Market Overview

The Israel Unmanned Marine Vehicles market current size stands at around USD ~ million and reflects expanding defense modernization priorities. Deployment volumes during recent cycles reached ~ units, supported by rising naval automation programs and coastal surveillance investments. Operational fleets expanded across multiple maritime roles including surveillance, reconnaissance, and underwater inspection. Platform utilization rates increased steadily as mission endurance and autonomy improved. Procurement activity remained stable despite shifting budget allocations. Domestic development programs continued to mature through sustained government-backed initiatives.

Israel’s coastal defense infrastructure drives concentrated demand across Mediterranean operational zones and strategic maritime corridors. High naval readiness requirements, dense maritime traffic, and offshore asset protection reinforce adoption intensity. The ecosystem benefits from advanced defense manufacturing clusters, strong naval R&D institutions, and established testing facilities. Policy emphasis on unmanned systems integration supports sustained procurement cycles. Mature command infrastructure enables rapid platform deployment. Interoperability with broader defense networks further strengthens adoption momentum.

Market Segmentation

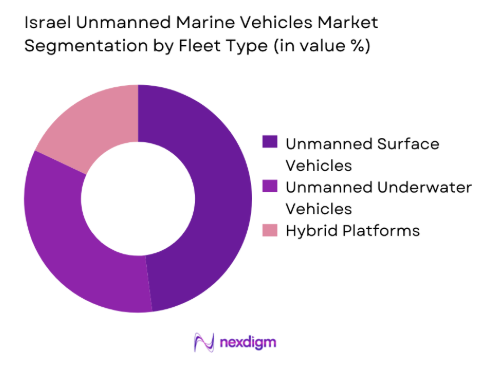

By Fleet Type

Unmanned surface vehicles dominate deployments due to flexibility in patrol, surveillance, and rapid-response missions. These platforms benefit from lower operational risk, extended endurance, and compatibility with existing naval command systems. Unmanned underwater vehicles hold strong relevance for mine countermeasures and seabed mapping. Hybrid platforms are gaining attention for multi-mission adaptability and reduced detection risk. Fleet selection increasingly aligns with mission-specific performance requirements and endurance optimization strategies.

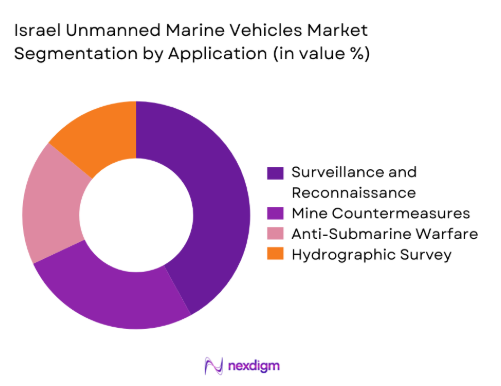

By Application

Surveillance and reconnaissance represent the dominant application due to persistent maritime security needs. Mine countermeasure operations continue expanding as naval forces modernize threat mitigation strategies. Anti-submarine warfare applications benefit from improved sensor integration. Hydrographic surveying supports infrastructure development and environmental monitoring. Multi-role deployment capability increasingly influences procurement decisions across naval agencies.

Competitive Landscape

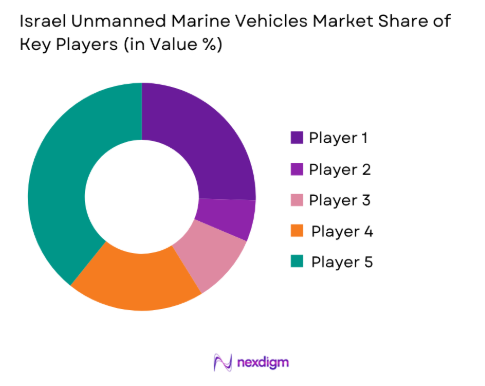

The competitive landscape is characterized by a concentrated group of defense-focused manufacturers with strong government alignment. Companies compete primarily on technological sophistication, platform autonomy, and system integration capabilities. Long-term defense contracts and recurring upgrades shape competitive positioning.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Israel Shipyards | 1959 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Aeronautics Group | 1997 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

Israel Unmanned Marine Vehicles Market Analysis

Growth Drivers

Rising maritime border security requirements

Growing regional security concerns continue to elevate demand for persistent maritime monitoring solutions across strategic coastal zones. Naval forces increasingly prioritize unmanned platforms to enhance situational awareness and reduce personnel exposure. Expanded patrol requirements drive deployment of autonomous vessels for continuous surveillance missions. Advanced sensor integration supports improved detection accuracy across maritime boundaries. Increased offshore infrastructure protection further reinforces platform utilization. Governments prioritize maritime domain awareness through advanced unmanned systems deployment. Coastal security modernization programs expand procurement volumes steadily. Multi-mission capability strengthens operational efficiency across diverse maritime scenarios. Integration with existing naval command networks improves response coordination. Sustained defense funding supports continued platform acquisition and deployment.

