Market Overview

The Japan Aircraft Carrier Ship Market is valued at approximately USD ~ billion in 2024. This market is primarily driven by Japan’s increasing defense budget and its focus on modernizing its Maritime Self-Defense Force (JMSDF) to counter regional security challenges. The acquisition and development of new carrier platforms, along with the modernization of existing ones like the Izumo-class, have led to significant market growth. This investment is largely motivated by Japan’s need to strengthen its naval presence, particularly in the face of rising geopolitical tensions in the Indo-Pacific region, which has led to a renewed focus on expanding naval capabilities.

Japan, as the primary market for aircraft carrier development, dominates the regional landscape due to its strong defense and technological capabilities. The presence of major shipbuilding yards such as Mitsubishi Heavy Industries and Japan Marine United Corporation solidifies Japan’s central position in the aircraft carrier market. Additionally, the country’s strategic defense initiatives and partnership with the United States in defense technology further enhance its market dominance. Other nations, such as the United States, Australia, and South Korea, contribute to the region’s defense ecosystem but are not direct competitors in the development of carriers for Japan’s own military needs.

Japan Aircraft Carrier Ship Market Segmentation

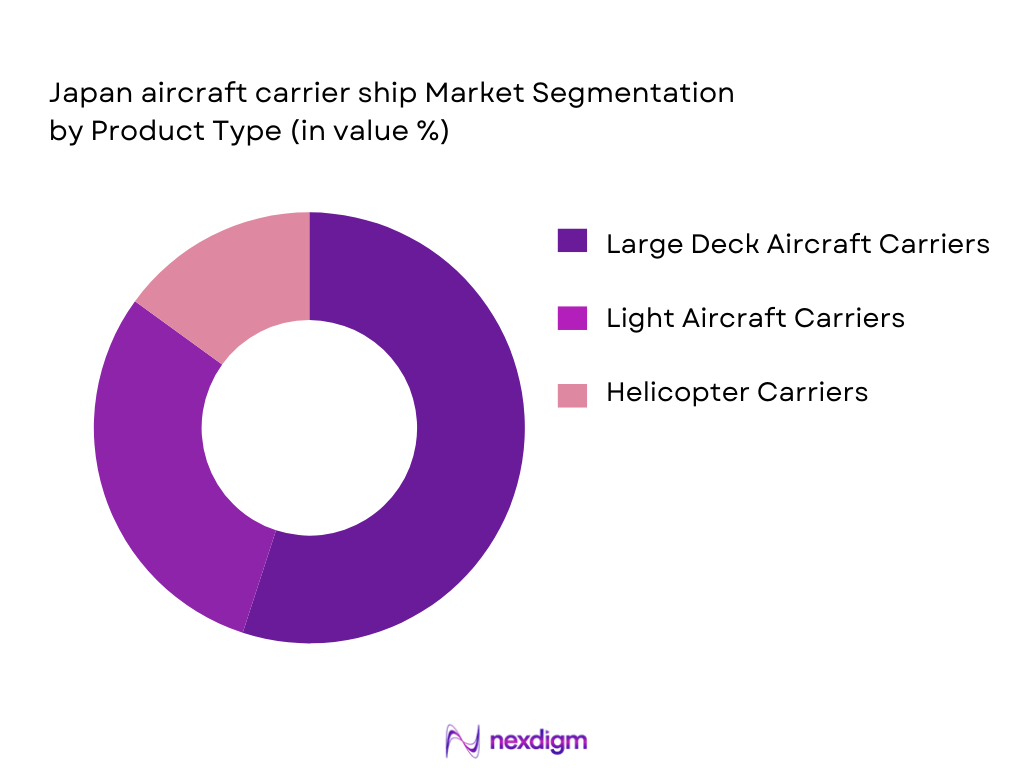

By Product Type

The Japan Aircraft Carrier Ship market is segmented into various product types, primarily distinguished by the size and functionality of the ships. The market has seen a dominant focus on large-deck aircraft carriers due to Japan’s defense strategies and its focus on power projection. These carriers serve as the central element of the Japan Maritime Self-Defense Force (JMSDF), providing air superiority and operational flexibility.

