Market Overview

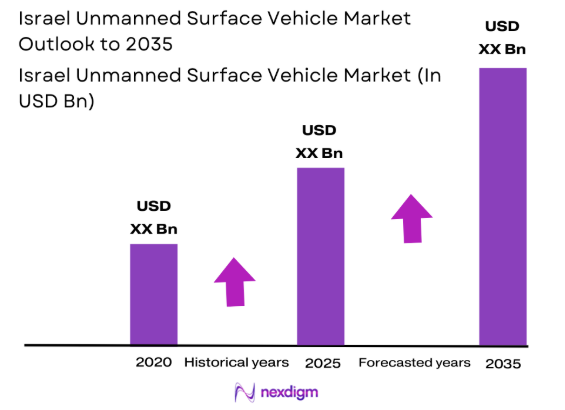

The Israel Unmanned Surface Vehicle market current size stands at around USD ~ million with active deployments exceeding ~ units across coastal and offshore missions. Operational spending intensity increased across 2024 and 2025 driven by surveillance modernization, maritime security upgrades, and autonomous platform trials. Fleet expansion remained steady as programs focused on endurance, sensor integration, and multi-mission capability. Procurement activity reflected growing emphasis on unmanned patrol coverage, threat detection, and force protection requirements. Development cycles accelerated due to modular architecture adoption and rapid system integration practices.

Israel’s coastal regions remain dominant due to concentrated naval infrastructure, defense research facilities, and operational command centers. Deployment density is highest near strategic ports and offshore security corridors supporting energy and maritime trade protection. Strong defense-industrial collaboration, established naval doctrine, and advanced testing environments support sustained adoption. Regulatory clarity and operational validation frameworks further strengthen domestic ecosystem maturity. Technology clusters around coastal innovation hubs enable rapid prototyping and system deployment cycles.

Market Segmentation

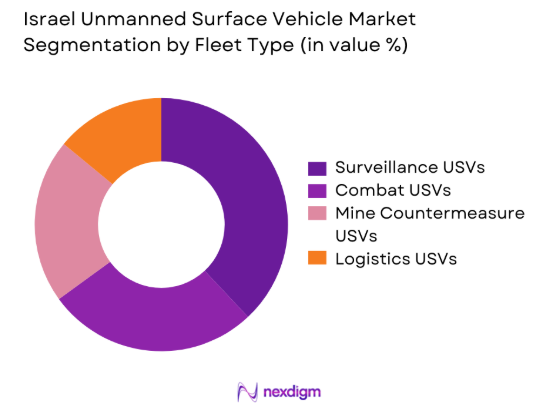

By Fleet Type

The fleet structure is dominated by surveillance and reconnaissance platforms due to persistent maritime monitoring requirements and border protection priorities. Combat-capable unmanned surface vehicles maintain steady adoption supported by modular weapon integration and autonomous navigation maturity. Mine countermeasure platforms show growing relevance as naval safety mandates increase, particularly around ports and shipping lanes. Logistics and support USVs remain niche but expanding, driven by interest in reducing crew exposure and enhancing mission endurance. Fleet diversification continues as naval forces emphasize multi-role adaptability and mission reconfiguration flexibility.

By Application

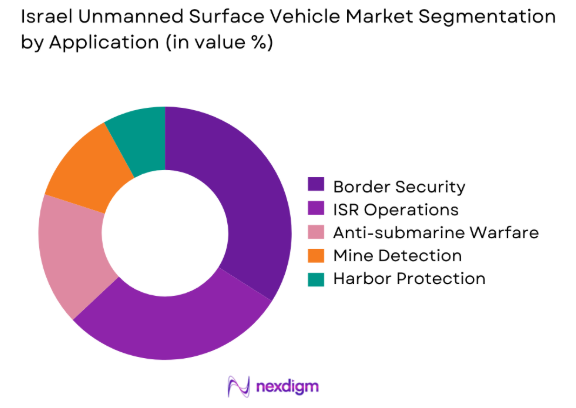

Maritime border security represents the largest application due to persistent monitoring needs and regional security conditions. Intelligence and reconnaissance operations continue expanding as sensor fusion and autonomy improve situational awareness. Anti-submarine roles show gradual adoption supported by acoustic sensing advancements. Mine detection applications remain strategically important for port safety and naval mobility. Harbor protection applications benefit from integration with coastal command systems and real-time threat monitoring platforms.

