Market Overview

The Japan aerospace and defense composites market is valued at approximately USD ~billion in 2024. This growth is driven by the increasing demand for lightweight, durable materials in military and commercial aerospace applications. Japan’s well-established aerospace sector, including key players like Mitsubishi Heavy Industries and Japan Aerospace Exploration Agency (JAXA), continues to focus on the development of advanced composite materials to enhance aircraft efficiency and performance. The country’s ongoing investment in defense modernization and technological innovation in composite materials contributes significantly to the market’s expansion.

Japan dominates the aerospace and defense composites market, with cities like Tokyo, Osaka, and Nagoya leading the charge. Tokyo is home to major defense contractors and aerospace companies, while Nagoya is a hub for aerospace manufacturing. The city of Kakegawa also plays a significant role, with Mitsubishi Heavy Industries operating a key facility there for aerospace composites. Japan’s dominance stems from its strong industrial base, strategic investments in defense technology, and significant advancements in aerospace composites. The Japanese government’s ongoing support for aerospace R&D further solidifies its position as a global leader.

Market Segmentation

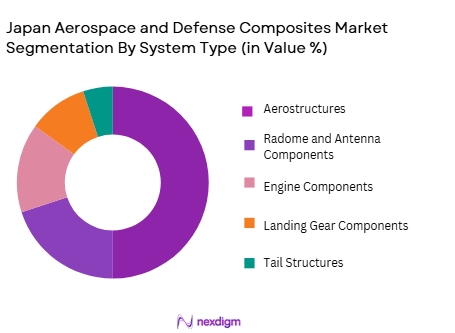

By System Type

The Japan aerospace and defense composites market is segmented by system type into aerostructures, radome and antenna components, engine components, landing gear components, and tail structures. The aerostructures segment holds a dominant position in the market. This dominance can be attributed to Japan’s significant investments in developing advanced aircraft like the Mitsubishi Regional Jet (MRJ), where aerostructures made from composite materials play a critical role in reducing weight and enhancing fuel efficiency. As Japan’s aerospace industry focuses on producing next-generation, fuel-efficient aircraft, aerostructures remain a key driver in the composites market.

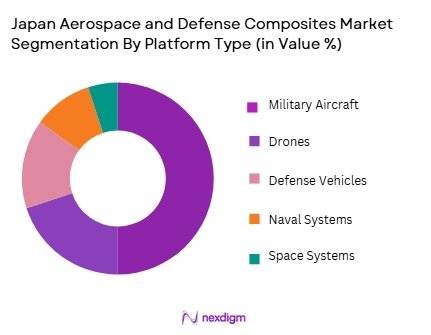

By Platform Type

The Japan aerospace and defense composites market is segmented by platform type, including military aircraft, drones, defense vehicles, naval systems, and space systems. Military aircraft dominate this segment, owing to Japan’s ongoing defense modernization efforts and emphasis on upgrading its fleet with lightweight, durable composite materials. The Japanese Air Self-Defense Force continues to invest heavily in advanced fighter jets, including the F-~, which extensively utilizes composite materials in its structure. Drones are also emerging as a significant market segment, with increasing demand for lightweight and durable materials that can withstand the operational demands of UAVs in defense applications.

Competitive Landscape

The Japan aerospace and defense composites market is highly competitive, dominated by a few major players. Companies like Mitsubishi Heavy Industries, Kawasaki Heavy Industries, and IHI Corporation are key players in the aerospace and defense sectors, leveraging their technological expertise and longstanding industry experience. These companies are involved in the manufacturing of composite materials used in aerospace applications, such as lightweight structures, radomes, and advanced engine components. Additionally, global aerospace giants like Boeing and Lockheed Martin play a significant role in influencing the market through their collaborations and partnerships with Japanese firms.

