Market Overview

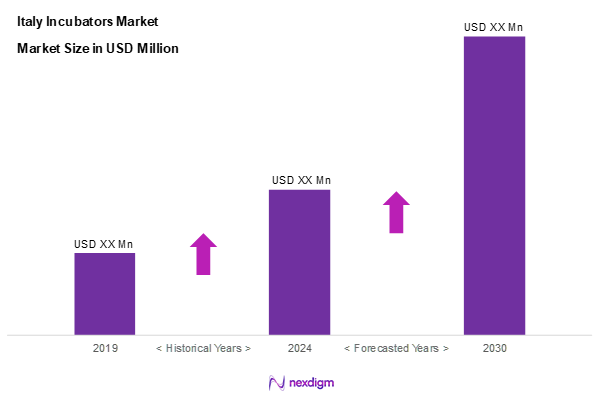

As of 2024, the Italy incubators market is valued at USD 450.3 million, with a growing CAGR of 5.4% from 2024 to 2030, reflecting robust growth due to an upsurge in entrepreneurial activities and supportive government policies. Driven by increased venture capital investments and rising interest in technology start-ups. This growth indicates a favourable business environment, attracting both local and international investors eager to support innovative ideas and sustainable business models.

Key cities such as Milan, Rome, and Turin dominate the Italy Incubators Market due to their significant industrial bases and the presence of numerous universities and research institutions. Milan, as a financial hub, offers access to a plethora of networking opportunities and investment sources. Rome, with its cultural appeal and diverse economy, serves as a fertile ground for businesses focused on creative and social innovation. Turin, historically known for its automotive industry, is transforming into a centre for technology-driven ventures, further enhancing the country’s overall incubator environment.

Market Segmentation

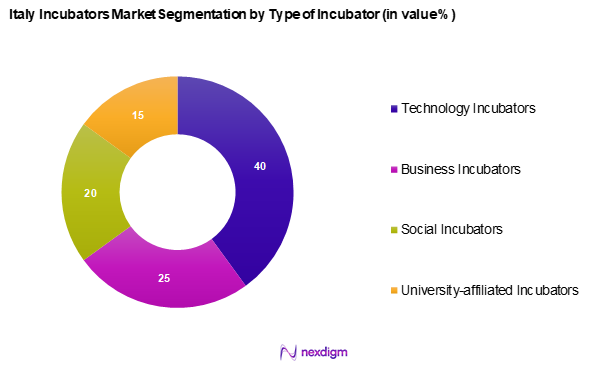

By Type of Incubator

The Italy incubators market is segmented into technology incubators, business incubators, social incubators, and university-affiliated incubators. Technology incubators currently dominate the market share, as they cater to the growing demand for innovative tech solutions that address modern challenges. This segment thrives due to the increasing focus on digital transformation across various industries. Many start-ups leverage these incubators to gain access to technical expertise, funding sources, and mentorship, which are critical in the early stages of their business. Moreover, as the global digital landscape evolves, technology incubators are likely to continue attracting budding entrepreneurs looking to capitalize on advancements in artificial intelligence, block chain, and other emerging technologies.

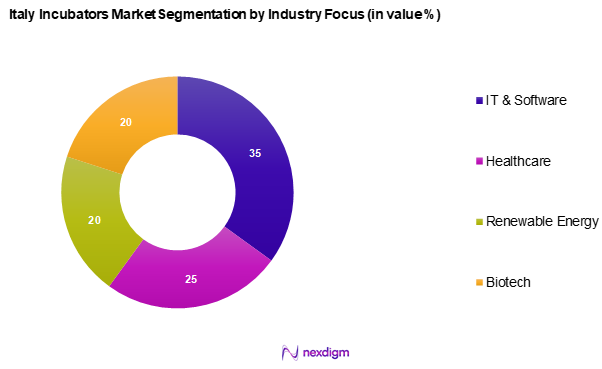

By Industry Focus

The Italy incubators market is segmented into IT & software, healthcare, renewable energy, and biotech. The IT & software sub-segment is leading market share due to the remarkable acceleration of digital solutions and services in recent years. With an increasing number of companies looking for software-based solutions to enhance productivity and efficiency, startups focusing on IT and software development are finding substantial support from incubators. This nurturing environment allows innovators to thrive, given that technology has become integral to nearly every sector of the economy. Consequently, IT & software startups are thriving as they tap into this demand for efficient and integrated technological solutions, further cementing their dominance in the incubator space.

