Market Overview

The Israel Weapons and Ammunition Market is valued at approximately USD ~ billion, driven by a robust defense budget and increasing demand for advanced weapon systems and ammunition. This market is propelled by government initiatives focused on enhancing defense capabilities and the development of innovative technologies. The growth of military modernization programs and the integration of cutting-edge technologies into defense systems are key factors contributing to this market’s expansion. Based on a recent historical assessment, the market for weapons and ammunition continues to evolve, benefiting from sustained national defense spending and increasing security concerns.

Israel dominates the weapons and ammunition market due to its strategic geographic position and its advanced defense technologies. The country’s strong defense sector, supported by government investments and partnerships with global defense companies, plays a significant role in its market leadership. Additionally, Israel’s continuous development of high-tech weaponry and its reputation for military innovation have contributed to the country’s dominance. Israel’s geopolitical security concerns further drive domestic demand for advanced weapon systems and ammunition.

Market Segmentation

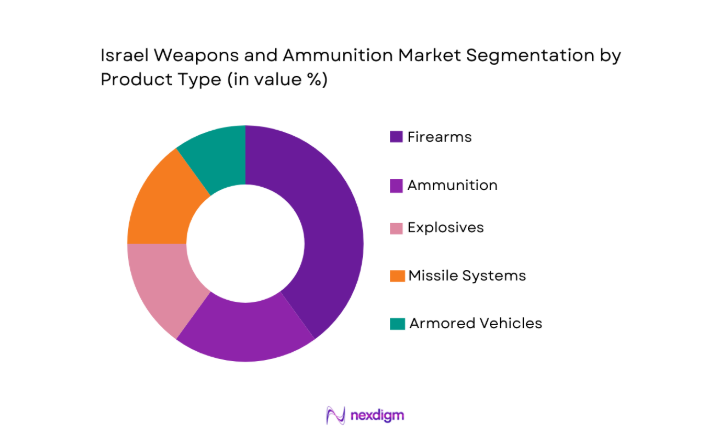

By Product Type

The Israel Weapons and Ammunition market is segmented by product type into firearms, ammunition, explosives, missile systems, and armored vehicles. Recently, ammunition has a dominant market share due to the increasing demand for both small arms and specialized ammunition driven by military, law enforcement, and security operations. The growing demand for advanced ammunition technology, coupled with Israel’s established reputation for producing high-quality, reliable ammunition, has made this segment a leader in the market. Additionally, Israel’s continuous innovations in ammunition manufacturing and the integration of cutting-edge materials further bolster its market position.

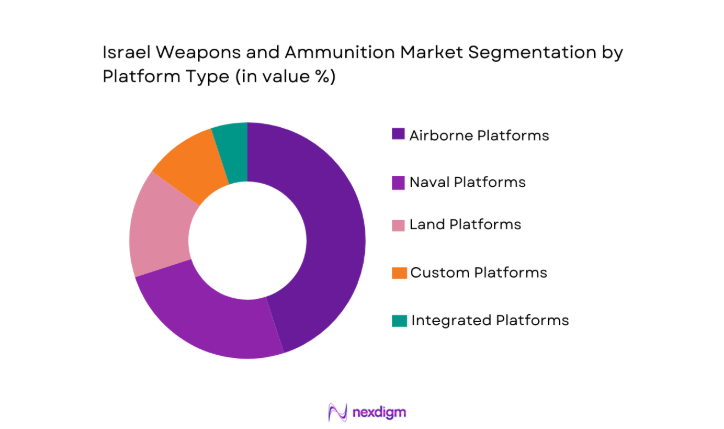

By Platform Type

The Israel Weapons and Ammunition market is segmented by platform type into land platforms, airborne platforms, naval platforms, integrated platforms, and custom platforms. Recently, land platforms have a dominant market share, driven by Israel’s strategic focus on ground-based defense technologies and increasing demand for portable weapon systems. The need for advanced and tactical land-based defense solutions has led to significant investments in developing systems suited for ground operations, especially in counterterrorism and border defense initiatives. This has given land platforms a solid footing in the market, as the Israeli defense sector continues to prioritize ground defense systems.