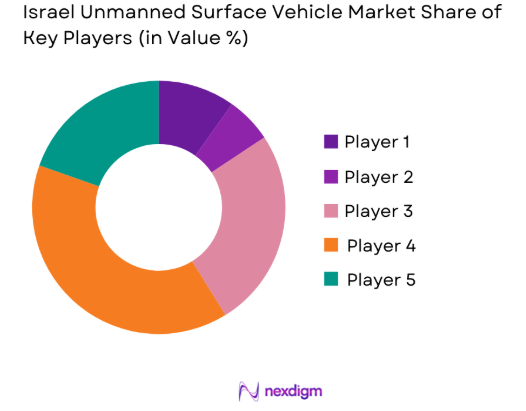

Competitive Landscape

The competitive landscape is characterized by strong domestic defense manufacturers supported by advanced naval research ecosystems. Players differentiate through autonomy software, sensor integration, and system reliability. Long-term defense contracts and technology validation programs shape market positioning. Strategic partnerships with naval agencies strengthen deployment pipelines. Innovation intensity remains high due to evolving maritime threat environments.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Israel Shipyards | 1959 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Aeronautics Group | 1997 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

Israel Unmanned Surface Vehicle Market Analysis

Growth Drivers

Increasing naval border surveillance requirements

Rising maritime security concerns continue increasing demand for persistent unmanned monitoring across coastal and offshore operational zones. Naval authorities expanded surveillance deployments during 2025 to improve situational awareness and early threat detection. Continuous border monitoring reduces manpower dependency and enhances real-time response capabilities. Technological maturity has enabled longer endurance missions supporting extended patrol operations. Integration with coastal command systems improves data utilization efficiency. Increased cross-border maritime activity necessitates automated surveillance solutions for operational effectiveness. Platform reliability improvements further encourage fleet expansion decisions. Enhanced sensor performance supports accurate identification of surface threats. Government defense strategies increasingly prioritize autonomous surveillance infrastructure. Operational feedback continues validating unmanned systems effectiveness in maritime security missions.

Rising adoption of autonomous maritime defense platforms

Autonomous surface platforms gained traction as defense forces prioritize reduced human exposure and operational efficiency. Advancements in navigation algorithms improved obstacle avoidance and mission reliability significantly. Autonomous command integration supports coordinated multi-vehicle operations in complex environments. Defense planners increasingly rely on unmanned systems for persistent maritime coverage. Reduced crew requirements enhance cost efficiency across long-duration missions. Platform modularity supports rapid adaptation to evolving operational needs. Increased testing during 2025 validated autonomous response capabilities. Autonomous mission planning reduces response time during maritime incidents. Enhanced decision-support algorithms improve situational awareness accuracy. Defense modernization initiatives continue reinforcing autonomous system adoption.

Challenges

High system integration and deployment costs

Complex integration of sensors, communication systems, and propulsion units elevates deployment complexity. Customization requirements increase engineering workload across mission-specific configurations. Testing and validation cycles require extended timelines before operational clearance. Infrastructure upgrades are often necessary for autonomous system deployment. High integration costs limit adoption among smaller naval units. Maintenance complexity further increases lifecycle expenditure considerations. Limited standardization restricts interoperability across platforms. Integration with legacy systems remains technically challenging. Certification processes add additional cost layers. Budget constraints slow large-scale deployment programs.

Complex regulatory and maritime compliance requirements

Regulatory frameworks governing unmanned maritime operations remain evolving and fragmented. Compliance requirements differ across operational zones and mission profiles. Certification processes require extensive documentation and testing validation. Maritime safety standards impose operational restrictions on autonomous deployment. Navigation rules limit autonomous maneuvering in congested waters. Regulatory uncertainty impacts long-term investment planning. Cross-border operations face additional compliance complexities. Communication frequency regulations affect system performance optimization. Approval timelines often delay operational readiness. Policy harmonization remains limited across jurisdictions.

Opportunities

Expansion of autonomous maritime patrol missions

Increasing maritime domain awareness requirements support wider deployment of patrol-oriented unmanned systems. Autonomous patrols enable continuous monitoring without crew fatigue limitations. Border security agencies increasingly prioritize persistent surveillance solutions. Integration with coastal radar networks enhances detection accuracy. Operational data collected improves threat prediction capabilities. Modular payloads allow rapid mission reconfiguration. Patrol automation reduces operational risk exposure. Expanded patrol coverage improves response coordination. Defense modernization budgets support extended patrol investments. Technological maturity enables scalable patrol deployment models.

Integration of AI-driven threat detection systems

Artificial intelligence enhances object recognition and anomaly detection performance. AI-driven analytics improve response speed during threat identification. Data fusion capabilities enable comprehensive situational awareness development. Machine learning models improve operational accuracy over time. AI integration supports predictive maintenance functions. Enhanced processing reduces operator workload significantly. Automated threat prioritization improves decision efficiency. Continuous learning algorithms strengthen mission effectiveness. AI-based systems support multi-domain operational coordination. Defense agencies increasingly fund AI-enabled maritime platforms.

