Market Overview

Based on a recent historical assessment, the Israel X-band radar market has experienced significant growth in recent years, driven by increasing demand for advanced defense systems and enhanced security. The market size is valued at USD ~ billion, with substantial investments from the defense sector, contributing to a rising need for cutting-edge radar technology. This demand is supported by geopolitical tensions and national security priorities, prompting continued expansion in both defense and commercial sectors.

Dominant countries in the Israel X-band radar market include Israel, the United States, and several European nations, which dominate due to their strong defense infrastructure and technological expertise. Israel’s defense sector, in particular, plays a vital role due to ongoing advancements in radar technology and the integration of radar systems into military and aerospace applications. Furthermore, countries with significant defense budgets, such as the U.S., continue to invest heavily in radar solutions for both strategic defense and border security operations.

Market Segmentation

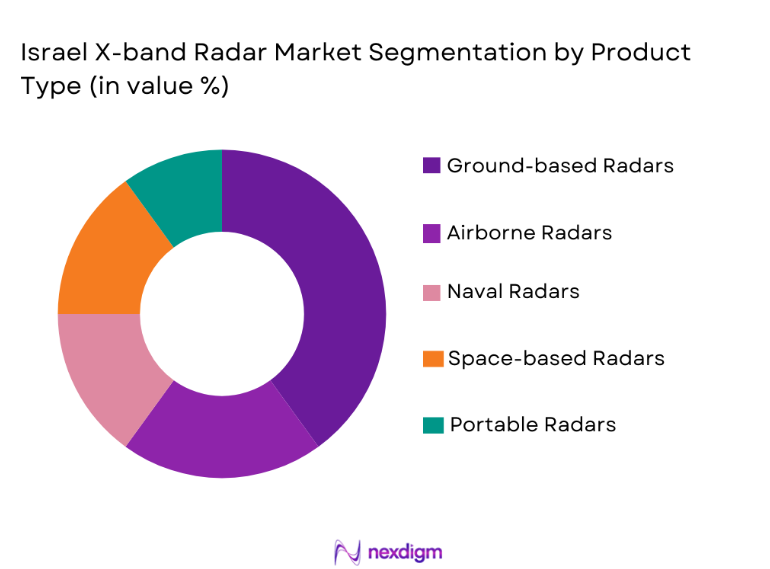

By Product Type

Israel X-band radar market is segmented by product type into ground-based radars, airborne radars, naval radars, space-based radars, and portable radars. Recently, ground-based radars have a dominant market share due to factors such as high demand for border security and surveillance applications. Ground-based radars offer enhanced reliability and operational efficiency, making them ideal for monitoring large geographical areas and securing critical infrastructure. Their versatility in adapting to diverse environmental conditions and integration with existing defense systems further strengthens their position in the market.

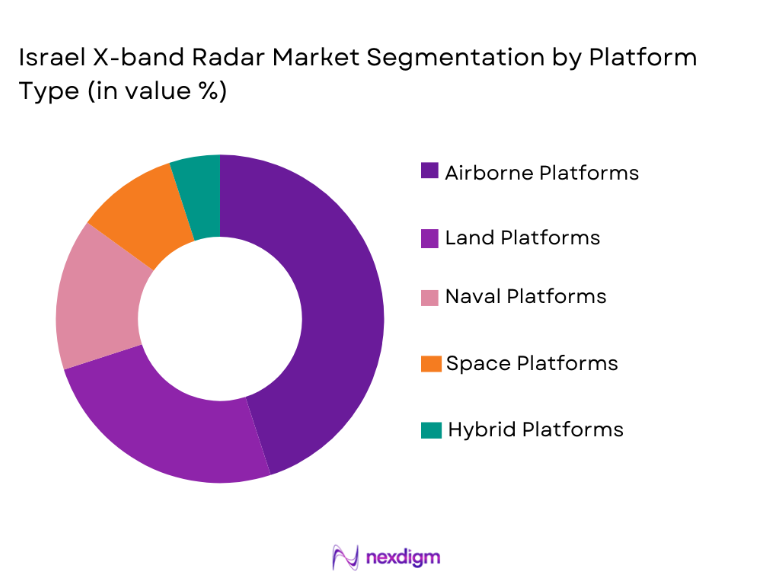

By Platform Type

Israel X-band radar market is segmented by platform type into land platforms, airborne platforms, naval platforms, space platforms, and hybrid platforms. Recently, land platforms have a dominant market share due to factors such as the increasing demand for ground-based defense systems and advanced surveillance technology. These platforms are critical for monitoring land borders, tactical defense, and missile defense systems, making them essential for national security. Their reliability and cost-effectiveness have led to widespread adoption, further solidifying their position in the radar market.