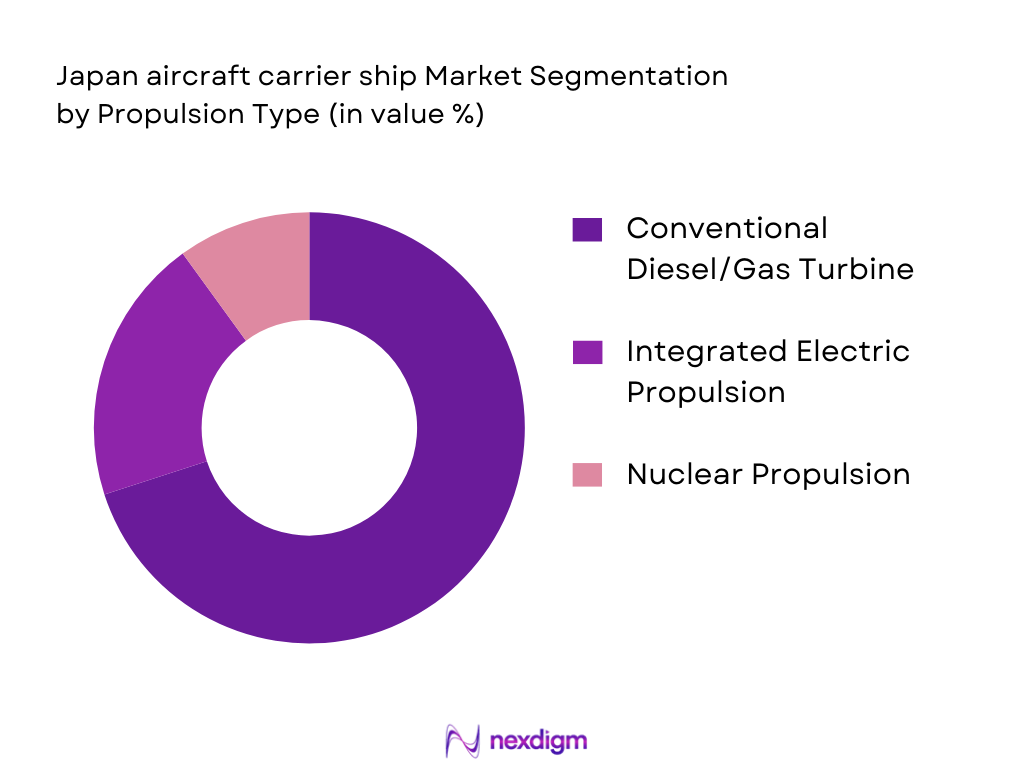

By Propulsion Type

The propulsion system plays a critical role in determining the operational efficiency and sustainability of aircraft carriers. Japan’s focus on enhancing energy efficiency and long-term operational capabilities has influenced its choice of propulsion systems for its carriers.

Competitive Landscape

The Japan Aircraft Carrier Ship Market is dominated by a few major players, with Mitsubishi Heavy Industries, Japan Marine United Corporation, and other established Japanese shipyards leading the way. Their dominance is attributed to their deep ties to the Japanese government and their capacity to deliver complex military-grade platforms. The consolidation of a few key players further highlights the strategic importance of the sector in Japan’s defense landscape.

| Company Name | Establishment Year | Headquarters | Market Focus | Shipbuilding Capacity (Units per Year) | Technologies Offered | Key Collaborators |

| Mitsubishi Heavy Industries | 1884 | Tokyo, Japan | ~ | ~ | ~ | ~ |

| Japan Marine United Corporation | 2002 | Tokyo, Japan | ~ | ~ | ~ | ~ |

| IHI Corporation – Marine Sector | 1853 | Tokyo, Japan | ~ | ~ | ~ | ~ |

| Kawasaki Heavy Industries | 1896 | Kobe, Japan | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ |

Japan Aircraft Carrier Ship Market Analysis

Growth Drivers

Urbanization

Urbanization in Japan continues to drive the demand for advanced infrastructure, including military modernization and naval force projection. The Japanese government has committed substantial resources to upgrading its defense capabilities to match its urban growth. With an increasing urban population in metropolitan areas like Tokyo (which has a population of ~ million in 2024), the need for robust security becomes critical. Additionally, Japan’s urban centers are pivotal hubs for economic activities that contribute to defense investments. According to World Bank data, Japan’s urban population was ~ % of the total population, which indicates growing urbanization and an increased demand for advanced defense platforms, including aircraft carriers.

Industrialization

Industrialization in Japan supports technological innovation in defense manufacturing, specifically for naval assets. Japan remains one of the world’s leading industrial nations, with a strong manufacturing base in heavy industries. In 2024, Japan’s industrial production grew by ~ %, reflecting its sustained industrial capabilities. This industrial growth, combined with significant investments in advanced manufacturing technologies, enhances Japan’s ability to produce state-of-the-art military hardware, such as aircraft carriers. The industrialization efforts of Japan have also led to improvements in production and efficiency, positioning Japanese shipyards to meet the needs of the Maritime Self-Defense Force and other naval sectors globally.

