Market Overview

The Israel Unmanned Systems market current size stands at around USD ~ million, supported by expanding defense programs, increasing autonomous deployments, and strong domestic manufacturing activity. System deployments increased across aerial, ground, and maritime platforms, with consistent procurement cycles observed across 2024 and 2025. Technology upgrades focused on autonomy, endurance, and secure communications continued accelerating adoption. Fleet expansion was supported by sustained defense allocations and operational modernization initiatives. Indigenous production capabilities reduced reliance on imports while supporting export readiness. The market maintained steady operational growth supported by consistent platform upgrades and replacement demand.

The market remains concentrated across Tel Aviv, Haifa, and southern defense corridors due to dense defense infrastructure and testing facilities. These regions benefit from proximity to military commands, R&D centers, and system integrators. Strong collaboration between defense agencies and domestic manufacturers supports rapid technology validation. Infrastructure maturity enables accelerated deployment cycles and operational testing. Regulatory oversight remains centralized, supporting controlled development. Regional specialization continues to shape supply chains and innovation ecosystems.

Market Segmentation

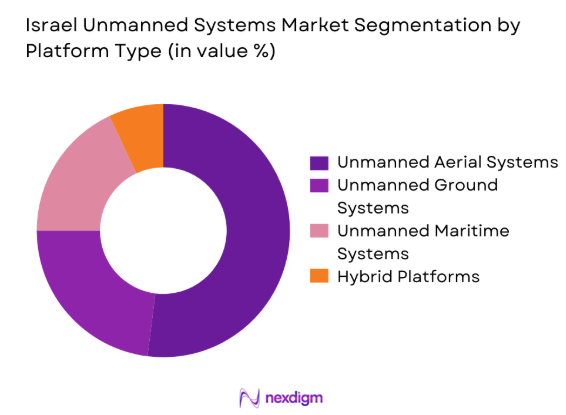

By Platform Type

Unmanned aerial systems dominate deployment volumes due to ISR, border security, and tactical surveillance requirements. Ground systems are expanding steadily for logistics and reconnaissance applications in controlled environments. Maritime unmanned platforms show rising adoption driven by offshore security and naval modernization initiatives. Platform diversification is influenced by mission-specific performance requirements, endurance optimization, and payload flexibility. Continued integration of autonomous navigation and sensor fusion technologies further differentiates platform demand. Procurement decisions increasingly favor modular systems supporting multi-mission adaptability across operational theaters.

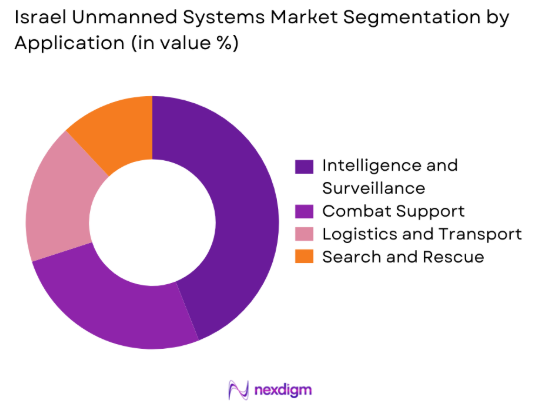

By Application

Intelligence and surveillance applications account for dominant demand due to continuous border monitoring requirements. Combat support systems show expanding adoption driven by tactical flexibility and reduced human risk exposure. Logistics and resupply platforms are gaining traction for base operations and contested environments. Search and rescue applications remain specialized but growing steadily. Application diversification reflects increasing integration of unmanned systems across military and homeland security missions, supported by improved autonomy and sensor reliability.

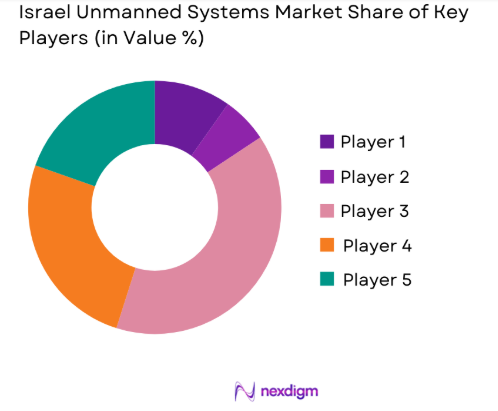

Competitive Landscape

The competitive landscape is characterized by vertically integrated manufacturers with strong government alignment and advanced engineering capabilities. Companies emphasize system reliability, secure communication architectures, and rapid deployment readiness. Continuous investment in autonomy, payload integration, and software-defined platforms defines competitive positioning. Domestic supply chains and regulatory familiarity provide strategic advantages. Export readiness remains a key differentiator across participants.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Aeronautics Group | 1997 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| BlueBird Aero Systems | 2002 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

