Market Overview

The Israel UAV Propulsion Systems market current size stands at around USD ~ million, supported by steady platform modernization and indigenous defense manufacturing activities. Demand momentum is shaped by increasing UAV deployment across surveillance, intelligence, and tactical operations, with propulsion upgrades driven by endurance and reliability requirements. In recent years, development programs emphasized lightweight engines, hybrid configurations, and improved fuel efficiency. Operational utilization increased consistently across defense units, with propulsion reliability becoming a central procurement parameter. Domestic development initiatives and long-term platform sustainment contracts continue to support stable industry performance.

The market is primarily concentrated in central and southern Israel, supported by established aerospace clusters and defense research infrastructure. High concentration of UAV manufacturing, testing facilities, and defense integration centers drives localized demand. Government-backed innovation ecosystems support propulsion technology advancement, while regulatory clarity facilitates rapid testing cycles. Export-oriented development programs also shape domestic demand patterns. Strong collaboration between defense agencies and local manufacturers sustains ecosystem maturity and operational continuity.

Market Segmentation

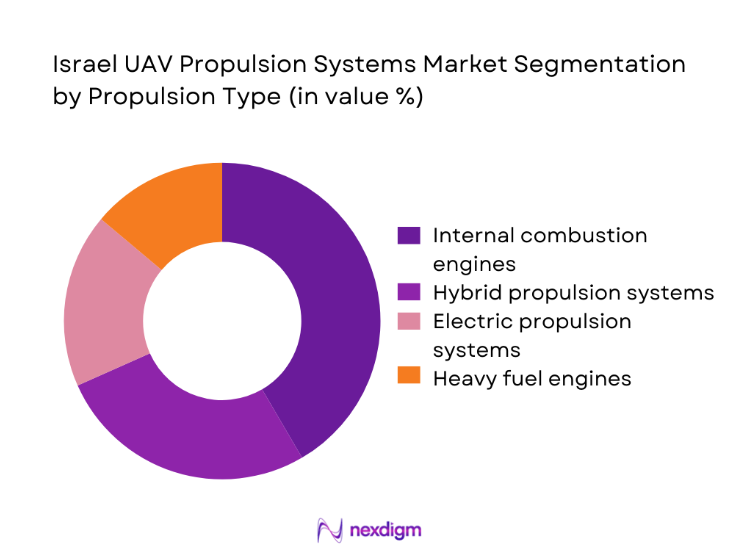

By Propulsion Type

The propulsion segment is dominated by internal combustion and hybrid propulsion systems due to their operational reliability and extended endurance capabilities. Hybrid propulsion adoption increased during recent development cycles as defense agencies sought optimized fuel efficiency and reduced acoustic signatures. Electric propulsion remains limited to smaller tactical platforms, constrained by payload capacity and endurance limitations. Heavy fuel engines maintain preference for long-range missions because of logistical compatibility. Continuous engine refinement and mission-specific customization remain central to segmentation dynamics.

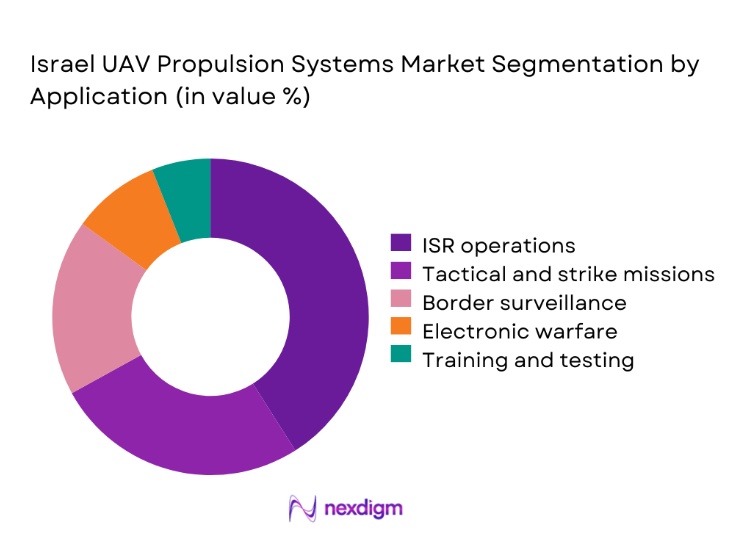

By Application

ISR operations dominate propulsion demand due to persistent surveillance requirements and extended loitering missions. Tactical strike and reconnaissance applications follow, supported by evolving border security requirements. Maritime patrol and electronic warfare platforms represent emerging application areas, driven by regional security priorities. Training and testing UAVs maintain limited but stable demand. Mission-specific propulsion tuning continues to shape procurement preferences across applications.

