Market Overview

The Japan aerospace and defense carbon brake market is valued at approximately USD ~ billion in 2025. This market is primarily driven by the growing demand for lightweight, high-performance braking systems, especially in the commercial and military aircraft sectors. The increasing adoption of carbon-carbon composite materials due to their superior heat resistance and durability plays a pivotal role in the expansion of this market. Japan’s emphasis on aerospace innovation, bolstered by the country’s advanced manufacturing capabilities and defense modernization programs, further contributes to the robust growth of this market.

Japan dominates the aerospace and defense carbon brake market, primarily due to its leading aerospace companies and strong defense sector. Cities like Tokyo and Nagoya are key hubs for aerospace manufacturing and technological development. Major players such as Mitsubishi Heavy Industries and Kawasaki Heavy Industries are based here, driving both civilian and defense applications for carbon brakes. Japan’s strategic investments in defense and its role in international aerospace collaborations reinforce its position as a dominant player in the market

Market Segmentation

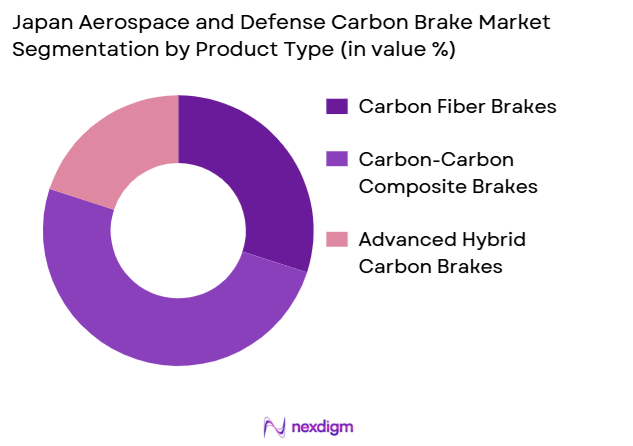

By Product Type

The Japan aerospace and defense carbon brake market is segmented by product type into carbon fiber brakes, carbon-carbon composite brakes, and advanced hybrid carbon brakes. Among these, carbon-carbon composite brakes hold the largest market share, as they are specifically designed for high-performance applications such as military aircraft and commercial wide-body jets. Carbon-carbon brakes are known for their lightweight and superior heat dissipation properties, which make them ideal for applications with high operational demands and frequent brake cycles. The dominance of this segment can be attributed to the ongoing trend of improving fuel efficiency and reducing maintenance costs in both military and commercial aviation sectors.

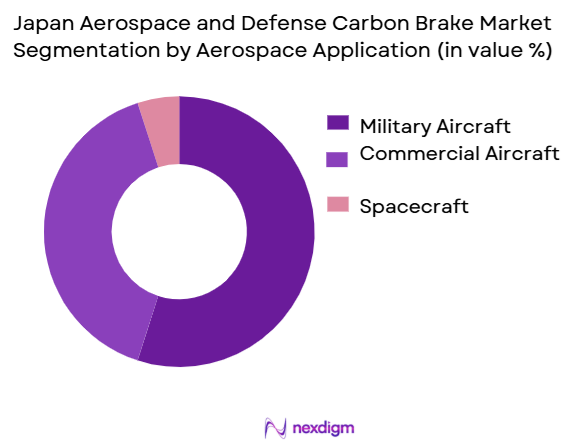

By Aerospace Application

In terms of aerospace applications, the market is divided into military aircraft, commercial aircraft, and spacecraft. The military aircraft segment holds the largest share in the Japanese market. This is primarily driven by Japan’s defense expenditure and the increasing need for advanced braking solutions in next-generation fighter jets and transport aircraft. The Japanese Self-Defense Forces (JSDF) and other defense contractors rely on high-performance carbon brakes for their aircraft, making this segment a key player in the overall market. Additionally, advancements in hybrid and carbon-carbon technologies are being integrated into both military and commercial aircraft, further driving growth.

