Market Overview

The Israel Unmanned Traffic Management market current size stands at around USD ~ million, reflecting strong system deployment activity across controlled airspace and urban test zones. During the recent period, deployment density increased due to regulatory pilots, defense-led adoption, and commercial drone integration initiatives. Platform installations expanded across civil aviation corridors, municipal surveillance programs, and logistics trials. Technology investment focused on traffic orchestration, airspace digitization, and real-time flight monitoring. Operational deployments increased across multi-operator environments supported by regulatory sandbox programs. Market maturity remains intermediate with strong institutional participation.

Israel’s unmanned traffic management ecosystem is concentrated around Tel Aviv, Haifa, and Beersheba due to advanced aviation infrastructure and defense technology clusters. These regions benefit from dense drone testing activity, strong startup ecosystems, and direct government participation. Regulatory authorities actively collaborate with private operators to enable controlled airspace trials. Infrastructure readiness, high technology adoption rates, and integrated command centers support rapid deployment. Demand concentration is influenced by security applications, urban mobility pilots, and logistics experimentation. Policy consistency and digital aviation initiatives further strengthen national implementation momentum.

Market Segmentation

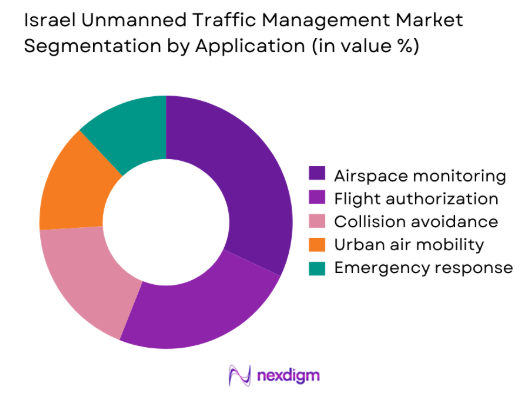

By Application

The application landscape is dominated by airspace monitoring and flight authorization functions, driven by rising unmanned flight density and regulatory enforcement needs. Collision avoidance and deconfliction systems represent a significant share due to increasing multi-drone operations. Urban air mobility coordination is emerging rapidly, supported by municipal smart mobility programs and pilot corridors. Emergency response and security surveillance applications maintain consistent demand due to national security priorities. Platform interoperability and automation levels increasingly determine adoption rates across application categories. Integration with manned aviation systems further elevates operational relevance.

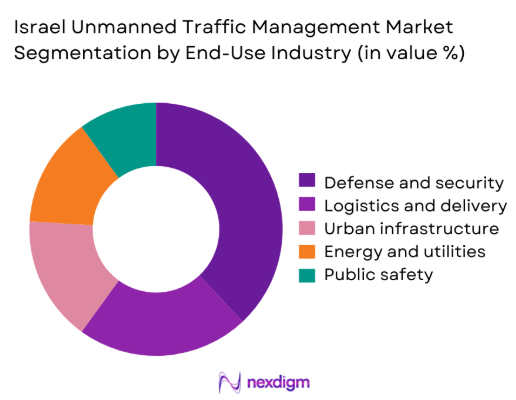

By End-Use Industry

Defense and homeland security represent the largest end-use segment, driven by persistent surveillance requirements and border monitoring programs. Logistics and delivery applications are expanding steadily as pilot projects transition toward operational scale. Urban infrastructure monitoring supports smart city initiatives and asset inspection needs. Energy and utilities increasingly deploy unmanned traffic systems for corridor monitoring and asset safety. Public safety agencies rely on integrated traffic platforms for coordinated emergency response. End-use adoption is strongly influenced by regulatory approvals and operational risk tolerance.

Competitive Landscape

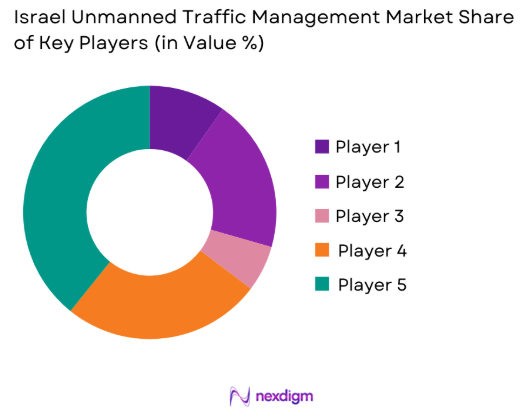

The competitive landscape is characterized by a mix of domestic aerospace firms and international air traffic technology providers. Market positioning is defined by regulatory alignment, system reliability, and integration depth. Vendors compete on scalability, data security, and interoperability with national aviation systems.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Frequentis | 1947 | Austria | ~ | ~ | ~ | ~ | ~ | ~ |