Increasing adoption of autonomous naval platforms

Naval forces increasingly favor autonomous platforms to enhance mission endurance and operational flexibility. Reduced reliance on crewed vessels improves cost efficiency and deployment frequency. Advancements in navigation algorithms improve autonomous maneuvering reliability. Artificial intelligence enables real-time threat identification and response optimization. Autonomous systems enhance persistence in contested maritime environments. Fleet operators leverage automation to minimize operational risk exposure. Interoperability with surface and aerial assets expands mission scope. Autonomous mission planning improves coverage efficiency across extended patrol zones. Technology maturation reduces operational complexity over time. Strategic emphasis on autonomy accelerates procurement programs.

Challenges

High system integration and maintenance complexity

Integration of unmanned systems with legacy naval infrastructure presents ongoing technical challenges. Compatibility issues arise across command, control, and communication interfaces. Maintenance requirements increase due to complex sensor and propulsion systems. Skilled technical personnel shortages affect long-term operational readiness. System upgrades require extensive testing and validation cycles. Integration delays impact deployment schedules and readiness targets. Platform customization increases lifecycle management complexity. Interoperability constraints limit multi-platform coordination effectiveness. Logistics support infrastructure requires continuous enhancement. Operational downtime risks increase with system complexity.

Cybersecurity vulnerabilities in unmanned platforms

Unmanned platforms face heightened exposure to cyber intrusion risks during operations. Communication links remain vulnerable to jamming and interception attempts. Data transmission security requires constant system upgrades and monitoring. Cyber resilience becomes critical for mission reliability and asset protection. Increasing autonomy expands potential attack surfaces within system architecture. Threat actors target navigation and control systems to disrupt missions. Defensive cyber frameworks require continuous testing and reinforcement. Regulatory compliance adds further cybersecurity implementation requirements. Cyber incident mitigation planning remains resource intensive. Security assurance remains a critical procurement consideration.

Opportunities

Expansion of autonomous fleet programs

National defense strategies increasingly emphasize unmanned fleet expansion initiatives. Budget allocations support scaling autonomous vessel deployments across maritime zones. Fleet standardization enables cost efficiencies and simplified maintenance processes. Integration with aerial and surface systems enhances multi-domain operations. Domestic manufacturing capabilities support accelerated fleet expansion. Technological maturity encourages adoption across broader mission profiles. Collaborative development programs strengthen innovation pipelines. Autonomous fleets improve operational resilience and mission continuity. Training frameworks adapt to support expanded autonomous operations. Long-term defense planning reinforces sustained demand growth.

Rising demand for mine countermeasure solutions

Naval modernization programs prioritize advanced mine detection and neutralization capabilities. Unmanned systems offer safer alternatives for high-risk underwater operations. Enhanced sonar and sensor integration improves detection accuracy. Autonomous navigation supports extended underwater mission endurance. Strategic waterways require continuous mine clearance capabilities. Increased maritime trade drives heightened focus on safe navigation corridors. Defense agencies invest in specialized countermeasure platforms. Integration with command systems improves response coordination. Technological advancements reduce operational deployment timeframes. Growing threat complexity sustains long-term demand.

