Market Overview

The Israel uav flight training and simulation market current size stands at around USD ~ million with steady expansion observed across defense and security training programs. Activity levels during 2024 and 2025 reflected increasing simulator deployments, rising training hours, and broader adoption of synthetic environments. Demand is supported by growing unmanned fleet complexity and the need for safe, repeatable mission rehearsal. Investment momentum remains consistent as modernization initiatives expand across operational units. Training platforms are increasingly integrated with mission systems and command networks. This has driven sustained utilization across operational and instructional settings.

Israel’s market concentration is strongest around defense infrastructure hubs with mature aerospace ecosystems and advanced testing ranges. High adoption is visible in regions hosting air force bases, defense R&D centers, and UAV manufacturing clusters. Strong policy backing for unmanned system readiness supports simulator integration. Collaboration between defense agencies and domestic technology developers enhances ecosystem maturity. Local supply chains benefit from proximity to users and rapid feedback cycles. Regulatory alignment further reinforces consistent deployment and operational acceptance.

Market Segmentation

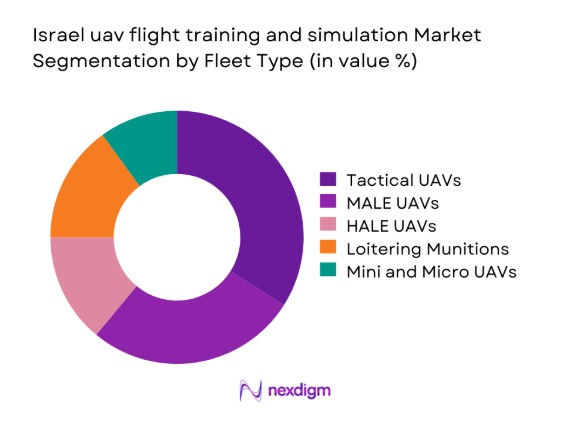

By Fleet Type

The fleet type segmentation is dominated by tactical and MALE UAV platforms due to their extensive operational deployment and continuous training requirements. These fleets require recurring pilot instruction, mission rehearsal, and sensor operation simulations, driving higher simulator utilization. Loitering munitions and mini UAVs contribute moderate demand, mainly for operator familiarization and mission planning training. HALE platforms account for a smaller share due to limited fleet size but require advanced simulation fidelity. Growth across fleet types is influenced by mission complexity and autonomy integration levels. Defense modernization initiatives continue reinforcing demand across all fleet categories.

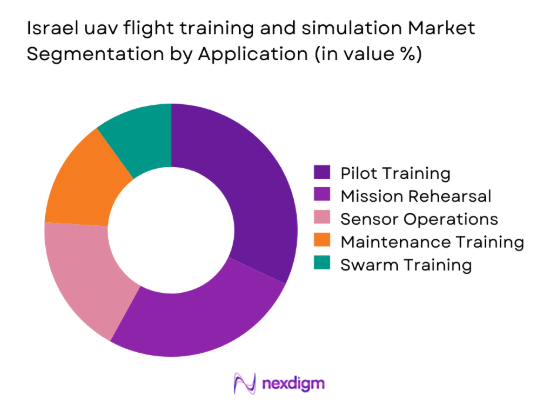

By Application

Application-based segmentation is led by pilot training and mission rehearsal due to mandatory qualification and recurrent training cycles. Sensor and payload operation training follows, driven by ISR mission complexity and real-time data processing requirements. Maintenance training represents a stable share as technical personnel require simulator-based familiarization. Swarm and cooperative mission training is expanding rapidly as autonomous operations gain prominence. Simulation for certification and readiness assessments continues to gain importance. Overall segmentation reflects increasing operational realism requirements across training programs.

Competitive Landscape

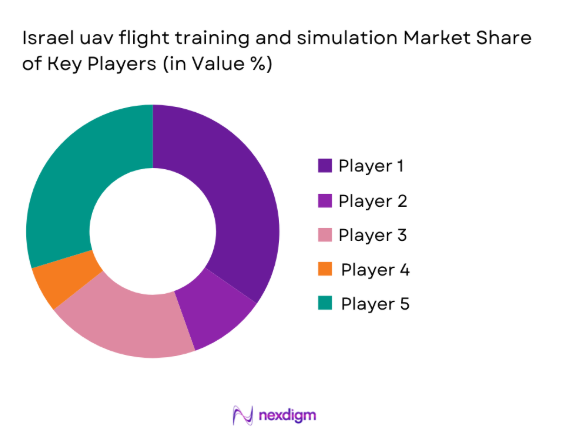

The competitive environment is characterized by a mix of domestic defense technology leaders and global simulation providers with localized integration capabilities. Market participants compete on realism, system interoperability, and customization depth. Long-term defense contracts and program-based procurement dominate vendor engagement. Technological differentiation is driven by software fidelity, AI integration, and scalability. Collaboration with defense agencies strengthens competitive positioning.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| CAE Inc. | 1947 | Canada | ~ | ~ | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 1997 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

