Market Overview

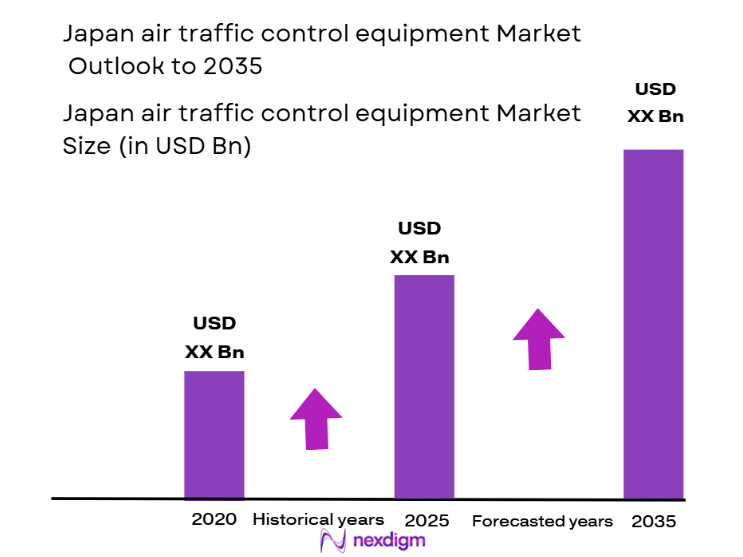

The Japan Air Traffic Control Equipment market is valued at USD ~ billion, primarily driven by the nation’s strategic importance in the global aviation industry. The Japanese air traffic control system serves as a crucial hub in East Asia, with more than 80 airports managing a high volume of domestic and international flights. The ongoing modernization of Japan’s air traffic control infrastructure, including the introduction of new radar systems, automation technology, and satellite-based navigation, fuels market growth. Additionally, government investments in airspace safety and efficiency contribute to the increasing demand for advanced ATC equipment. The market size continues to expand, with projected growth driven by technological upgrades, rising air traffic, and heightened safety protocols.

Tokyo and Osaka are the dominant cities in Japan’s air traffic control equipment market, largely due to their significance as major aviation hubs in East Asia. Tokyo’s Narita and Haneda airports, alongside Osaka’s Kansai Airport, handle a substantial portion of international and domestic traffic, necessitating state-of-the-art ATC systems to manage the high volume of flights. These cities benefit from robust government spending on aviation infrastructure, as well as strategic investments from both public and private sectors. Japan’s leadership in technological advancements in air traffic management further solidifies its dominance, as it continues to innovate with automation and satellite-based systems.

Market Segmentation

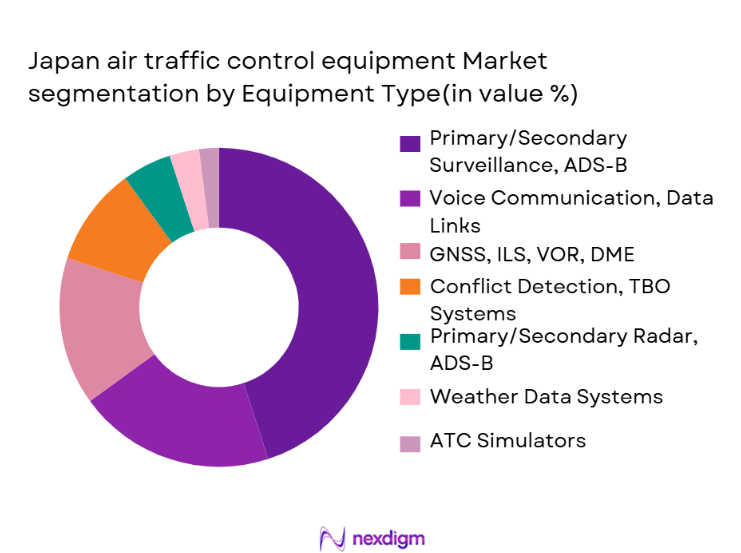

By Equipment Type

The Japan Air Traffic Control Equipment market is segmented by equipment type into radar systems, communication systems, navigation systems, automation and ATM software, surveillance systems, meteorological sensors, and simulation and training systems. Radar systems, particularly primary and secondary radar, dominate the market due to their critical role in ensuring safety and managing air traffic flow across Japan’s busy airspace. Japan’s geographic location, with dense air traffic and complex flight patterns, makes radar systems essential for monitoring aircraft positions in both controlled and uncontrolled airspace. Additionally, advancements in radar technology, such as the integration of Automatic Dependent Surveillance-Broadcast (ADS-B), are increasingly popular due to their enhanced tracking capabilities. Japan’s regulatory standards also require advanced radar systems to maintain high levels of safety and prevent accidents in congested air corridors.

