Market Overview

The Israel Weapons Carriage and Release Systems market is driven by significant investments in defense technologies and a growing demand for precision weaponry. Based on a recent historical assessment, the market size for weapons carriage and release systems in Israel is valued at approximately USD ~ billion. This is primarily driven by the continuous advancements in unmanned aerial vehicle (UAV) technologies, modernization programs in defense forces, and the integration of next-gen weaponry systems. The market is also supported by rising defense budgets, especially for advanced defense technology systems such as integrated weapon release mechanisms for fighter jets and UAVs.

Dominant countries in the weapons carriage and release systems market include Israel, the United States, and several key European nations, with Israel standing out due to its robust defense infrastructure and innovation in military technologies. The country’s leadership in defense technologies, particularly with UAVs, enables the rapid adoption and integration of cutting-edge weapons carriage systems. Israel’s well-established defense sector, including major players like Israel Aerospace Industries and Rafael Advanced Defense Systems, ensures its dominance in both production and export of these systems.

Market Segmentation

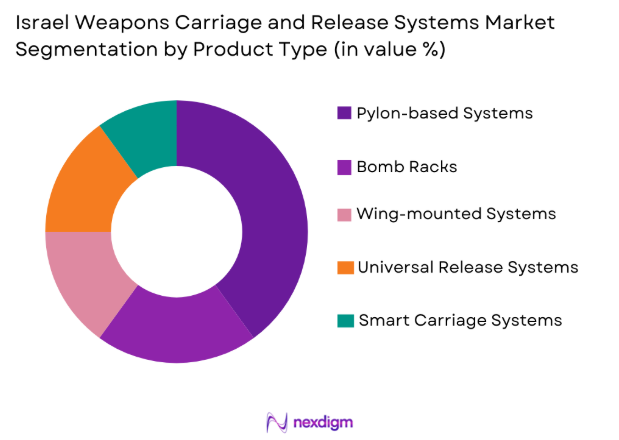

By Product Type:

The Israel Weapons Carriage and Release Systems market is segmented by product type into bomb racks, pylon-based systems, wing-mounted systems, universal release systems, and smart carriage systems. Recently, the pylon-based systems have shown dominance in market share, mainly driven by their versatility, cost-effectiveness, and compatibility with multiple types of aircraft. They offer flexible integration with both military and commercial aircraft, which has made them the preferred choice in the defense sector. The continued advancements in smart release mechanisms and improved infrastructure for maintenance and logistics further push their dominance in the market.

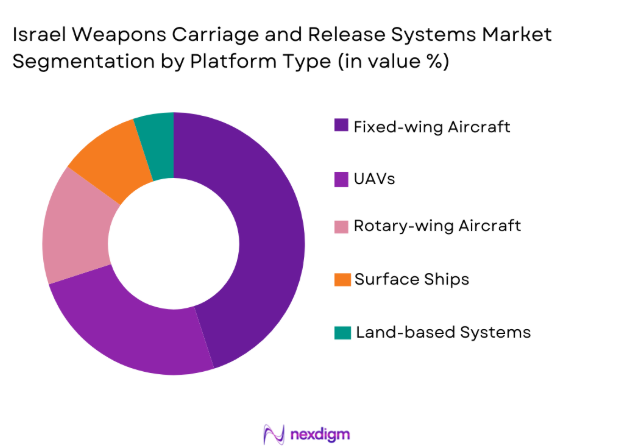

By Platform Type:

The Israel Weapons Carriage and Release Systems market is segmented by platform type into fixed-wing aircraft, rotary-wing aircraft, unmanned aerial vehicles (UAVs), surface ships, and land-based systems. Among these, fixed-wing aircraft have the dominant market share due to the increasing demand for multi-role and fighter aircraft capable of carrying advanced weapon systems. These aircraft platforms, especially those developed by Israel, such as the F-35 and F-16, are crucial for modern defense operations and are heavily equipped with advanced carriage and release systems. The significant infrastructure and defense investments in air force modernization continue to strengthen the position of fixed-wing aircraft.