Israel uav flight training and simulation Market Analysis

Growth Drivers

Rising UAV fleet induction by Israeli defense forces

Rising UAV fleet induction by Israeli defense forces continues accelerating simulator demand across training and readiness programs. Increasing operational complexity requires enhanced mission rehearsal tools capable of replicating real-world scenarios accurately. Training standardization initiatives encourage wider adoption of certified simulation environments across units. Simulator usage reduces operational risks while maintaining high readiness levels for UAV operators. Integration of AI-based threat modeling improves training realism and effectiveness. Increased defense allocations during 2024 and 2025 support sustained simulator procurement cycles. Advanced mission profiles necessitate continuous skills upgrades through simulated environments. Operational tempo growth further elevates dependency on simulation-based training systems. Technological upgrades enhance fidelity and operational confidence among trained personnel. These factors collectively strengthen long-term demand across training segments.

Increasing complexity of UAV missions and autonomy

Increasing complexity of UAV missions and autonomy significantly elevates reliance on advanced training simulation platforms. Multi-domain operations require pilots to manage sensor fusion and data interpretation under simulated conditions. Autonomous navigation functions demand rigorous pre-deployment validation through training systems. Simulation enables testing of mission scenarios not feasible in live environments. Operators benefit from repeatable training cycles without asset degradation risks. Growth in AI-enabled UAVs further expands training requirements. Enhanced mission complexity directly increases simulator utilization frequency. Training effectiveness becomes critical for operational success in contested environments. Simulator platforms help standardize procedures across operational units. This driver continues shaping procurement strategies across defense agencies.

Challenges

High development and certification costs

High development and certification costs limit rapid deployment of advanced simulator platforms across all units. Complex regulatory approval processes slow the introduction of new simulation technologies. Budget allocation constraints affect upgrade cycles for legacy training infrastructure. Simulator customization increases development timelines and resource commitments. Technical validation requirements add to program execution complexity. Integration with existing UAV systems often requires extensive testing phases. Smaller units face access limitations due to cost and infrastructure needs. These challenges collectively impact scalability across the defense ecosystem. Cost containment remains a priority for procurement authorities. Addressing these barriers is essential for wider adoption.

Restricted access to classified training data

Restricted access to classified training data limits simulator realism and scenario depth. Security protocols restrict information sharing with technology vendors. This constraint reduces flexibility in modeling advanced mission parameters. Data sensitivity also affects collaborative development with external partners. Simulation fidelity can be compromised without access to real operational datasets. Regulatory oversight further complicates data utilization processes. Delays occur during approval cycles for content integration. These limitations affect training adaptability and responsiveness. Managing classified information securely increases system complexity. Overcoming these constraints remains a persistent challenge for market participants.

Opportunities

Export of Israeli UAV training technologies

Export of Israeli UAV training technologies presents strong growth potential across allied defense markets. Proven operational effectiveness enhances international adoption prospects. Training solutions aligned with NATO standards gain faster acceptance. Simulation-based training reduces deployment costs for foreign operators. International exercises increase demand for interoperable training systems. Export programs benefit from Israel’s reputation in UAV technology. Demand growth is evident across Asia and Europe. Strategic partnerships enable localized deployment models. Export-oriented solutions diversify revenue streams for suppliers. This opportunity supports long-term market expansion.

Adoption of AI-driven adaptive training

Adoption of AI-driven adaptive training creates opportunities for advanced learning environments. Intelligent simulators adjust scenarios based on trainee performance metrics. This improves skill acquisition efficiency and training outcomes. AI integration enhances realism and decision-making complexity. Automated evaluation reduces instructor workload and training time. Advanced analytics enable performance tracking and optimization. These capabilities align with modern military training doctrines. Demand for intelligent systems continues rising across defense units. Technology maturity supports scalable deployment models. AI-enabled training is expected to reshape future simulation platforms.

