Market Overview

The Japan Airport Baggage Handling System market current size stands at around USD ~ million, reflecting steady recovery momentum driven by infrastructure modernization and renewed passenger throughput. Recent performance indicates transaction values of nearly USD ~ million across large-scale terminal upgrades and system retrofits. Installation activity covers more than ~ systems annually, with cumulative deployed capacity exceeding ~ million bag movements per year. Capital commitments remain concentrated in automated sortation and screening modules, supporting higher operational reliability and throughput efficiency.

Demand concentration remains strongest in major aviation hubs across Tokyo, Osaka, and Nagoya, supported by dense passenger flows, advanced airport infrastructure, and mature system integration ecosystems. These regions benefit from long-standing public investment programs, strong engineering capabilities, and streamlined regulatory approvals for automation. Secondary airports are gradually adopting modular systems as traffic disperses regionally. Policy alignment around safety compliance and digital transformation further reinforces the leadership position of metropolitan aviation clusters.

Market Segmentation

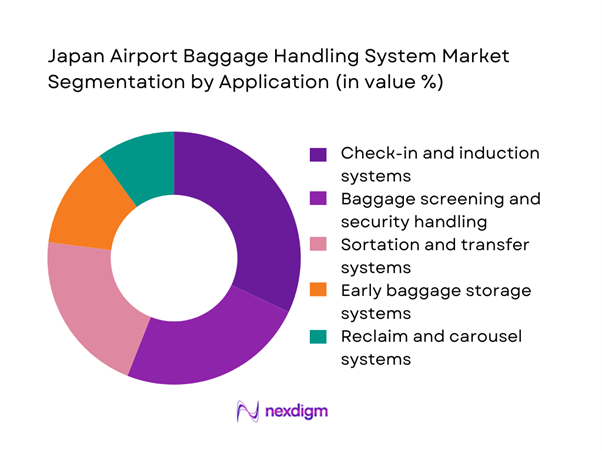

By Application

The baggage handling system market in Japan is strongly influenced by application-specific demand patterns, with check-in and induction systems dominating procurement activity due to their direct impact on passenger experience and terminal throughput. Security screening and sortation solutions follow closely, driven by stricter compliance mandates and the need to streamline transfer operations. Early baggage storage is gaining relevance in high-density terminals seeking to smooth peak-hour congestion. Reclaim and carousel systems continue to attract steady upgrades, particularly in legacy terminals, where modernization programs prioritize reliability, noise reduction, and energy efficiency to align with sustainability targets.

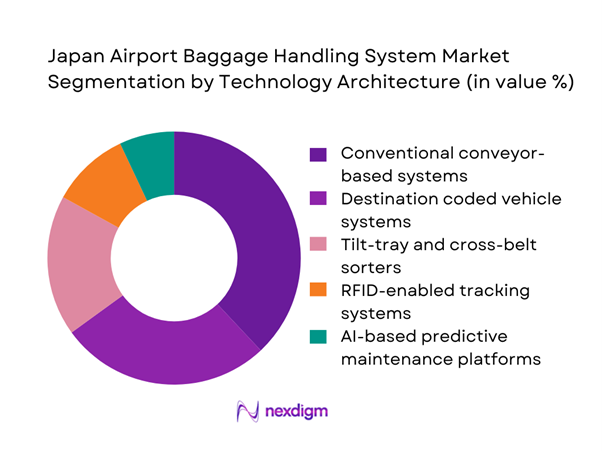

By Technology Architecture

Technology architecture defines competitive differentiation in the Japan Airport Baggage Handling System market, with conveyor-based platforms maintaining dominance due to their proven reliability and ease of integration. High-speed destination coded vehicle solutions are expanding rapidly in large hubs seeking higher throughput and reduced mishandling risk. Cross-belt and tilt-tray sorters are increasingly preferred for transfer-heavy terminals where speed and accuracy are critical. RFID-enabled tracking and AI-based maintenance layers are emerging as strategic add-ons, enhancing system intelligence, reducing downtime, and supporting predictive servicing models aligned with long-term operational efficiency goals.