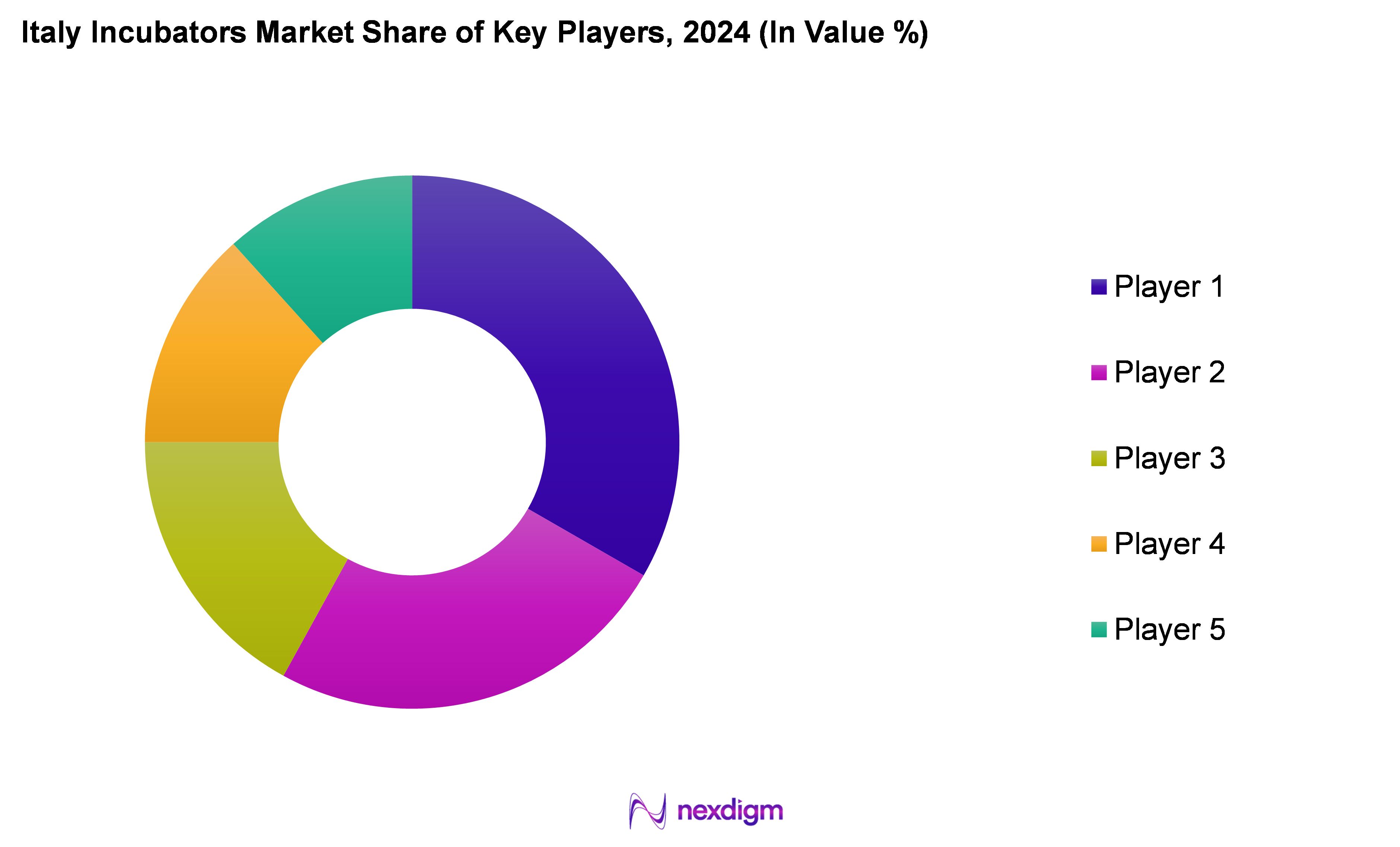

Competitive Landscape

The Italy incubators market is characterized by the presence of key players, both local and international, that contribute significantly to its growth. Major players include LUISS EnLabs, H-FARM, and Impact Hub, among others. This consolidation of diverse companies enhances competition and drives innovation within the market.

| Player | Establishment Year | Headquarters | Revenue (USD) | Focus Area | Number of Startups Incubated | Major Partnerships |

| LUISS EnLabs | 2010 | Rome, Italy | – | – | – | – |

| H-FARM | 2005 | Genoa, Italy | – | – | – | – |

| Impact Hub | 2005 | Vienna, Austria | – | – | – | – |

| Digital Magics | 2003 | Milan, Italy | – | – | – | – |

| TIM WCAP | 2009 | Rome, Italy | – | – | – | – |

Italy Incubators Market Analysis

Growth Drivers

Rise in Entrepreneurship

Italy has seen a growing interest in entrepreneurship, particularly among younger populations and university graduates. This trend is supported by a cultural shift towards innovation and self-employment. More individuals are seeking to build their own ventures rather than pursuing traditional career paths. This environment encourages the development and expansion of incubators to support these early-stage businesses.