Restraints

High Initial Costs

The high initial costs associated with developing and maintaining aircraft carriers are one of the key restraints in Japan’s defense sector. According to the Ministry of Defense Japan, the procurement and construction of modern aircraft carriers can cost upwards of USD ~ billion per ship. This does not include the operational and maintenance costs, which can add significantly to the budget. Japan’s defense spending in 2024 reached JPY ~ trillion, a record high, but such high expenditures on defense platforms still strain national budgets. The financial burden of these high costs could limit the pace of carrier procurement and fleet modernization.

Technical Challenges

The technical challenges related to integrating cutting-edge technologies into aircraft carriers, such as advanced radar systems, combat management systems, and unmanned aerial vehicles (UAVs), pose significant hurdles. Japan’s defense technology is highly advanced, but implementing new, untested technologies in aircraft carriers often requires overcoming engineering and system integration issues. The Ministry of Defense Japan has reported delays in some high-tech projects due to integration problems. Additionally, Japan’s complex legal framework around technology transfers can delay these advancements, affecting the speed at which carriers can be modernized.

Opportunities

Technological Advancements

Technological advancements in naval warfare systems, such as autonomous drones, advanced combat systems, and energy-efficient propulsion systems, present significant opportunities for Japan’s aircraft carrier market. Japan is focusing on the integration of unmanned aerial vehicles (UAVs) and artificial intelligence (AI) in its defense technology. The country has been expanding its research into AI and autonomous systems, with Japan’s national AI strategy allocating JPY ~ billion in 2024 for technological innovation in defense. These technologies could enhance the capabilities of aircraft carriers by improving operational efficiency, reducing the crew requirements, and increasing combat effectiveness.

International Collaborations

International collaborations are expected to play a pivotal role in enhancing Japan’s aircraft carrier market. Japan has long-standing defense ties with the United States, which provides access to advanced military technologies and design expertise. In recent years, Japan has been engaging in defense collaborations with countries such as Australia, India, and the UK to co-develop military assets, including aircraft carriers. As of 2024, Japan’s Ministry of Defense has strengthened these partnerships, with joint naval exercises planned with Australia and the United States to enhance carrier interoperability. These collaborations can lead to sharing of technology, joint construction, and better procurement options for Japan’s future carriers.

Future Outlook

The Japan Aircraft Carrier Ship Market is expected to witness continued growth and transformation over the next several years. This growth will be driven by Japan’s increased defense spending, technological advancements in shipbuilding, and a continued emphasis on naval power projection to counter regional security threats. With modernization programs underway for the Izumo-class carriers and future plans for next-generation carriers, the market is poised for significant expansion. Additionally, Japan’s growing defense ties with the United States and other regional allies are expected to result in enhanced technology transfers and collaborative shipbuilding ventures.

Major Players in the Japan Aircraft Carrier Ship Market

- Mitsubishi Heavy Industries

- Japan Marine United Corporation

- IHI Corporation – Marine Sector

- Kawasaki Heavy Industries

- BAE Systems

- Huntington Ingalls Industries

- Fincantieri S.p.A.

- Lockheed Martin

- General Dynamics – NASSCO

- Thales Group

- Navantia S.A.

- Raytheon Technologies

- SAAB

- Rolls-Royce Marine

- Kongsberg Defence & Aerospace

Key Target Audience

- Government Agencies (Ministry of Defense, Japan Maritime Self-Defense Force (JMSDF))

- Shipbuilding and Naval Contractors

- Investment and Venture Capital Firms

- Defense OEMs

- Military Decision Makers and Procurement Officers

- Naval Defense Technology Suppliers

- Defense Equipment Integrators

- Regulatory Bodies (Japan Defense Procurement Agency)

Research Methodology

Step 1: Identification of Key Variables

In this phase, we will identify the major variables affecting the Japan Aircraft Carrier Ship Market, including technological advancements, geopolitical factors, and government procurement policies. This will be done through extensive desk research and reviewing secondary market reports.

Step 2: Market Analysis and Construction

This step involves analyzing historical data on procurement patterns, fleet growth, and carrier type preferences. A bottom-up approach will be used to assess the market size and break down the trends influencing these segments.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses regarding the growth drivers and challenges will be validated through interviews with key industry experts such as naval engineers, procurement officers, and technology developers.

