Market Overview

The Japan Air Traffic Management (ATM) market is valued at USD ~ billion, driven by a complex ecosystem of airport operations, airspace control, and technological advancements. The market’s growth is largely attributed to the country’s heavy investment in modernization programs, including the implementation of advanced radar and communication systems. Additionally, Japan’s role as one of the busiest air travel hubs in Asia fuels the demand for efficient air traffic management solutions, supported by the Civil Aviation Bureau of Japan and other regulatory bodies. With ongoing upgrades to infrastructure and airspace optimization efforts, such as the use of Remote Tower technologies, Japan’s ATM market is poised for further expansion.

Japan’s air traffic management landscape is dominated by major international airports such as Tokyo Narita, Osaka Kansai, and Haneda, which handle large volumes of both domestic and international flights. These cities dominate the market due to their strategic geographical location, robust infrastructure, and the high frequency of flights, both commercial and cargo. Additionally, Japan’s advanced regulatory framework and airspace modernization initiatives further boost these regions as key hubs for ATM solutions, driving demand for efficient air traffic control systems. The dominance of these cities is further supported by heavy investments in automation technologies and the need for high-capacity, state-of-the-art surveillance systems.

Market Segmentation

By System Type

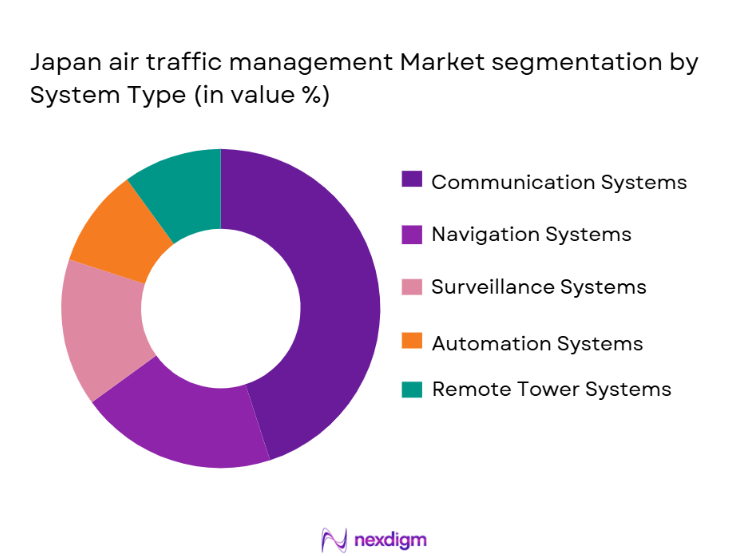

Japan’s Air Traffic Management (ATM) market is primarily segmented into different system types, including communication systems, navigation systems, surveillance systems, and automation systems. Among these, communication systems, specifically those utilizing very high frequency (VHF) and advanced digital communications (such as ADSB), dominate the market. Their prevalence is due to Japan’s robust air traffic control infrastructure, which relies heavily on clear communication between aircraft and air traffic controllers for safety and efficient operations. Communication systems have emerged as the dominant segment within Japan’s ATM market. Their critical role in ensuring uninterrupted communication between aircraft and ground controllers, especially for long-haul international flights, has made them essential. Japan’s vast airspace network, which is among the busiest globally, requires highly reliable and efficient communication systems to minimize delays and ensure safety, contributing to their dominance in the market.