| Company Name | Establishment Year | Headquarters | Product Focus | Market Reach | Technological Advancements | Strategic Initiatives |

| Mitsubishi Heavy Industries | 1884 | Tokyo, Japan | ~ | ~ | ~ | ~ |

| Kawasaki Heavy Industries | 1878 | Kobe, Japan |

~ | ~ | ~ | ~ |

| IHI Corporation | 1853 | Tokyo, Japan | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ |

| Boeing | 1916 | Chicago,usa | ~ | ~ | ~ | ~ |

Japan Aerospace and Defense Composites Market Analysis

Growth Drivers

Demand for Lightweight, High‑Performance Materials

In Japan’s aerospace and defense sectors, there is a strong push toward lightweight, high‑strength composite materials—especially carbon fiber‑reinforced polymers—to improve fuel efficiency, payload capacity, and operational performance in aircraft, UAVs, and defense platforms. The expansion of the aerospace industry, fleet modernization efforts, and stringent environmental regulations accelerating the adoption of fuel‑efficient materials directly support composites demand. This growth is further underpinned by continuous R&D aimed at enhancing mechanical properties and durability, positioning composites as strategic materials in next‑generation aerospace and defense applications.

Technological Advancement and R&D Investment

Japan’s focus on advanced materials technology—such as innovations in carbon fiber composites, hybrid materials, and manufacturing processes—strengthens the composites market outlook. Increased investment from OEMs, defense primes, and research institutions accelerates the development of novel composites with greater strength‑to‑weight ratios, improved fatigue resistance, and multifunctional capabilities. Partnerships and collaborations between industry players and research entities also spur digitalization, automation, and smarter production methods, allowing more efficient integration of composites into complex aerospace and defense components.

Market Challenges

High Production & Certification Costs

The aerospace and defense composites market faces significant cost pressures related to the production, processing, and certification of advanced composite materials. High raw material costs—especially for carbon‑based composites—and expensive fabrication technologies make entry and scaling difficult for smaller suppliers. Additionally, rigorous industry certification and quality assurance standards for safety‑critical aerospace and military applications add time and expense to product development cycles. These cost barriers can slow adoption and constrain the competitiveness of Japanese composites firms relative to global peers focused on economies of scale.

Supply Chain Constraints & Material Availability

Another challenge lies in securing a resilient supply chain for advanced composite precursors and specialized fibers. Japan, like many other markets, relies on imports for some high‑end raw materials and sophisticated manufacturing equipment. Disruptions—arising from geopolitical tensions or logistic bottlenecks—can impact production continuity and cost stability. Furthermore, recycling and end‑of‑life management of composite materials remain underdeveloped, posing sustainability concerns and regulatory challenges as the industry seeks to balance performance with environmental responsibility.

Opportunities

Defense Modernization & Dual‑Use Applications

Japan’s strategic focus on defense modernization—coupled with increasing investments in autonomous systems, UAVs, and next‑generation aircraft—creates significant opportunities for advanced composites. Growth in unmanned and autonomous platforms that benefit from lightweight, high‑performance materials presents a fast‑expanding segment. Additionally, dual‑use applications that span military and commercial aerospace platforms allow composites manufacturers to leverage broader demand cycles and develop versatile, high‑value products that serve both markets.

Export Growth and International Collaboration

Expanding export opportunities through international defense and aerospace collaborations can unlock new markets for Japanese composite producers. Participation in multinational programs—such as next‑generation fighter projects and space initiatives—can facilitate technology transfer, scale production, and integrate Japanese composites into global supply chains. Exporting specialized composite solutions also allows Japanese firms to diversify revenue streams beyond domestic defense spending, enhancing long‑term resilience. Collaborative R&D with global partners can further accelerate innovation and market penetration.

Future Outlook

Over the next decade, the Japan aerospace and defense composites market is expected to continue its growth trajectory, driven by the increasing adoption of lightweight composite materials in both military and commercial aerospace sectors. As Japan’s defense budget rises, with a forecasted increase of around ~trillion yen in 2025, there is a growing emphasis on producing more efficient and durable aerospace systems. Japan is also focused on expanding its commercial aerospace capabilities, with the development of the Mitsubishi Regional Jet (MRJ) poised to increase the demand for composite materials. Technological advancements in manufacturing processes and the continuous push toward sustainability in aerospace will further fuel the market’s expansion during this period.

