Market Overview

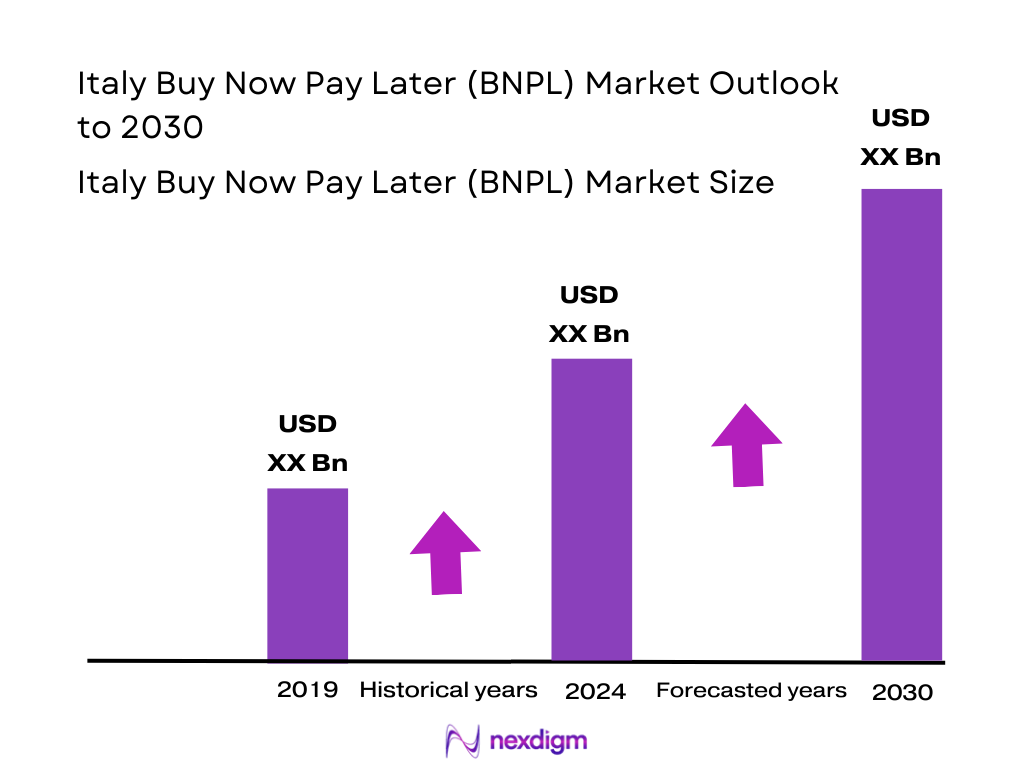

The Italy BNPL market is valued at USD 6.70 billion, based on a detailed analysis of past transactions and KPIs. This market size reflects the rapidly increasing gross merchandise value facilitated by BNPL platforms between 2023 and 2024, as reported by reliable industry bodies. The market’s expansion is driven by accelerating e‑commerce penetration, shifting consumer preferences favoring flexible payments, and broadening provider ecosystems.

Major Italian cities like Milan and Rome dominate the BNPL landscape, attributable to their high concentrations of e‑commerce merchants, tech‑savvy populations, and significant retail volumes. These urban hubs benefit from dense digital infrastructure and a consumer base open to innovative payment methods, enabling faster adoption and broader reach of BNPL services throughout the country.