By Offering

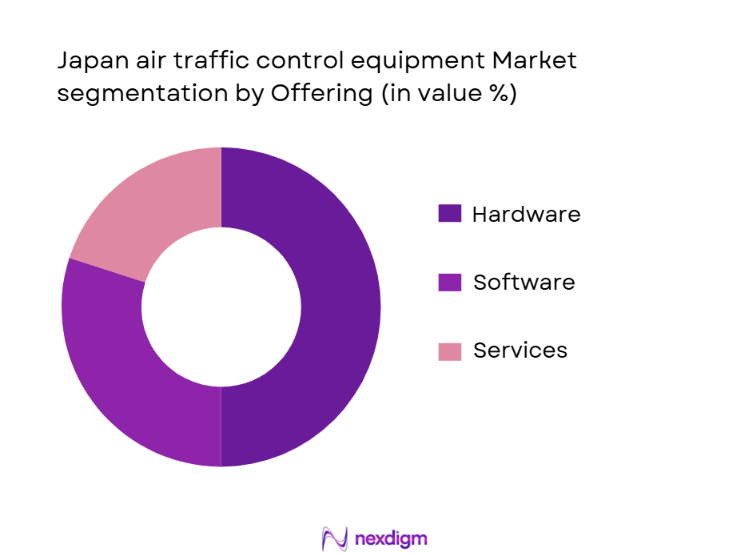

The ATM market in Japan is also segmented by offering into hardware, software, and services. The hardware segment, including radar systems, communication towers, and advanced air traffic control equipment, holds the largest market share. This is driven by the continuous need to upgrade and maintain physical infrastructure to support high air traffic volumes. The hardware segment, which encompasses radar, communications towers, and surveillance equipment, commands the majority of the market share. Japan’s long-term investments in upgrading radar systems, coupled with the rise of next-gen surveillance technologies, reinforce the need for substantial hardware infrastructure. These investments ensure enhanced airspace management capabilities, bolstering the demand for hardware solutions within the market.

Competitive Landscape

The Japan Air Traffic Management market is dominated by both local and international players, with major companies such as Thales Group, Indra Sistemas, and Leonardo S.p.A. making substantial contributions. These companies have a competitive edge due to their innovative technologies in radar systems, navigation systems, and automation, and their deep integration into Japan’s regulatory and operational frameworks. The consolidation of key players in this market reflects a strategic focus on high-value technologies that ensure safe, efficient, and seamless air traffic operations.

| Company | Establishment Year | Headquarters | System Types | Revenue in ATM Solutions | Technology Used | Strategic Partnerships | Market Focus |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ |

| Indra Sistemas | 1989 | Spain | ~ | ~ | ~ | ~ | ~ |

| Leonardo S.p.A. | 1948 | Italy | ~ | ~ | ~ | ~ | ~ |

| Harris/RTX | 2018 | USA | ~ | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 2018 | USA | ~ | ~ | ~ | ~ | ~ |

Japan Air Traffic Management Market Analysis:

Growth Drivers

Technological Advancements

The continuous development of next-generation air traffic control systems, including automation, AI-driven traffic management, and Remote Towers, is significantly boosting the market’s growth. These innovations increase airspace efficiency, reduce delays, and improve safety, making air traffic management systems more critical as air traffic volumes grow.

Government Investments and Modernization Programs

Japan’s government has invested heavily in modernizing its air traffic infrastructure through initiatives like the CARATS program. This modernization not only enhances safety and efficiency but also helps accommodate rising passenger and cargo traffic, driving demand for advanced air traffic management solutions.

Market Challenges

High Implementation and Maintenance Costs

The complexity of integrating advanced technologies into existing air traffic management systems presents a substantial financial burden. These high implementation and ongoing maintenance costs can deter smaller players from adopting new solutions, limiting market growth.

Regulatory and Compliance Hurdles

The aviation industry is heavily regulated, and any changes or upgrades to air traffic management systems must comply with stringent national and international regulations. Navigating these regulations, such as those set by the ICAO, creates barriers to swift system upgrades and integration.

Opportunities

Integration of UAV Traffic Management

The increasing use of unmanned aerial vehicles (UAVs) presents a new market opportunity. Developing integrated solutions for managing both manned and unmanned air traffic will drive demand for new technologies, expanding the scope of traditional air traffic management systems.

Sustainability and Green Technologies

As environmental concerns rise, there is growing demand for greener air traffic management solutions that can reduce the carbon footprint of aviation. Innovations such as fuel-efficient routing, AI-based optimization, and environmental monitoring systems offer significant opportunities for market growth.

Future Outlook

Over the next five years, the Japan Air Traffic Management market is poised to experience significant growth driven by advancements in airspace management technologies such as Remote Towers, AI-powered traffic flow optimization, and NextGen surveillance systems. The ongoing investments by the government and private sector in modernizing the air traffic infrastructure, alongside Japan’s increasing air traffic demands, are expected to foster greater efficiencies in both regional and international airspace management.

This growth will be further bolstered by Japan’s continued participation in global ATM modernization programs, enhancing the country’s ability to handle larger volumes of traffic while minimizing delays. Additionally, the integration of UTM (UAV Traffic Management) and innovations in air traffic control automation will redefine the future landscape of air traffic management.

Major Players in the Market

- Thales Group

- Indra Sistemas

- Leonardo S.p.A.

