Market Overview

The Japan aerospace and defense connectors market is valued at approximately USD ~ billion, driven by the increasing demand for high-performance, reliable connectors in aerospace and defense systems. The market growth is fueled by the expansion of military and aerospace sectors, emphasizing precision engineering, miniaturization, and enhanced connectivity solutions. The integration of advanced technologies like AI, IoT, and next-generation communication systems further propels market demand. Government defense budgets and commercial aerospace expansions are key contributors to the robust growth in connector applications, particularly in unmanned aerial vehicles (UAVs), military aircraft, and space programs.

Japan, a global leader in the aerospace and defense industry, dominates the market due to its highly developed manufacturing infrastructure, technological advancements, and strong government backing. Tokyo and Osaka are the key cities driving the market, thanks to their proximity to major aerospace and defense manufacturers like Mitsubishi Heavy Industries and Japan Aerospace Exploration Agency (JAXA). The country’s commitment to innovation, strategic defense initiatives, and its position as a key player in global aerospace supply chains contribute significantly to its dominance.

Market Segmentation

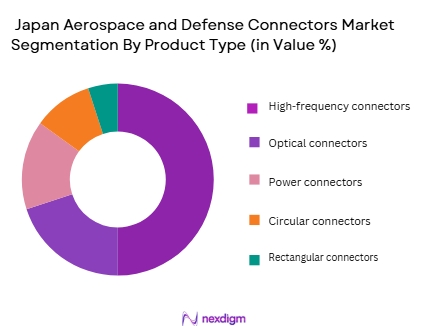

By Product Type

The Japan aerospace and defense connectors market is segmented by product type into high-frequency connectors, optical connectors, power connectors, circular connectors, and rectangular connectors. High-frequency connectors have a dominant market share, driven by their increasing use in military and aerospace applications that require efficient signal transmission for communication systems. These connectors are crucial in avionics, radar systems, and satellite communications, where minimizing signal loss is vital. The continued development of next-generation communication systems, such as 5G, fuels the demand for these connectors, making them the preferred choice for high-performance aerospace systems.

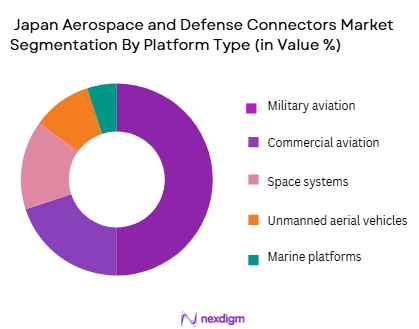

By Platform Type

The market is also segmented by platform type into commercial aviation, military aviation, space systems, unmanned aerial vehicles (UAVs), and marine platforms. Military aviation holds the largest market share in this segment, as defense forces globally invest in advanced military aircraft and defense systems. These systems require connectors that can withstand extreme conditions, including high temperatures, vibration, and electromagnetic interference. Japan’s commitment to upgrading its military infrastructure, combined with the growth in defense spending, makes military aviation the dominant platform, requiring robust connectors for applications in fighter jets, surveillance aircraft, and military drones.

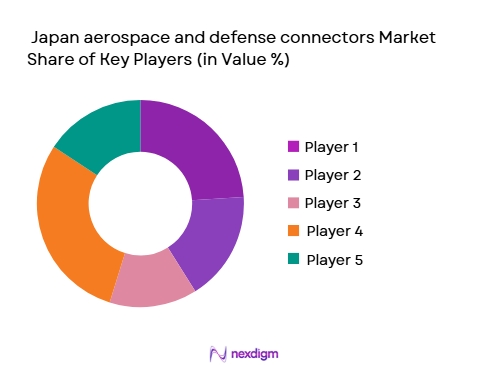

Competitive Landscape

The Japan aerospace and defense connectors market is dominated by several key players, including both global and regional leaders in connector manufacturing. These companies compete through innovation, product development, and establishing strong partnerships with aerospace and defense contractors.

