Market Overview

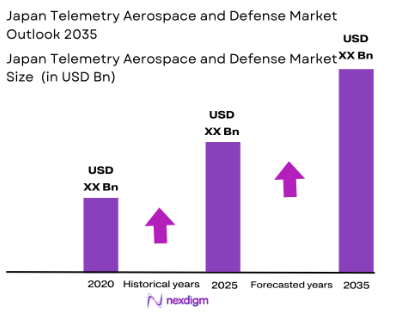

The Japan Aerospace and Defense Telemetry market is valued at approximately USD ~billion in 2025. The market’s growth is driven by continuous technological advancements in telemetry systems, which enable efficient real-time data transmission and performance monitoring for various defense and aerospace applications. Increasing demand for enhanced satellite communication systems, missile telemetry, and UAV integration is propelling the sector forward. Furthermore, rising government defense budgets, particularly in the aerospace and space exploration sectors, are boosting the adoption of telemetry systems to meet advanced data and communication needs.

Japan remains a dominant player in the Aerospace and Defense Telemetry market, primarily due to the robust capabilities of Japan’s aerospace agency (JAXA) and the nation’s active participation in space exploration programs. The country’s strong defense industry, especially in unmanned aerial vehicles (UAVs), missiles, and space applications, drives significant demand for telemetry systems. Moreover, Japan’s strategic position within Asia and its collaboration with global defense powers, such as the U.S., further positions it as a leader in the market. Additionally, cities like Tokyo and Fukuoka are key hubs for aerospace innovation and military advancements, making them vital contributors to the market’s growth.

Market Segmentation

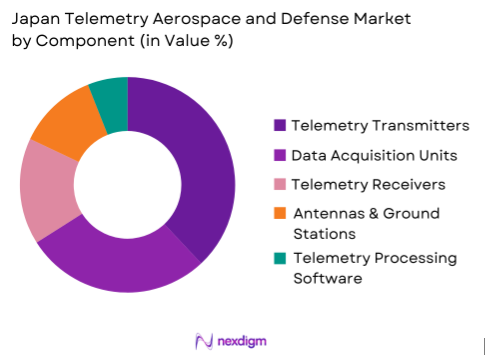

By Component

The Japan Aerospace and Defense Telemetry market is segmented by component into telemetry transmitters, data acquisition units (DAUs), telemetry receivers, antennas, ground station equipment, and telemetry processing software. Among these, telemetry transmitters hold the dominant market share in 2024. This segment’s dominance can be attributed to the increasing need for advanced communication systems in both military and civilian aerospace platforms. With the growing number of satellite missions, UAV testing, and missile defense applications, telemetry transmitters are essential for capturing and transmitting data in real-time. Companies focusing on miniaturization and enhanced transmission range are further driving the growth of this sub-segment.

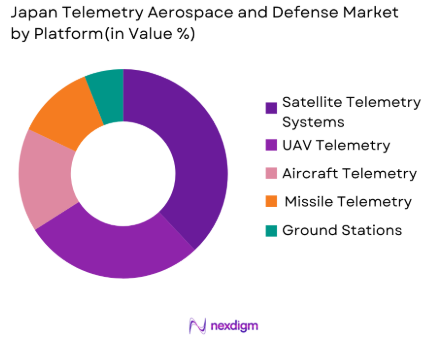

By Platform

The market is also segmented by platform into satellite telemetry systems, UAV telemetry, aircraft telemetry, missile telemetry, and ground stations. Satellite telemetry systems dominate the market in 2025, driven by Japan’s increasing investments in space exploration and satellite communication. The rising number of low Earth orbit (LEO) satellites and the country’s participation in global space missions contribute significantly to the growth of satellite telemetry. Additionally, the expansion of Japan’s Earth observation satellites and the demand for real-time data from these platforms continue to propel the satellite telemetry sub-segment as the leader in this segment.