Competitive Landscape

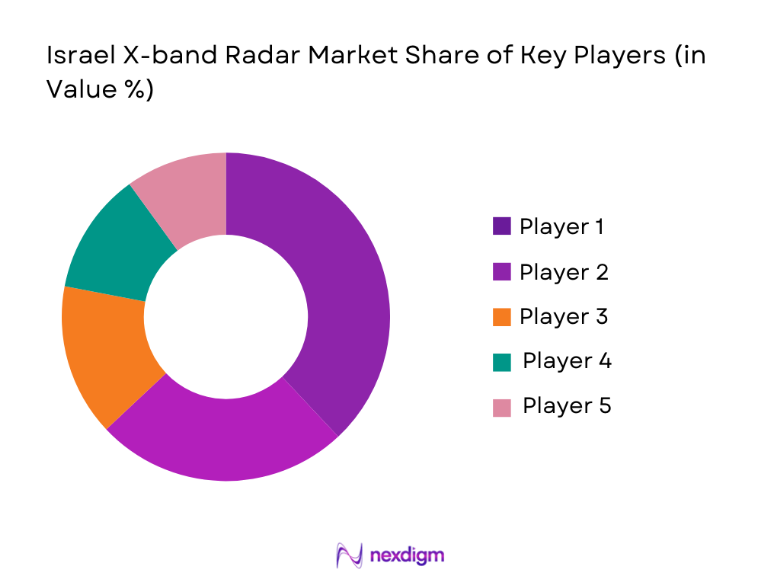

The Israel X-band radar market is highly competitive, with major players constantly innovating and consolidating their positions through strategic partnerships and technological advancements. Key players in the industry include defense contractors, technology firms, and research organizations, all of whom significantly influence market dynamics and contribute to the growth of the radar sector. The growing demand for sophisticated radar systems is fostering consolidation among market players, as companies look to expand their product offerings and regional reach.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Defense Integration |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Lod, Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1984 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, USA | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

Israel X-band Radar Market Analysis

Growth Drivers

Government Investments in National Security

Government investments in national security are a significant growth driver for the Israel X-band radar market. These investments focus on strengthening border defense and enhancing surveillance capabilities. Israel, in particular, is dedicating substantial funds to improve its radar technology as part of its broader defense modernization efforts. This investment allows for more advanced radar systems, which provide better detection and tracking capabilities, particularly for military applications such as missile defense and airspace management. As geopolitical instability continues, the demand for highly sophisticated and reliable radar systems will likely rise. This surge in government spending on defense technology creates substantial opportunities for radar manufacturers and suppliers, further accelerating market growth.

Technological Advancements in Radar Systems

Technological advancements are playing a pivotal role in driving the growth of the Israel X-band radar market. Innovations in radar signal processing, frequency scanning, and miniaturization of components are making radar systems more efficient and adaptable. As military and defense sectors require more precise and rapid detection capabilities, X-band radar technology, with its superior accuracy and resolution, has gained significant traction. These advancements allow for better tracking of fast-moving targets, improving defense operations and situational awareness. The continuous development of next-generation radar systems with integrated AI and machine learning capabilities further boosts market expansion. The ability to provide multifunctional radar solutions, including targeting, surveillance, and missile defense, is creating new growth avenues in the market.

Market Challenges

High Costs of Advanced Radar Systems

The high costs associated with advanced radar systems represent a significant challenge for the Israel X-band radar market. These systems, while highly effective, require substantial capital investment in research and development, production, and maintenance. For defense contractors and government bodies, balancing the need for cutting-edge radar technology with budget constraints can be difficult. Additionally, the complexity and scale of integration required to deploy X-band radar systems across military platforms drive up costs further. Smaller nations or regions with limited defense budgets may find it challenging to procure such advanced systems, thus limiting the market’s overall expansion. Furthermore, the cost of maintaining and upgrading radar systems over time is a critical factor, particularly for defense agencies looking to maximize their operational capabilities without exceeding financial limits.

Technological Integration and Interoperability Issues

One of the critical challenges facing the Israel X-band radar market is the integration of radar systems into existing defense infrastructures. The complexity of integrating advanced radar systems into multi-layered military operations can pose significant hurdles, particularly when radar technologies need to work seamlessly across land, air, and naval platforms. Moreover, issues with interoperability between various defense systems can affect overall performance, leading to operational inefficiencies and increased system downtimes. As defense forces across the globe aim to modernize their military technologies, ensuring that radar systems can operate effectively within a diverse technological ecosystem remains a pressing challenge.