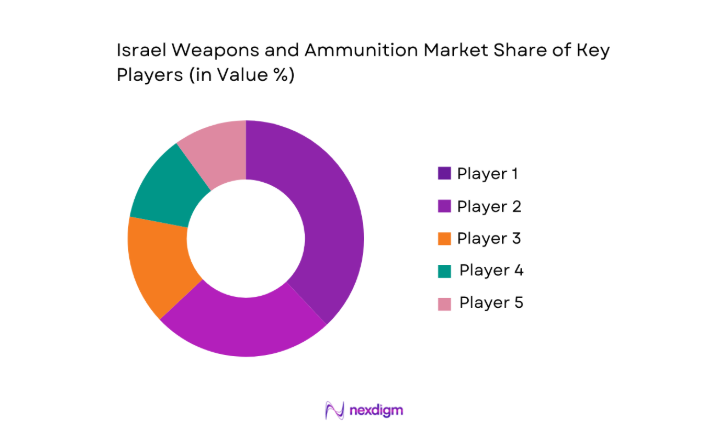

Competitive Landscape

The competitive landscape of the Israel Weapons and Ammunition market is highly concentrated, with a few key players dominating the sector. Consolidation is prevalent, with large defense contractors leading the market, often working with the Israeli government on national security projects. The major players have a significant influence on technological advancements and product innovations in this sector, shaping market trends and determining the competitive dynamics. This strong presence of large firms ensures a continued emphasis on high-quality, technologically advanced systems in the weapons and ammunition market.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameters |

| Israel Weapon Industries | 1933 | Ramat HaSharon | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense | 2002 | Haifa | ~ | ~ | ~ | ~ | ~ |

| IMI Systems | 1933 | Lod | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa | ~ | ~ | ~ | ~ | ~ |

| Plasan | 1985 | Sderot | ~ | ~ | ~ | ~ | ~ |

Israel Weapons and Ammunition Market Analysis

Growth Drivers

Increased National Defense Spending

National defense spending in Israel has seen a consistent increase in recent years, fueling demand for weapons and ammunition across both military and security sectors. This growth is driven by the need to address evolving security threats, as well as Israel’s commitment to maintaining technological superiority in defense. Israel has long been recognized for its defense technology innovations, and the government’s continued financial investment in its military forces supports the ongoing demand for advanced weaponry and ammunition. The defense sector in Israel benefits from strong state funding and an established relationship with international partners, further fueling growth in the weapons and ammunition market. This expansion is also supported by the increasing geopolitical instability in the region, which encourages governments to modernize their defense capabilities and strengthen their security infrastructure. In response to these demands, the Israeli defense industry continues to lead advancements in weapons manufacturing and development, including advanced ammunition systems.

Technological Advancements in Weaponry

Israel has been a leader in weaponry innovation, with advancements in areas such as robotics, AI integration, and precision-guided systems. These technological developments have contributed significantly to the growth of the weapons and ammunition market. Israel’s expertise in developing high-tech weapons systems, such as autonomous systems and advanced missile technologies, has led to the adoption of these innovations across global defense forces. The growth of military modernization programs worldwide has further accelerated the demand for high-tech solutions, driving the Israeli defense industry to develop next-generation weaponry and ammunition. These advancements not only enhance the operational capabilities of military forces but also provide cost-effective and strategic solutions. The continued focus on technology innovation in the sector is expected to keep Israel at the forefront of defense technology and expand its market share in the global weapons and ammunition market.

Market Challenges

Geopolitical Instability and Security Concerns

While Israel’s defense sector is one of the most advanced globally, it faces significant challenges arising from ongoing regional geopolitical instability. The volatile security situation, including conflicts with neighboring countries and non-state actors, increases the complexity of operating in this market. The need to continuously upgrade defense capabilities to keep pace with these security challenges places additional pressure on the defense sector. Furthermore, geopolitical risks often lead to fluctuating defense budgets and policies, which can disrupt the stability of the weapons and ammunition market. In addition, the ever-present security concerns make it more difficult for the government and private sector players to engage in international trade and partnerships, which are crucial for market expansion. These factors create market uncertainty and hinder the free flow of capital, technology, and resources, posing challenges to the growth of the weapons and ammunition industry.

Regulatory Compliance and Export Restrictions

The Israeli weapons and ammunition market is heavily influenced by government regulations and international arms trade agreements. Israel is subject to strict domestic and international regulations governing the manufacture, export, and use of its defense products. Compliance with these regulations can create challenges for companies looking to expand their market reach, as they must navigate complex export controls and international sanctions. These regulatory restrictions also impact the speed at which new products can be brought to market, delaying time-to-market and reducing the competitiveness of Israeli-made products in global markets. Additionally, the export control policies in place can limit market access to certain regions, thus preventing Israeli companies from capitalizing on potentially lucrative contracts in regions outside their traditional markets. The need to balance innovation with compliance makes it challenging for Israeli defense companies to expand their market presence and meet the growing demand for high-quality weaponry and ammunition.

