Market Overview

The Israel Unmanned Combat Aerial Vehicle market current size stands at around USD ~ million, supported by steady defense modernization programs and operational deployments. The market has demonstrated consistent expansion due to increasing reliance on unmanned systems for surveillance, strike, and tactical missions. Platform deliveries and system upgrades recorded measurable activity during 2024 and 2025, driven by sustained procurement cycles. Technological maturity across avionics, propulsion, and payload integration continues to strengthen system reliability and mission effectiveness across operational theaters.

Israel’s market dominance is centered around advanced aerospace clusters located in central and southern regions, supported by mature defense infrastructure. Strong collaboration between military users, defense manufacturers, and research entities accelerates innovation and deployment readiness. High operational tempo, continuous testing environments, and a well-developed defense supply chain reinforce domestic demand. Regulatory alignment, export compliance frameworks, and long-term capability planning further sustain ecosystem stability and growth momentum.

Market Segmentation

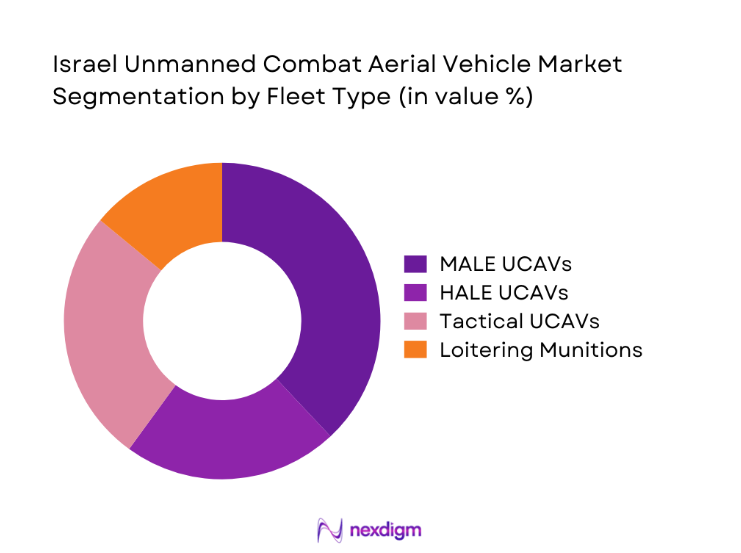

By Fleet Type

The fleet type segmentation is dominated by medium-altitude long-endurance and tactical combat platforms due to their flexibility across intelligence, surveillance, and strike missions. These systems are preferred for sustained border monitoring and rapid response operations. Loitering munitions have gained traction because of precision engagement requirements and lower deployment complexity. High-altitude platforms continue to support strategic surveillance needs, while smaller tactical platforms are increasingly integrated into ground force operations. Fleet diversification remains aligned with evolving operational doctrines and mission-specific requirements across defense units.

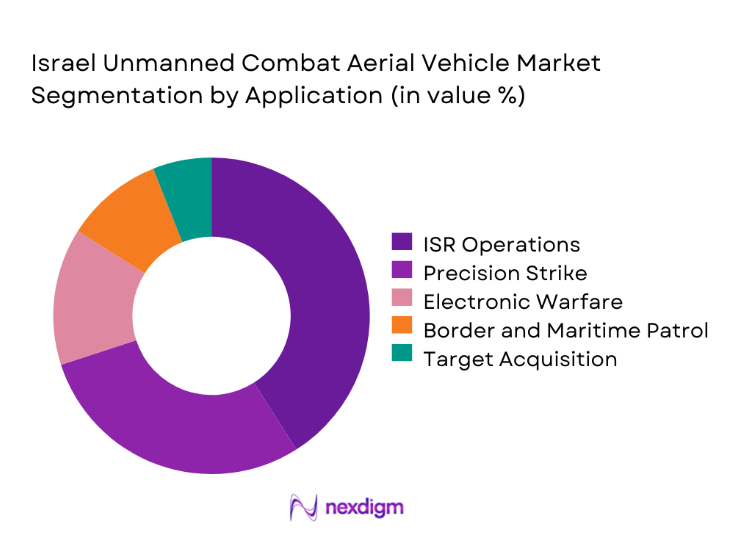

By Application

Application-based segmentation reflects strong demand for intelligence, surveillance, and reconnaissance missions, which remain central to operational planning. Precision strike applications continue expanding due to increasing reliance on unmanned platforms for risk mitigation. Electronic warfare and target acquisition roles are gaining importance as battlefield digitization increases. Maritime and border patrol applications are also growing due to regional security dynamics. The diversification of mission profiles continues to drive platform customization and system integration requirements.