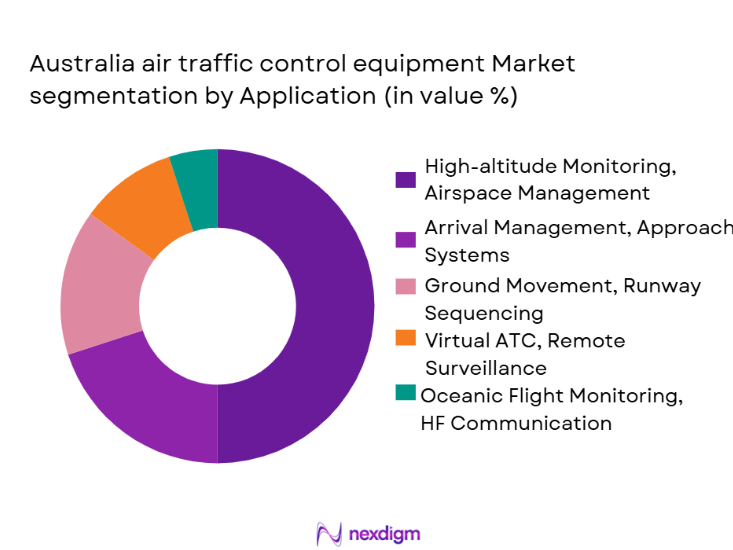

By Application

The market is segmented by application into en-route ATC, terminal/approach control, tower control systems, remote tower operations, and oceanic/over-water control. Among these, en-route ATC systems dominate the market due to Japan’s expansive airspace and the high volume of international flights passing through its airspace. En-route control involves managing flights that are flying at cruising altitudes, which requires advanced radar and communication systems. Japan’s proximity to key international flight paths further elevates the demand for high-tech en-route control systems to ensure smooth flight operations. The adoption of automated systems and satellite-based navigation, along with ongoing system modernization, is propelling growth within this application segment.

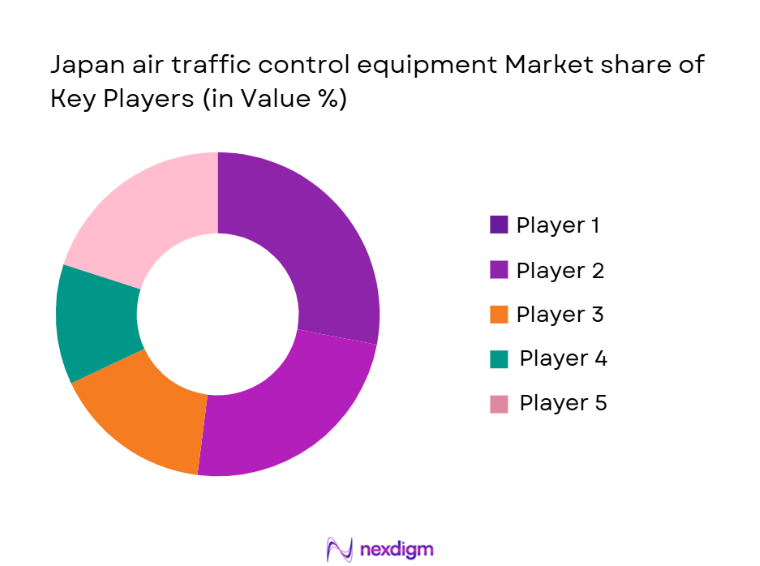

Competitive Landscape

The Japan Air Traffic Control Equipment market is highly competitive, with both international and local players competing for contracts in various segments such as radar systems, automation, and communication equipment. The market is dominated by a few major players, including Thales Group, Raytheon Technologies, Indra Sistemas, Frequentis, and Honeywell International. These players possess a strong foothold due to their technological expertise, extensive product portfolios, and established relationships with government bodies like Japan Civil Aviation Bureau (JCAB). Additionally, partnerships between local Japanese firms and global giants have strengthened their market position, enabling them to meet the demands of Japan’s advanced air traffic management system.