Opportunities

Emerging Demand for Autonomous Systems

The rising demand for autonomous systems presents a significant opportunity for the Israel X-band radar market. Autonomous vehicles and drones, both military and civilian, are increasingly requiring advanced radar systems for navigation, monitoring, and collision avoidance. As more countries and defense organizations adopt autonomous technologies for surveillance and reconnaissance, the demand for precise and reliable radar solutions is expected to increase. These systems, particularly those utilizing advanced radar technologies like X-band, enable high-resolution data capture and real-time situational awareness. The integration of X-band radar into autonomous systems allows for improved target tracking and monitoring in complex environments, creating new market opportunities for radar manufacturers and developers.

Collaboration with Technology Firms for Radar Innovation

The opportunity to collaborate with private technology firms in the Israel X-band radar market is growing. These partnerships allow defense companies to integrate cutting-edge technologies such as artificial intelligence, machine learning, and big data analytics into radar systems, significantly enhancing their performance. As defense budgets rise globally, particularly in Israel, there is an increasing focus on improving the accuracy and speed of radar systems. Collaborations with tech firms not only expand the capabilities of radar systems but also help reduce development time and costs. This synergy fosters a dynamic environment for innovation, opening new doors for the market’s growth in the coming years.

Future Outlook

The Israel X-band radar market is poised for substantial growth over the next five years, driven by continued advancements in radar technology and rising defense budgets worldwide. Technological developments, such as the integration of AI and machine learning into radar systems, will play a significant role in improving performance and efficiency. Increased investments from governments and defense agencies will further accelerate market expansion, particularly in the areas of surveillance, missile defense, and border security. Additionally, the growing demand for autonomous systems and the development of multi-functional radar solutions will shape the future trajectory of the market.

Major Players

- Elbit Systems

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- Raytheon Technologies

- Lockheed Martin

- Thales Group

- Northrop Grumman

- BAE Systems

- Leonardo

- Saab Group

- General Dynamics

- Harris Corporation

- L3 Technologies

- Boeing

- Leonardo DRS

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Aerospace companies

- National security agencies

- Defense technology firms

- Border security agencies

- Military forces

Research Methodology

Step 1: Identification of Key Variables

Identify the critical variables influencing the market, including technological advancements, regulatory factors, and regional defense spending.

Step 2: Market Analysis and Construction

Analyze the current market dynamics, examining product types, end-users, and geographical influences to construct a comprehensive market overview.

Step 3: Hypothesis Validation and Expert Consultation

Validate initial hypotheses through expert interviews, consultations with industry professionals, and surveys within the defense sector.

Step 4: Research Synthesis and Final Output

Synthesize the collected data into a cohesive market report, focusing on key insights, trends, and strategic recommendations.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased defense spending in Israel

Advancements in radar signal processing technology

Rising demand for military surveillance

Development of multi-functional radar systems

Focus on border security and surveillance - Market Challenges

High cost of advanced radar systems

Complexity in radar system integration

Regulatory and compliance barriers

Technological obsolescence in radar systems

Cybersecurity threats to radar systems - Market Opportunities

Emerging demand for autonomous radar systems

Collaborations with private technology firms for radar advancements

Growing need for radar systems in the commercial aerospace sector - Trends

Integration of AI and machine learning in radar systems

Miniaturization of radar systems for mobile use

Increased adoption of hybrid radar systems

Use of radar for unmanned aerial vehicle (UAV) tracking

Rising investments in research and development for radar systems - Government Regulations & Defense Policy

Radar technology export control policies

Compliance with international defense standards

Government funding for radar system upgrades - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Ground-based Radars

Airborne Radars

Naval Radars

Space-based Radars

Portable Radars - By Platform Type (In Value%)

Land Platforms

Airborne Platforms

Naval Platforms

Space Platforms

Hybrid Platforms - By Fitment Type (In Value%)

Fixed Installation

Mobile Installation

Modular Installation

Integrated Solutions

Portable Solutions - By EndUser Segment (In Value%)

Military

Government Agencies

Commercial

Aerospace

Security & Defense Contractors - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (In Value%)

Solid-state Technology

Phased Array Technology

Gallium Nitride (GaN) Technology

Electronically Scanned Array (ESA)

Hybrid Radar Technology

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Material / Technology, Price Range, Installation Complexity, Global Presence)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Rafael Advanced Defense Systems

Israel Aerospace Industries

Airbus Defence and Space

Thales Group

Northrop Grumman

Lockheed Martin

Raytheon Technologies

Boeing

Saab Group

Harris Corporation

L3 Technologies

General Dynamics

Leonardo

Leonardo DRS

- Military Forces’ Growing Dependence on Advanced Radar

- Defense Contractors’ Role in Radar System Development

- Government Agencies’ Involvement in Procurement and Deployment

- Aerospace Companies’ Increasing Demand for Radar Systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035