Opportunities

Expansion of Autonomous and AI-powered Defense Solutions

Autonomous systems and AI-powered defense solutions represent a significant growth opportunity in the Israel weapons and ammunition market. As Israel leads the development of cutting-edge defense technologies, the demand for unmanned aerial vehicles (UAVs), autonomous ground vehicles, and AI-driven defense systems is expected to rise sharply. These systems enhance operational efficiency, reduce human casualties, and provide military forces with strategic advantages in conflict zones. The rapid evolution of AI and robotics presents opportunities for Israeli defense companies to develop innovative solutions that meet the needs of modern military forces. With the increasing reliance on automation and precision-guided systems, Israel’s weapons and ammunition market is poised to capitalize on these advancements, establishing itself as a leader in autonomous defense technology. The growing demand for such systems across international markets offers significant revenue potential for Israeli defense manufacturers.

Growing Demand for Private Sector Security Solutions

The expansion of private sector security solutions represents a new avenue for growth in Israel’s weapons and ammunition market. With the increasing need for advanced security systems in sectors such as critical infrastructure, oil and gas, and corporate assets, private companies are increasingly turning to high-quality weapons and ammunition solutions. Israel’s well-established defense industry is ideally positioned to meet these needs, providing innovative solutions that integrate military-grade technology with commercial applications. As global security threats evolve, the private sector is expected to invest more in advanced weapons systems, especially those related to cybersecurity and perimeter defense. This growing trend presents an untapped market for Israeli companies to develop products specifically tailored to private-sector security needs, further diversifying their customer base and revenue streams. The shift toward securing private infrastructure and assets is expected to continue, creating substantial opportunities for market growth.

Future Outlook

The future outlook of the Israel Weapons and Ammunition market is promising, with steady growth anticipated in the coming years. Technological advancements in areas such as AI, robotics, and cyber defense are expected to drive further innovation in weapon systems and ammunition. Government support for defense sector innovation, combined with the growing geopolitical tensions in the region, will continue to fuel demand for high-tech defense solutions. Additionally, the market is poised to benefit from increasing private sector interest in security solutions, expanding the customer base and creating new revenue opportunities.

Major Players

- Israel Weapon Industries

- Rafael Advanced Defense

- IMI Systems

- Elbit Systems

- Plasan

- General Dynamics

- Lockheed Martin

- BAE Systems

- Northrop Grumman

- Thales Group

- Honeywell International

- Saab Group

- Leonardo

- Raytheon Technologies

- L3 Technologies

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military contractors

- Defense technology companies

- Aerospace and defense equipment manufacturers

- International defense agencies

- Private security firms

- OEMs in defense

Research Methodology

Step 1: Identification of Key Variables

This step involves defining the core market variables and ensuring accurate segmentation, identifying critical factors that affect the Israel Weapons and Ammunition market.

Step 2: Market Analysis and Construction

In this phase, data is gathered from reliable sources, analyzed, and modeled to provide a comprehensive view of market dynamics and potential trends.

Step 3: Hypothesis Validation and Expert Consultation

A hypothesis is developed based on the initial analysis, which is then validated through consultations with industry experts and market stakeholders.

Step 4: Research Synthesis and Final Output

The final synthesis compiles all research findings, ensuring the report is well-structured and aligns with industry expectations.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased National Defense Spending

Technological Advancements in Weaponry

Rising Geopolitical Tensions - Market Challenges

High Capital Investment in Defense Technologies

Geopolitical Instability and Security Concerns

Regulatory Compliance and Export Restrictions - Market Opportunities

Expansion of Autonomous and AI-powered Defense Solutions

Rising Demand for Advanced Ammunition and Explosive Systems

Growing Demand for Private Sector Security Solutions - Trends

Increased Use of AI in Weapon Systems

Advancements in Cybersecurity for Defense Systems - Government Regulations & Defense Policy

- SWOT Analysis

- Porter’s Five Forces

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Firearms

Ammunition

Explosives

Missile Systems

Armored Vehicles - By Platform Type (In Value%)

Land Platforms

Airborne Platforms

Naval Platforms

Integrated Platforms

Custom Platforms - By Fitment Type (In Value%)

On-premise Solutions

Integrated Solutions - By End User Segment (In Value%)

Military Forces

Law Enforcement Agencies

Defense Contractors - By Procurement Channel (In Value%)

Government Tenders

Direct Procurement

Online Bidding Platforms

- Market share of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type, Material/Technology, Government Regulations, Competitive Positioning, Technological Innovation)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Israel Weapon Industries

Elbit Systems

Rafael Advanced Defense Systems

IMI Systems

Magal Security Systems

Plasan

Israel Aerospace Industries

Uzi Group

Rassco

Ziv Av Systems

Cedar Electronics

AeroVironment

General Dynamics

Lockheed Martin

Northrop Grumman

- Military Forces’ Growing Technological Requirements

- Private Sector’s Adoption of Security Systems

- Government Agencies’ Role in Procurement

- Law Enforcement Agencies’ Focus on Non-lethal Weapons

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035