Market Overview

The Israel uav navigation systems market current size stands at around USD ~ million, supported by strong domestic defense demand and steady export activity. The market recorded consistent deployment growth during 2024 and 2025 driven by fleet modernization programs and integration of advanced navigation architectures. Increased adoption of inertial and hybrid navigation systems has strengthened platform reliability. Ongoing investments in autonomous flight capabilities continue to expand system requirements. Technology refresh cycles remain short due to evolving mission profiles. The market benefits from sustained defense spending priorities and operational deployment needs.

Israel’s UAV navigation ecosystem is concentrated around defense clusters with strong R&D infrastructure and integrated supply networks. Urban technology hubs support avionics development, sensor fusion, and embedded software engineering. High military adoption rates reinforce demand stability, while export-oriented production benefits from established aerospace manufacturing capacity. Regulatory alignment with defense standards supports consistent procurement. Collaboration between government agencies and domestic manufacturers sustains innovation momentum. The ecosystem remains tightly linked to national security and aerospace policy priorities.

Market Segmentation

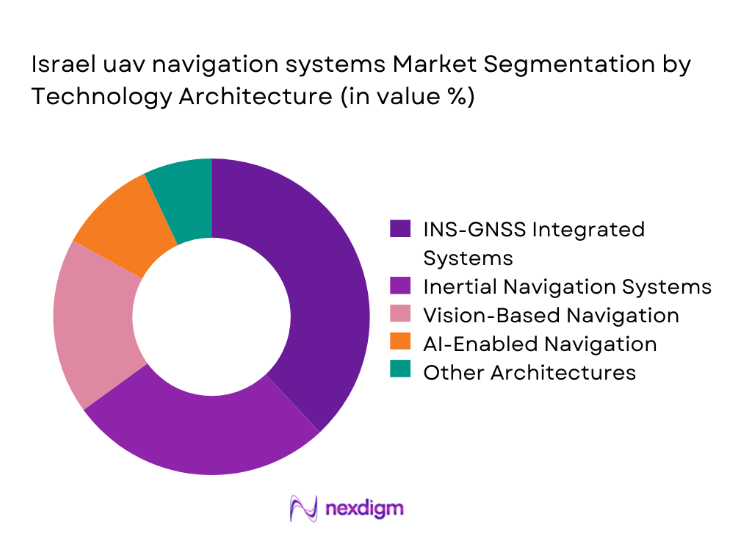

By Technology Architecture

The technology architecture segment is dominated by integrated INS-GNSS systems due to their operational reliability in contested environments. Vision-aided and AI-assisted navigation systems are gaining traction as platforms require greater autonomy and resilience against signal denial. Inertial navigation systems remain essential for mission continuity, particularly in tactical and long-endurance UAVs. Hybrid navigation solutions combining multiple sensor inputs are increasingly deployed to improve accuracy and redundancy. Continuous R&D investment supports advancements in sensor miniaturization and real-time data fusion.

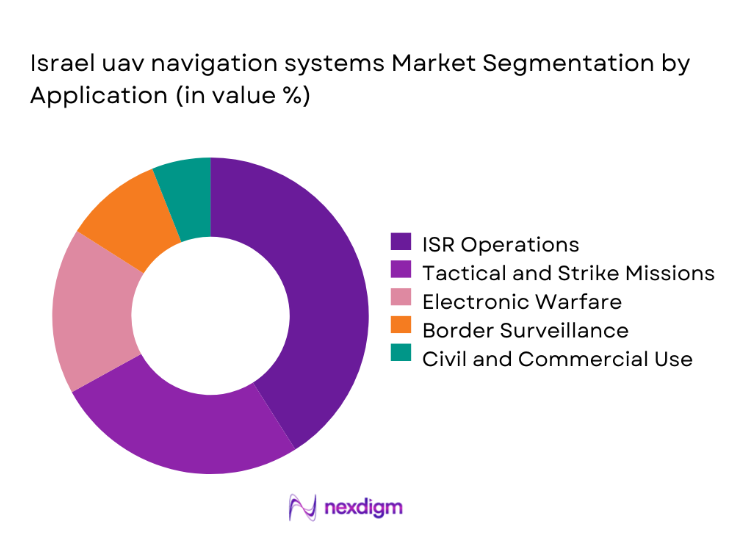

By Application

Surveillance and reconnaissance applications dominate demand due to persistent border monitoring and intelligence operations. Tactical mission execution and targeting applications continue expanding with increased UAV deployment. Electronic warfare navigation requirements are rising as operational environments become more complex. Commercial and civil applications remain limited but show gradual growth through mapping and inspection use cases. Mission-specific navigation customization remains a key purchasing criterion across applications.