Step 4: Research Synthesis and Final Output

The final phase will involve synthesizing the insights gathered from industry experts, government officials, and defense contractors to produce a validated and comprehensive report on the Japan Aircraft Carrier Ship Market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Aircraft Carrier Classification Standards, Shipbuilding Market Sizing Methodology for Defense Platforms, Primary & Secondary Data Sources, Expert Interviews from JMSDF and Shipbuilders, Forecast Modelling, Limitations & Validation)

- Historical Context of Aircraft Carriers in Japan (Pre‑ & Post‑WWII Evolution)

- Strategic Naval Doctrine & Defense Policy Impact

- Aircraft Carrier Fleet Genesis & Capability Roadmap

- Strategic Supply Chain & Value Chain Analysis for Naval Platforms

- Aircraft Carrier Lifecycle Cost Components (Procurement, O&S, Disposal)

- Growth Drivers

Geopolitical Tension in East & South China Seas (Regional Security Imperatives)

Expansion of Integrated Fleet Air Power (Carrier Strike Capability)

JMSDF Modernization Programs (Operational Doctrine)

Technological Advances

Defense Budget Increases & Reform of Procurement Process

- Market Challenges

Constitutional & Regulatory Constraints on Carrier Classification

High CapEx & O&M Burden of Carrier Platforms

Shipyard Capacity Constraints & Global Competition

Supply Chain Risk for Critical Components

Export Barriers & Strategic Export Control

- Opportunities

Platform Upgrades & Retrofit Markets

Regional Export Partnerships & Co‑Production

Next‑Gen Air Operations Tech Integration

Dual‑Use Platform Development

- Market Trends

Shift to STOVL Carrier Configurations

Modular Combat Systems

Digital Shipbuilding and Smart Shipyards

Integration of Autonomous Aerial System

- SWOT Analysis

- Porter’s Five Forces

- Stakeholder Ecosystem – DJ, JMSDF, MOD, OEM, Shipyards

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Platform Type (In Value %)

Large Deck Aircraft Carrier

Light Aircraft Carrier / STOVL Support Vessel (STOVL Operational Capability)

Helicopter Carrier / Multi‑Mission Platform (Rotor Ops Capability)

Amphibious Assault Carrier

Auxiliary Carrier Support Vessel (Aviation Logistics Support)

- By Propulsion Type (In Value %)

Conventional Diesel/Gas Turbine Combination (Operational Endurance)

Integrated Electric Propulsion (Energy Distribution Capacity)

Nuclear Power (Sustained Power & Mission Radius)

- By Launch/Recovery Configuration (In Value %)

Catapult Assisted Take‑Off But Arrested Recovery

Short Take‑Off But Arrested Recovery

Short Take‑Off & Vertical Landing - By End User (In Value %)

Japan Maritime Self‑Defense Force

Export / Foreign Naval Procurement

Defense OEM / Subcontractor Suppliers

Government R&D Agencies

JV / Consortium Shipbuilding Entities

- Market Share – Japan Platforms vs International Competitors

- Cross‑Comparison Parameters (Growth Strategy, Fleet Tech Level, Combat System Tier, Launch System Type, STOVL Capability, Deck Air Wing Capacity, Procurement Value, Production Throughput, Integration Cost Index, Navy Interoperability, O&M Lifecycle Costs, Export Footprint, Tier‑1 Supply Chain Depth, Autonomy & AI Readiness)

- SWOT – Key Competitors

- Unit Cost Benchmarking by Ship Class & Configuration

- Detailed Company Profiles

Mitsubishi Heavy Industries Ltd.

Japan Marine United Corporation

IHI Corporation – Marine Sector

Kawasaki Heavy Industries – Shipbuilding Division

BAE Systems plc (International Fleet Integrator)

Huntington Ingalls Industries (Carrier Systems)

Fincantieri S.p.A. (Carrier Builds & Systems)

Navantia S.A.

General Dynamics – NASSCO Division

Lockheed Martin (Systems & Integration)

Thales Group (Combat Systems)

Kongsberg Defence & Aerospace

Raytheon Technologies (Sensors & Def Systems)

SAAB (Naval & Aerial Systems)

Rolls‑Royce Marine

- Fleet Deployment & Mission Utilization

- JMSDF Operational Requirements (Air Wing, Deck Ops)

- Training, Logistics & Sustainment Load Profiles

- Operational Pain Points & Capability Gaps

- Force Decision‑Making Process

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035