Competitive Landscape

The competitive landscape is characterized by a concentrated group of defense manufacturers with deep technological capabilities and long-standing military relationships. Companies focus on platform innovation, payload integration, and lifecycle support to maintain competitive advantage. Continuous upgrades, indigenous development programs, and export-oriented strategies shape market positioning. Competitive differentiation is driven by autonomy levels, endurance capabilities, and system interoperability with existing defense infrastructure.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Aeronautics Group | 1997 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| BlueBird Aero Systems | 2002 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

Israel Unmanned Combat Aerial Vehicle Market Analysis

Growth Drivers

Rising emphasis on unmanned warfare and force protection

Increasing operational risk in contested environments has accelerated adoption of unmanned systems for force protection. Military planners increasingly prioritize platforms reducing pilot exposure during reconnaissance and strike operations. Deployment frequency of unmanned missions increased noticeably during 2024 operational cycles. Advanced sensors improved mission success rates across multiple terrains. Commanders favor unmanned assets for persistent surveillance and rapid response tasks. Tactical flexibility enhances battlefield situational awareness significantly. Reduced manpower requirements improve long-term operational efficiency. System reliability improvements support extended mission endurance. Integration with digital command systems strengthens operational effectiveness. These factors collectively reinforce sustained demand growth.

Increased defense spending on ISR and precision strike capabilities

Defense budget allocations increasingly favor intelligence and precision strike modernization initiatives. Investment patterns in 2024 and 2025 show higher allocations toward unmanned platforms. ISR modernization remains a strategic priority due to evolving threat environments. Precision engagement capabilities reduce collateral risk and enhance mission outcomes. Procurement programs emphasize multi-mission compatibility and payload flexibility. Advanced targeting systems improve engagement accuracy. Operational doctrines increasingly integrate unmanned strike assets. Force readiness programs prioritize rapid deployment capabilities. Budget continuity supports long-term procurement planning. These trends collectively accelerate UCAV adoption.

Challenges

High development and integration costs

Development complexity significantly increases system engineering requirements and validation timelines. Integration of sensors, communications, and weapons systems remains technically demanding. Development cycles often extend due to evolving operational requirements. Testing and certification processes increase deployment timelines. High customization demands elevate engineering resource utilization. Integration with legacy command systems presents technical challenges. Software validation requires extensive simulation and field testing. System upgrades require continuous investment allocation. Program delays may impact operational readiness schedules. These factors collectively elevate development challenges.

Regulatory constraints on exports and technology transfer

Export approvals involve multi-layered regulatory oversight and lengthy authorization processes. Technology transfer restrictions limit international collaboration opportunities. Compliance with international arms regulations affects sales cycles. Export licensing frameworks introduce uncertainty into delivery schedules. Regulatory alignment varies across target markets. Intellectual property protection requirements complicate partnerships. Geopolitical considerations influence approval timelines. Policy changes can impact long-term export strategies. Documentation requirements increase administrative workload. These constraints affect market expansion potential.

Opportunities

Next-generation autonomous combat systems

Advancements in artificial intelligence enable higher autonomy levels in combat operations. Autonomous navigation reduces dependency on continuous operator control. Decision-support algorithms enhance mission adaptability in dynamic environments. Swarm technologies improve coordinated mission execution capabilities. Autonomous threat detection increases operational responsiveness. Reduced communication dependency improves survivability in contested zones. Investment in autonomy accelerates innovation cycles. Research initiatives support next-generation combat concepts. Autonomous systems align with future warfare doctrines. These developments create strong long-term growth potential.

Integration with multi-domain command and control networks

Modern warfare increasingly relies on integrated multi-domain operational frameworks. UCAVs provide critical data inputs to command networks. Enhanced data fusion improves decision-making accuracy. Network-centric operations increase mission coordination efficiency. Interoperability with naval and ground systems expands operational reach. Secure communication protocols enhance battlefield resilience. Real-time data sharing strengthens situational awareness. Command integration reduces response latency. Digital transformation initiatives drive adoption. These factors open new integration opportunities.

