Israeli Navy

Defense Intelligence Units

Special Operations Forces - By Connectivity Type (in Value %)

Line-of-Sight Communication

SATCOM-Enabled Systems

Manned-Unmanned Teaming

Encrypted Tactical Data Links - By Region (in Value %)

Israel Domestic Deployment

North America Exports

Europe Exports

Asia-Pacific Exports

Middle East and Africa Exports

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (platform range, payload capability, autonomy level, combat experience, pricing structure, export footprint, R&D intensity, system integration capability)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Elbit Systems

Rafael Advanced Defense Systems

Aeronautics Group

BlueBird Aero Systems

UVision Air

Xtend

Steadicopter

Airobotics

Percepto

Sentrycs

Skylock Systems

General Atomics

Lockheed Martin

Northrop Grumman

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase support and upgrade expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035