Competitive Landscape

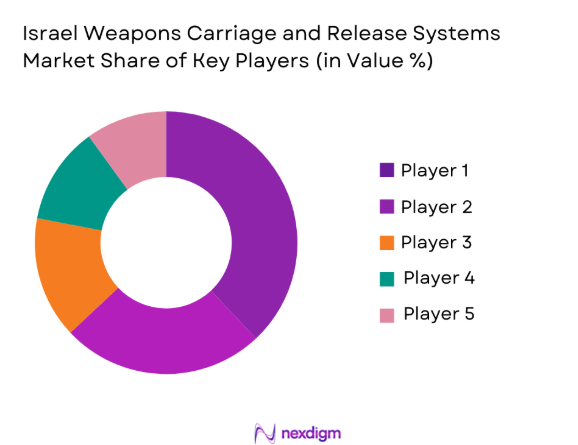

The Israel Weapons Carriage and Release Systems market is highly competitive, with several major players dominating the landscape. These players focus on consolidation, forming strategic partnerships to enhance their technological capabilities and expand their market reach. Israel Aerospace Industries and Rafael Advanced Defense Systems are the two leading players in this sector, leveraging their long-standing expertise in defense technology to maintain a competitive edge. The consolidation of military defense technology companies and collaborations with international defense firms have led to enhanced product offerings and stronger market positions for these key players.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD billion) | Additional Parameters |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1958 | Israel | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ |

| Boeing | 1916 | USA | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | USA | ~ | ~ | ~ | ~ | ~ |

Israel Weapons Carriage and Release Systems Market Analysis

Growth Drivers

Technological Advancements in UAVs:

The growth of the Israel Weapons Carriage and Release Systems market is significantly driven by the rapid advancements in unmanned aerial vehicles (UAVs). UAVs are becoming essential for modern warfare due to their ability to conduct reconnaissance and deliver precise strikes without risking human lives. Israel’s defense industry is a global leader in UAV technology, and the adoption of advanced weapon carriage and release systems for UAVs is a primary factor pushing the growth in this sector. As the integration of UAVs with sophisticated weapons systems grows, the demand for reliable carriage systems that can operate seamlessly with UAV platforms increases. Additionally, the cost-effectiveness and operational flexibility offered by UAVs for various military applications have led to widespread adoption across numerous countries, further contributing to market growth. Israel’s leadership in UAV technology and its ongoing innovations in autonomous systems are expected to drive the market for weapons carriage and release systems further.

Military Modernization Initiatives:

Another significant growth driver for the Israel Weapons Carriage and Release Systems market is the increasing military modernization initiatives globally. Governments worldwide are investing heavily in modernizing their defense forces to address emerging threats and enhance national security. This trend is especially prominent in Israel, where continuous defense system upgrades are crucial to maintaining strategic advantages in the region. These initiatives often involve the integration of advanced weapons systems, including more efficient and reliable carriage and release systems. As nations seek to enhance their air combat capabilities and overall defense infrastructure, the demand for next-generation weapons carriage solutions continues to rise. The ongoing investments in upgrading the Israel Defense Forces (IDF) with cutting-edge weaponry and technological solutions are directly linked to the expansion of the weapons carriage and release systems market.

Market Challenges

High Integration Costs:

The high cost of integrating advanced weapons carriage and release systems into existing defense platforms is a significant challenge faced by the market. These systems require specialized components and significant engineering to be properly fitted and operational, especially for older aircraft models. This increases the cost for both manufacturers and end-users, making it difficult for some defense forces to adopt the latest technologies. While the cost of raw materials such as titanium and advanced composites is high, the integration costs, which also involve specialized training and maintenance programs, add to the overall financial burden. This challenge is particularly significant for smaller defense budgets, as they may prioritize other areas of defense technology over upgrading their weapons carriage systems. The cost barrier also limits the number of countries able to access and implement advanced solutions, thereby restraining market growth.

Regulatory Compliance and Standards:

Regulatory compliance and standardization of defense systems present another challenge to the Israel Weapons Carriage and Release Systems market. Different countries have varying defense regulations, certification requirements, and export control laws that make it challenging to offer a one-size-fits-all solution for military systems. These regulatory obstacles can delay product development, testing, and certification processes, and companies must adhere to stringent national and international standards to ensure compatibility and safety. Furthermore, these regulations can limit the speed of technological advancements in certain markets. In regions where defense spending is lower or where there are restrictions on foreign defense systems, companies may face additional challenges when attempting to secure contracts for weapons carriage and release systems.

Opportunities

Integration of Artificial Intelligence (AI) in Weapon Systems:

One of the most significant opportunities in the Israel Weapons Carriage and Release Systems market is the integration of artificial intelligence (AI) in weapon systems. AI has the potential to revolutionize weapons carriage and release systems by enhancing targeting accuracy, improving decision-making, and reducing the operational burden on military personnel. AI-driven systems can analyze battlefield conditions in real-time, allowing for more precise targeting and reducing collateral damage. This technology also allows for autonomous weapon release, which can further increase operational efficiency. The development of AI-powered weapons systems presents a new avenue for growth and differentiation for companies in this market.