Israel Unmanned Systems Market Analysis

Growth Drivers

Rising defense modernization programs

Defense modernization initiatives continue expanding unmanned system deployment across air, land, and maritime operational domains. Increased budget allocations during 2025 enabled accelerated procurement of advanced autonomous platforms. Modernization strategies emphasize reducing personnel exposure while improving situational awareness and response speed. Indigenous development programs strengthened domestic manufacturing and system integration capabilities. Modern battlefield requirements favor real-time intelligence and persistent surveillance coverage. Advanced sensor integration supports multi-mission adaptability across diverse environments. Fleet upgrades continue replacing legacy manned platforms with autonomous alternatives. Network-centric warfare doctrines further increase unmanned system relevance. Defense planners prioritize scalability and rapid deployment capabilities. These factors collectively sustain consistent demand growth across segments.

Increasing reliance on autonomous surveillance platforms

Surveillance requirements intensified due to evolving border security and asymmetric threat environments. Autonomous platforms enable continuous monitoring with reduced operational fatigue. Advances in artificial intelligence improve target recognition and threat classification accuracy. Integration with command systems enhances decision-making efficiency across defense units. Persistent surveillance capabilities support early warning and rapid response strategies. Reduced human intervention improves operational safety and mission continuity. Multi-sensor payloads increase mission versatility and data collection effectiveness. Real-time data transmission strengthens tactical coordination. Autonomous surveillance reduces long-term operational burden. These factors reinforce sustained adoption across defense agencies.

Challenges

Stringent export control regulations

Export control frameworks impose strict compliance requirements on unmanned system manufacturers. Licensing procedures extend procurement cycles and limit international sales flexibility. Technology classification restricts component sharing and joint development initiatives. Regulatory approvals require extensive documentation and verification processes. Compliance costs increase administrative burdens for manufacturers. Export restrictions constrain market expansion opportunities beyond domestic demand. Geopolitical sensitivities further complicate cross-border technology transfers. Manufacturers must align designs with evolving regulatory expectations. Delays impact revenue realization and production planning. These constraints challenge scalability and global competitiveness.

High development and certification costs

Advanced unmanned systems require substantial investment in research and testing activities. Certification processes demand extensive validation across operational scenarios. Integration of secure communication and autonomous navigation increases development complexity. Testing cycles are prolonged to meet defense safety standards. High engineering costs limit entry of smaller technology providers. Continuous upgrades require sustained financial commitment. Certification timelines impact product commercialization schedules. Compliance with military standards raises operational expenses. Cost pressures affect pricing flexibility and procurement competitiveness. These factors constrain rapid innovation cycles.

Opportunities

Expansion of unmanned maritime platforms

Naval security requirements are driving adoption of unmanned surface and underwater systems. Coastal surveillance demands persistent monitoring capabilities with minimal crew involvement. Maritime platforms enhance port security and offshore asset protection. Autonomous navigation enables extended operational endurance. Integration with naval command systems improves situational awareness. Reduced operational risk supports broader deployment scenarios. Maritime unmanned systems complement existing naval assets effectively. Technology maturation lowers maintenance complexity over time. Export interest in maritime platforms continues increasing. This segment presents strong growth potential.

Cross-domain system integration

Integrated operations across air, land, and sea enhance mission effectiveness significantly. Unified command architectures enable synchronized multi-platform deployments. Data fusion improves operational intelligence accuracy and responsiveness. Cross-domain interoperability supports complex mission execution. Advances in communication protocols facilitate seamless system coordination. Integrated platforms reduce redundancy and operational inefficiencies. Defense agencies prioritize interoperability in procurement decisions. Joint operational doctrines encourage system convergence. Technology convergence accelerates innovation opportunities. Cross-domain integration remains a strategic growth avenue.