Increase in Venture Capital Investment

Venture capital activity in Italy has been steadily growing, creating a more vibrant startup ecosystem. Investors are increasingly willing to fund early-stage companies, which fuels demand for incubator support. This financial backing provides startups with greater resources to scale their operations. As a result, incubators are becoming more attractive and essential within the market.

Market Challenges

Regulatory Hurdles

Complex regulatory frameworks in Italy can create barriers for both startups and incubators. The bureaucratic processes involved in setting up a business are often time-consuming and unclear. This environment can discourage innovation and limit the speed at which incubators can support new ventures. Navigating these regulations requires significant effort and often external legal support.

Competition from International Markets

Italian incubators face strong competition from well-established international programs, particularly those in more developed startup ecosystems. Startups may prefer to join incubators abroad that offer broader networks and more advanced resources. This can result in a talent drain and reduce the appeal of local incubators. It also challenges Italian incubators to continuously innovate and remain competitive.

Opportunities

Rise of Digital Health Startups

Digital health is emerging as a high-growth sector in Italy, driven by innovation in healthcare technology and growing public demand. Startups in this space require specialized support, which incubators are increasingly equipped to provide. This sector offers significant potential for incubators to carve out a niche. The trend also aligns with broader government interest in health tech innovation.

Potential for Cross-Industry Collaboration

There is a growing opportunity for incubators to foster collaboration across different sectors such as technology, design, agriculture, and manufacturing. Such synergy can create unique value propositions and drive innovation at the intersection of industries. Incubators that facilitate these partnerships can help startups access diverse expertise and markets. This collaborative approach enhances both creativity and competitiveness.

Future Outlook

The outlook for the Italy Incubators Market indicates significant growth potential over the coming years, driven by ongoing investments in digital infrastructure, supportive governmental policies, and an increase in the diversification of incubated sectors. Continuous advancements in technology, coupled with rising demand for innovative solutions from an entrepreneurial perspective, paint a favourable picture for this market’s future. The sustained collaboration among universities, businesses, and public entities is expected to create a robust ecosystem conducive to nurturing start-ups and fostering sustainable business practices.

Major Players

- LUISS EnLabs

- H-FARM

- Impact Hub

- Digital Magics

- TIM WCAP

- I3P

- PoliHub

- Venture Factory

- Seedlab

- Startup Bootcamp

- 500 Startups

- Infactory

- Faber Ventures

- Plug and Play Tech Center

Key Target Audience

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Italian Ministry of Economic Development)

- Corporate Innovation Teams

- Start-up Founders and Entrepreneurs

- Industry Associations and Trade Bodies

- Technology Transfer Offices

- Economic Development Agencies

- Business Development Managers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Italy Incubators Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, including the types of incubators and the sectors they cater to.

Step 2: Market Analysis and Construction

In this phase, we compile and analyse historical data pertaining to the Italy Incubators Market. This involves assessing market penetration rates, the ratio of incubators to active start-ups, and resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates, providing a solid foundation for our analysis.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through Computer-Assisted Telephone Interviews (CATI) with industry experts representing diverse companies in the incubators sector. These consultations will provide valuable operational and financial insights directly from practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple incubators and start-up accelerators to acquire detailed insights into product segments, funding dynamics, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Italy Incubators Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Rise in Entrepreneurship

Increase in Venture Capital Investment - Market Challenges

Regulatory Hurdles

Competition from International Markets - Opportunities

Rise of Digital Health Startups

Potential for Cross-Industry Collaboration - Trends

Growth of Remote Incubation

Focus on Sustainability - Government Regulation

Funding Policies

Tax Incentives - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Investment, 2019-2024

- By Type of Incubator (In Value %)

Technology Incubators

Business Incubators

Social Incubators

University-affiliated Incubators - By Stage of Development (In Value %)

Pre-Seed

Seed

Growth - By Region (In Value %)

Northern Italy

Central Italy

Southern Italy - By Industry Focus (In Value %)

IT & Software

Healthcare

Renewable Energy

Biotech - By Funding Type (In Value %)

Publicly Funded

Privately Funded

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Incubator, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Client Acquisition Strategy, Number of Active Start-ups, Distribution of Resources, Unique Value Proposition)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

LUISS EnLabs

Startup Bootcamp

H-FARM

Impact Hub

Digital Magics

I3P

PoliHub

TIM WCAP

Venture Factory

500 Startups

Faber Ventures

Seedlab

Seedrs

Plug and Play Tech Center

Infactory

- Market Demand and Utilization

- Funding Behaviour and Preferences

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Investment, 2025-2030