Market Overview

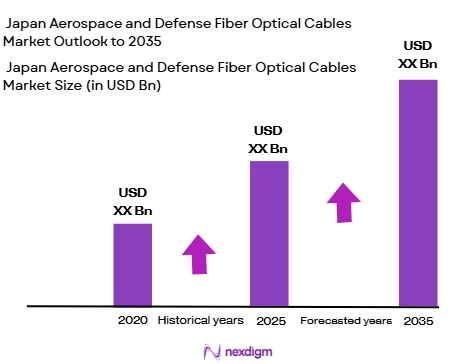

The Japan aerospace and defense fiber optic cables market is valued at approximately USD ~ billion in 2024. This market growth is primarily driven by advancements in aerospace and defense systems that demand high-performance, secure, and reliable communication networks. Fiber optic cables are essential for these systems due to their ability to handle high-speed data transmission in harsh environmental conditions. The increased use of fiber optic cables in military communication systems, aerospace technologies, and space exploration initiatives is expected to support the market’s growth during the forecast period. The integration of fiber optics into emerging technologies, such as UAVs, satellites, and military aircraft, further strengthens demand for high-quality fiber optic cables in Japan

Japan, particularly cities such as Tokyo, Osaka, and Yokohama, dominates the aerospace and defense fiber optic cables market due to the country’s strong presence in defense and aerospace manufacturing. Companies like Mitsubishi Heavy Industries and Japan Aerospace Exploration Agency (JAXA) lead in developing advanced technologies that require high-performance fiber optic cables. These cities house key aerospace and defense contractors and are central hubs for innovation and manufacturing. Additionally, Japan’s continuous investment in defense modernization and space exploration plays a crucial role in solidifying the country’s dominance in the global fiber optic cables market.

Market Segmentation

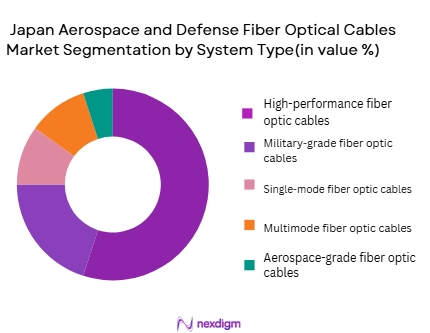

By System Type

Japan’s aerospace and defense fiber optic cables market is segmented by system type into high-performance fiber optic cables, military-grade fiber optic cables, single-mode fiber optic cables, multimode fiber optic cables, and aerospace-grade fiber optic cables.

High-performance fiber optic cables have the largest share in this market segment. These cables are crucial for military applications, especially for secure communication systems in military aircraft, UAVs, and other high-tech defense systems. Their superior data transmission capabilities, reliability under extreme environmental conditions, and resistance to electromagnetic interference make them the preferred choice for demanding applications. As military and aerospace sectors continue to innovate and deploy advanced communication systems, the demand for high-performance cables remains high.

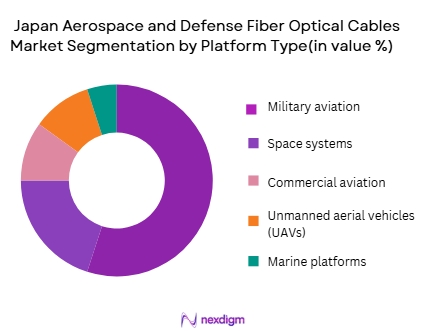

By Platform Type

The market is also segmented by platform type into military aviation, space systems, commercial aviation, unmanned aerial vehicles (UAVs), and marine platforms.

this segment due to Japan’s strong focus on defense modernization. Military aircraft, such as fighter jets, reconnaissance planes, and surveillance systems, require secure and high-speed communication, making fiber optic cables indispensable. As Japan continues to invest in its defense sector and enhances its technological capabilities, the need for reliable, high-performance fiber optics grows. Additionally, Japan’s strategic focus on enhancing defense capabilities, particularly in response to regional security concerns, supports the increasing demand for fiber optic cables in military aviation.

