Market Overview

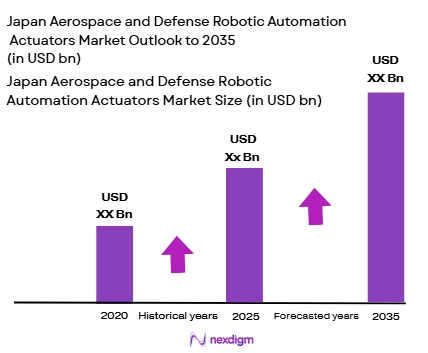

The Japan aerospace and defense robotic automation actuators market has witnessed consistent growth, driven by advancements in robotic automation and an increasing reliance on robotics in both aerospace and defense sectors. As of 2024, the market is valued at approximately USD ~ billion. This growth is primarily fueled by the need for more precise, efficient, and cost-effective solutions for military operations and aerospace manufacturing. Additionally, the push for automation to enhance productivity, reduce human error, and address labor shortages has significantly contributed to the rising adoption of robotic actuators in these sectors. Technological innovations, including artificial intelligence and machine learning integration, further accelerate market growth.

Japan’s aerospace and defense robotic automation actuators market is dominated by regions with strong industrial bases, notably Tokyo, Kawasaki, and Aichi. These regions are home to several aerospace giants like Mitsubishi Heavy Industries and Japan Aerospace Exploration Agency (JAXA), which significantly contribute to the demand for robotic automation actuators. The nation’s advanced technology infrastructure, government support, and strategic defense investments make it a key player in the global market. Tokyo leads as the hub of innovation and technology development, while Kawasaki and Aichi are critical for their automotive and aerospace manufacturing sectors, driving the demand for robotic solutions in these industries.

Market Segmentation

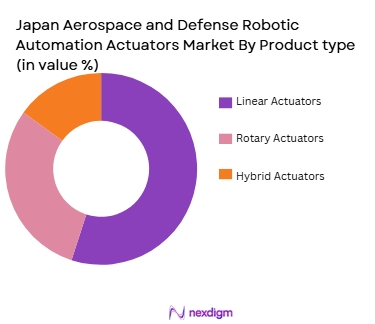

By Product Type:

The Japan aerospace and defense robotic automation actuators market is segmented by product type into linear actuators, rotary actuators, and hybrid actuators. Among these, linear actuators dominate the market due to their wide range of applications in both aerospace and defense industries, including in unmanned vehicles, missile systems, and aircraft. Linear actuators are preferred for their precision, reliability, and ease of integration into automation systems, which is crucial in the defense sector where high levels of control and stability are needed. Moreover, their adaptability in various robotic systems makes them a critical component in modern defense technologies, especially in robotics used in the field.

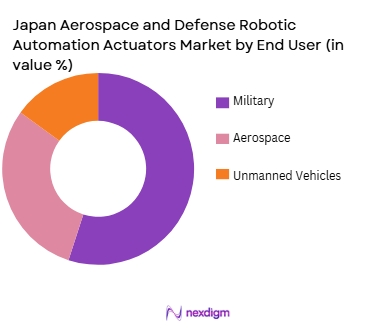

By End User:

In the aerospace and defense robotic automation actuators market, the primary end users include military, aerospace, and unmanned vehicles. The military sector holds the largest share, driven by increasing automation in defense systems. The adoption of robotics in defense operations such as missile guidance systems, drone control, and automated combat systems is at the forefront of this growth. The aerospace industry follows closely, leveraging automation to enhance aircraft manufacturing processes and optimize supply chains. The growing demand for unmanned vehicles in both defense and aerospace applications also boosts the robotic actuator market.

Competitive Landscape

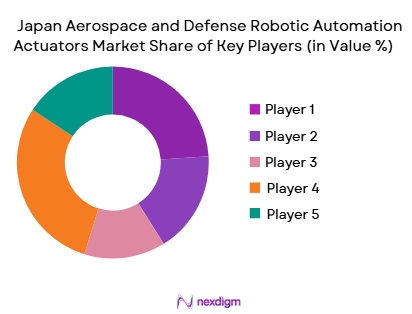

The Japan aerospace and defense robotic automation actuators market is highly competitive, with a few dominant players driving the industry’s innovation and growth. The major players include both global corporations and specialized Japanese firms. Leading companies such as Yaskawa Electric Corporation, Mitsubishi Electric Corporation, and Fanuc Corporation have solidified their positions by offering advanced actuators used in aerospace and defense robotic automation applications. These companies are known for their cutting-edge technology, extensive research and development capabilities, and strong supply chain networks, allowing them to maintain leadership in the market.