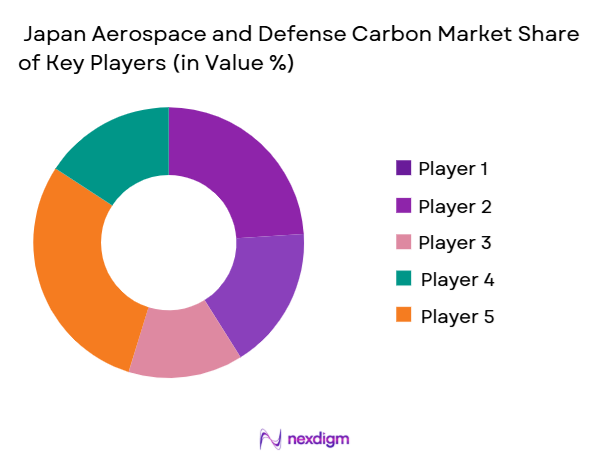

Competitive Landscape

The Japanese aerospace and defense carbon brake market is highly competitive, with both domestic and international players vying for dominance. Global leaders such as Safran Landing Systems, Honeywell Aerospace, and Collins Aerospace have a strong presence in the market. At the same time, Japanese companies like Mitsubishi Heavy Industries and Kawasaki Heavy Industries continue to expand their capabilities, focusing on innovation and developing tailored solutions for the Japanese aerospace industry.The market is characterized by a few key players who control a significant portion of the market share. These companies are heavily involved in research and development, ensuring the continual advancement of brake technologies. Furthermore, strategic partnerships with aircraft OEMs and MRO providers play a crucial role in shaping the competitive dynamics.

| Company Name | Establishment Year | Headquarters | Brake System Efficiency | Regulatory Approvals | Market Reach | R&D Investment | Technological Advancements | Strategic Partnerships |

| Safran Landing Systems | 2005 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1906 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 1933 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Mitsubishi Heavy Industries | 1870 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Kawasaki Heavy Industries | 1896 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

Market Analysis

Growth Drivers

Urbanization

Urbanization plays a key role in driving the aerospace and defense carbon brake market in Japan. Japan has one of the most urbanized populations in the world, with ~% of its population living in urban areas as of 2025, according to the United Nations. The growth of urbanization directly impacts the demand for commercial aircraft, especially in regions with heavy urban development, such as Tokyo and Osaka. This urban expansion fosters an increase in both domestic and international air travel, boosting the need for advanced aerospace components, including carbon braking systems for lighter, more fuel-efficient aircraft. Additionally, Japan’s robust transport infrastructure, including airports such as Narita and Haneda, supports the continuous demand for high-performance brake systems in commercial aviation.

Industrialization

The industrialization of Japan’s aerospace and defense sectors has a significant influence on the growth of the aerospace and defense carbon brake market. Japan’s aerospace sector has seen steady growth with substantial government support, as evidenced by the 2025 increase in defense-related production, which saw a rise in Japan’s defense expenditure to USD ~billion. This growth in defense spending leads to greater demand for military aircraft, furthering the need for durable, lightweight materials like carbon composite brakes. Additionally, the industrial production index in Japan saw a ~% increase in 2025, indicating a strong manufacturing base capable of meeting the rising demand for aerospace components. Japan’s industrialization efforts in defense manufacturing foster the continued adoption of cutting-edge technologies, including carbon brakes.

Restraints

High Initial Costs

The high initial costs of carbon brake systems act as a restraint in the Japan aerospace and defense carbon brake market. In 2025, Japan’s manufacturing industry faced a ~% rise in material costs, particularly for high-performance carbon composites, which remain expensive compared to traditional metallic brake systems. The production of carbon brakes involves complex processes, including high temperatures and precision manufacturing, which further drive up costs. The initial setup and maintenance of these systems can significantly impact defense budgets, particularly in Japan’s defense sector, where military aircraft procurement and modernization programs already face financial constraints. Despite the growing demand for advanced materials, these high costs remain a significant barrier to adoption, particularly in the commercial aviation segment.