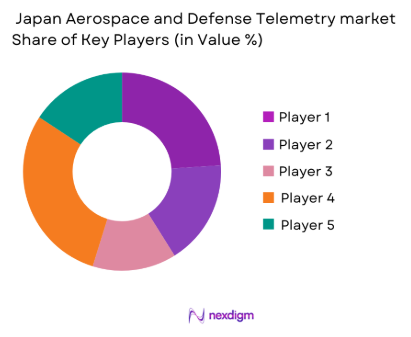

Competitive Landscape

The Japan Aerospace and Defense Telemetry market is characterized by the presence of both local and international players, ranging from large defense contractors to specialized technology companies. Key players include L3Harris Technologies, Thales Group, Northrop Grumman, and Japan’s own Mitsubishi Electric, among others. These players dominate the market due to their established technological expertise, strong defense contracts, and the ability to innovate within telemetry and satellite communications. Local players, such as Mitsubishi Electric, have a unique advantage in catering to Japan’s national defense and space agencies, including JAXA.

| Company | Establishment Year | Headquarters | Core Product Focus | Telemetry Market Focus | Research & Development Investment | Defense Contracts | Regional Presence |

| L3Harris Technologies | 2007 | United States | Secure Telemetry Solutions | Global | High | Strong | North America |

| Thales Group | 1893 | France | Aerospace and Defense Solutions | Global | High | Strong | Europe, Asia |

| Northrop Grumman | 1939 | United States | Integrated Telemetry Systems | Global | High | Extensive | North America |

| Mitsubishi Electric | 1921 | Japan | Telemetry and Communication Systems | National, Asia | Moderate | Strong | Asia, Japan |

| Japan Aerospace Exploration Agency (JAXA) | 2003 | Japan | Satellite and Space Telemetry | National | Moderate | Strong | Japan |

Japan Telemetry Aerospace and Defense Market Dynamics

Growth Drivers

Increase in UAV/UAS & Hypersonic Flight Testing

The introduction and expansion of unmanned aerial vehicles (UAVs) and hypersonic technologies in Japan’s defense repertoire are creating robust requirements for advanced telemetry systems. The Japan Ministry of Defense secured ~billion to procure additional MQ‑9B UAV platforms and allocated funds for demonstrations involving simultaneous control of multiple unmanned systems, highlighting real‑time data coordination needs across airborne platforms.2 Unmanned systems, including small attack UAVs and shipborne UAVs, require constant telemetry transmission for navigation, sensor data relay, and command control in dynamic environments.7 With Japan integrating such platforms across its Maritime, Air, and Ground Self‑Defense Forces under its SHIELD strategy, telemetry systems form the essential communication backbone, enabling mission success and enhancing autonomous operational capabilities in contested environments.

Integration of AI & Edge Analytics for Telemetry

The convergence of telemetry with artificial intelligence (AI) and edge analytics is enhancing predictive and real‑time decision‑making capabilities across Japan’s aerospace and defense sectors. Collaborative initiatives—such as the JAXA and JR‑West partnership to apply machine learning for satellite failure prediction using telemetry data—illustrate how AI models extract actionable insights from vast telemetry streams, improving operational safety and efficiency without manual intervention.1 Japan’s broader digital ecosystem, supported by advanced AI frameworks and ubiquitous high‑speed connectivity, underpins real‑time analytics at the edge, where telemetry data is processed nearer to source for rapid decision support. This integration reduces latency, enables adaptive system behaviours’, and elevates mission readiness, thereby accelerating telemetry adoption in defense and space systems.

Market Challenges

Spectrum Allocation Constraints

Spectrum allocation constraints present a tangible challenge to telemetry communications, especially as aerospace and telecommunications sectors compete for finite frequency bands. Allocating spectrum for defense telemetry must balance military needs with commercial and civilian spectrum demands, complicated by international coordination and regulatory limitations that govern frequency use. As global spectrum planning evolves to accommodate emerging technologies like 6G, dynamic spectrum sharing becomes increasingly complex, particularly in ranges critical for satellite uplink and downlink services.10 These constraints limit flexibility in deploying dedicated telemetry frequencies, forcing defense planners to engage in policy advocacy and technical coordination to secure reliable channels for secure long‑range telemetry data transmission.