Future Outlook

The Israel Unmanned Combat Aerial Vehicle market is expected to maintain steady expansion through 2035, supported by defense modernization priorities and evolving threat environments. Technological advancements in autonomy, sensors, and data integration will shape next-generation platform development. Increased focus on interoperability and multi-domain operations will further enhance system relevance. Export opportunities and domestic innovation initiatives are expected to reinforce long-term market stability.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Rafael Advanced Defense Systems

- Aeronautics Group

- BlueBird Aero Systems

- UVision Air

- Steadicopter

- XTEND

- IAI Malat

- Elbit Hermes Division

- Israel Military Industries

- General Atomics Aeronautical Systems

- Turkish Aerospace Industries

- Baykar Technologies

- Northrop Grumman

Key Target Audience

- Ministry of Defense procurement divisions

- Israeli Air Force and operational commands

- Defense procurement agencies

- Homeland security agencies

- Border security forces

- Defense system integrators

- Investments and venture capital firms

- Government and regulatory bodies with agency names

Research Methodology

Step 1: Identification of Key Variables

The study identifies operational, technological, and procurement-related variables influencing market performance. Emphasis is placed on platform classification, mission roles, and deployment intensity. Data points are structured around defense acquisition cycles and modernization priorities.

Step 2: Market Analysis and Construction

Market structure is developed using platform deployment trends, operational usage patterns, and system upgrade cycles. Demand drivers are analyzed across service branches and mission profiles to establish logical segmentation.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions are validated through structured consultations with defense professionals, system integrators, and domain specialists. Insights are cross-verified with operational data and procurement activity trends.

Step 4: Research Synthesis and Final Output

Findings are consolidated using triangulation techniques to ensure consistency and accuracy. Analytical outputs are refined to reflect realistic market behavior and future outlook scenarios.

- Executive Summary

- Research Methodology (Market Definitions and Operational Scope Mapping, UCAV Platform Taxonomy and Mission Classification, Bottom-Up Defense Budget and Program-Based Market Sizing, Revenue Attribution by Platform and Payload Integration, Primary Validation through Defense OEMs and Military Experts, Triangulation Using Procurement Data and Export Licenses, Assumptions on Force Modernization and Doctrine Evolution)

- Definition and Scope

- Market evolution

- Operational and mission usage landscape

- Ecosystem and value chain structure

- Defense procurement and integration framework

- Regulatory and export control environment

- Growth Drivers

Rising emphasis on unmanned warfare and force protection

Increased defense spending on ISR and precision strike capabilities

Operational success of UCAVs in asymmetric warfare

Advancements in autonomous navigation and AI targeting

Export demand for combat-proven platforms - Challenges

High development and integration costs

Regulatory constraints on exports and technology transfer

Vulnerability to electronic warfare and cyber threats

Limited airspace for domestic testing

Dependence on defense budget cycles - Opportunities

Next-generation autonomous combat systems

Integration with multi-domain command and control networks

Rising demand for loitering munitions

Export partnerships and joint development programs

AI-driven swarm and cooperative engagement concepts - Trends

Shift toward autonomous and semi-autonomous UCAVs

Increased use of loitering munitions

Miniaturization of sensors and payloads

Integration with manned-unmanned teaming concepts

Emphasis on survivability and stealth features - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

MALE UCAVs

HALE UCAVs

Tactical UCAVs

Loitering Munition Platforms - By Application (in Value %)

Intelligence, Surveillance and Reconnaissance

Strike and Precision Attack

Electronic Warfare

Border and Maritime Patrol

Target Acquisition and Battle Damage Assessment - By Technology Architecture (in Value %)

Fixed Wing UCAVs

Rotary Wing UCAVs

Hybrid VTOL UCAVs

Autonomous Swarm-Enabled Platforms - By End-Use Industry (in Value %)

Air Force

Army and Ground Forces

Navy and Coastal Defense

Intelligence and Special Operations Units - By Connectivity Type (in Value %)

Line-of-Sight Data Link

Beyond Line-of-Sight SATCOM

Encrypted Tactical Networks

AI-Enabled Autonomous Communication - By Region (in Value %)

Northern Israel

Southern Israel

Central Israel

Operational Export Deployments

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Platform Capability, Endurance and Payload, Combat Radius, Autonomy Level, Sensor Integration, Cost Structure, Export Footprint, Lifecycle Support)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Israel Aerospace Industries

Elbit Systems

Rafael Advanced Defense Systems

Aeronautics Group

BlueBird Aero Systems

UVision Air

Steadicopter

XTEND

IAI Malat Division

Elbit Hermes Division

Israel Military Industries

General Atomics Aeronautical Systems

Turkish Aerospace Industries

Baykar Technologies

Northrop Grumman

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service and upgrade expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035