Competitive Landscape

The competitive landscape is moderately consolidated, with a mix of domestic aerospace leaders and specialized propulsion manufacturers. Market participants emphasize in-house engineering, long-term defense contracts, and propulsion system integration capabilities. Technological differentiation and compliance with military certification standards remain primary competitive factors.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| UAV Engines Ltd | 1978 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Rotax Aircraft Engines | 1920 | Austria | ~ | ~ | ~ | ~ | ~ | ~ |

Israel UAV Propulsion Systems Market Analysis

Growth Drivers

Rising defense UAV deployment across border surveillance and intelligence operations

Increasing border monitoring requirements have driven higher deployment of unmanned platforms across multiple operational zones. Defense agencies prioritized UAV fleets for persistent surveillance missions requiring efficient propulsion reliability. Expanded mission duration requirements influenced procurement of advanced propulsion configurations. Increased platform utilization rates accelerated replacement and refurbishment cycles. Operational dependency on UAV systems strengthened procurement stability across recent years. Indigenous production incentives further reinforced sustained demand. Strategic modernization programs enhanced focus on propulsion performance reliability. UAV integration into layered defense strategies expanded propulsion system procurement. Continuous upgrades in endurance requirements supported propulsion innovation. Operational readiness mandates reinforced propulsion system standardization.

Advancements in hybrid propulsion technologies for extended endurance missions

Hybrid propulsion systems gained traction due to their operational efficiency and reduced acoustic signatures. Defense planners prioritized endurance enhancement without increasing payload weight. Integration of hybrid systems supported multi-mission adaptability across platforms. Engineering advancements improved power management and fuel optimization capabilities. Hybrid adoption aligned with long-duration ISR operational requirements. Testing programs validated performance under diverse climatic conditions. Operational feedback encouraged iterative propulsion refinements. Lower thermal signatures improved mission survivability. Development programs focused on modular hybrid configurations. Sustained R&D funding reinforced technology adoption pathways.

Challenges

High development complexity and extended certification timelines

Propulsion systems require extensive testing to meet stringent defense certification requirements. Lengthy validation cycles increase development costs and deployment timelines. Compliance with military airworthiness standards adds engineering complexity. Testing infrastructure availability constrains rapid iteration. Certification delays affect platform induction schedules. Integration with UAV avionics increases technical dependencies. Export compliance adds additional approval layers. Limited testing windows restrict accelerated innovation cycles. Program modifications increase lifecycle management challenges. These constraints slow rapid technology deployment.

Dependence on specialized components and limited supplier base

Critical propulsion components rely on specialized suppliers with limited production scalability. Supply chain disruptions affect engine availability and maintenance schedules. Limited domestic alternatives increase dependency risks. Export restrictions impact sourcing flexibility for key subsystems. Long lead times affect production planning accuracy. Component qualification requirements restrict supplier diversification. Replacement part availability impacts operational readiness. Inventory buffering increases operational costs. Supply chain concentration increases vulnerability to geopolitical shifts. Mitigation strategies require long-term supplier agreements.

Opportunities

Expansion of UAV fleets for persistent intelligence and surveillance operations

Increased surveillance requirements create sustained propulsion demand across multiple UAV classes. Border security modernization initiatives drive fleet expansion programs. ISR mission frequency continues to rise across operational theaters. Endurance-focused propulsion systems gain priority in procurement planning. Integration of autonomous flight capabilities increases propulsion reliability requirements. Fleet expansion supports long-term service and maintenance demand. Domestic production capabilities support rapid deployment cycles. Enhanced mission complexity drives propulsion innovation. Multi-role UAV adoption broadens propulsion application scope. Long-term operational planning sustains consistent market opportunity.

Technological innovation in fuel efficiency and power-to-weight optimization

Ongoing research targets improved thrust-to-weight ratios for UAV propulsion systems. Fuel efficiency improvements support extended mission duration objectives. Lightweight materials enhance propulsion system performance. Advanced thermal management improves operational reliability. Digital engine monitoring improves maintenance efficiency. Integration of smart diagnostics enhances system longevity. Optimization reduces operational downtime. Continuous innovation aligns with evolving defense requirements. Collaborative R&D programs accelerate technology adoption. Efficiency gains support long-term fleet sustainability.