Regulatory Export/Import Controls

Japan’s stringent export and import controls on advanced defense technologies, shaped by national security policy and international frameworks, restrict the free flow of certain telemetry components and systems. Telemetry hardware and secure communications modules often fall under dual‑use or military‑specific controls, complicating procurement and cross‑border partnerships. Compliance with export control regimes requires extensive documentation and government approvals, lengthening procurement cycles for both domestic and foreign telemetry technologies. These regulatory layers can delay integration of cutting‑edge telemetry solutions—especially those that depend on imported cryptographic or RF components—thereby impacting timelines for capability enhancements in defense telemetry networks.

Market Opportunities

Next‑Gen Optical & Laser Telemetry Adoption

The successful demonstration of optical communication between Japanese satellites at speeds of 1.8 Gbps showcases a powerful future direction for telemetry systems, where optical and laser links can deliver significantly higher bandwidth than traditional RF systems.5 This next‑generation telemetry technology reduces latency and increases data volumes transmitted from space assets, enabling advanced remote sensing and command responsiveness. As global space traffic intensifies and real‑time data demands escalate across defense and aerospace missions, adopting optical telemetry will provide Japan with competitive system capabilities.

Telemetry for Autonomous Platform Monitoring

The rapid integration of autonomous systems, such as UAVs and emerging unmanned maritime and ground vehicles, underscores expanded telemetry needs for mission monitoring and control. Japan’s Defense Ministry has allocated significant funds—for example, ~ billion to acquire additional UAVs—demonstrating operational reliance on remote telemetry systems to coordinate unmanned platforms.2 As autonomous systems proliferate across defense missions, telemetry solutions that provide reliable, secure, and high‑frequency data links will be indispensable to ensure mission success and real‑time oversight.

Future Outlook

Over the next five years, the Japan Aerospace and Defense Telemetry market is expected to witness substantial growth, driven by advancements in satellite technology, UAV systems, and the increasing need for secure real-time communication. The market will continue to benefit from Japan’s active participation in global space exploration missions and defense modernization programs. The adoption of cutting-edge telemetry systems will be accelerated by the expanding space programs, missile defense applications, and the increasing reliance on UAVs for surveillance and reconnaissance.

Major Players

- L3Harris Technologies

- Thales Group

- Northrop Grumman

- Mitsubishi Electric

- Japan Aerospace Exploration Agency

- Lockheed Martin

- BAE Systems

- Raytheon Technologies

- Honeywell International

- General Dynamics

- Saab Group

- Cobham Aerospace Communications

- NEC Corporation

- IHI Corporation

- Leonardo S.p.A.

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Aerospace and Defense OEMs

- Satellite Operators

- Telecommunications and Connectivity Providers

- UAV Manufacturers and Service Providers

- Missile Defense Contractors

- Space Agencies and Research Institutes

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, we mapped out the ecosystem by identifying key stakeholders involved in the Japan Aerospace and Defense Telemetry market, including government agencies (JAXA, Ministry of Defense) and technology providers. Secondary data was sourced from government reports, industry publications, and proprietary databases.

Step 2: Market Analysis and Construction

Historical market data from sources such as the Japanese Ministry of Defense and space agencies were compiled. This phase involved understanding the adoption rate of telemetry technologies in various segments, including defense, satellite communication, and UAV platforms. Revenue generation and penetration statistics were also reviewed to construct future projections.

Step 3: Hypothesis Validation and Expert Consultation

We validated market assumptions through interviews with industry experts, defense contractors, and telemetry technology providers. CATIs with key executives from companies like Mitsubishi Electric and JAXA helped refine the data and validate market trends.