Israel Unmanned Traffic Management Market Analysis

Growth Drivers

Expansion of drone-based commercial operations

Commercial drone operations expanded rapidly across logistics, surveillance, and inspection segments during 2024 and 2025 nationwide. Increased licensing approvals enabled wider operational coverage for delivery and monitoring missions across urban and semi-urban zones. Platform utilization rose as enterprises adopted drones for recurring operational workflows requiring traffic coordination. Integration with enterprise software improved mission planning efficiency and compliance assurance. Commercial operators increasingly demanded automated traffic deconfliction systems to support simultaneous multi-drone operations. Regulatory clarity encouraged private sector participation in controlled airspace trials. Infrastructure investments supported higher flight density and improved situational awareness capabilities. Operational cost efficiencies further incentivized drone adoption across industrial use cases. Flight data analytics improved operational predictability and reduced mission failure rates. These dynamics collectively accelerated UTM platform demand across commercial sectors.

Government-led airspace digitization initiatives

Government initiatives focused on digitizing airspace management to support unmanned aviation growth across civilian and defense domains. National aviation authorities expanded digital flight approval frameworks enabling automated clearance processing. Policy-backed pilot programs tested advanced traffic management capabilities in controlled environments. Inter-agency coordination improved data sharing and airspace visibility for unmanned operations. Digital identity systems enhanced operator authentication and compliance enforcement. Public sector funding supported development of interoperable traffic management platforms. Regulatory sandboxes accelerated technology validation under real-world conditions. Airspace modernization aligned with broader smart mobility strategies. Government mandates increased adoption consistency across operators. These initiatives established foundational infrastructure for scalable UTM deployment.

Challenges

Fragmented regulatory frameworks

Regulatory fragmentation remains a key challenge affecting consistent unmanned traffic management deployment across operational zones. Differing airspace classifications create uncertainty for operators planning cross-regional missions. Approval timelines vary significantly between authorities, delaying commercial deployments. Compliance requirements differ for civil and defense operations, complicating integration efforts. Limited harmonization restricts interoperability between platform providers and regulators. Policy updates often lag behind technological advancements in autonomous systems. Regulatory complexity increases operational costs for service providers. Lack of standardized certification frameworks hinders scalable implementation. Cross-border operations face additional approval barriers. These issues collectively slow market expansion.

Airspace congestion and safety risks

Increasing drone density elevates airspace congestion risks in urban and peri-urban environments. Manual coordination methods struggle to manage high traffic volumes effectively. Collision avoidance systems require continuous refinement to ensure reliability. Integration with manned aviation introduces additional safety complexities. Communication latency can impact real-time traffic decision-making accuracy. Limited spectrum availability constrains data transmission reliability. Incident management protocols remain under development across jurisdictions. Public safety concerns influence regulatory conservatism. Infrastructure gaps limit real-time situational awareness capabilities. These challenges necessitate advanced traffic orchestration solutions.

Opportunities

Urban air mobility pilot programs

Urban air mobility pilots create significant opportunities for advanced traffic management deployment. Municipal authorities increasingly support controlled testing of aerial mobility concepts. These programs require sophisticated routing, monitoring, and deconfliction capabilities. Integration with ground mobility systems enhances overall transport efficiency. Data generated from pilot programs informs regulatory framework development. Public-private collaboration accelerates technology validation cycles. Infrastructure investments improve vertiport and corridor readiness. Successful pilots encourage broader commercial adoption. Advanced analytics improve airspace utilization efficiency. These initiatives position UTM platforms as critical enablers.

Defense and border surveillance modernization

Defense modernization programs continue to prioritize unmanned systems for surveillance and reconnaissance missions. Border monitoring requires persistent aerial coverage supported by reliable traffic coordination. UTM platforms enhance mission safety through automated conflict resolution. Secure communication frameworks align with national security requirements. Integration with command and control systems strengthens operational effectiveness. Increased defense budgets support technology upgrades and system integration. Real-time tracking improves situational awareness across sensitive zones. Autonomous mission planning reduces manpower requirements. These factors create sustained demand for advanced UTM solutions.