| Company | Established Year | Headquarters | Revenue (2024) | Product Portfolio | Key Technologies | Global Reach |

| Yaskawa Electric Corporation | 1915 | Kitakyushu, Japan | ~ | ~ | ~ | ~ |

| Mitsubishi Electric Corporation | 1921 | Tokyo, Japan | ~ | ~ | ~ | ~ |

| Fanuc Corporation | 1956 | Oshino, Japan | ~ | ~ | ~ | ~ |

| Kawasaki Heavy Industries | 1896 | Kobe, Japan | ~ | ~ | ~ | ~ |

| Hitachi Ltd | 1910 | Tokyo, Japan | ~ | ~ | ~ | ~ |

Japan Aerospace and Defense Robotic Automation Actuators Market Analysis

Growth Drivers

Expansion of Automated Aerospace Production & Maintenance

Japan’s aerospace industry is increasingly integrating robotic systems with advanced actuators to automate assembly, inspection, and maintenance processes. These actuators — which convert electronic controls into precise mechanical movement — are vital in high‑precision tasks required for aircraft structure assembly and component testing. The push toward automation is driven by goals to improve operational efficiency, reduce human error, and enhance production scalability. Aerospace robotics also supports space systems operations that require fine motion control and dependable automation, making advanced actuators essential to next‑generation aerospace manufacturing and defense platforms.

Demand from Autonomous & Unmanned Systems

Defense applications such as UAVs, autonomous ground vehicles, and robotic inspection platforms are growing globally and within Japan, requiring robust, reliable actuators for navigation, manipulation, and mission tasks. In aerospace and defense, robotic automation actuators enable precise control of motion subsystems and dexterous manipulation in constrained environments. Their role is also expanding in space robotics for satellite servicing and in‑orbit assembly. Advanced actuator technologies — including electric and integrated motion systems — support higher levels of autonomy and real‑time responsiveness, fueling demand in both military and dual‑use aerospace automation markets.

Market Challenges

High Development & Integration Costs

Developing and integrating high‑performance robotic automation actuators tailored for aerospace and defense is costly. These systems require engineering that meets strict reliability, redundancy, and environmental tolerance standards, leading to significant R&D and certification expenses. Aerospace platforms demand actuators with enhanced durability, precision feedback systems, and ruggedised construction — all of which increase production costs. Smaller suppliers may particularly struggle to justify investments without established contracts. This cost barrier can slow the adoption of next‑generation actuation technologies in Japan’s defense and aerospace automation programs.

Complex Regulatory & Certification Requirements

Actuators used in aerospace systems must comply with rigorous safety and performance standards, which differ across civil and military domains. Achieving aerospace certification involves extensive testing and documentation, increasing time to market and requiring specialist expertise. Moreover, integrating robotic automation systems into legacy aerospace infrastructure — often built around traditional hydraulic actuation — presents compatibility challenges. Suppliers must navigate complex testing regimes and work closely with OEMs to demonstrate reliability under extreme conditions, adding to technical and regulatory hurdles.

Opportunities

Growth from Electric & Smart Actuation Technologies

The transition from traditional hydraulic actuation to electric and smart actuator solutions presents a major opportunity. Electric actuators offer advantages in weight reduction, energy efficiency, precise motion control, and digital integration with aircraft control systems. With the broader robotics automation actuators market projected to expand significantly through 2035, these technologies can capture increased aerospace and defense spend as platforms modernise. Incorporating sensors, feedback systems, and software control enhances performance and enables predictive maintenance, aligning with trends toward smarter, connected aerospace systems.

Export Potential & International Collaboration

Japan’s expertise in precision robotics and control systems positions its actuator manufacturers to participate in global aerospace and defense supply chains. As demand for automation actuators grows across Asia‑Pacific and beyond, Japanese firms can leverage technology partnerships and exports to allied aerospace programs. Collaborative R&D with international OEMs and defense consortia — especially in space robotics and autonomous vehicles — could expand market reach. This is particularly relevant as global aerospace primes seek advanced actuation solutions that combine reliability with cutting‑edge automation capability.

