Market Overview

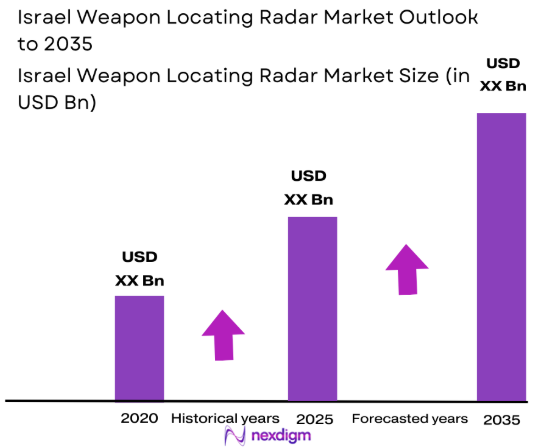

The Israel Weapon Locating Radar market is estimated to be valued at approximately USD ~ billion based on recent assessments. This growth is driven by the increased defense budgets, technological advancements in radar systems, and rising geopolitical tensions in the region. Furthermore, the demand for advanced surveillance and defense solutions, such as radar-based systems, has been increasing as nations focus on strengthening their defense capabilities, with Israel leading the way in innovation and defense technology integration. The sector’s development is also influenced by the country’s strategic investments in research and development, particularly in radar technologies that enhance military readiness and response times.

The market is primarily dominated by Israel, where the advanced technology and robust defense sector have positioned the country as a leader in radar systems. Factors contributing to Israel’s dominance include its strong military infrastructure, significant government investment in defense, and collaboration with defense contractors, driving the demand for advanced weapon locating radar systems. Other countries in the Middle East and global defense contractors are also increasingly adopting these systems due to Israel’s technological leadership, which offers a competitive edge in surveillance and defense capabilities.

Market Segmentation

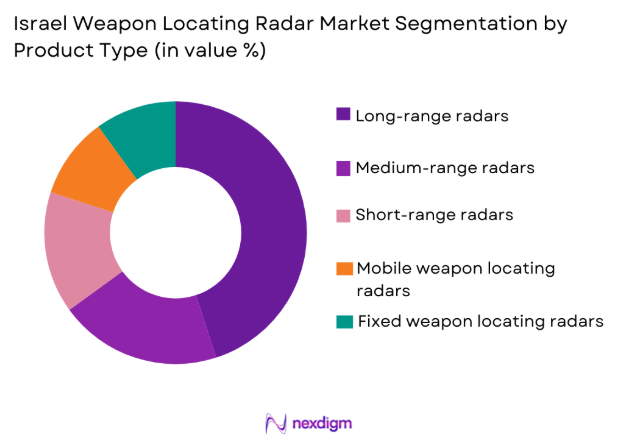

By Product Type:

The Israel Weapon Locating Radar market is segmented by product type into long-range radars, medium-range radars, short-range radars, mobile weapon locating radars, and fixed weapon locating radars. Recently, long-range radars have dominated the market share due to their ability to detect threats at greater distances, crucial for early warning systems. The technological advancements in long-range radar systems have made them increasingly essential in defense strategies, providing better protection by detecting and tracking potential threats over large areas. These systems are particularly favored by military forces for border surveillance and in conflict zones, where large-scale detection is vital for security.

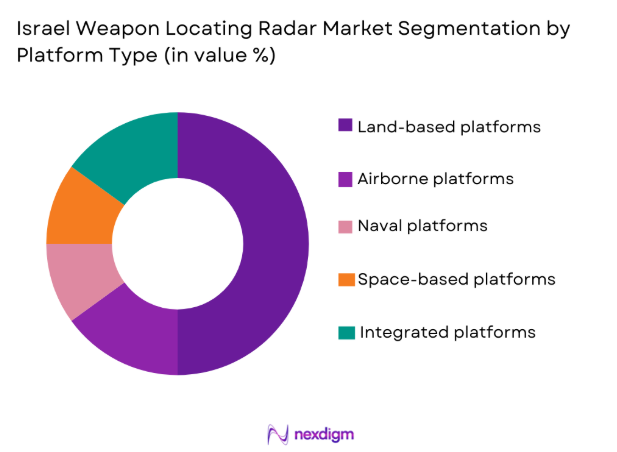

By Platform Type:

The Israel Weapon Locating Radar market is segmented by platform type into land-based platforms, airborne platforms, naval platforms, space-based platforms, and integrated platforms. Recently, land-based platforms have captured the dominant market share due to their deployment in border defense and perimeter security. These platforms are crucial for surveillance in land-based military operations, where the need for real-time data on enemy movements is essential. Land-based weapon locating radars offer flexibility and can be rapidly deployed in various terrains, making them a preferred choice for military installations and defense contractors.