Market Segmentation

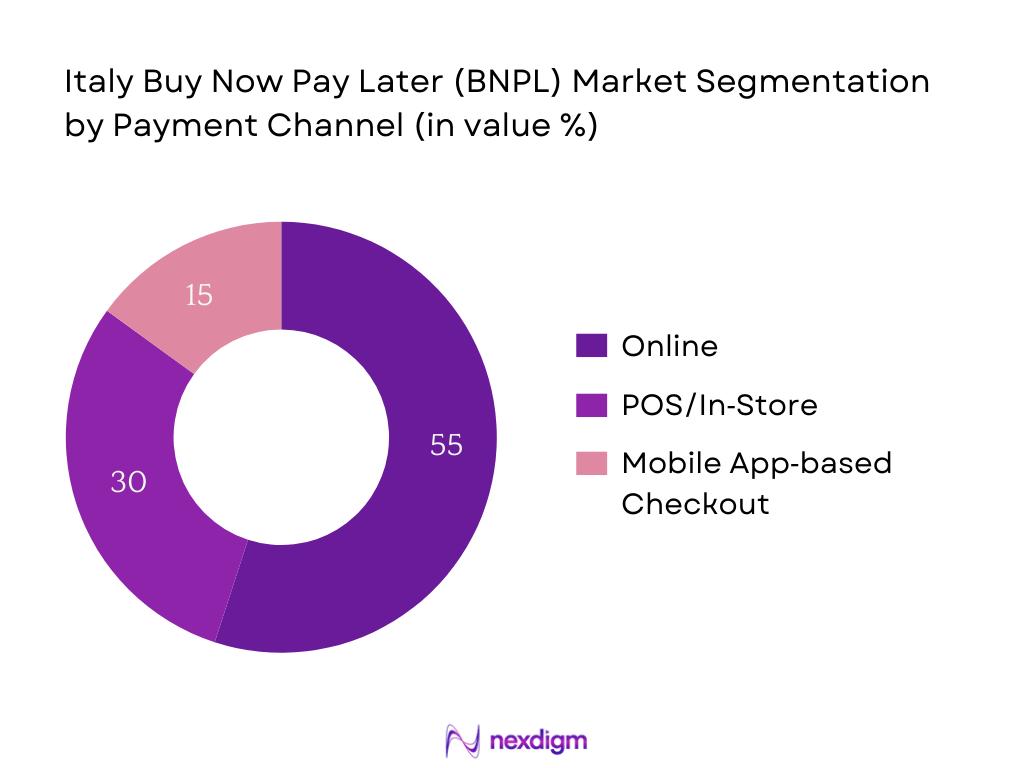

By Payment Channel

Italy BNPL market is segmented into Online, POS/In‑Store, and Mobile App payments. The Online sub‑segment leads in market share, due to strong expansion of e‑commerce platforms and consumer comfort with digital checkouts. BNPL’s appeal of splitting payments resonates deeply during online shopping, supported by seamless integrations, promotional exposures, and flexibility advantages. Retailers incentivize BNPL through lower cart abandonment rates and higher average order values. Meanwhile, younger demographics prefer digital-first solutions, further reinforcing Online BNPL’s dominance. The proliferation of established e‑commerce marketplaces and fintech integrations makes Online BNPL the primary channel by value in Italy, outpacing traditional in‑store and mobile checkout options.