Competitive Landscape

The competitive landscape is characterized by a mix of domestic defense leaders and global avionics suppliers. Companies focus on advanced navigation accuracy, system reliability, and compliance with military standards. Strategic partnerships and in-house development dominate product strategies, while export readiness remains a competitive differentiator.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1906 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

Israel uav navigation systems Market Analysis

Growth Drivers

Rising defense UAV procurement programs

Rising defense UAV procurement programs continue to expand demand for advanced navigation systems across military platforms. Defense agencies increased UAV acquisitions during 2024 to strengthen surveillance and tactical readiness. Enhanced operational requirements drive integration of precise navigation and positioning technologies. Indigenous UAV development programs support consistent system upgrades. Procurement policies emphasize reliability and mission adaptability. Modernization initiatives favor navigation solutions with multi-sensor fusion. Domestic manufacturers benefit from long-term defense contracts. UAV fleet expansion directly correlates with navigation system demand growth. Technological sovereignty priorities reinforce local sourcing preferences. This driver remains central to sustained market expansion.

Increasing demand for GPS-denied navigation

Increasing demand for GPS-denied navigation accelerates adoption of alternative positioning technologies. Operational environments increasingly experience signal jamming and spoofing risks. Defense planners prioritize resilient navigation for mission continuity. Advanced inertial and vision-based systems gain wider deployment. UAV missions increasingly require autonomous navigation capabilities. Integration of multi-modal navigation enhances operational security. Development programs focus on reducing reliance on satellite signals. Field deployments validate performance under contested conditions. This demand supports innovation and system diversification. The trend reinforces long-term investment in navigation resilience.

Challenges

High cost of advanced navigation subsystems

High cost of advanced navigation subsystems limits widespread adoption across all UAV categories. Sophisticated sensors and processors increase overall platform expenses. Budget constraints affect procurement cycles for smaller defense programs. Cost sensitivity impacts scalability of advanced navigation features. Development and testing expenses remain substantial. Integration complexity raises system validation costs. Smaller manufacturers face entry barriers due to capital requirements. Cost optimization remains a persistent industry challenge. Affordability concerns influence purchasing decisions. This challenge constrains rapid market expansion.

Export control and ITAR-related constraints

Export control and ITAR-related constraints restrict international sales of navigation technologies. Regulatory compliance increases documentation and approval timelines. Export limitations reduce addressable markets for domestic suppliers. Sensitive technologies face licensing hurdles. International collaboration becomes more complex under regulatory scrutiny. Compliance costs impact profitability and delivery schedules. Restrictions influence product design and component selection. Companies must align development with export policies. These constraints slow global market penetration. Regulatory complexity remains a significant operational challenge.

Opportunities

Development of AI-assisted navigation algorithms

Development of AI-assisted navigation algorithms presents significant growth potential for the market. Artificial intelligence improves route optimization and threat avoidance. Machine learning enhances real-time decision making capabilities. Autonomous mission execution benefits from adaptive navigation models. AI integration reduces dependency on external signals. Continuous data learning improves system accuracy over time. Defense agencies support AI-enabled autonomy initiatives. Software-driven innovation accelerates system evolution. This opportunity supports differentiation and long-term competitiveness. AI adoption reshapes future navigation architectures.

Miniaturization of inertial navigation systems

Miniaturization of inertial navigation systems enables deployment across smaller UAV platforms. Reduced size and weight improve payload flexibility. Advances in MEMS technology enhance performance reliability. Compact systems lower integration complexity for manufacturers. Smaller UAVs gain extended mission capabilities. Energy-efficient designs support longer operational endurance. Miniaturization supports swarm and tactical UAV applications. Cost efficiencies improve scalability across fleets. Innovation accelerates adoption in new use cases. This opportunity drives market expansion across platform classes.

Future Outlook

The Israel uav navigation systems market is expected to maintain steady growth through the forecast period. Continued defense modernization and autonomous system adoption will shape future demand. Technological advancements in AI and sensor fusion will redefine navigation capabilities. Export opportunities may expand with evolving regulatory frameworks. Long-term growth will depend on innovation, resilience, and system interoperability.