The competitive landscape is characterized by the presence of well-established players, such as TE Connectivity, Amphenol Aerospace, and Smiths Interconnect. These companies leverage their technological expertise and extensive R&D capabilities to meet the stringent requirements of the aerospace and defense industries. Japan’s leading connector manufacturers, such as Hirose Electric, also contribute to the market’s consolidation by providing cutting-edge solutions that meet military standards and aerospace reliability.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Technological Focus | Revenue | Key Customers |

| TE Connectivity | 2007 | Switzerland | ~ | ~ | ~ | ~ |

| Amphenol Aerospace | 1932 | USA | ~ | ~ | ~ | ~ |

| Hirose Electric | 1937 | Japan | ~ | ~ | ~ | ~ |

| Smiths Interconnect | 2006 | UK | ~ | ~ | ~ | ~ |

| Glen air Inc. | 1956 | USA | ~ | ~ | ~ | ~ |

Japan aerospace and defense connectors Market Analysis

Growth Drivers

Rising Military and Aerospace Expenditures

Japan has significantly increased its military and aerospace budgets in recent years. In 2024, Japan’s defense budget is projected to reach approximately USD ~ billion, driven by geopolitical tensions and the country’s strategic focus on upgrading its military capabilities. This investment supports the demand for advanced aerospace and defense connectors that are required for modern aircraft, space missions, and defense systems, fueling the growth of the market.

Technological Advancements in Aerospace and Defense Systems

Technological innovations, such as the development of next-generation fighter jets, space exploration programs, and UAVs, are driving demand for more advanced and reliable connectors. With Japan’s leading aerospace companies like Mitsubishi Heavy Industries focusing on cutting-edge technology, connectors must meet stringent performance standards. These innovations are pushing the demand for highly specialized aerospace connectors designed to perform under extreme conditions, driving market growth.

Market Challenges

High Production and Development Costs

The cost of designing and manufacturing aerospace and defense connectors remains a major challenge. Japan’s advanced aerospace systems require connectors made from specialized materials and technologies that are both expensive and complex to produce. High production costs, especially in a market where price sensitivity is critical, can deter the widespread adoption of these components in certain defense and commercial sectors

Strict Regulatory and Certification Requirements

The aerospace and defense industries are heavily regulated, and Japan’s market is no exception. Connectors used in these sectors must meet stringent certification standards set by organizations such as the Japan Civil Aviation Bureau (JCAB) and international bodies like the FAA and EASA. These regulatory requirements often increase development times and costs, creating a challenge for manufacturers who must comply with ever-evolving safety and performance standards.

Opportunities

Expansion of Space Exploration and Satellite Programs

Japan’s growing focus on space exploration and satellite technology presents significant opportunities for aerospace and defense connector manufacturers. The country’s space agency, JAXA, has been involved in numerous space missions, and the increasing demand for satellite communications and space exploration programs is expected to require advanced connectors. These applications, especially in space, demand high-reliability connectors, creating a lucrative market opportunity.

Integration of Advanced Materials and Miniaturization

The increasing trend toward miniaturization of aerospace and defense systems provides a unique opportunity for connector manufacturers to develop smaller, lighter, and more efficient connectors. The use of advanced materials such as titanium alloys, composites, and high-temperature-resistant materials allows for smaller form factors without compromising performance. These technological advancements in materials and design open up opportunities for connectors in both defense and commercial aerospace sectors, meeting the demand for high-performance, space-saving solutions.

Future Outlook

Over the next decade, the Japan aerospace and defense connectors market is expected to experience steady growth driven by the expanding aerospace and defense sectors, which continue to innovate and demand more advanced, reliable connectors. Increased investment in unmanned aerial vehicles (UAVs), defense aircraft, and space exploration initiatives will be significant drivers of market expansion. Furthermore, Japan’s focus on technological advancements in communications systems and defense applications will push the development of smaller, high-performance connectors. As the defense sector modernizes and space exploration ventures intensify, the market for aerospace and defense connectors will see strong demand, particularly for high-frequency and optical connectors, which are essential for future communications and radar systems.