Step 4: Research Synthesis and Final Output

Data from expert consultations were synthesized with historical and market trend data. Cross-verification of telemetry application trends was conducted with industry leaders to ensure the findings were accurate. The final report encompasses a comprehensive analysis of Japan’s market dynamics and future trends in telemetry systems.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Definition and Scope of Telemetry

- Role of Telemetry in Aerospace & Defense Platforms

- Evolution of Telemetry Standards and Encryption Protocols in Japan

- Japan’s National Telemetry Infrastructure

- Regulatory, Export Control & Security Frameworks

- Growth Drivers

Rising Defense Modernization Telemetry Spend

Expansion of Space Programs

High‑Bandwidth Real‑Time Data Requirements

Increase in UAV/UAS & Hypersonic Flight Testing

Integration of AI & Edge Analytics for Telemetry - Market Challenges

Telemetry Security & Encryption Complexity

Integration with Japan’s Defense Command Networks

High Development & Certification Costs

Spectrum Allocation Constraints

Regulatory Export/Import Controls - Market Opportunities

Growth of Satellite Search & Rescue / SSA Telemetry

Telemetry Analytics Services

Japan‑US & International Defense Telemetry Collaboration

Next‑Gen Optical & Laser Telemetry Adoption

Telemetry for Autonomous Platform Monitoring - Market Trends

Shift towards Edge Telemetry Processing

Convergence of Civil & Defense Telemetry Networks

Modular Telemetry Hardware Platforms

Integrated Telemetry + Command/Control Solutions

Telemetry as a Service

- Telemetry Market Value, 2020-2025

- Telemetry System Units Installed, 2020-2025

- Average Selling Price Per Telemetry System, 2020-2025

- By Component (In Value %)

Telemetry Transmitters

Data Acquisition Units

Telemetry Receivers

Antennas & Ground Station Equipment

Processing & Analytics Software

Secure Encryption & Communications Units - By Platform (In Value %)

Satellite Telemetry Systems

Aircraft Telemetry

UAV / UAS Telemetry Systems

Missile & Guided Weapon Telemetry

Ground / Naval Telemetry Stations - By Transmission Medium (In Value %)

Radio Frequency (RF) Telemetry

Satellite Telemetry Links

Optical/Laser Telemetry

Wired / Fiber‑Based Telemetry Backhaul - By Technology Stack (In Value %)

Wired Telemetry

Wireless Telemetry

AI‑Enabled & Edge Data Telemetry

Secure Cryptographic Telemetry

Redundant & Fault‑Tolerant Telemetry - By End‑User Sector (In Value %)

Civil Space

National Defense

Defense Contractors / Integrators

Private Aerospace System Developers

Research & Test Flight Programs

- Market Share of Major Players — Value & Volumn

- Cross‑Comparison Parameters (Company Overview, Core Telemetry Technologies Owned, Japan Domain Certifications, R&D Telemetry Intensity, Defense Contract Pipeline, Platform Footprint, Secure Communication & Encryption Capability, Integration Partnerships)

- SWOT Analysis of Leading Companies

- Detailed Company Profiles

L3Harris Technologies

Honeywell International

Lockheed Martin

BAE Systems

Northrop Grumman

Raytheon Technologies

General Dynamics

Thales Group

Mitsubishi Electric / Mitsubishi Space Software

NEC Corporation

JAXA

IHI Corporation

Cobham / EME

Kongsberg Defence & Aerospace

Leonardo S.p.A.

- Decision Criteria & Procurement Drivers

- Telemetry Budget Allocations

- Technology Adoption Barriers

- Operational Telemetry Needs

- Telemetry Lifecycle & Replacement Cycles

- Value Forecast by Platform , 2026-2035

- Volume Forecast by Telemetry System Type, 2026-2035

- ASP Trends and Impact of Technology Upgrades, 2026-2035