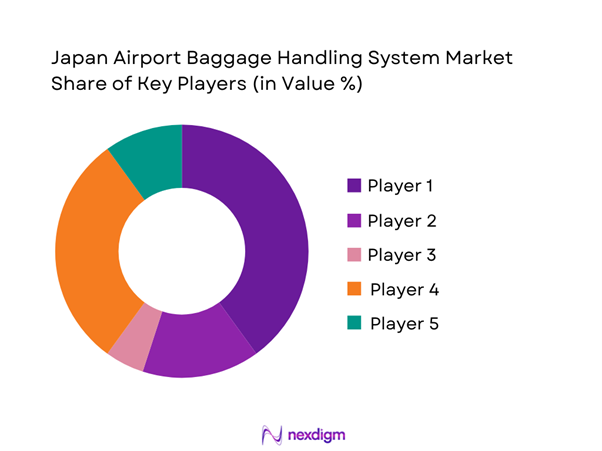

Competitive Landscape

The Japan Airport Baggage Handling System market features a moderately concentrated structure, led by a mix of domestic engineering leaders and global automation specialists. Competitive intensity is shaped by long project cycles, high entry barriers, and strong reliance on system reliability and service continuity. Established players benefit from deep integration capabilities and long-term airport authority relationships, while new entrants focus on niche technologies such as smart tracking and digital monitoring layers.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Daifuku Co., Ltd. | 1937 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Vanderlande Industries | 1949 | Netherlands | ~ | ~ | ~ | ~ | ~ | ~ |

| Beumer Group | 1935 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Siemens Logistics | 1900 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Murata Machinery, Ltd. | 1935 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

Japan Airport Baggage Handling System Market Analysis

Growth Drivers

Rising international passenger traffic post-pandemic recovery

The rebound in international travel has significantly increased operational pressure on major Japanese airports, driving demand for higher-capacity baggage handling systems. Current terminals process over ~ million international passengers annually, translating into baggage throughput exceeding ~ million units per year. This surge has accelerated procurement of automated sortation and screening solutions, with system deployments expanding by nearly ~ systems across large hubs. Higher transfer volumes and tighter turnaround schedules are compelling airport operators to prioritize reliability and speed, reinforcing sustained investment momentum in advanced baggage handling infrastructure.

Terminal modernization programs across major Japanese hubs

Large-scale terminal redevelopment initiatives across metropolitan airports are reshaping procurement patterns in the baggage handling segment. Modernization programs currently encompass more than ~ terminals, with cumulative project spending exceeding USD ~ million on automation upgrades. These initiatives focus on replacing aging conveyor networks with high-speed, modular architectures capable of processing ~ million bags annually. Integration of digital monitoring layers further enhances asset utilization and maintenance efficiency. As redevelopment timelines extend across multiple phases, system vendors benefit from recurring upgrade cycles and long-term service contracts.

Challenges

High capital expenditure for system upgrades and retrofits

Baggage handling system modernization requires substantial upfront financial commitments, with single-terminal retrofits often exceeding USD ~ million in equipment and installation costs. For mid-sized airports handling ~ million passengers annually, such investments can strain operating budgets and delay procurement decisions. Long payback cycles and competing infrastructure priorities intensify financial scrutiny, particularly in publicly funded facilities. These constraints slow the adoption of advanced technologies despite clear efficiency gains, creating a cautious investment environment that favors phased upgrades over comprehensive system replacements.

Complex integration with legacy airport infrastructure

Many Japanese airports operate baggage systems installed over ~ decades ago, creating significant integration challenges for new automation layers. Retrofitting modern sortation or tracking modules into constrained terminal layouts often requires extended shutdown windows, disrupting operations that process ~ million bags annually. Compatibility issues between old control software and new digital platforms further complicate deployment timelines. As a result, system upgrades frequently exceed planned schedules, increasing project risk and elevating total implementation costs for airport authorities and system integrators.

Opportunities

Adoption of RFID and real-time baggage tracking solutions

RFID-enabled tracking presents a major growth opportunity as airports seek to reduce mishandling and improve passenger satisfaction. Current pilot deployments demonstrate the ability to monitor over ~ million bags annually with real-time visibility across transfer points. Investment in RFID infrastructure, averaging USD ~ million per terminal, delivers measurable reductions in lost baggage incidents and enhances operational transparency. As regulatory encouragement for traceability strengthens, widespread adoption of these solutions is expected to unlock new revenue streams for technology providers and system integrators.

Growth of automated early baggage storage systems

Early baggage storage automation is gaining traction in high-traffic terminals managing more than ~ million departing passengers each year. These systems enable airports to buffer peak-hour congestion by holding ~ million bags securely before flight allocation. Installation programs typically involve capital commitments of USD ~ million per terminal but deliver strong returns through improved space utilization and labor efficiency. Expanding use of self-service check-in further amplifies demand for automated storage, positioning this segment as a key growth pillar within the baggage handling ecosystem.

Future Outlook

The Japan Airport Baggage Handling System market is expected to advance steadily through the next decade, supported by long-term airport redevelopment programs and rising automation standards. Continued emphasis on digital integration, sustainability, and passenger experience will shape procurement priorities. Regional airports are likely to emerge as incremental growth centers as traffic disperses beyond major hubs. Strategic partnerships between system providers and airport authorities will further define competitive dynamics in the years ahead.

