Market Overview

The Israel VTOL UAV market is expected to witness substantial growth driven by advancements in drone technologies and increasing military and commercial demand for vertical take-off and landing capabilities. Based on recent historical assessments, the market size for VTOL UAVs in Israel is projected to reach USD ~ billion. This growth is propelled by the need for advanced surveillance, reconnaissance, and defense applications, especially in complex terrains and urban environments. The continuous innovation in propulsion systems, AI, and autonomous navigation is also contributing to the market’s expansion.

Israel remains a dominant player in the VTOL UAV market due to its strong defense industry, technological innovations, and strategic investments in unmanned systems. Key factors behind Israel’s leadership include its robust defense sector, characterized by high government spending on advanced military technologies, and its well-established UAV manufacturing ecosystem. The country’s geopolitical position and security requirements have further fueled demand for efficient and versatile UAVs capable of both military and commercial operations. Moreover, collaborations with international defense agencies and private sector innovations have bolstered Israel’s dominance in this market.

Market Segmentation

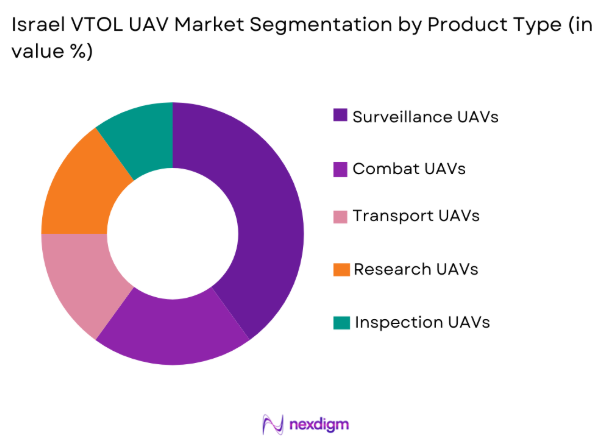

By Product Type:

The Israel VTOL UAV market is segmented by product type into surveillance UAVs, combat UAVs, transport UAVs, research UAVs, and inspection UAVs. Recently, surveillance UAVs have a dominant market share due to their versatility in both military and commercial applications. The rising need for border surveillance, intelligence gathering, and reconnaissance missions has driven the demand for surveillance UAVs. Moreover, the growing adoption of UAVs for security monitoring, environmental inspections, and surveillance tasks further boosts the market presence of surveillance UAVs. Their advanced camera systems, long endurance, and ability to operate in complex environments make them the preferred choice for government and private sector entities, ensuring their continued dominance in the market.

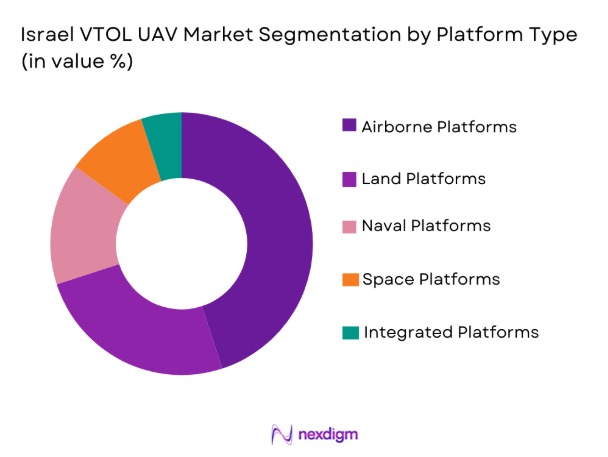

By Platform Type:

The Israel VTOL UAV market is segmented by platform type into airborne platforms, land platforms, naval platforms, space platforms, and integrated platforms. Recently, airborne platforms have a dominant market share due to their wide range of military and civilian applications. Airborne VTOL UAVs offer significant advantages in surveillance, intelligence gathering, and communication relay operations, especially in areas with limited infrastructure or hostile environments. The versatility and adaptability of airborne platforms, coupled with their ability to access challenging regions, have made them the preferred choice for various applications. The growing need for rapid deployment, stealth capabilities, and extended operational ranges further consolidates airborne platforms’ leading position in the market.

Competitive Landscape

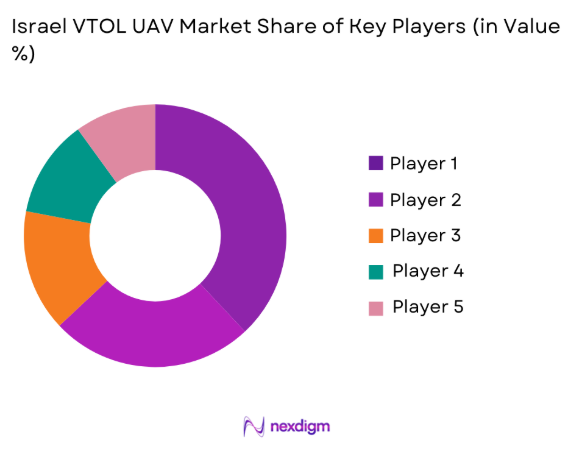

The competitive landscape in the Israel VTOL UAV market is characterized by consolidation among key players, with leading firms continually innovating and securing government contracts. Major players are actively expanding their research and development efforts to improve UAV capabilities, especially in autonomous navigation, payload integration, and operational endurance. The increasing involvement of defense contractors, as well as the entrance of new technology-focused companies, has intensified competition in the market. Furthermore, partnerships between local and international firms have fostered the growth of Israel’s UAV industry, ensuring the market’s dynamic evolution and ongoing innovations.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ |

| Aeronautics Ltd | 1997 | Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1980 | Israel | ~ | ~ | ~ | ~ | ~ |

| Aerovision UAV Systems | 2011 | Israel | ~ | ~ | ~ | ~ | ~ |

Israel VTOL UAV Market Analysis

Growth Drivers

Technological Advancements in UAV Systems:

Technological advancements in unmanned aerial vehicle systems have significantly contributed to the growth of the Israel VTOL UAV market. The integration of cutting-edge technologies such as artificial intelligence (AI), machine learning (ML), and advanced sensor systems has transformed the UAV landscape. These advancements allow for autonomous navigation, enhanced payload capabilities, and real-time data processing, which are crucial for both military and commercial applications. Moreover, the development of hybrid propulsion systems, offering a balance between vertical take-off and long-duration flight, has further broadened the scope of VTOL UAVs. With continuous improvements in battery technology, payload integration, and materials science, Israel’s VTOL UAVs are becoming more efficient, versatile, and reliable. These innovations not only meet the increasing demands of defense sectors but also open new avenues in sectors such as agriculture, logistics, and environmental monitoring. As a result, technological advancements are expected to continue driving the growth of the Israel VTOL UAV market in the coming years.

Government Defense Spending and Strategic Investments:

Government defense spending and strategic investments play a pivotal role in driving the Israel VTOL UAV market. Israel’s government has consistently allocated significant funds to modernize its defense technologies, particularly in the field of unmanned systems. The country’s geopolitical situation and security concerns have necessitated the development of advanced UAV technologies capable of operating in challenging environments. Moreover, Israel’s robust defense industry, including companies like Elbit Systems and Israel Aerospace Industries, has benefited from strategic investments that support R&D and production. These investments not only enhance the capabilities of Israel’s VTOL UAVs but also ensure their continued relevance in defense operations. Additionally, collaborations with international defense agencies have further bolstered the market, providing both technological expertise and access to global markets. As defense spending continues to grow, Israel’s VTOL UAV market is expected to expand, driven by an increasing demand for advanced surveillance, reconnaissance, and combat capabilities.

Market Challenges

Regulatory and Certification Barriers:

Regulatory and certification barriers remain a significant challenge to the growth of the Israel VTOL UAV market. Despite the rapid advancements in UAV technology, obtaining regulatory approval for civilian and military UAV operations can be a complex and time-consuming process. In Israel, while military UAVs are subject to relatively lenient regulations, civilian UAVs face stringent certification requirements to ensure safety, privacy, and compliance with airspace rules. Moreover, international regulations regarding UAV operations, especially in terms of cross-border flight and export controls, further complicate the market landscape. These regulatory hurdles can delay the adoption of VTOL UAVs in non-defense sectors, such as commercial inspection services and agricultural applications. Additionally, the evolving nature of UAV regulations presents uncertainties for manufacturers and operators, hindering long-term market planning and investments. As the market matures, regulatory frameworks need to adapt to keep pace with technological innovations while ensuring public safety and privacy.

Technological Integration and Interoperability Issues:

Technological integration and interoperability issues are a key challenge in the Israel VTOL UAV market. While the development of advanced UAV systems has led to significant improvements in capabilities, integrating these systems into existing defense and commercial infrastructures can be complex. Many VTOL UAVs rely on specialized software, communication systems, and payloads that must be compatible with other UAVs, ground control stations, and military systems. This poses a challenge for both operators and manufacturers, as ensuring seamless integration is crucial for mission success. Moreover, the need for interoperable UAV systems across various platforms and sectors requires substantial investments in research, development, and testing. As the market grows and diversifies, achieving standardization and compatibility across different UAV models, manufacturers, and technologies becomes increasingly important. Overcoming these integration challenges will be essential to the continued expansion and adoption of VTOL UAVs in various industries.

Opportunities

Expansion in Commercial Sectors:

The expansion of VTOL UAV applications in commercial sectors presents a significant opportunity for growth in the Israel VTOL UAV market. As industries such as logistics, agriculture, and infrastructure inspection increasingly turn to drones for efficiency and cost-effectiveness, there is growing demand for advanced UAV solutions that can operate in both rural and urban environments. VTOL UAVs are particularly well-suited for these applications, as they can take off and land vertically, making them ideal for areas with limited space, such as construction sites and densely populated urban areas. Furthermore, the ability of VTOL UAVs to carry heavy payloads, including sensors and cameras, makes them a valuable tool for inspecting infrastructure, monitoring crops, and delivering goods. As Israel continues to lead in UAV technology, the commercial sector will provide a lucrative opportunity for companies to expand their offerings and capitalize on the growing demand for UAV services across various industries.