Future Outlook

The Israel UAV Propulsion Systems market is expected to maintain steady expansion through continued defense modernization and UAV fleet enhancement programs. Ongoing technological innovation will focus on endurance optimization, hybridization, and system reliability. Export-oriented development and indigenous manufacturing capabilities will further strengthen market positioning. Regulatory support and strategic defense investments will continue shaping long-term industry growth.

Major Players

- Elbit Systems

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- UAV Engines Ltd

- Rotax Aircraft Engines

- Safran Helicopter Engines

- Honeywell Aerospace

- Rolls-Royce Defence

- GE Aerospace

- PBS Velká Bíteš

- Austro Engine

- Orbital UAV

- Hirth Engines

- General Atomics Aeronautical

- Kratos Defense

Key Target Audience

- Defense procurement agencies

- Israeli Ministry of Defense

- Aerospace OEMs

- UAV platform manufacturers

- System integrators

- Military research organizations

- Investments and venture capital firms

- Civil Aviation Authority of Israel

Research Methodology

Step 1: Identification of Key Variables

Market boundaries, propulsion categories, and operational applications were identified based on defense usage patterns and UAV deployment trends. Key variables included propulsion type, mission profile, and platform class.

Step 2: Market Analysis and Construction

Market structure was developed using platform-level assessment and propulsion integration mapping. Demand patterns were analyzed through defense procurement activity and platform deployment cycles.

Step 3: Hypothesis Validation and Expert Consultation

Industry specialists and defense technology experts were consulted to validate assumptions, performance benchmarks, and technology adoption trends. Feedback was integrated to refine analytical accuracy.

Step 4: Research Synthesis and Final Output

Findings were consolidated through cross-verification of technical, operational, and strategic inputs. Final outputs were structured to reflect realistic market dynamics and future outlook.

- Executive Summary

- Research Methodology (Market Definitions and Scope Delineation for UAV Propulsion Systems, Platform and Propulsion Architecture Segmentation Framework, Bottom-Up Market Sizing Using UAV Production and Retrofit Data, Revenue Attribution Across Engine Types and Power Classes, Primary Validation with Israeli Defense OEMs and Tier-1 Suppliers, Data Triangulation Using Defense Budgets and Fleet Deployment Data, Assumptions and Limitations Linked to Classified Program Disclosure)

- Definition and Scope

- Market evolution

- Usage and mission profiles

- Ecosystem structure

- Supply chain and sourcing dynamics

- Regulatory and defense procurement environment

- Growth Drivers

Technological Advancements in UAV Propulsion

Increase in Military UAV Deployments

Rising Demand for Commercial UAV Services - Market Challenges

High Development Costs for Advanced Propulsion Systems

Regulatory Barriers and Compliance Issues

Limited Availability of Skilled Workforce - Market Opportunities

Emerging Demand for Hybrid and Electric UAVs

Growth in Commercial Drone Delivery Systems

Government Investment in UAV Research - Trends

Integration of Artificial Intelligence in UAV Operations

Advancement in Hybrid Propulsion Technologies

Rise in UAV Propulsion System Reliability - Government Regulations

UAV Certification Requirements

Drone Flight Safety Regulations

Environmental Regulations for UAV Propulsion Systems - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Tactical UAVs

MALE UAVs

HALE UAVs

Loitering munitions

Mini and micro UAVs - By Application (in Value %)

Intelligence, Surveillance and Reconnaissance

Strike and combat missions

Border and maritime surveillance

Electronic warfare and SIGINT

Target acquisition and tracking - By Technology Architecture (in Value %)

Internal combustion engines

Hybrid propulsion systems

Electric propulsion systems

Turboprop engines

Heavy fuel engines - By End-Use Industry (in Value %)

Defense and military forces

Homeland security agencies

Intelligence agencies

Border protection authorities

Aerospace R&D organizations - By Connectivity Type (in Value %)

Line-of-sight controlled UAVs

Beyond visual line-of-sight UAVs

Satellite communication enabled UAVs

Autonomous and semi-autonomous systems - By Region (in Value %)

Northern Israel

Central Israel

Southern Israel

Defense industrial zones

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (product portfolio breadth, propulsion efficiency, endurance performance, military certification status, domestic manufacturing capability, R&D intensity, integration flexibility, export footprint)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Elbit Systems

Israel Aerospace Industries

Rafael Advanced Defense Systems

UAV Engines Ltd

Rotax Aircraft Engines

Hirth Engines

Honeywell Aerospace

Safran Helicopter Engines

Rolls-Royce Defence

General Electric Aviation

Austro Engine

PBS Velká Bíteš

Orbital UAV

UAV Factory

Korea Aerospace Industries

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035