Future Outlook

The market outlook remains positive as regulatory clarity improves and unmanned operations expand across civilian and defense sectors. Continued investment in digital airspace infrastructure will support higher traffic densities. Collaboration between regulators, technology providers, and operators is expected to accelerate. Integration of autonomous flight systems will further increase demand for scalable traffic management platforms. Long-term growth will depend on interoperability and regulatory harmonization.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Rafael Advanced Defense Systems

- Thales Group

- Frequentis

- Indra Sistemas

- Saab

- Leonardo

- Lockheed Martin

- Unifly

- Altitude Angel

- Airobotics

- DJI

- Cando Drones

- Thales Alenia Space

Key Target Audience

- Defense and security agencies including Israel Ministry of Defense

- Israel Civil Aviation Authority

- Urban mobility and smart city authorities

- Logistics and last-mile delivery operators

- Infrastructure and utilities operators

- Airport and airspace management authorities

- Investments and venture capital firms

- Public safety and emergency response agencies

Research Methodology

Step 1: Identification of Key Variables

Key operational, regulatory, and technological variables were identified through analysis of airspace usage patterns, deployment models, and system architectures relevant to unmanned traffic management.

Step 2: Market Analysis and Construction

Market structure was developed using segmentation based on application, end use, and operational frameworks, incorporating deployment trends and adoption intensity.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through consultations with aviation regulators, system integrators, and operational stakeholders involved in unmanned traffic deployments.

Step 4: Research Synthesis and Final Output

All insights were synthesized into a coherent analytical framework ensuring consistency, accuracy, and relevance to current and emerging market dynamics.

- Executive Summary Research Methodology (Market Definitions and Airspace Scope Mapping, UTM Architecture and Service Taxonomy Development, Traffic Volume and Flight Density Estimation Modeling, Revenue Attribution Across Software and Service Layers, Primary Validation with UAS Operators and Regulators, Data Triangulation Across Civil Aviation and Defense Sources, Assumptions and Limitations Based on Regulatory Maturity)

- Definition and Scope

- Market evolution

- Usage and operational integration pathways

- Ecosystem structure and stakeholder roles

- Technology and data flow architecture

- Regulatory and airspace governance framework

- Growth Drivers

Expansion of drone-based commercial operations

Government-led airspace digitization initiatives

Rising demand for automated traffic coordination

Integration of unmanned systems into civilian airspace

Advancement in AI-driven flight management - Challenges

Fragmented regulatory frameworks

Airspace congestion and safety risks

Interoperability limitations between platforms

Cybersecurity and data integrity concerns

High integration and deployment complexity - Opportunities

Urban air mobility pilot programs

Defense and border surveillance modernization

Smart city and infrastructure monitoring

Cross-border airspace management solutions

Private sector investment in autonomous aviation - Trends

Adoption of AI-enabled traffic orchestration

Shift toward cloud-native UTM platforms

Increased collaboration between regulators and operators

Growth of BVLOS flight approvals

Integration with manned aviation systems - Government Regulations

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Revenue per Deployment, 2020–2025

- By Fleet Type (in Value %)

Civil drones

Commercial drones

Government and defense drones

Autonomous delivery fleets - By Application (in Value %)

Airspace monitoring

Flight authorization and tracking

Collision avoidance and deconfliction

Urban air mobility coordination

Emergency and security operations - By Technology Architecture (in Value %)

Centralized UTM platforms

Federated UTM systems

Cloud-based traffic management

AI-enabled traffic optimization - By End-Use Industry (in Value %)

Defense and homeland security

Logistics and delivery

Urban mobility and infrastructure

Energy and utilities

Public safety and emergency response - By Connectivity Type (in Value %)

Cellular-based connectivity

Satellite-enabled connectivity

Hybrid communication systems

Dedicated aviation spectrum - By Region (in Value %)

Central Israel

Northern Israel

Southern Israel

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Technology Maturity, Regulatory Compliance, Platform Scalability, Integration Capability, Geographic Presence, Partnership Network, Service Depth, Pricing Strategy)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Porter’s Five Forces Analysis

- Detailed Profiles of Major Companies

Israel Aerospace Industries

Elbit Systems

Rafael Advanced Defense Systems

Airobotics

Airwayz

Cando Drones

Thales Group

Frequentis

Indra Sistemas

Unifly

Altitude Angel

DJI

Lockheed Martin

Leonardo

Saab

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Revenue per Deployment, 2026–2035