Major Players

- TE Connectivity

- Amphenol Aerospace

- Hirose Electric

- Smiths Interconnect

- Glenair Inc.

- Molex

- Lemo

- ITT Interconnect Solutions

- Harwin

- Kyocera Connector Products

- Esterline Connection Technologies

- Souriau-Sunbank

- JAXA

- Samtec

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodie

- Defense contractors

- Commercial aviation operators

- Space agencies (JAXA)

- Military procurement agencies

- System integrators

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying and mapping the key market variables in the Japan aerospace and defense connectors market. This is achieved through extensive desk research, incorporating industry reports, secondary data sources, and stakeholder interviews. The goal is to identify the critical factors that drive market growth, challenges, and opportunities.

Step 2: Market Analysis and Construction

This phase includes the compilation and analysis of historical data related to market size, penetration, and growth trends. This analysis focuses on revenue generation, growth projections, and market segmentation to assess the total market potential and key drivers.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, we validate the formulated market hypotheses by engaging industry experts. Expert consultations will be conducted via computer-assisted telephone interviews (CATIs) with professionals from aerospace and defense sectors to corroborate the research data and refine market predictions.

Step 4: Research Synthesis and Final Output

In the final phase, all data collected will be synthesized to generate a detailed, well-rounded market report. This includes cross-referencing findings with key industry players, validating consumer trends, and reviewing product development strategies. The final output will reflect the most accurate and actionable insights into the Japan aerospace and defense connectors market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for advanced aerospace systems

Rising government defense budgets

Technological advancements in aerospace and defense sectors - Market Challenges

High costs of aerospace and defense components

Strict regulatory compliance requirements

Supply chain complexities and disruptions - Market Opportunities

Emerging space exploration initiatives

Growing demand for military UAVs

Technological advancements in connector miniaturization - Trends

Integration of smart technologies in aerospace connectors

Sustainability initiatives driving eco-friendly materials

Miniaturization of aerospace connectors for better performance - Government regulations

Tightening of aerospace and defense certification standards

Implementation of stricter environmental regulations

Increased focus on cybersecurity in defense systems - SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price ,2020-2025

- By System Complexity Tier ,2020-2025

- By System Type (In Value%)

High-frequency connectors

Optical connectors

Power connectors

Circular connectors

Rectangular connectors - By Platform Type (In Value%)

Commercial aviation

Military aviation

Space systems

Unmanned aerial vehicles (UAVs)

Marine platforms - By Fitment Type (In Value%)

Board-to-board connectors

Cable-to-board connectors

Wire-to-wire connectors

Rectangular connectors

Circular connectors - By EndUser Segment (In Value%)

Aerospace manufacturers

Defense contractors

Commercial aircraft operators

Space agencies

Government defense departments - By Procurement Channel (In Value%)

Direct sales

Distributors and resellers

OEM partnerships

Online platforms

Government contracts

- Cross Comparison Parameters (Price, Performance, Technology, Innovation, Reliability, Cost Structure, End-Use Industry, Compliance & Standards, Manufacturing Process, Performance Characteristics, Application Sector)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Molex

TE Connectivity

Amphenol Aerospace

Esterline Connection Technologies

Glenair Inc.

Smiths Interconnect

Souriau-Sunbank

Lemo

ITT Interconnect Solutions

Harwin

Honeywell Aerospace

JST Corporation

Samtec

Kyocera Connector Products

Vero Technologies

- Aerospace manufacturers seeking lightweight, high-performance connectors

- Defense contractors focusing on robust and reliable systems

- Commercial aircraft operators preferring cost-effective solutions

- Government defense departments adopting cutting-edge defense technologies

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035