Future Outlook

The Japan aerospace and defense robotic automation actuators market is poised for significant growth in the coming years, driven by technological advancements in robotics, an increase in defense automation, and the rising demand for unmanned vehicles in military and aerospace sectors. As defense systems become more reliant on robotics for efficiency, precision, and safety, the demand for robotic actuators is expected to rise. Moreover, aerospace manufacturing will continue to adopt automation solutions to meet high production standards and enhance system reliability. With ongoing research and development, especially in AI and machine learning integration, the market will see robust growth through 2035.

Major Players

- Yaskawa Electric Corporation

- Mitsubishi Electric Corporation

- Fanuc Corporation

- Kawasaki Heavy Industries

- Hitachi Ltd

- Nidec Corporation

- Panasonic Corporation

- Sumitomo Heavy Industries

- Toshiba Corporation

- Seiko Instruments Inc.

- Daifuku Co. Ltd

- SMC Corporation

- Alps Alpine Co., Ltd

- Omron Corporation

- Rockwell Automation Inc.

Key Target Audience

- Aerospace and defense contractors

- Robotics manufacturers

- Government and regulatory bodies

- Aerospace engineers and manufacturers

- Defense technology investors

- Unmanned vehicle manufacturers

- Automation and robotics R&D organizations

- Investment and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

The first phase involves gathering secondary data from industry reports, government publications, and company websites to define key variables such as product types, market trends, and major companies. This research will help map out the major components influencing the market, including technological advancements and regional dynamics.

Step 2: Market Analysis and Construction

In this phase, we analyze historical data on market growth, technological adoption, and product demand across various end-user sectors like aerospace and defense. This also involves building a projection model based on market drivers, technology integration, and production trends.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are tested with insights from industry experts via interviews and surveys. This will help refine the forecast model by validating key findings with real-world industry data, especially regarding technological advancements and market penetration in the defense and aerospace sectors.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing data from interviews, surveys, and secondary sources into a comprehensive analysis. This process includes validating findings with field-specific experts, ensuring the report is robust and representative of the current market landscape.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for automation in aerospace and defense sectors

Technological advancements in actuator systems for robotics

Government investments in defense and aerospace automation - Market Challenges

High initial investment costs for advanced actuator systems

Regulatory hurdles in international markets

Complexity in integrating new automation technology into existing systems - Market Opportunities

Emerging markets in autonomous defense systems

Development of next-gen actuators for space exploration

Growing interest in robotics for military applications - Trends

Integration of AI with robotic actuators

Miniaturization of actuators for compact platforms

Rise of electric and hybrid actuators in defense and aerospace - Government regulations

Stricter defense-related export controls

Regulations for space system safety and technology

Compliance with ISO 9001 standards for aerospace actuators

- SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Robotic Manipulators

Linear Actuators

Rotary Actuators

Servo Motors

Hydraulic Actuators - By Platform Type (In Value%)

Aerospace Systems

Defense Systems

Autonomous Vehicles

Satellite Platforms

Robotic Systems - By Fitment Type (In Value%)

OEM Fitment

Retrofit Fitment

Custom Fitment

System Upgrade Fitment

Modular Fitment - By End-user Segment (In Value%)

Aerospace Manufacturers

Defense Contractors

Government Agencies

Commercial Space Operators

Robotics & Automation Firms - By Procurement Channel (In Value%)

Direct Procurement

Indirect Procurement

OEM-Specific Procurement

Third-party Distribution

E-commerce Procurement

- Cross Comparison Parameters(Market share, Price trends, System efficiency, Innovation rate, Customer loyalty, Actuator Type, Control Interface & Integration, Environmental & Ruggedization Standards, Power Efficiency,)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Mitsubishi Heavy Industries

Yaskawa Electric Corporation

Fanuc Corporation

Omron Corporation

Denso Corporation

Nabtesco Corporation

Thales Group

Northrop Grumman

Raytheon Technologies

General Electric

Rockwell Automation

ABB Robotics

KUKA AG

Honeywell International

Schaeffler Group

- Growing reliance on robotics in military operations

- Increased demand for autonomous aircraft and unmanned vehicles

- Expanding space programs driving need for specialized actuators

- Shift toward integrated automation solutions in aerospace manufacturing

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035