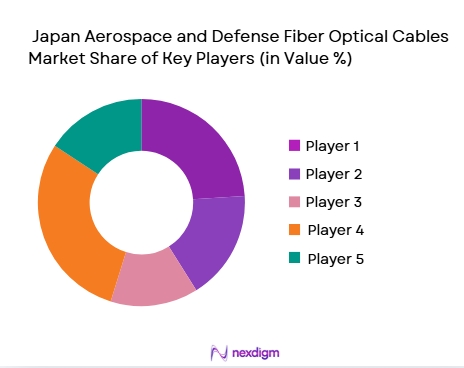

Competitive Landscape

The Japan aerospace and defense fiber optic cables market is characterized by intense competition, with several global and local players dominating the space. Companies such as TE Connectivity, Amphenol Aerospace, and Smiths Interconnect are key players, leveraging their technological advancements to provide cutting-edge fiber optic solutions. These players benefit from strong R&D capabilities, a global presence, and long-standing relationships with aerospace and defense contractors. The competition in this market is largely driven by the need for specialized, high-quality cables that can meet the demanding requirements of military and aerospace applications.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Technology Focus | Revenue | Key Customers |

| TE Connectivity | 2007 | Switzerland | ~ | ~ | ~ | ~ |

| Amphenol Aerospace | 1932 | USA | ~ | ~ | ~ | ~ |

| Smiths Interconnect | 2006 | UK | ~ | ~ | ~ | ~ |

| Hirose Electric | 1937 | Japan | ~ | ~ | ~ | ~ |

| Harwin | 1952 | UK | ~ | ~ | ~ | ~ |

Japan Aerospace and Defense Fiber Optical Cables Market Analysis

Growth Drivers

Increasing Demand for High-Speed Communication in Military and Aerospace Applications

The growing need for secure, high-speed communication in military and aerospace systems is a key driver for the fiber optical cables market in Japan. With advancements in military technologies, including next-generation fighter jets, UAVs, and space exploration systems, the demand for fiber optics, which offer high bandwidth and low latency, continues to rise. Japan’s ongoing investment in these high-tech systems, such as defense satellites and radar systems, increases the need for fiber optic cables, which provide reliable, high-performance communication solutions in challenging environments.

Advancements in Space Exploration and Satellite Communication

Japan’s increased focus on space exploration and satellite communication systems is another significant driver of the fiber optic cables market. With the Japan Aerospace Exploration Agency (JAXA) expanding its space missions, fiber optic cables are essential for reliable and high-capacity data transmission in space systems. Fiber optics are used extensively in satellites for communication and data transfer, supporting Japan’s efforts to strengthen its position in global space technologies. As space missions become more complex, the demand for fiber optic cables in space systems is expected to grow.

Market Challenges

High Manufacturing Costs and Complex Production Processes

The high cost of producing advanced fiber optic cables is a major challenge for the aerospace and defense market in Japan. Manufacturing fiber optics requires specialized materials and intricate production processes, which increase the overall cost of the cables. Additionally, the quality control standards in aerospace and defense applications require highly specialized equipment and procedures, further driving up production costs. These high costs could limit the adoption of fiber optics, particularly in price-sensitive applications within the defense and aerospace sectors.

Regulatory and Certification Barriers

Japan’s aerospace and defense sectors are subject to stringent regulations and certification standards, particularly when it comes to fiber optic cables used in military and space applications. Fiber optic cables must meet rigorous safety, performance, and environmental standards set by agencies such as the Japan Civil Aviation Bureau (JCAB) and international bodies like the Federal Aviation Administration (FAA). These regulatory requirements can slow down product development cycles and make it more challenging for manufacturers to quickly bring new, innovative fiber optic solutions to market.

Opportunities

Technological Innovations in Fiber Optics

Technological advancements, such as the development of smaller, lighter, and more durable fiber optic cables, present significant opportunities in Japan’s aerospace and defense markets. Innovations like the integration of fiber optics with 5G technologies and advanced satellite systems will drive the adoption of these cables in next-generation aerospace systems. The use of fiber optics in new applications, such as autonomous vehicles and advanced defense communications, opens up new market opportunities for fiber optic cable manufacturers.

Growing Adoption of Fiber Optics in Unmanned Aerial Vehicles (UAVs)

The increasing use of unmanned aerial vehicles (UAVs) in both military and commercial sectors offers a significant opportunity for fiber optic cables in Japan. UAVs require lightweight, high-performance communication systems that fiber optic cables can provide. These cables are used to support the UAVs’ communication, navigation, and control systems. As Japan continues to invest in UAV technologies, particularly for defense and surveillance, the demand for specialized fiber optic cables for UAV applications is expected to grow.