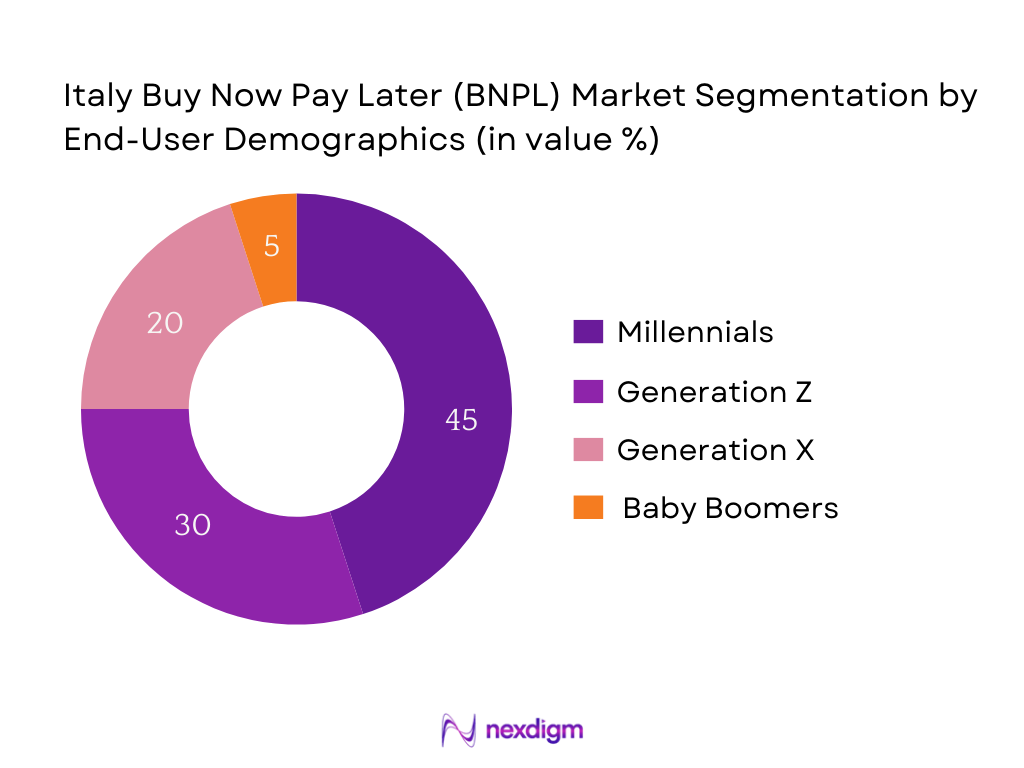

By End‑User Demographics

Italy BNPL market is segmented by age categories: Millennials, Generation Z, Generation X, and Baby Boomers. Millennials hold the largest share, as they balance starting or raising families with budget-conscious lifestyles, and often favor flexible, interest-free payment methods. Their strong digital literacy, combined with high e‑commerce engagement, makes them a key BNPL cohort. Millennials are also heavily targeted by merchants and BNPL providers through tailored offers, loyalty rewards, and personalized experiences. Their payment behavior aligns closely with BNPL’s value proposition—budget management without credit cards. This balance of online purchasing power and openness to installment pay boosts Millennials to the top demographic for Italy’s BNPL market.

Competitive Landscape

The Italy BNPL market features a concentrated competitive environment, with prominent global and local players driving innovation and partnerships. Market dynamics are shaped by Fintech disruptors, traditional finance entrants, and embedded retail solutions.

| Company | Establishment Year | Headquarters | Merchant Integration Capability | Underwriting Model | Mobile App Strength | Localized Compliance | Brand Awareness |

| Scalapay | — (Fintech entrant) | Milan, Italy | — | — | — | — | — |

| Klarna | 2005 | Stockholm, Sweden | — | — | — | — | — |

| PagoLight (Compass) | — | Italy | — | — | — | — | — |

| Soisy | — | Italy | — | — | — | — | — |

| PayPal BNPL | 1998 | USA | — | — | — | — | — |

Italy BNPL Market Analysis

Key Growth Drivers

E‑Commerce Acceleration and Smartphone‑Driven Retail

Italy’s digital transformation is reflected in its economy: GDP in nominal US dollars reached USD 2.377 trillion in 2024, up from USD 2.302 trillion in 2023, showing resilience amid modest real growth of 0.7%. Concurrently, Italians embraced digital retail—with card payments projected to hit €410.2 billion in 2025, rising from €385 billion in 2024. Smartphone use and payment digitisation underpin online shopping uptake across all age groups and regions, especially in urban centers. Such payment dynamics directly feed into BNPL adoption: consumers increasingly opt for installment options during checkout in e‑commerce and mobile contexts, enabled by widespread smartphone penetration and digitally enabled retail. These macro shifts in GDP and payment flows indicate favorable structural conditions for BNPL’s continued expansion.

Youth Credit Aversion & Gen Z Spending Behavior

Italy’s youth unemployment, a proxy for financial insecurity among younger consumers, stood at 20.5% in May 2024, highlighting a sizable demographic facing income constraints. At the same time, average gross salary is approximately €2,968 per month. This environment fosters alternative payment methods that avoid traditional credit burdens. BNPL appeals to Gen Z (under 25), offering interest‑free installments without credit‑card debt. Their preference for digital-first, flexible payments aligns with higher smartphone usage and e‑commerce activity. As Italy’s youth represent a large and economically cautious cohort, growing BNPL uptake is supported by macro indicators—high youth unemployment paired with modest disposable income—driving reliance on budget‑friendly purchasing options.