Major Players

- Daifuku Co., Ltd.

- Vanderlande Industries

- Beumer Group

- Siemens Logistics

- Murata Machinery, Ltd.

- Mitsubishi Electric Corporation

- Toshiba Infrastructure Systems & Solutions

- Nippon Conveyor Co., Ltd.

- Sankyu Inc.

- TGW Logistics Group

- Fives Group

- Leonardo S.p.A.

- Crisplant A/S

- Pteris Global

- SITA

Key Target Audience

- Airport authorities and terminal operators

- Airlines and ground handling service providers

- Infrastructure investment and venture capital firms

- Ministry of Land, Infrastructure, Transport and Tourism

- Japan Civil Aviation Bureau

- Airport system integrators and EPC contractors

- Smart infrastructure technology providers

- Public-private partnership project sponsors

Research Methodology

Step 1: Identification of Key Variables

Assessment of passenger throughput indicators, baggage flow intensity, and automation penetration levels. Evaluation of infrastructure modernization pipelines across major and regional airports. Identification of regulatory compliance requirements shaping system design priorities.

Step 2: Market Analysis and Construction

Mapping of demand clusters by airport category and terminal scale. Structuring of application and technology architecture segments. Development of baseline market models using masked financial and volume indicators.

Step 3: Hypothesis Validation and Expert Consultation

Engagement with airport operations specialists and system engineers. Validation of adoption trends for RFID, DCV, and predictive maintenance platforms. Refinement of growth assumptions through scenario testing.

Step 4: Research Synthesis and Final Output

Integration of qualitative insights with quantitative modeling outputs. Alignment of findings with policy and infrastructure development frameworks. Preparation of consulting-grade insights for strategic decision-making.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, airport baggage handling system taxonomy across sortation screening and early bag storage modules, market sizing logic by airport traffic and system capacity upgrades, revenue attribution across equipment sales software and maintenance services, primary interview program with airport operators system integrators and MRO providers, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Passenger and baggage flow pathways

- Ecosystem structure

- Supply chain and system integrator landscape

- Regulatory environment

- Growth Drivers

Rising international passenger traffic post-pandemic recovery

Terminal modernization programs across major Japanese hubs

Government investment in airport digitalization and smart infrastructure

Increasing security and screening automation mandates

Operational efficiency and labor shortage mitigation needs

Expansion of low-cost carrier terminals - Challenges

High capital expenditure for system upgrades and retrofits

Complex integration with legacy airport infrastructure

Extended procurement and approval cycles in public projects

Operational disruption risks during installation phases

Shortage of skilled maintenance technicians

Cybersecurity risks in connected baggage systems - Opportunities

Adoption of RFID and real-time baggage tracking solutions

Growth of automated early baggage storage systems

Greenfield airport development in regional cities

AI-driven predictive maintenance services

Public-private partnership models for airport upgrades

Export of Japanese system integration expertise to Asia-Pacific - Trends

Shift toward modular and scalable handling systems

Increasing deployment of DCV-based high-speed sortation

Integration of baggage systems with airport operational databases

Use of digital twins for system design and optimization

Sustainability-driven adoption of energy-efficient conveyors

Growth of remote monitoring and service platforms - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Greenfield airport installations

Brownfield airport retrofits

Terminal expansion projects

Cargo terminal systems

Regional and secondary airport deployments - By Application (in Value %)

Check-in and induction systems

Baggage screening and security handling

Sortation and transfer systems

Early baggage storage systems

Reclaim and carousel systems - By Technology Architecture (in Value %)

Conventional conveyor-based systems

High-speed destination coded vehicle systems

Tilt-tray and cross-belt sorters

RFID-enabled tracking systems

AI-based predictive maintenance platforms - By End-Use Industry (in Value %)

International airports

Domestic airports

Low-cost carrier terminals

Dedicated cargo airports

Private and defense aviation facilities - By Connectivity Type (in Value %)

Standalone systems

On-premise integrated systems

Cloud-connected monitoring platforms

IoT-enabled smart handling systems

Hybrid connectivity architectures - By Region (in Value %)

Kanto region

Kansai region

Chubu region

Kyushu and Okinawa

Hokkaido and Tohoku

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (system reliability, throughput capacity, lifecycle cost, installation lead time, integration capability, service network coverage, technology innovation level, sustainability performance)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Daifuku Co., Ltd.

Beumer Group

Vanderlande Industries

Siemens Logistics

TGW Logistics Group

SITA

Fives Group

Leonardo S.p.A.

Murata Machinery, Ltd.

Nippon Conveyor Co., Ltd.

Toshiba Infrastructure Systems & Solutions

Mitsubishi Electric Corporation

Sankyu Inc.

Crisplant A/S

Pteris Global

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035