| Company | Establishment Year | Headquarters | Product Portfolio | Technology Leadership | Revenue (Approx.) | Key Partnerships |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 2020 | USA | ~ | ~ | ~ | ~ |

| Indra Sistemas | 1993 | Spain | ~ | ~ | ~ | ~ |

| Frequentis | 1947 | Austria | ~ | ~ | ~ | ~ |

| Honeywell International | 1906 | USA | ~ | ~ | ~ | ~ |

Japan Air Traffic Control Equipment Market Analysis

Growth Drivers

Technological Advancements in Air Traffic Management

The increasing adoption of automation, satellite-based navigation systems like ADS-B, and AI-based tools for air traffic management are driving market growth. Japan’s government and air traffic control agencies are investing heavily in modernizing their ATC infrastructure to enhance efficiency and improve safety. This shift towards technology-driven systems is crucial in managing the growing air traffic in Japanese airspace, particularly for international flights.

Increasing Air Traffic and Airport Expansion

Japan is witnessing an uptick in both domestic and international air traffic due to its strategic geographical position as a major aviation hub in East Asia. Airport expansions, such as those at Tokyo’s Narita and Osaka’s Kansai airports, are contributing to the need for more sophisticated air traffic control systems. These expansions create demand for advanced equipment to handle the increased volume of flights and ensure optimal safety and efficiency in airspace management.

Market Challenges

High Capital and Operational Costs

The implementation and maintenance of advanced air traffic control systems require substantial capital investment, along with ongoing operational costs for training personnel and system updates. This can be a barrier, especially for smaller airports or less well-funded regional air navigation service providers (ANSPs) in Japan.

Regulatory and Compliance Requirements

Japan’s air traffic control systems must comply with stringent international regulations set by bodies such as ICAO (International Civil Aviation Organization) and JCAB (Japan Civil Aviation Bureau). Compliance with these regulations requires continuous investment in system updates and modifications, which can be a financial and logistical challenge for equipment manufacturers and service providers.

Opportunities

Growing Demand for Remote Tower Operations

As airports in Japan, particularly smaller and regional ones, look to reduce operating costs, there is a growing opportunity for remote tower technologies. This involves the use of digital surveillance and remote-control systems to manage air traffic, allowing for the centralization of operations. The cost-effectiveness and efficiency of remote towers offer significant growth potential for providers in this segment.

Integration of Artificial Intelligence in Air Traffic Control

The incorporation of AI and machine learning for predictive analytics in air traffic management presents an exciting opportunity. By leveraging AI to optimize flight paths, enhance real-time decision-making, and automate routine tasks, Japan’s air traffic control infrastructure can achieve greater efficiency and reduce human error, improving safety and operational capacity. This represents a significant opportunity for vendors who specialize in AI-driven solutions.

Future Outlook

Over the next 5 years, the Japan Air Traffic Control Equipment market is expected to show substantial growth driven by continuous upgrades in air traffic management infrastructure, with a particular emphasis on automation and satellite-based systems. This growth will be fueled by the expansion of Japan’s airports, increased air traffic, and government-backed modernization initiatives. Additionally, the global push for more sustainable and efficient air travel will influence Japan’s adoption of next-generation air traffic control technologies. Furthermore, the integration of artificial intelligence (AI) and machine learning to enhance decision-making and predictive analytics will offer significant opportunities for market players to expand their presence.