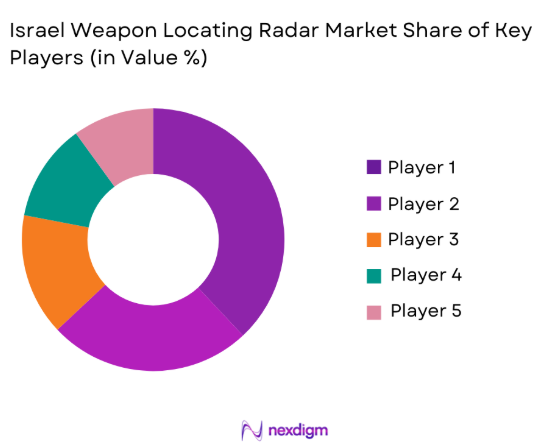

Competitive Landscape

The competitive landscape of the Israel Weapon Locating Radar market is marked by consolidation as major players dominate the defense radar industry. Companies like Elbit Systems, Israel Aerospace Industries, and Rafael Advanced Defense Systems have a strong presence in the market, offering advanced technologies and integration capabilities. These companies continue to lead in innovation, with strategic partnerships and government collaborations. The growing influence of these players has led to competitive pricing, technological advancements, and the development of customized radar solutions.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Military Defense Solutions |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Lod, Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense | 1948 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, USA | ~ | ~ | ~ | ~ | ~ |

Israel Weapon Locating Radar Market Analysis

Growth Drivers

Technological Advancements in Radar Systems:

Radar technology has advanced rapidly, with significant improvements in detection range, accuracy, and integration with other defense systems. The Israel Weapon Locating Radar market is driven by these technological advancements that enable more efficient and reliable threat detection. The integration of Artificial Intelligence (AI) and machine learning algorithms into radar systems is enhancing real-time data processing, improving target identification and tracking. As these systems evolve, their ability to detect and counter new types of threats, such as stealth aircraft and drones, has expanded. Furthermore, Israel’s defense sector is a global leader in radar innovation, which has created a high demand for advanced weapon locating radar systems across various countries.

Geopolitical Tensions and Defense Investments:

Geopolitical instability in the Middle East has led to an increase in military spending, especially in defense technologies such as weapon locating radar systems. Israel’s location and strategic military alliances have positioned it as a key player in defense innovation. The country’s defense budget has steadily increased, enabling the development of cutting-edge technologies, including radar systems designed to detect and counter threats. Neighboring countries and military allies are also investing in similar systems to maintain a technological edge, further driving the demand for advanced radar systems. The growing security concerns from missile threats and armed conflicts have led to a rise in the adoption of weapon locating radar systems globally.

Market Challenges

High Development and Production Costs:

One of the major challenges for the Israel Weapon Locating Radar market is the high cost of developing and producing advanced radar systems. These systems require significant investments in research and development, materials, and manufacturing processes. The complex technologies involved in radar systems, such as signal processing, antenna designs, and data analysis algorithms, contribute to these high costs. Additionally, the integration of these systems with existing military infrastructures requires substantial funding. For countries with smaller defense budgets, the high costs of adopting these systems can be a barrier, limiting their market penetration.

Technological Integration and Interoperability Issues:

Despite their advanced capabilities, integrating weapon locating radar systems with other defense systems often presents challenges. Interoperability between different systems and manufacturers is not always seamless, which can hinder the operational efficiency of defense networks. The need for compatibility with existing platforms, such as surveillance systems and command centers, requires continuous upgrades and adaptations, adding complexity to the deployment of these radar systems. Additionally, adapting new technologies to different military contexts and infrastructure can be time-consuming and costly, limiting their effectiveness in some regions.