Major Players

- Elbit Systems

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- Honeywell Aerospace

- Thales Group

- Northrop Grumman

- Collins Aerospace

- Safran Electronics & Defense

- L3Harris Technologies

- BAE Systems

- Trimble

- u-blox

- Advanced Navigation

- Hexagon

- Leonardo

Key Target Audience

- Defense procurement agencies

- Ministry of Defense and procurement directorates

- Homeland security agencies

- UAV manufacturers and integrators

- Aerospace component suppliers

- System integrators and avionics firms

- Investments and venture capital firms

- Civil aviation and regulatory authorities

Research Methodology

Step 1: Identification of Key Variables

Key technical, operational, and regulatory variables influencing UAV navigation systems were identified. Platform types, navigation architectures, and deployment use cases were mapped. Data parameters were aligned with defense and aerospace standards.

Step 2: Market Analysis and Construction

Market structure was developed using deployment trends, system integration patterns, and technology adoption levels. Segmentation logic was constructed based on application and architecture relevance.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through expert consultations across defense engineering and UAV operations. Feedback helped refine demand drivers, constraints, and adoption patterns.

Step 4: Research Synthesis and Final Output

All findings were synthesized into a cohesive market framework. Data triangulation ensured consistency, and insights were structured for strategic decision-making.

- Executive Summary

- Research Methodology (Market Definitions and UAV navigation scope alignment, platform-based segmentation and taxonomy mapping, bottom-up market sizing using shipment and ASP modeling, revenue attribution across INS GNSS and hybrid navigation stacks, primary validation through Israeli defense OEMs and avionics suppliers, triangulation using procurement data and export statistics, assumptions and limitations related to defense confidentiality and dual-use controls)

- Definition and Scope

- Market evolution

- Usage and mission navigation requirements

- Ecosystem structure

- Supply chain and component sourcing

- Regulatory and defense compliance environment

- Growth Drivers

Rising defense UAV procurement programs

Increasing demand for GPS-denied navigation

Expansion of autonomous mission capabilities

High defense R&D investment in Israel

Growing export demand for Israeli UAV platforms

Operational requirements for precision navigation - Challenges

High cost of advanced navigation subsystems

Export control and ITAR-related constraints

Susceptibility to electronic warfare environments

Integration complexity with legacy UAVs

Limited commercial UAV navigation standardization - Opportunities

Development of AI-assisted navigation algorithms

Miniaturization of inertial navigation systems

Rising demand for swarm-enabled UAV navigation

Growth in counter-UAS navigation solutions

Export partnerships with allied defense forces - Trends

Shift toward GNSS-denied navigation solutions

Integration of vision-based navigation

Adoption of multi-sensor fusion architectures

Increased focus on cyber-resilient navigation

Use of MEMS-based INS technologies - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

MALE UAVs

HALE UAVs

Tactical UAVs

Mini and Micro UAVs

Loitering Munitions - By Application (in Value %)

Intelligence Surveillance and Reconnaissance

Border and Coastal Surveillance

Targeting and Strike Navigation

Electronic Warfare and SIGINT

Civil and Commercial Mapping - By Technology Architecture (in Value %)

Inertial Navigation Systems

GNSS-Based Navigation

INS-GNSS Integrated Systems

Vision-Based and AI-Aided Navigation

Anti-Jam and Anti-Spoofing Navigation Systems - By End-Use Industry (in Value %)

Defense Forces

Homeland Security

Aerospace and Defense OEMs

Commercial UAV Operators

Research and Government Agencies - By Connectivity Type (in Value %)

Line-of-Sight Navigation Systems

Beyond Visual Line of Sight Systems

Satellite-Assisted Navigation

Hybrid Communication-Navigation Systems - By Region (in Value %)

Northern Israel

Central Israel

Southern Israel

Export-Oriented Deployments

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (technology capability, navigation accuracy, system integration level, military certification, pricing structure, export footprint, R&D intensity, platform compatibility)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Elbit Systems

Israel Aerospace Industries

Rafael Advanced Defense Systems

Elbit Elop

Honeywell Aerospace

Northrop Grumman

Collins Aerospace

Safran Electronics & Defense

Thales Group

BAE Systems

L3Harris Technologies

Hexagon NovAtel

u-blox

Trimble

Advanced Navigation

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035