Future Outlook

The market outlook reflects sustained defense modernization and increasing reliance on autonomous maritime systems. Continued technological innovation will enhance mission autonomy and integration efficiency. Strategic investments are expected to strengthen domestic manufacturing and system interoperability. Long-term naval security priorities will continue shaping procurement decisions. Expansion into multi-domain operational frameworks will further support market evolution.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Rafael Advanced Defense Systems

- Israel Shipyards

- Aeronautics Group

- Elta Systems

- BlueBird Aero Systems

- Controp Precision Technologies

- Orbit Communication Systems

- RT LTA Systems

- UVision Air

- XTEND Defense

- TAT Technologies

- IMCO Industries

- Seagull Technologies

Key Target Audience

- Israeli Ministry of Defense

- Israeli Navy Procurement Directorate

- Directorate of Defense Research and Development

- Homeland Security Agencies

- Naval Systems Integrators

- Maritime Surveillance Operators

- Offshore Infrastructure Operators

- Investment and Venture Capital Firms

Research Methodology

Step 1: Identification of Key Variables

Market parameters were defined through analysis of platform categories, mission profiles, and operational usage. Key performance indicators were established based on deployment characteristics and technological maturity. Data alignment focused on defense procurement structures.

Step 2: Market Analysis and Construction

Market segmentation was developed using platform type, application, and operational deployment logic. Data synthesis incorporated program-level assessment and capability mapping. Cross-validation ensured consistency across deployment categories.

Step 3: Hypothesis Validation and Expert Consultation

Industry specialists and defense technology experts validated assumptions through structured interviews. Feedback refined demand drivers, operational constraints, and adoption trends. Validation ensured alignment with current defense strategies.

Step 4: Research Synthesis and Final Output

Findings were consolidated through triangulation of qualitative and quantitative insights. Analytical frameworks ensured consistency and accuracy. Final outputs were structured to support strategic decision-making.

- Executive Summary

- Research Methodology (Market Definitions and Operational Scope Framing, Platform and Mission-Based Segmentation Logic, Bottom-Up Fleet and Program Level Market Estimation, Defense Budget Allocation and Program Mapping Analysis, Primary Interviews with Naval and Defense Technology Stakeholders, Data Triangulation through Procurement Records and Fleet Deployments, Assumption Modeling Based on Regional Maritime Threat Profiles)

- Definition and Scope

- Market Evolution

- Operational and Mission Usage Landscape

- Industry and Defense Ecosystem Structure

- Supply Chain and Integration Framework

- Regulatory and Defense Procurement Environment

- Growth Drivers

Rising maritime border security requirements

Increasing adoption of autonomous naval platforms

Expansion of asymmetric naval warfare capabilities

Growing emphasis on unmanned ISR missions

Technological advancements in sensor fusion and AI - Challenges

High system integration and maintenance complexity

Cybersecurity vulnerabilities in unmanned platforms

Limited interoperability with legacy naval systems

High procurement and lifecycle management costs

Operational constraints in contested maritime zones - Opportunities

Expansion of autonomous fleet programs

Rising demand for mine countermeasure solutions

Integration of AI-enabled navigation systems

Export potential of indigenous unmanned platforms

Collaborative defense technology development programs - Trends

Shift toward fully autonomous maritime systems

Increasing use of swarm-based naval operations

Integration of multi-domain surveillance platforms

Growing focus on modular payload architectures

Adoption of digital twin and simulation technologies - Government Regulations

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Unmanned Surface Vehicles

Unmanned Underwater Vehicles

Hybrid Surface-Subsurface Platforms - By Application (in Value %)

Intelligence Surveillance and Reconnaissance

Mine Countermeasures

Anti-Submarine Warfare

Maritime Security and Patrol

Hydrographic and Oceanographic Survey - By Technology Architecture (in Value %)

Remotely Operated Vehicles

Autonomous Vehicles

Semi-Autonomous Platforms - By End-Use Industry (in Value %)

Naval Defense Forces

Homeland Security Agencies

Research and Oceanography Institutions

Commercial Offshore Operators - By Connectivity Type (in Value %)

Line-of-Sight Communication

Satellite-Based Communication

Hybrid Communication Systems - By Region (in Value %)

Northern Coastal Zone

Central Coastal Zone

Southern Maritime Zone

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Product Portfolio, Technology Maturity, Platform Autonomy Level, Defense Contract Penetration, R&D Intensity, Integration Capability, Geographic Presence, Strategic Partnerships)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Porter’s Five Forces Analysis

- Detailed Profiles of Major Companies

Israel Aerospace Industries

Elbit Systems

Rafael Advanced Defense Systems

Israel Shipyards

Elta Systems

Aeronautics Group

BlueBird Aero Systems

Seagull Technologies

XTEND Defense

UVision Air

IMCO Industries

Orbit Communication Systems

Controp Precision Technologies

TAT Technologies

RT LTA Systems

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035