- Harris/RTX

- L3Harris Technologies

- Frequentis AG

- Saab AB

- Honeywell International

- Raytheon Technologies

- Mitsubishi Electric

- NEC Corporation

- ATC Japan Consortium

- ADB SAFEGATE

- Airbus Defence & Space

- Raytheon Technologies

Key Target Audience

- Investments and Venture Capitalist Firms

- Civil Aviation Authorities

- ANSPs

- Airports

- Airline Operators

- Aerospace and Defense Contractors

- Government and Regulatory Bodies

- Technology Providers and OEMs

Research Methodology

Step 1: Identification of Key Variables

The research begins with identifying key variables influencing the Japan Air Traffic Management market, such as technological innovations, regulatory factors, and air traffic volumes. We will rely on secondary research and proprietary databases to create an accurate map of all stakeholders involved in ATM systems.

Step 2: Market Analysis and Construction

Historical market data will be analyzed to understand trends in ATM infrastructure investment, the adoption of next-gen technologies, and airspace management efficiency. This will be supplemented by gathering information on Japan’s ongoing air traffic modernization programs and examining system deployments.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses regarding future trends in ATM technology, including Remote Towers and automated systems, will be validated through expert consultations, particularly with Japan’s aviation authorities and industry stakeholders.

Step 4: Research Synthesis and Final Output

Final insights will be synthesized through a combination of industry data, expert consultations, and market trends, creating a comprehensive, reliable report on Japan’s Air Traffic Management market outlook.

- Executive Summary

- Research Methodology (Market Definitions & Scope, Assumptions, Primary + Secondary Research Framework, Japanspecific Data Sources, Sampling Frame, Data Validation, Forecasting Model, Limitations)

- Definition and Scope

- Japan ATM Ecosystem Genesis & Evolution

- National ATM Programs

- Regulatory Framework

- Airspace Architecture & Control Regions

- Key Metrics: Annual Aircraft Movements, Airport Slot Utilization, Airspace Density

- Growth Drivers

Rising Passenger & Cargo Traffic

Government Modernization Programs

Adoption of NextGen Surveillance & AI Systems

Urban Air Mobility Integration - Market Challenges

Integration with Legacy Infrastructure

High Implementation & Lifecycle Costs

Skills Gap in ATM Controller Workforce - Opportunities

NextGen Airspace Tools

Regional Air Traffic Optimization

ValueAdded Services - Trends & Innovations

Digital Tower Control – Centralized Operations

SatelliteBased Communication

Modular & Scalable ATM Platforms - Regulatory & Compliance Landscape

MLIT/ICAO Air Traffic Standards

Safety Management Systems (SMS)

Environmental/Noise Efficiency Metrics - SWOT Analysis

- By Market Value 2020-2025

- By System Volume 2020-2025

- By Air Traffic Management Service Demand 2020-2025

- By ATM Technology Revenue 2020-2025

- By System Type (In Value%)

Communications Systems

Navigation Systems

Surveillance Systems

Automation & Decision Support

Digital & Remote Tower Solutions - By Offering (In Value%)

Hardware

Software

Services - By EndUser/Operator (In Value%)

Civil Aviation Authorities

Airports

Airlines

Military & Defense - By Deployment Type (In Value%)

OnPremise Systems

CloudEnabled ATM Platforms

Hybrid - By Air Traffic Control Zone (In Value%)

HighAltitude Airspace

Terminal Manoeuvring Areas

Approach & Departure Control

Remote Tower Controlled Airports

- Japan ATM Market Share by Value & Volume

- CrossComparison Parameters (Company Overview, Japan Revenue Contribution, Installed Base, Product Technology Footprint, Innovation & Patents, Certification/Compliance Credentials, Service & Support Network, Pricing / TCO Benchmarks)

- Player SWOT Profiles

- Major Competitors

Thales Group

Indra Sistemas

Harris/RTX

Frequentis AG

Honeywell International

Leonardo S.p.A.

Saab AB

L3Harris Technologies

NEC Corporation (Japan)

Mitsubishi Electric (ATM Systems)

Hitachi Aviation Solutions

Airbus Defence & Space

ATC Japan Consortium

Raytheon Technologies

Leidos Holdings

- Traffic Volume Trends & Forecast

- Air Traffic Density Metrics & Capacity Constraints

- Performance Indicators

- Slot Utilization

- User Demand Patterns

- Market Value Outlook 2026-2035

- Installed Systems / Technology Adoption Volumes 2026-2035

- Topical Forecasts 2026-2035

- Scenario Analysis 2026-2035