Key Market Challenges

Regulatory Transition under EU CCD II

Italy must align with the EU’s revised Consumer Credit Directive (CCD II), which removes previous exemptions for BNPL schemes and will apply to deferred payment offerings beyond a 50-day interest‑free window. Transposition into Italian law is mandated by 20 November 2025, with full implementation by 20 November 2026. During this period, BNPL providers face uncertainty over compliance requirements, especially for large merchants who may now require registration and additional reporting with the Italian supervisory authority. This transition introduces operational complexity and increased regulatory costs, potentially limiting BNPL options in the interim.

Ambiguity over Merchant Intermediary Status and SPV Liability

Under CCD II and Italy’s draft decree, merchant participation as credit intermediaries is subject to stringent new registration and organizational obligations, particularly for non‑SMEs. Additionally, securitization structures typical of BNPL setups—where receivables are sold to SPVs—face unclear legal accountability: it is uncertain who (originator, servicer, SPV) is responsible for credit assessments, pre‑contractual duties, or compliance. This legal ambiguity can deter partnerships between BNPL providers and merchants, hamper use of structured financing vehicles, and elevate liability concerns in the Italian market.

Opportunities

Expansion in Healthcare, Travel, and Luxury Sectors

Italy’s tourism continues to be an economic powerhouse: 2024 saw international tourist expenditure reach over €55 billion, up from €50 billion in 2023. Domestic tourism added €122.6 billion in 2024 spending. Healthcare infrastructure spends at USD 3,228 per capita in 2023, rising from USD 3,135 in 2022. Luxury tourism contributes significantly: luxury tourists—though only representing 1% of accommodation businesses—generate 25% of tourist expenditure, roughly €25 billion directly and €60 billion including indirect spending. These substantial 2024 finance flows in travel, healthcare, and luxury segments suggest fertile ground for BNPL adoption—particularly for high‑ticket travel packages, elective medical services, and premium experiences. Consumers are likely to adopt installment-based financing in these sectors, offering strong opportunity without relying on projected future figures.

BNPL‑as‑a‑Service Models for SMEs

As mentioned earlier, Italy is home to over 4 million SMEs tracking 13 million employees and delivering over 65% of added value. While SMEs face digital skill shortages relative to EU peers, Italy’s macroeconomic landscape—characterized by fragmented commerce and many small-scale merchants—creates ideal conditions for BNPL-as-a-Service offerings. These solutions allow SMEs to deploy installment payments rapidly through plug‑in modules and API setups, bypassing internal capability constraints. With SMEs forming the backbone of Italy’s economy, facilitating their access to BNPL via simplified technological integration is a compelling growth lever, grounded in current economic structure and workforce data.

Future Outlook

Over the coming years, the Italy BNPL market is positioned for continued expansion, powered by sustained e‑commerce growth, deeper merchant integrations, and evolving regulatory clarity. These dynamics will expand access, consumer trust, and innovation across retail sectors. Projected market progression indicates a climb from USD 6.70 billion in value to USD 12.41 billion, underpinned by an average CAGR of 10.2% for the period 2024–2030. Additionally, alternative sources expect even stronger growth: from USD 636.1 million in 2023 to USD 5.61 billion by 2030, reflecting a robust 30.6% CAGR

Major Players

- Scalapay

- Klarna

- Compass (PagoLight)

- Soisy

- PayPal BNPL

- Afterpay (Block)

- Younited Credit

- Cofidis

- Floa Bank

- Mash

- Zip Co

- Nexi (embedded financial systems)

- PausePay

- Revolut

- Ubuy

Key Target Audience

- Payments and e‑commerce divisions of major retail enterprises

- Italy‑based investments and venture capitalist firms

- CFOs and strategy teams at banks entering BNPL

- Product development heads at digital wallet providers

- Heads of government and regulatory bodies (e.g., Bank of Italy, CONSOB)

- Strategic planning executives at large Fintech platforms

- Board members at card networks expanding into installment finance

- Marketing directors at BNPL providers targeting Italian consumers

Research Methodology

Step 1: Identification of Key Variables

We conducted exhaustive desk research—including Italian financial databases, e‑commerce performance reports, and regulatory documents—to map stakeholders such as fintechs, banks, retailers, and consumers. This defined the critical variables for Italy’s BNPL dynamics.