Future Outlook

The Israel unmanned systems market is expected to maintain steady expansion driven by sustained defense modernization and technological advancement. Continued investment in autonomous capabilities will shape future platform development. Regulatory alignment and export strategy evolution will influence international opportunities. Integration of artificial intelligence and multi-domain operations will define competitive differentiation. The market outlook remains positive with strong long-term deployment potential.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Rafael Advanced Defense Systems

- Aeronautics Group

- BlueBird Aero Systems

- UVision Air

- Steadicopter

- Xtend

- Percepto

- Sentrycs

- Elta Systems

- Israel Shipyards

- Smart Shooter

- Cognata

- Dronix

Key Target Audience

- Defense procurement agencies

- Ministry of Defense procurement directorate

- Border security authorities

- Homeland security agencies

- Naval and air force command units

- Defense system integrators

- Investments and venture capital firms

- Government and regulatory bodies including export control authorities

Research Methodology

Step 1: Identification of Key Variables

Core variables included platform categories, deployment environments, operational use cases, and regulatory frameworks. Data points were aligned with defense procurement structures and system classifications.

Step 2: Market Analysis and Construction

Market structure was developed through platform mapping, application assessment, and deployment analysis across operational domains. Segmentation logic reflected real-world procurement practices.

Step 3: Hypothesis Validation and Expert Consultation

Insights were validated through consultations with defense engineers, procurement specialists, and system integrators. Feedback refined assumptions related to adoption patterns and deployment priorities.

Step 4: Research Synthesis and Final Output

Findings were consolidated through triangulation of qualitative and quantitative inputs. Final outputs reflect validated trends, constraints, and strategic growth pathways.

- Executive Summary

- Research Methodology (Market Definitions and operational scope alignment, Platform and mission-based segmentation logic, Bottom-up fleet and procurement-based market sizing, Value attribution across systems and lifecycle stages, Primary interviews with defense, homeland security, and OEM stakeholders, Data triangulation using procurement records and deployment data, Assumptions and limitations specific to Israeli defense export controls)

- Definition and Scope

- Market evolution

- Usage and deployment pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory and defense procurement environment

- Growth Drivers

Rising defense modernization programs

Increasing reliance on autonomous surveillance platforms

Expanding asymmetric warfare requirements

Growing demand for force multiplication technologies

Rapid advancement in AI-enabled autonomy - Challenges

Stringent export control regulations

High development and certification costs

Cybersecurity and data integrity risks

Airspace and maritime traffic integration constraints

Limited skilled workforce availability - Opportunities

Expansion of unmanned maritime platforms

Cross-domain system integration

Dual-use technology commercialization

AI-driven autonomy upgrades

International defense collaborations - Trends

Increased adoption of swarm technologies

Shift toward multi-mission platforms

Integration of AI-based decision support

Miniaturization of unmanned platforms

Rising demand for endurance-focused systems - Government Regulations

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Unmanned aerial systems

Unmanned ground systems

Unmanned surface vehicles

Unmanned underwater vehicles - By Application (in Value %)

Intelligence, surveillance, and reconnaissance

Combat and strike operations

Border security and patrol

Logistics and cargo support

Search and rescue - By Technology Architecture (in Value %)

Remotely piloted systems

Semi-autonomous systems

Fully autonomous systems

Swarm-enabled platforms - By End-Use Industry (in Value %)

Defense forces

Homeland security agencies

Border control authorities

Commercial and industrial operators - By Connectivity Type (in Value %)

Line-of-sight communication

Beyond visual line-of-sight

Satellite-enabled systems

Hybrid communication systems - By Region (in Value %)

Northern Israel

Central Israel

Southern Israel

Coastal regions

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Product portfolio depth, Platform autonomy level, Defense certification coverage, Export readiness, Integration capability, R&D intensity, Aftermarket support, Geographic reach)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Porter’s Five Forces

- Detailed Profiles of Major Companies

Israel Aerospace Industries

Elbit Systems

Rafael Advanced Defense Systems

Aeronautics Group

UVision Air

BlueBird Aero Systems

Elta Systems

Israel Shipyards

Steadicopter

Xtend

Dronix

Sentrycs

Cognata

Percepto

Smart Shooter

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035