Major Players

- Thales Group

- Raytheon Technologies

- Indra Sistemas

- Frequentis AG

- Honeywell International

- Lockheed Martin

- COMSOFT Solutions

- Saab AB

- NEC Corporation

- Northrop Grumman

- Leonardo S.p.A

- Searidge Technologies

- NAV CANADA

- ENRI

- Harris Corporation

Key Target Audience

- Air Traffic Control Authorities

- Airports and Aviation Infrastructure Providers

- Government and Regulatory Bodies

- Aviation Technology Suppliers

- Airlines and Aircraft Operators

- Investment Firms and Venture Capitalists

- Military and Defense Agencies

- Airport Technology Integration Companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping key stakeholders, which includes airports, airlines, ANSPs (Air Navigation Service Providers), and government agencies such as JCAB. A combination of secondary research using databases and primary data through industry consultations will identify the critical variables influencing the market.

Step 2: Market Analysis and Construction

In this phase, historical market data will be gathered and analyzed. We will evaluate trends in air traffic growth, equipment adoption rates, and government spending on air traffic control infrastructure, assessing market penetration across Japan’s key airports.

Step 3: Hypothesis Validation and Expert Consultation

We will validate market hypotheses by conducting in-depth interviews with industry experts from leading ATC companies, government representatives, and regulatory bodies. Their insights will help us refine the data and ensure accuracy in market projections.

Step 4: Research Synthesis and Final Output

The final report will synthesize findings from both primary and secondary research. This will include product segmentation, market size, competitive analysis, and future projections. Expert feedback and statistical analysis will verify all data points for reliability.

- Executive Summary

- Research Methodology (Market Definitions & Air Traffic Operational Scope, Assumptions & Standard Abbreviations, Japan Air Traffic Service Providers Coverage, Air Traffic Control Equipment Component Taxonomy, Market Sizing & Forecasting Methodologies, Primary & Secondary Research Synthesis, Data Quality Standards & Triangulation Techniques, Limitations & Risk Adjustments)

- Market Definition & ATC System Boundaries

- Aviation Infrastructure Landscape in Japan

- Air Traffic Growth Patterns & Airport Capacity

- Air Traffic Management (ATM) Architecture

- Civil & Defense Airspace Interaction

- Supply, Implementation & Lifecycle Framework

- Growth Drivers

Traffic Growth

Airport Expansion

Safety Mandates - Market Constraints

High CapEx/maintenance cost

Skilled personnel shortage - Opportunities

AI adoption

integrated digital towers - Market Trends

Automation

Remote towers

ADSB saturation - Regulatory Environment

- SWOT Analysis

- By Market Value 2020-2025

- By Total Operational Units 2020-2025

- By Average Selling Price 2020-2025

- By CapEx vs OpEx Share 2020-2025

- By Equipment Type (In Value%)

Radar Systems

Surveillance Systems

Communication Systems

Navigation Systems

Automation & ATM Software

Meteorological Sensors

Simulation & Training Systems - By Application (In Value%)

EnRoute ATC Systems

Terminal/Approach Control

Tower Control Systems

Remote Tower Operations

Oceanic/Overwater Control - By EndUser (In Value%)

Civil/Commercial ATC

Defense/Military ATC

ANSP Direct Deployments - By Deployment Mode (In Value%)

Brownfield Modernization

Greenfield ATC Infrastructure

Cloud/Networkcentric ATC Solutions - By Technology Integration (In Value%)

AI & Predictive Analytics Systems

Automation & TrajectoryBased Operations (TBO)

SatelliteBased Navigation & ADSB

Cybersecurity & Resilience Solutions

- Market Share

- CrossComparison Parameters (R&D investment in ATC tech, Radar/ADSB footprint, Automation level, Spectrum of Communication Protocols, Number of ATS Units Installed, Compliance to ICAO/JCAB standards, Interoperability score, AfterSales Support Network)

- Major Competitors

Thales Group

Indra Sistemas

Raytheon Technologies

Frequentis AG

Honeywell International

NEC Corporation

Lockheed Martin

Harris Corporation

Saab AB

Northrop Grumman

COMSOFT Solutions

Searidge Technologies

NAV CANADA

Leonardo S.p.A

ENRI / Local Integrators

- Demand Patterns

- Seasonal & Traffic Flow Variability

- Budgeting & Procurement Cycles

- Operational KPI & Safety Metrics

- EndUser Challenges & Decision Criteria

- By Market Value 2026-2035

- By Installed Units 2026-2035

- By Technology Adoption Levels 2026-2035

- By EndUser Type 2026-2035