Increasing Demand for Multi-Role Aircraft:

The growing demand for multi-role aircraft presents a significant opportunity for the Israel Weapons Carriage and Release Systems market. Multi-role aircraft, such as the F-35, are designed to perform a wide variety of missions, including air superiority, strike, reconnaissance, and close air support. These versatile platforms require advanced weapons carriage and release systems that can accommodate different types of munitions and payloads. The expanding need for these flexible aircraft, particularly in defense modernization programs, is expected to drive demand for more advanced and adaptable carriage systems. As countries invest in multi-role platforms, the integration of weapons release systems capable of supporting a wide range of missions becomes increasingly critical.

Future Outlook

The future of the Israel Weapons Carriage and Release Systems market looks promising, with strong growth anticipated over the next five years. Technological developments, particularly in AI, UAVs, and multi-role platforms, are expected to drive market demand for more efficient, reliable, and versatile systems. Additionally, regulatory support from defense ministries and international arms control agreements will play a crucial role in shaping the market’s growth trajectory. As countries prioritize defense modernization, there will be a steady rise in demand for advanced weapons carriage and release systems, ensuring robust market expansion.

Major Players

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- Lockheed Martin

- Boeing

- Northrop Grumman

- BAE Systems

- General Dynamics

- Elbit Systems

- Thales Group

- Leonardo

- Saab Group

- L3 Technologies

- Raytheon Technologies

- Harris Corporation

- MBDA

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aerospace and defense manufacturers

- Military contractors

- UAV and drone manufacturers

- Commercial aerospace companies

- Security services

- Defense and aerospace technology firms

Research Methodology

Step 1: Identification of Key Variables

The first step in the research process is identifying key variables that drive the market. This involves gathering data on technological advancements, regional defense budgets, and emerging threats.

Step 2: Market Analysis and Construction

Once key variables are identified, we construct the market framework by analyzing historical data, market trends, and regulatory influences to form the market structure.

Step 3: Hypothesis Validation and Expert Consultation

This step involves validating our hypotheses with industry experts, consulting defense analysts, and reviewing key reports to ensure that the data reflects current and accurate market dynamics.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing all the collected data, forming the complete market report, and ensuring that all insights and projections are clearly presented for stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Military Modernization Programs

Growing Demand for Unmanned Aerial Systems

Technological Advancements in Precision Weaponry

Rising Geopolitical Tensions

Increased Defense Budgets in Emerging Economies - Market Challenges

High Cost of Advanced Weaponry Systems

Technological Integration Issues

Regulatory Compliance Challenges

Lack of Standardization in System Fitment

Operational and Environmental Limitations - Market Opportunities

Emerging Demand for UAV-based Weapon Systems

Partnerships with Private Aerospace and Defense Firms

Integration of Smart Materials into Release Systems - Trends

Advancements in Autonomous Weapons Systems

Increase in Use of AI and Machine Learning for Targeting

Integration of Hybrid and Modular Systems

Miniaturization of Weapon Systems

Rise in Demand for Multi-role Platforms - Government Regulations & Defense Policy

Defense Export Control Laws

Regulations on the Use of Autonomous Weapon Systems

Policy Shifts Regarding Drone Warfare - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- By System Type (In Value%)

Pylon-based Release Systems

Wing-mounted Release Systems

Bomb Racks

Universal Release Systems

Magnetic Carriage Systems - By Platform Type (In Value%)

Fixed-wing Aircraft

Rotary-wing Aircraft

Unmanned Aerial Vehicles (UAVs)

Surface Ships

Land-based Systems - By Fitment Type (In Value%)

Standard Fitment

Customized Fitment

Retrofitting

Modular Fitment

Hybrid Fitment - By EndUser Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Private Aerospace & Defense Companies

Security Service Providers - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (In Value%)

Composite Materials

Aluminum-based Materials

Titanium Components

Smart Materials

Nanotechnology in Materials

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Technology, Price, Market Value, Installed Units)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Israel Aerospace Industries

Elbit Systems

Rafael Advanced Defense Systems

IMI Systems

AeroVironment

General Dynamics

BAE Systems

Lockheed Martin

Northrop Grumman

Raytheon Technologies

Thales Group

Leonardo

Saab Group

L3 Technologies

Boeing

- Military Forces’ Demand for Modernization

- Government Agencies’ Focus on Technological Integration

- Private Aerospace Companies Pushing Innovation

- Security Service Providers’ Need for Cost-effective Solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035