Technical Challenges

Technical challenges are a significant barrier to the widespread adoption of carbon brakes in the Japanese aerospace and defense sector. The integration of carbon-based braking systems into various aerospace platforms requires overcoming challenges in material performance, manufacturing techniques, and system integration. For instance, carbon-carbon composites, while excellent at high temperatures, are vulnerable to thermal fatigue under extreme conditions, posing a challenge for military applications in Japan’s fighter jets and transport aircraft. The complexity of manufacturing carbon brake systems with consistent quality and durability requires substantial technical expertise. Moreover, the lack of skilled technicians in certain advanced manufacturing processes has been a recurring issue, slowing the adoption of these systems. These technical difficulties are compounded by the need for specialized testing and certification, which can delay production schedules.

Opportunities

Technological Advancements

Technological advancements present significant opportunities for the Japan aerospace and defense carbon brake market. In recent years, Japan’s aerospace industry has witnessed breakthroughs in carbon brake materials, particularly in hybrid carbon composites and carbon-carbon composites. The Japanese government’s commitment to technological innovation, evident in its 2025 investment of USD ~billion in aerospace research and development, fosters advancements that reduce the weight of components and increase their heat resistance. Additionally, collaborations between Japan’s leading aerospace manufacturers and universities have spurred innovations in manufacturing processes like additive manufacturing (3D printing), which reduces production time and costs. These technological improvements enhance brake system performance, offering a strong growth potential for carbon brake adoption in both the defense and commercial aviation sectors.

International Collaborations

International collaborations present a key opportunity for expanding the Japan aerospace and defense carbon brake market. Japan’s aerospace industry has actively pursued partnerships with global players such as Boeing and Airbus, focusing on developing cutting-edge technologies for commercial aircraft. The 2025 collaboration between Japan’s Mitsubishi Heavy Industries and the European Union in the development of lighter aircraft materials has paved the way for broader international partnerships in the carbon brake sector. These collaborations not only provide Japan with access to advanced technology but also enhance its competitiveness in the global market. As Japan strengthens its aerospace ties with the United States, Europe, and other regions, opportunities for exporting advanced carbon braking systems will increase, further fueling market growth.

Future Outlook

Over the next five years, the Japan aerospace and defense carbon brake market is expected to show continued growth, driven by increasing investments in defense technologies, the modernization of commercial aircraft fleets, and the growing demand for lightweight materials. The ongoing development of next-generation aircraft, both military and commercial, is expected to further propel the adoption of advanced carbon brake technologies. Moreover, advancements in hybrid and carbon-carbon brake materials will provide the necessary performance enhancements required for emerging aerospace applications.

Major Players in the Market

- Safran Landing Systems

- Honeywell Aerospace

- Collins Aerospace

- Mitsubishi Heavy Industries

- Kawasaki Heavy Industries

- Meggitt PLC

- Rolls-Royce

- GE Aviation

- Parker Hannifin Corporation

- GKN Aerospace

- SGL Carbon

- Liebherr-Aerospace

- UTC Aerospace Systems

- Calspan Corporation

- Airbus Group

Key Target Audience

- Aerospace OEMs

- Defense and Aerospace Contractors

- Military and Commercial Aircraft Operators

- MRO Service Providers

- Carbon Brake Manufacturers and Suppliers

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies

- Aerospace Research Institutions

Research Methodology

Step 1: Identification of Key Variables

The first step in this research involves identifying the key variables influencing the Japan aerospace and defense carbon brake market. This is done through a comprehensive market review, utilizing secondary data sources and proprietary databases. Key stakeholders within the aerospace and defense sectors are mapped to identify influential drivers and barriers for market growth.

Step 2: Market Analysis and Construction

In this phase, historical data on the aerospace and defense carbon brake market is gathered. This includes analysis of revenue trends, product types, and the growth patterns in both the commercial and military segments. The market’s performance over the past five years provides the foundation for constructing accurate future projections.

Step 3: Hypothesis Validation and Expert Consultation

To validate the initial hypotheses, in-depth consultations are conducted with aerospace industry experts, including manufacturers, OEMs, and regulatory bodies. These consultations, through structured interviews, help refine market assumptions and enhance the accuracy of forecasts.

Step 4: Research Synthesis and Final Output

The final phase consolidates the insights gathered from data analysis, expert consultations, and market reviews. This phase ensures that the research findings are comprehensive and accurate, offering a complete picture of the Japan aerospace and defense carbon brake market.