Future Outlook

The Israel Unmanned Surface Vehicle market is expected to experience steady expansion driven by defense modernization and autonomous system adoption. Continued investment in artificial intelligence, autonomy, and sensor integration will shape platform evolution. Regulatory frameworks are expected to mature, enabling broader operational deployment. Strategic emphasis on maritime security will sustain demand growth through 2035.

Major Players

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- Elbit Systems

- Israel Shipyards

- Aeronautics Group

- Elta Systems

- BlueBird Aero Systems

- UVision Air

- XTEND Robotics

- Saildrone

- ASV Global

- L3Harris Technologies

- BAE Systems

- Thales Group

- Lockheed Martin

Key Target Audience

- Israeli Navy and maritime defense units

- Ministry of Defense procurement agencies

- Border security and coastal surveillance authorities

- Port and harbor management authorities

- Defense system integrators

- Maritime technology developers

- Investments and venture capital firms

- Government and regulatory bodies including Israeli Ministry of Defense

Research Methodology

Step 1: Identification of Key Variables

Market scope, operational platforms, deployment environments, and technology adoption factors were identified through structured industry mapping. Key performance indicators and segmentation logic were defined to reflect operational realities.

Step 2: Market Analysis and Construction

Data points were analyzed across fleet deployment, application usage, and technology integration patterns. Market structure was developed using operational adoption and procurement behavior indicators.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through expert insights from defense professionals and maritime system specialists. Assumptions were refined based on operational feasibility and deployment trends.

Step 4: Research Synthesis and Final Output

All findings were consolidated using triangulation techniques to ensure consistency. Insights were structured to support strategic decision-making and market understanding.

- Executive Summary

- Research Methodology (Market Definitions and operational scope mapping, Platform and mission taxonomy development for USVs, Bottom-up fleet and program-level market sizing, Revenue attribution across defense and commercial procurement channels, Primary validation with naval operators and defense system integrators, Data triangulation using procurement records and export disclosures, Assumption mapping for regulatory and deployment constraints)

- Definition and Scope

- Market evolution

- Operational and mission deployment landscape

- Ecosystem structure and stakeholder roles

- Supply chain and systems integration framework

- Regulatory and defense procurement environment

- Growth Drivers

Increasing naval border surveillance requirements

Rising adoption of autonomous maritime defense platforms

Expansion of unmanned naval warfare doctrines

Technological advancements in AI-enabled navigation

Growing emphasis on force protection and risk reduction - Challenges

High system integration and deployment costs

Complex regulatory and maritime compliance requirements

Cybersecurity vulnerabilities in unmanned platforms

Limited interoperability with legacy naval systems

Operational reliability in harsh marine environments - Opportunities

Expansion of autonomous maritime patrol missions

Integration of AI-driven threat detection systems

Export opportunities through defense collaboration programs

Development of modular payload architectures

Rising demand for persistent maritime surveillance - Trends

Shift toward fully autonomous surface platforms

Increased use of swarm-enabled USV operations

Integration of multi-sensor fusion technologies

Adoption of hybrid propulsion systems

Growing emphasis on modular mission payloads - Government Regulations

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Combat USVs

Surveillance and reconnaissance USVs

Mine countermeasure USVs

Logistics and support USVs - By Application (in Value %)

Maritime border security

Intelligence, surveillance, and reconnaissance

Anti-submarine warfare

Mine detection and neutralization

Port and harbor protection - By Technology Architecture (in Value %)

Remotely operated surface vehicles

Semi-autonomous surface vehicles

Fully autonomous surface vehicles - By End-Use Industry (in Value %)

Naval defense forces

Homeland security agencies

Port authorities

Maritime research organizations - By Connectivity Type (in Value %)

Line-of-sight communication

Satellite-based communication

Hybrid communication systems - By Region (in Value %)

Northern Israel

Central Israel

Southern Israel

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Platform capability, Autonomy level, Payload flexibility, Naval integration depth, Export readiness, Technology maturity, Pricing positioning, After-sales support)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Porter’s Five Force

- Detailed Profiles of Major Companies

Israel Aerospace Industries

Rafael Advanced Defense Systems

Elbit Systems

Israel Shipyards

UVision Air

Aeronautics Group

Elta Systems

BlueBird Aero Systems

Seagull USV Systems

XTEND Robotics

Saildrone

ASV Global

L3Harris Technologies

BAE Systems

Thales Group

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–203