Market Overview

The Israel UAV Payload and Subsystems market current size stands at around USD ~ million, supported by sustained defense modernization, platform upgrades, and indigenous payload integration programs. During the recent period, procurement activity accelerated across intelligence, surveillance, and reconnaissance missions, supported by consistent defense allocations and operational deployment cycles. Increasing system interoperability requirements and modular payload adoption strengthened procurement consistency. The market also benefits from domestic manufacturing depth, strong integration capabilities, and continuous field-driven technology refinement across operational UAV platforms.

The market is primarily concentrated in central and southern Israel, where aerospace manufacturing clusters, defense R&D centers, and testing facilities are established. Strong military demand, mature supplier networks, and proximity to operational units drive deployment density. Regulatory clarity and export-oriented production further strengthen regional dominance. Collaboration between defense agencies, system integrators, and subsystem developers enables rapid prototyping and field validation, reinforcing Israel’s position as a leading UAV payload innovation ecosystem.

Market Segmentation

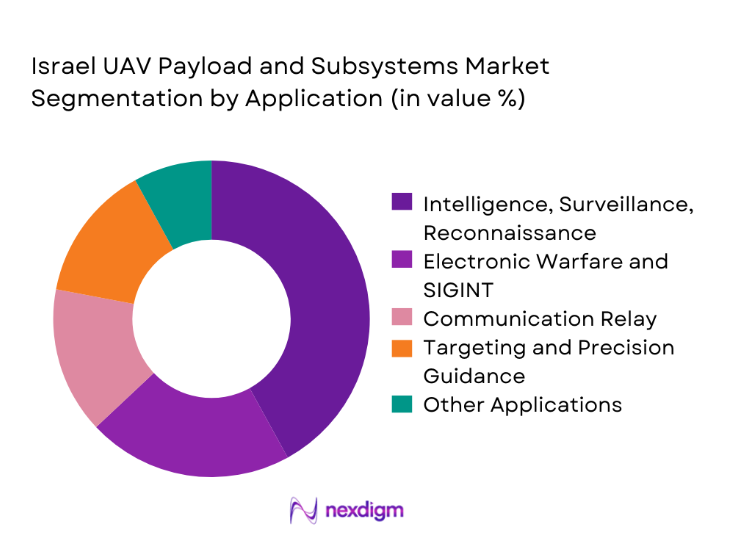

By Application

ISR remains the dominant application segment due to continuous operational demand for persistent surveillance, border monitoring, and intelligence gathering. Payloads supporting electro-optical, infrared, and signal intelligence functions account for the majority of integration volumes. Tactical and strategic missions increasingly require multi-sensor fusion, driving higher payload complexity. Communication relay and electronic warfare applications are expanding steadily, supported by evolving battlefield requirements. Strike and precision guidance payloads continue to gain traction as loitering munitions and armed UAVs become integral to defense operations. Integration flexibility and mission adaptability remain key determinants of application-level demand.

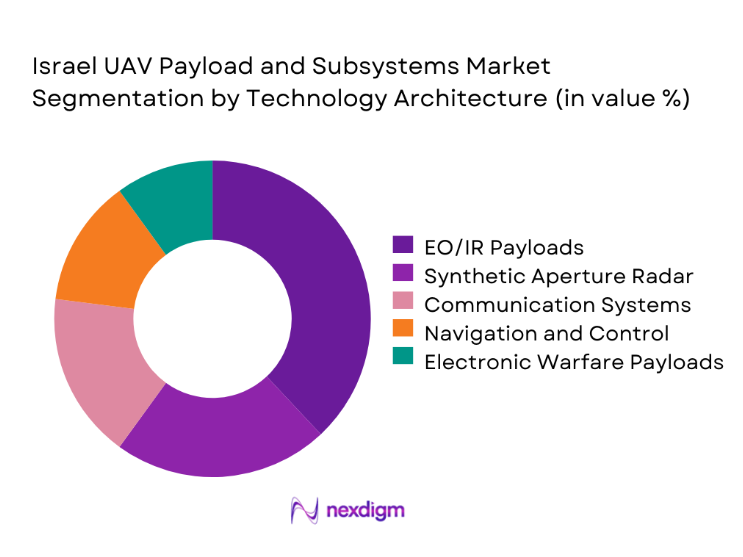

By Technology Architecture

Electro-optical and infrared payloads dominate due to their reliability, maturity, and broad operational use. Synthetic aperture radar systems are increasingly deployed for all-weather and long-range surveillance missions. Communication and data link subsystems are witnessing steady adoption as network-centric operations expand. Navigation and flight control subsystems benefit from continuous upgrades to support autonomous missions. Electronic warfare payloads show growing penetration, driven by electronic countermeasure requirements. Modular architecture adoption allows faster technology refresh cycles across UAV fleets.