Adoption of Autonomous Systems and AI:

The increasing adoption of autonomous systems and artificial intelligence (AI) in the Israel VTOL UAV market presents another opportunity for growth. As UAVs become more autonomous, they can perform complex tasks with minimal human intervention, reducing operational costs and increasing efficiency. The integration of AI algorithms enables VTOL UAVs to navigate autonomously, process data in real-time, and adapt to dynamic environments, enhancing their capabilities in both military and commercial applications. In Israel, the defense sector is already exploring autonomous UAVs for surveillance, reconnaissance, and border protection, while the commercial sector is looking to incorporate AI-driven UAVs for applications such as precision agriculture and infrastructure inspection. The growing interest in autonomous systems and AI will drive the demand for advanced VTOL UAVs, positioning Israel as a leader in this emerging market.

Future Outlook

The future of the Israel VTOL UAV market over the next five years looks promising, driven by continued technological advancements and increasing demand from both military and commercial sectors. The market is expected to grow rapidly due to advancements in AI, autonomy, and hybrid propulsion systems, which will enhance the efficiency and capabilities of VTOL UAVs. Furthermore, government defense spending and strategic investments in UAV technologies will continue to play a significant role in the market’s growth. The integration of autonomous systems and AI will further fuel market expansion, especially in commercial sectors such as logistics and infrastructure inspection. Additionally, the development of regulatory frameworks and certifications for civilian UAV operations will pave the way for broader adoption, creating new opportunities for Israel’s UAV industry. Overall, the Israel VTOL UAV market is poised for substantial growth, supported by technological, regulatory, and demand-side factors.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Aeronautics Ltd

- Rafael Advanced Defense Systems

- Aerovision UAV Systems

- Skylock Systems

- Quantum Systems

- Aeronautics Defense Systems

- Bluebird Aero Systems

- Mistral Solutions

- SkyRunner

- Ramon Aerospace

- Heron Systems

- Xcalibur Aerospace

- General Robotics

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Military agencies

- UAV manufacturers

- UAV service providers

- Technology integrators

- Aerospace equipment suppliers

Research Methodology

Step 1: Identification of Key Variables

Key variables such as market trends, regulatory frameworks, technological advancements, and end-user demand are identified to guide the research process.

Step 2: Market Analysis and Construction

Comprehensive market analysis is conducted to assess the market size, growth trends, and segmentation across different product types and platforms.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts, key stakeholders, and market players to ensure the accuracy and relevance of findings.

Step 4: Research Synthesis and Final Output

Data is synthesized to generate actionable insights, and a detailed report is produced to present the final market analysis and projections.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Technological advancements in autonomous flight

Increased government investments in national security

Surge in defense modernization programs

Rising demand for surveillance and reconnaissance missions

Growing commercial adoption of UAVs for logistics and inspection - Market Challenges

High capital expenditure for research and development

Technological integration and interoperability issues

Regulatory and certification barriers for UAV operations

Vulnerability to cyber-attacks and data breaches

Limited range and endurance of VTOL UAVs - Market Opportunities

Expanding UAV applications in agriculture and infrastructure

Emerging demand for VTOL UAVs in emergency services

Partnerships with private tech firms for advanced sensors and AI - Trends

Rising use of AI and machine learning for autonomous navigation

Integration of hybrid propulsion systems for extended flight

Surge in government policies favoring defense innovation

Increase in urban air mobility solutions

Advancements in payload capabilities for specialized missions - Government Regulations & Defense Policy

Aerospace and defense compliance regulations

Military UAV procurement policies

International agreements on UAV export controls - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Surveillance UAVs

Combat UAVs

Transport UAVs

Research UAVs

Inspection UAVs - By Platform Type (In Value%)

Airborne Platforms

Land Platforms

Naval Platforms

Space Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By EndUser Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Security Services

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (In Value%)

Carbon Fiber

Titanium

Aluminum

Hybrid Materials

Lithium Batteries

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Israel Aerospace Industries (IAI)

Aeronautics Defense Systems

Rafael Advanced Defense Systems

Skylock Systems

Aerovision UAV Systems

Mistral Solutions

Bluebird Aero Systems

Quantum Systems

UVision Air

Aeronautics Ltd

SkyRunner

Ramon Aerospace

Heron Systems

Xcalibur Aerospace

- Military forces increasing demand for advanced UAVs

- Government agencies expanding UAV monitoring programs

- Defense contractors innovating with VTOL technologies

- Private sector expanding into UAV inspection services

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035