Future Outlook

The Japan aerospace and defense fiber optic cables market is expected to continue its growth trajectory through 2035, fueled by ongoing advancements in military technologies, space exploration, and the increasing need for secure, high-speed communication systems. The country’s continued investment in defense modernization, particularly with the development of next-generation military systems, will drive demand for high-performance fiber optic cables. Furthermore, Japan’s space exploration initiatives, led by JAXA, will create substantial demand for fiber optic solutions that can withstand the harsh conditions of space environments. Fiber optic cables will also continue to play a crucial role in the expansion of UAVs and satellite communication systems.

Major Players

- TE Connectivity

- Amphenol Aerospace

- Smiths Interconnect

- Hirose Electric

- Harwin

- Molex

- ITT Interconnect Solutions

- Lemo

- Kyocera Connector Products

- Vero Technologies

- Souriau-Sunbank

- Esterline Connection Technologies

- Samtec

- Glenair

- OFS Fitel

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aerospace manufacturers

- Defense contractors

- Commercial aircraft operators

- Space agencies

- Military procurement agencies

- System integrators

Research Methodology

Step 1: Identification of Key Variables

The first phase involves defining the critical factors and variables that drive the Japan aerospace and defense fiber optic cables market. This is achieved by gathering extensive secondary data from credible sources, such as industry reports and government publications, to identify key growth drivers, challenges, and emerging trends.

Step 2: Market Analysis and Construction

In this phase, historical market data is compiled and analyzed to understand the market’s current state. The focus will be on assessing market penetration, technological advancements, and demand drivers, including government defense budgets and space exploration initiatives. A detailed analysis of past growth patterns will help establish projections for the market size and growth rates.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts are consulted through interviews and surveys to validate market hypotheses. These experts, from key players in the aerospace and defense sectors, will provide insights into product demand, technological developments, and regulatory impacts. The consultations help refine market forecasts and provide a more accurate view of the market’s future direction.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all collected data and expert feedback to deliver a comprehensive market report. This step includes the verification of results through direct engagement with key stakeholders in the aerospace and defense sectors. The output will provide actionable insights and strategic recommendations for businesses operating in the market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for high-speed communication systems in defense

Growing space exploration initiatives

Technological advancements in fiber optic cable materials and design - Market Challenges

High cost of advanced fiber optic cables

Rigorous certification and regulatory standards

Complex installation and maintenance requirements - Market Opportunities

Rising demand for fiber optic cables in satellite communication systems

Integration of fiber optics into military UAVs

Growing commercial demand for advanced aviation systems - Trends

Increasing adoption of fiber optics in space communication systems

Miniaturization of fiber optic cables for compact aerospace systems

Integration of fiber optic cables with IoT and smart defense technologies - Government regulations

Strict certification standards for fiber optic cables in defense and aerospace sectors

Regulatory push for enhanced cybersecurity in fiber optic communications

Environmental regulations promoting sustainable materials in cable production - SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

High-performance fiber optic cables

Military-grade fiber optic cables

Single-mode fiber optic cables

Multimode fiber optic cables

Aerospace-grade fiber optic cables - By Platform Type (In Value%)

Military aviation

Space systems

Commercial aviation

Unmanned aerial vehicles (UAVs)

Marine platforms - By Fitment Type (In Value%)

Board-to-board fiber optic connections

Cable-to-board fiber optic connections

Wire-to-wire fiber optic connections

Rectangular fiber optic connectors

Circular fiber optic connectors - By EndUser Segment (In Value%)

Aerospace manufacturers

Defense contractors

Commercial aircraft operators

Space agencies

Government defense departments - By Procurement Channel (In Value%)

Direct sales

Distributors and resellers

OEM partnerships

Online platforms

Government contracts

- Cross Comparison Parameters (Price, Technology, Performance, Reliability, Innovation, Fiber type, Cladding Diameter, Number of fibers, Cable, Weight, Diameter)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Molex

TE Connectivity

Amphenol Aerospace

Hirose Electric

Smiths Interconnect

Lemo

ITT Interconnect Solutions

Harwin

Samtec

Souriau-Sunbank

Kyocera Connector Products

Vero Technologies

OFS Fitel

Oxygen Networks

Viasat

- Increasing need for secure, high-speed communication in defense

- Aerospace manufacturers adopting fiber optics for lightweight, efficient systems

- Commercial aircraft operators using fiber optics for in-flight data systems

- Government defense departments investing in advanced communication infrastructure

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035