Major Players

- Mitsubishi Heavy Industries

- Kawasaki Heavy Industries

- IHI Corporation

- Lockheed Martin

- Boeing

- Northrop Grumman

- Airbus

- General Electric Aviation

- Raytheon Technologies

- Safran

- Thales Group

- Rolls-Royce

- Honeywell Aerospace

- Leonardo

- Saab

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aerospace and defense manufacturers

- Military agencies and contractors

- Aircraft manufacturers

- Aerospace material suppliers

- UAV manufacturers

- Aerospace research and development organizations

Research Methodology

Step 1: Identification of Key Variables

In this initial phase, we define and identify key market variables that influence the Japan aerospace and defense composites market. This includes analyzing demand drivers, technological advancements, regulatory frameworks, and other factors shaping the market. Extensive secondary research using industry databases and reports is conducted to map out all relevant market dynamics.

Step 2: Market Analysis and Construction

The market is analyzed by gathering historical data on the aerospace and defense composites market in Japan. This includes evaluating market penetration across different aircraft and defense platforms, as well as assessing trends in material adoption. Additionally, data on pricing, production rates, and market segmentation is compiled to construct an accurate market model.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses derived from initial data are validated through expert consultations, including interviews with key stakeholders in the aerospace and defense sectors. This phase ensures the reliability and accuracy of our market predictions by obtaining feedback from industry professionals and key players in Japan’s aerospace landscape.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing insights from primary and secondary research to validate the data. Engagements with aerospace manufacturers, research labs, and suppliers are used to refine market projections and confirm the results derived from earlier phases. The final report combines all validated findings and provides a comprehensive analysis of the Japan aerospace and defense composites market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased defense spending in Asia-Pacific

Rising demand for lightweight materials in military aircraft

Technological advancements in composite materials and manufacturing processes - Market Challenges

High initial costs of composite materials

Complexity in composite material certifications

Supply chain disruptions due to geopolitical tensions - Market Opportunities

Rising demand for UAVs and drones in defense and surveillance

Growing international collaborations in aerospace technology

Opportunities in the commercial aerospace sector for composite integration - Trends

Integration of composites in next-generation fighter jets

Adoption of AI and machine learning for composite manufacturing

Increased focus on sustainability and green technologies in aerospace - Government regulations

Export control laws on aerospace technologies

Regulations on the certification of composite materials in aerospace applications

Environmental standards for emissions from aerospace components - SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Aerostructures

Radome and Antenna Components

Engine Components

Landing Gear Components

Tail Structures - By Platform Type (In Value%)

Military Aircraft

Drones

Defense Vehicles

Naval Systems

Space Systems - By Fitment Type (In Value%)

OEM

Aftermarket

Upgrades & Refurbishments

Maintenance

Repair & Overhaul (MRO) - By EndUser Segment (In Value%)

Military

Commercial Aerospace

Defense Contractors

Government and Law Enforcement

Space Agencies - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Third-Party Distributors

E-commerce Platforms

Government Tenders

OEM Partnerships

- CrossComparison Parameters (Material innovation, Production capabilities, Compliance with regulations, Price competitiveness,Distribution network,Regulatory Compliance, Cost Structure, Performance Characteristics, Manufacturing Process, Application Sector, Material Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Mitsubishi Heavy Industries

Japan Aerospace Exploration Agency (JAXA)

Kawasaki Heavy Industries

IHI Corporation

Fujitsu Limited

Sumitomo Electric Industries

NTT Data Corporation

Safran

Rolls-Royce

GE Aviation

Northrop Grumman

Lockheed Martin

Boeing

Airbus

Thales Group

- Growing adoption of composites in military aircraft

- Increasing use of composites in drones and UAVs for surveillance and reconnaissance

- High demand for advanced composites in the commercial aerospace sector

- Government agencies and law enforcement agencies increasing investments in advanced defense technologies

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035