Competitive Landscape

The competitive landscape is characterized by vertically integrated manufacturers, specialized payload developers, and system integrators with strong defense linkages. Competition is driven by technological sophistication, platform compatibility, and long-term defense relationships. Continuous innovation, export readiness, and compliance capabilities define competitive positioning across domestic and international programs.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Elta Systems | 1967 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Controp Precision Technologies | 1978 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

Israel UAV Payload and Subsystems Market Analysis

Growth Drivers

Rising ISR and border surveillance requirements

Rising regional security concerns continue to increase demand for persistent aerial surveillance capabilities across multiple operational theaters. Military forces rely heavily on UAV payloads to support continuous intelligence gathering and border monitoring missions. Increased cross-border activity has driven deployment of advanced electro-optical and infrared payload systems. The requirement for real-time situational awareness reinforces sustained investment in ISR payload technologies. Operational feedback loops encourage rapid iteration and payload upgrades. Surveillance intensity increased notably across 2024 and 2025 operational cycles. Border monitoring programs prioritize endurance and sensor accuracy improvements. Payload integration cycles shortened due to urgent operational requirements. Mission adaptability has become a critical procurement parameter. ISR payload demand remains structurally linked to national security strategies.

Expansion of indigenous UAV manufacturing programs

Domestic UAV manufacturing expansion has accelerated payload and subsystem development activities significantly. Localized production supports customization and rapid deployment cycles. Indigenous programs emphasize reduced foreign dependency and technology sovereignty. Payload developers benefit from close collaboration with airframe manufacturers. Integration timelines shortened due to co-development frameworks. Manufacturing scalability improved during 2024 and 2025 program expansions. Government-backed initiatives promote domestic innovation ecosystems. Subsystem testing and validation increasingly occur within national facilities. Production volumes steadily increased to meet operational readiness goals. Indigenous manufacturing enhances export competitiveness and lifecycle support capabilities.

Challenges

High development and integration costs

Advanced payload development requires significant engineering resources and specialized testing infrastructure. Integration complexity increases with multi-sensor and multi-mission configurations. High certification requirements add to development timelines and cost burdens. Continuous technology upgrades strain development budgets. Customization for platform-specific interfaces elevates integration expenses. Smaller suppliers face barriers due to capital-intensive development needs. System validation cycles remain lengthy and resource-intensive. Payload miniaturization adds engineering complexity and cost pressure. Development risks increase with evolving operational requirements. Cost management remains a critical constraint for sustained innovation.

Export restrictions and regulatory approvals

Defense export controls significantly influence payload commercialization strategies. Regulatory compliance introduces uncertainty in international program execution. Approval timelines vary across destination markets and payload classifications. Export licensing requirements limit addressable customer base. Technology transfer restrictions impact collaborative development models. Compliance documentation adds administrative overhead for manufacturers. Changing geopolitical conditions affect export permissions unpredictably. Regulatory alignment is essential for long-term contract stability. Approval delays impact production planning and delivery schedules. Regulatory risk management remains a core operational challenge.

Opportunities

Next-generation AI-enabled ISR payloads

AI integration enables advanced target recognition and automated threat assessment capabilities. Intelligent payloads improve mission efficiency and reduce operator workload. Demand for onboard data processing continues to rise. AI-driven analytics enhance real-time decision-making accuracy. Integration of machine learning algorithms improves detection reliability. Autonomous mission execution capabilities gain operational acceptance. AI payloads support faster response times during surveillance missions. Development efforts accelerated during 2024 and 2025. Defense users prioritize smart payload investments. AI adoption strengthens long-term technology differentiation.

Miniaturization of sensors and electronics

Sensor miniaturization enables deployment on smaller and more agile UAV platforms. Reduced payload weight improves endurance and mission flexibility. Advances in materials and electronics support compact designs. Miniaturized components lower power consumption requirements. Smaller payloads enable multi-sensor configurations on limited platforms. Compact systems reduce logistical and maintenance burdens. Demand for portable ISR solutions continues to rise. Miniaturization supports swarm and tactical UAV applications. Development cycles favor lightweight and modular designs. Technology maturity accelerates adoption across UAV classes.

Future Outlook

The market is expected to maintain steady growth through 2035 driven by sustained defense modernization and evolving operational doctrines. Advancements in autonomous systems and sensor fusion will continue shaping payload development priorities. Export demand and domestic innovation will remain key growth enablers. Integration of AI and modular architectures is expected to define future competitiveness.