Opportunities

Expansion into Emerging Markets:

The demand for advanced defense technologies, including weapon locating radar systems, is growing in emerging markets. Countries in Asia, Africa, and Eastern Europe are increasing their defense budgets and seeking to modernize their military forces. This presents a significant opportunity for the Israel Weapon Locating Radar market to expand its reach into these regions. Emerging markets often have a strong desire to enhance their defense capabilities, and Israel’s expertise in radar technology makes it a key supplier. The ability to offer flexible, scalable solutions to these regions, which may not yet have fully integrated defense systems, creates new growth opportunities for manufacturers in the market.

Partnerships with Private Sector and Tech Firms:

There is a growing trend of collaboration between defense companies and private sector technology firms to enhance the development of radar technologies. By partnering with companies specializing in AI, machine learning, and cybersecurity, radar systems can be further enhanced to improve their capabilities. These collaborations allow defense contractors to integrate commercial technologies into military applications, enhancing the performance of weapon locating radar systems. This opportunity can help bring cutting-edge technologies to market faster and at a lower cost while ensuring that military forces have access to the most advanced radar systems available.

Future Outlook

The Israel Weapon Locating Radar market is expected to grow significantly over the next five years, driven by continued technological advancements and increasing defense investments. There will be a focus on enhancing radar capabilities, with improvements in detection ranges and the integration of AI to boost system performance. Technological innovations, such as the use of autonomous systems in conjunction with radar, will further elevate defense strategies. Additionally, regulatory support and government funding for defense technologies are expected to contribute to market growth, particularly in regions with increasing security concerns.

Major Players

- Elbit Systems

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- Lockheed Martin

- Northrop Grumman

- BAE Systems

- Raytheon Technologies

- General Dynamics

- Thales Group

- Saab Group

- Harris Corporation

- L3 Technologies

- Leonardo

- Rheinmetall AG

- Boeing

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Military forces

- National security agencies

- Private sector defense firms

- Technology providers specializing in radar and defense systems

- International defense alliances

Research Methodology

Step 1: Identification of Key Variables

Identify the key variables influencing the market, such as technological advancements, geopolitical factors, and defense budgets.

Step 2: Market Analysis and Construction

Analyze historical market data, trends, and growth patterns to construct a comprehensive market model.

Step 3: Hypothesis Validation and Expert Consultation

Validate hypotheses through expert consultations with industry professionals and defense sector leaders.

Step 4: Research Synthesis and Final Output

Synthesize findings from primary and secondary research to create the final market report.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased defense budgets in Israel

Growing demand for advanced surveillance systems

Advancements in radar technology

Geopolitical tensions in the Middle East

Government investment in national defense initiatives - Market Challenges

High development and production costs

Technological integration and interoperability issues

Cybersecurity threats and vulnerabilities

Regulatory and compliance barriers

Political and social resistance to defense expansion - Market Opportunities

Partnerships with private tech firms for enhanced radar capabilities

Adoption of AI and machine learning for radar systems

Expansion into emerging markets in defense technology - Trends

Increase in autonomous and unmanned vehicle integration

Use of AI in radar data processing

Surge in cybersecurity investments for defense systems

Emerging interest in space-based surveillance platforms

Growth in hybrid radar solutions - Government Regulations & Defense Policy

National defense procurement policies

Export control and compliance regulations

Government funding for defense innovation - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Long-range radars

Medium-range radars

Short-range radars

Mobile weapon locating radars

Fixed weapon locating radars - By Platform Type (In Value%)

Land-based platforms

Airborne platforms

Naval platforms

Space-based platforms

Integrated platforms - By Fitment Type (In Value%)

On-premise solutions

Cloud-based solutions

Hybrid solutions

Modular solutions

Integrated solutions - By EndUser Segment (In Value%)

Military forces

Defense contractors

Government agencies

Security services

Private sector / technology firms - By Procurement Channel (In Value%)

Direct procurement

Government tenders

Private sector procurement

Online bidding platforms

Third-party distributors - By Material / Technology (in Value%)

Radar materials

Signal processing technology

Antenna technology

Software algorithms

Electronics technology

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Israel Aerospace Industries

Rafael Advanced Defense Systems

Lockheed Martin

Northrop Grumman

BAE Systems

Raytheon Technologies

General Dynamics

Thales Group

Saab Group

Harris Corporation

L3 Technologies

Leonardo

Rheinmetall AG

Boeing

- Military forces’ increasing demand for digital radar systems

- Government agencies’ focus on national security surveillance

- Defense contractors’ investment in advanced radar solutions

- Private sector interest in radar technology for non-defense applications

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035