Future Outlook

The Israel uav flight training and simulation market is expected to maintain steady expansion through 2035 driven by modernization programs and operational readiness priorities. Increasing reliance on autonomous systems will strengthen simulator relevance. Integration of AI, networking, and digital twin technologies will redefine training frameworks. Policy support and defense investment continuity will sustain long-term growth momentum.

Major Players

- Elbit Systems

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- CAE Inc.

- L3Harris Technologies

- Leonardo S.p.A.

- Thales Group

- Saab AB

- Lockheed Martin

- BAE Systems

- Simlat

- Aeronautics Group

- BlueBird Aero Systems

- UVision Air

- Elta Systems

- Key Target Audience

- Defense ministries and armed forces

- Air force training commands

- UAV fleet operators

- Defense procurement agencies

- Homeland security organizations

- System integrators and OEMs

- Investments and venture capital firms

- Government and regulatory bodies including defense authorities

Research Methodology

Step 1: Identification of Key Variables

Market boundaries were defined based on UAV training platforms, simulator types, and operational use cases. Key demand drivers and technology components were identified through domain mapping. Segmentation logic was established around fleet type and application usage.

Step 2: Market Analysis and Construction

Market behavior was analyzed using deployment trends, procurement cycles, and training intensity patterns. Data consistency was ensured through cross-verification of operational indicators. Scenario modeling was applied to reflect evolving training requirements.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through consultations with defense professionals and training system specialists. Feedback was incorporated to refine market dynamics and usage patterns. Validation focused on realism, scalability, and operational alignment.

Step 4: Research Synthesis and Final Output

Insights were consolidated into structured market narratives. Analytical consistency was maintained across sections. Final outputs were reviewed to ensure alignment with industry realities and policy frameworks.

- Executive Summary

- Research Methodology (Market Definitions and operational scope mapping for UAV flight training and simulation, Platform and training taxonomy development across military and civil UAV classes, Bottom-up market sizing using simulator installations and training hours)

- Definition and Scope

- Market evolution

- Usage and training pathways

- Ecosystem structure

- Growth Drivers

Rising UAV fleet induction by Israeli defense forces

Increasing complexity of UAV missions and autonomy

Emphasis on cost-efficient pilot training solutions

Integration of AI and synthetic environments

Expansion of export-oriented UAV training programs - Challenges

High development and certification costs

Restricted access to classified training data

Integration complexity with legacy UAV platforms

Limited availability of trained simulator instructors

Cybersecurity risks in networked simulators - Opportunities

Export of Israeli UAV training technologies

Adoption of AI-driven adaptive training

Integration with multinational training exercises

Growth of contractor-operated training services

Simulation upgrades for next-generation UAVs - Trends

Shift toward virtual and mixed reality training

Increased use of digital twins

Modular and scalable simulator architectures

Cloud-based mission rehearsal environments

Convergence of UAV and manned aviation training - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Revenue per Training System, 2020–2025

- By Fleet Type (in Value %)

Tactical UAVs

MALE UAVs

HALE UAVs

Loitering munitions

Mini and micro UAVs - By Application (in Value %)

Pilot flight training

Mission rehearsal and rehearsal simulation

Sensor and payload operation training

Swarm and cooperative mission training

Maintenance and operator certification - By Technology Architecture (in Value %)

Full flight simulators

Part-task trainers

Desktop and virtual simulators

AI-based adaptive training systems

Digital twin-based simulation - By End-Use Industry (in Value %)

Military and defense forces

Homeland security and border control

Intelligence and surveillance agencies

Commercial UAV operators

Research and testing institutions - By Connectivity Type (in Value %)

Standalone simulators

Networked simulators

Cloud-enabled training platforms

Live-virtual-constructive (LVC) systems - By Region (in Value %)

Northern Israel

Central Israel

Southern Israel

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Technology maturity, Training realism, System scalability, Integration capability, Pricing structure, After-sales support, Defense certifications, Export readiness)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Israel Aerospace Industries

Rafael Advanced Defense Systems

Elta Systems

BlueBird Aero Systems

Aeronautics Group

UVision Air

CAE Inc.

L3Harris Technologies

Leonardo S.p.A.

Thales Group

Saab AB

Lockheed Martin

BAE Systems

Simlat

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Revenue per Training System, 2026–2035