Step 2: Market Analysis and Construction

Historical data from 2019 to 2024 (e‑commerce sales, average ticket size, number of BNPL transactions) were consolidated to model transaction values. Projections were validated by comparing multiple forecast sources to ensure accuracy in revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses—such as age-related adoption patterns and channel shifts—were validated through interviews with Italian industry professionals, including BNPL platform executives and merchant analysts, detangling market behaviors.

Step 4: Research Synthesis and Final Output

We combined bottom‑up modeling with company-specific input to cross‑check projections and consumer trends. This final synthesis yielded a validated, detailed report specific to Italy’s BNPL landscape.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Historical Evolution

- Timeline of Major BNPL Entrants in Italy

- Business Cycle – Italian Retail and Payment Seasonality

- Supply Chain and Value Chain Analysis

- Key Growth Drivers

E-Commerce Acceleration and Smartphone-Driven Retail

Youth Credit Aversion & Gen Z Spending Behavior

Entry of Banks into BNPL & Digital Credit Innovation

Retail Integration and API-Powered Merchant Adoption - Key Market Challenges

Regulatory Transition under EU CCD II

High Delinquency Risk in Underbanked Segments

Limited Merchant Education on BNPL Margins

Consumer Debt Accumulation and Overspending Risks - Opportunities

Expansion in Healthcare, Travel, and Luxury Sectors

BNPL-as-a-Service Models for SMEs

Cross-Border Integration with EU BNPL Providers

AI/ML Credit Risk Underwriting in BNPL - Trends

Average BNPL Ticket Size (~€149)

Embedded BNPL in Subscription Commerce

Green/ESG-Centric BNPL Programs - Government Regulations

Impact of CCD II and Consumer Credit Oversight

Data Privacy & Consent under GDPR for BNPL - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value (Market Size in EUR, USD), 2019-2024

- By Volume (Transaction Count, Average Ticket Size), 2019-2024

- Market Penetration Rate (% of Online Retail Transactions), 2019-2024

- By Payment Channel (In Value %)

Online

POS/In-Store

Mobile

App-based BNPL

Contactless/NFC - By End-User Demographics (In Value %)

Generation Z

Millennials

Generation X

Baby Boomers

Seniors (65+) - By Industry/Application (In Value %)

Fashion & Apparel

Electronics & Gadgets

Travel & Hospitality

Healthcare & Wellness

Furniture & Home Appliances - By Provider Type (In Value %)

Fintech-native BNPL

Bank-led BNPL

Retailer-embedded BNPL

Payment Gateway BNPL

Telco/Utility BNPL - By Loan Duration (In Value %)

Pay-in-3 (Short Term)

Pay-in-6 or Pay-in-12 (Medium Term)

Deferred Pay Full (30–45 Days)

Recurring Installment Plans

Flexible/AI-based Term Lending

- Market Share of Major Players (by Value and Volume)

Market Share by Provider Type

Market Share by Merchant Type (Large Retailers vs SMEs) - Cross Comparison Parameters (Company Overview, Business Strategies in Italy, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenue and Transaction Volumes, Revenue by Segment, Merchant Onboarding Capabilities, Distribution Channels, Credit Models and Risk Algorithms, Unique Value Proposition)

- SWOT Analysis of Major Players

- Pricing Analysis: Merchant Fees & Consumer Late Charges

- Detailed Profiles of Major Companies

Scalapay

Klarna

Compass (PagoLight)

Soisy

Younited Credit

PayPal

Afterpay (Block Inc.)

Cofidis

Floa Bank

Mash

Zip Co

Nexi

PausePay

Revolut

Ubuy

- Market Demand and Utilization Trends

- Digital Payment Behavior and Credit Attitudes

- Awareness of BNPL Offerings and Preferences

- Needs, Desires, and Pain Point Analysis by Demographic

- Decision-Making Process Across Age Segments

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Ticket Size and Repayment Duration, 2025-2030