Major Players

- Elbit Systems

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- Elta Systems

- Controp Precision Technologies

- Aeronautics Group

- BlueBird Aero Systems

- UVision Air

- Top I Vision

- NextVision Stabilized Systems

- Steadicopter

- Sky Sapience

- Dronix Technologies

- ESC BAZ

- IAI Malat

Key Target Audience

- Ministry of Defense procurement divisions

- Israeli Defense Forces operational units

- Homeland security and border control agencies

- Aerospace and defense OEMs

- UAV system integrators

- Payload and subsystem manufacturers

- Defense-focused investment and venture capital firms

- Government and regulatory bodies including SIBAT and MOD

Research Methodology

Step 1: Identification of Key Variables

Market scope, payload classifications, application categories, and technology architectures were identified through structured industry mapping. Key operational and procurement variables were defined to reflect actual deployment conditions. Emphasis was placed on defense-specific demand drivers.

Step 2: Market Analysis and Construction

Market structure was developed through platform-level analysis, subsystem mapping, and application alignment. Data normalization ensured consistency across UAV classes and payload types. Trends were evaluated based on deployment and integration patterns.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through expert consultations with defense engineers and procurement specialists. Feedback loops ensured alignment with real-world operational practices. Iterative reviews refined data reliability.

Step 4: Research Synthesis and Final Output

Insights were consolidated into structured outputs emphasizing clarity and strategic relevance. Analytical consistency was maintained across all sections. Final validation ensured coherence with defense market dynamics.

- Executive Summary

- Research Methodology (Market Definitions and UAV Payload Scope Mapping, Platform and Subsystem Taxonomy Development, Bottom-Up Payload Revenue Estimation by Program, Defense Budget and Procurement Allocation Analysis, OEM and Integrator Expert Interviews, Program-Level Data Triangulation and Validation, Operational and Export Control Assumptions)

- Definition and Scope

- Market evolution

- Usage and mission deployment framework

- Ecosystem and value chain structure

- Supply chain and subsystem integration dynamics

- Regulatory and defense export environment

- Growth Drivers

Rising ISR and border surveillance requirements

Expansion of indigenous UAV manufacturing programs

Increasing electronic warfare and SIGINT demand

High defense R&D spending and innovation ecosystem

Export demand from allied defense forces

Operational need for modular and multi-mission payloads - Challenges

High development and integration costs

Export restrictions and regulatory approvals

Technology obsolescence risk

Platform and payload interoperability constraints

Supply chain dependence on specialized components

Cybersecurity vulnerabilities in payload systems - Opportunities

Next-generation AI-enabled ISR payloads

Miniaturization of sensors and electronics

Growing loitering munition deployments

Upgrades of legacy UAV fleets

Increased international defense collaborations

Dual-use payload development - Trends

Shift toward multi-sensor fused payloads

Adoption of open architecture payload systems

Growth in autonomous mission payloads

Increased use of EO/IR with AI analytics

Demand for lighter and power-efficient subsystems

Integration of satellite communication payloads - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

MALE UAVs

HALE UAVs

Tactical UAVs

Mini and Micro UAVs

Loitering Munitions - By Application (in Value %)

Intelligence Surveillance and Reconnaissance

Target Acquisition and Tracking

Electronic Warfare and SIGINT

Communication Relay

Strike and Precision Guidance - By Technology Architecture (in Value %)

Electro-Optical and Infrared Payloads

Synthetic Aperture Radar

Electronic Warfare Payloads

Communication and Data Link Systems

Navigation and Flight Control Subsystems - By End-Use Industry (in Value %)

Defense Forces

Homeland Security

Border Surveillance Agencies

Intelligence Agencies

Export Military Programs - By Connectivity Type (in Value %)

Line of Sight

Beyond Line of Sight

Satellite Communication Enabled

Hybrid Connectivity - By Region (in Value %)

Northern Israel

Central Israel

Southern Israel

Export-Oriented Installations

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Payload portfolio breadth, Technology maturity, Platform compatibility, Export footprint, R&D intensity, Pricing competitiveness, Customization capability, After-sales support)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Elbit Systems

Israel Aerospace Industries

Rafael Advanced Defense Systems

Elta Systems

Controp Precision Technologies

IAI Malat

UVision Air

BlueBird Aero Systems

Aeronautics Group

Top I Vision

ESC BAZ

NextVision Stabilized Systems

Dronix Technologies

Steadicopter

Sky Sapience

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035