- Executive Summary

- Research Methodology(Market Definitions and Assumptions, Japan-Specific Terminologies and Metrics, Abbreviations & Acronyms, Market Sizing Approach , Triangulation Framework for Data Integrity, Primary Research Insights: OEMs, Tier-1 Suppliers, MRO Providers, Supply-Side & Demand-Side Analysis Weightage, Data Reliability Index & Limitations, Forward-Looking Assumptions)

- Definition and Scope of Aerospace and Defense Carbon Brakes

- Market Genesis and Evolution Pathway in Japan

- Japan Aerospace and Defense Carbon Brake Industry Timeline

- Aerospace and Defense Carbon Brake Business Cycle

- Supply Chain & Value Chain Analysis

- Market Trends Shaping the Aerospace and Defense Carbon Brake Landscape

- Regulatory Landscape Impacting Aerospace and Defense Carbon Brake Systems

- Key Growth Drivers

Technological Advancements in Aerospace Braking Systems

Growth in Aerospace Fleet Size & New Aircraft Programs

Push for Lightweight Materials and Fuel Efficiency

Rising Focus on Sustainability in Aerospace Manufacturing

- Market Challenges

High Initial Cost of Carbon Brakes

Regulatory Constraints on Material Usage and Manufacturing

- Key Trends

Shift Towards Hybrid and Carbon-Carbon Braking Technologies

Integration of Carbon Brakes in Spacecraft and Autonomous Aircraft

Efforts to Reduce Maintenance Costs and Enhance Brake System Performance

- Market Opportunities

Advanced Braking Solutions for Military Aircraft

Demand for Carbon Brakes in New-Generation Commercial Aircraft

Strategic Investment in Japan’s Aerospace Sector - Government Regulations

Japan’s National Aerospace Safety Regulations

International Standards and Compliance

Environmental Regulations for Sustainable Aerospace Manufacturing

- SWOT Analysis

- Porter’s Five Forces Analysis

- By Value, 2020-2025

- By Volume, 2020-2025

- By Average Price, 2020-2025

- By Product Type Adoption, 2020-2025

- By Aerospace Platform, 2020-2025

- By Region, 2020-2025

- By Product Type (In Value %)

Carbon Fiber Brakes

Carbon-Carbon Composite Brakes

Advanced Hybrid Carbon Brakes - By Aerospace Application (In Value %)

Military Aircraft

Commercial Aircraft

Spacecraft

UAVs - By Brake System Type (In Value %)

Wheel Brakes

Emergency Brakes

Anti-Skid Brakes

Parking Brakes - By Distribution Channel (In Value %)

OEMs (Original Equipment Manufacturers)

Aftermarket (Retrofit, Spares)

Third-Party Distributors - By Region (In Value %)

Central Japan

Northern Japan

Southern Japan

Eastern Japan

- Market Share Analysis

- Cross Comparison Parameters(Product Portfolio Breadth & Technological Innovation, Brake System Efficiency & Security Features, Regulatory Approvals & Certifications JCAB, FAA, EASA, Global Distribution Reach & Local Manufacturing Footprint, R&D Investment & Technological Advancements, Strategic Partnerships and Collaborations)

- SWOT Analysis of Key Market Players

- Pricing Analysis

Price Trends for Carbon Brake Technologies Unit Pricing, Volume Discounts

Price Comparison Across Leading Carbon Brake Providers - Detailed Company Profiles

Safran Landing Systems

Collins Aerospace

Meggitt PLC

Honeywell Aerospace

Parker Hannifin Corporation

Brembo

SGL Carbon

GKN Aerospace

Rolls-Royce

GE Aviation

Airbus Group

Boeing

Liebherr-Aerospace

UTC Aerospace Systems

Calspan Corporation

- Demand Pattern & Utilization Metrics

- Procurement Models & Purchasing Cycles

- Compliance & Certification Expectations

- Consumer Needs, Desires & Pain-Point Mappin

- By Value, 2026-2035

- By Volume, 2026-2035

- By Average Selling Price, 2026-2035

- By Technology and Deployment Type, 2026-2035