Market Overview

The Japan airport ground handling systems market current size stands at around USD ~ million, reflecting steady demand across major international and regional airports driven by modernization and operational efficiency needs. Recent spending momentum has pushed system deployments to nearly ~ systems, supported by capital allocation of USD ~ million toward automation, digital coordination platforms, and sustainable ground operations. The market continues to evolve with rising integration of intelligent handling solutions that streamline aircraft turnaround, cargo processing, and passenger service efficiency.

Dominant demand centers are concentrated around Tokyo, Osaka, and Nagoya, where dense air traffic, hub airport infrastructure, and mature aviation ecosystems support continuous technology upgrades. These regions benefit from strong airline concentration, advanced logistics networks, and consistent policy backing for smart airport programs. The presence of large airport authorities, global carriers, and third-party handling operators further accelerates adoption of advanced systems, positioning these cities as benchmarks for operational excellence and innovation in ground handling modernization.

Market Segmentation

By Application

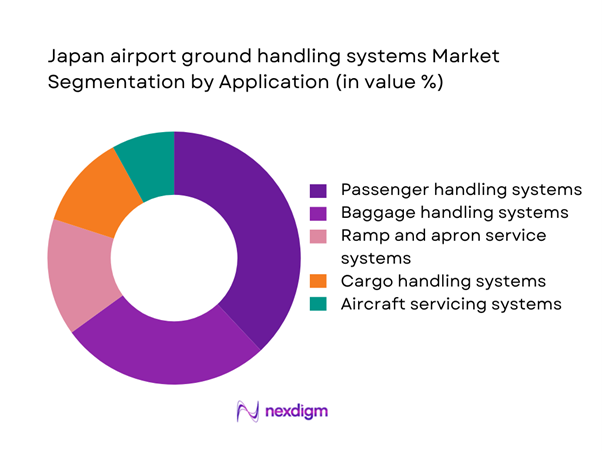

Passenger handling and baggage management systems dominate this market segmentation, driven by the high concentration of traffic at major hubs and the need to reduce turnaround times. Airlines and airport operators prioritize integrated solutions that enhance throughput, minimize manual intervention, and improve service consistency. Investments of USD ~ million in automation across terminals have supported the expansion of intelligent check-in, boarding, and baggage sorting platforms. Cargo handling systems are also gaining relevance, supported by sustained growth in express logistics and e-commerce air freight volumes of ~ units handled annually. The emphasis on seamless passenger experience, operational continuity, and compliance with safety protocols has firmly positioned passenger-centric applications as the most influential segment in shaping procurement decisions and technology roadmaps.

By Technology Architecture

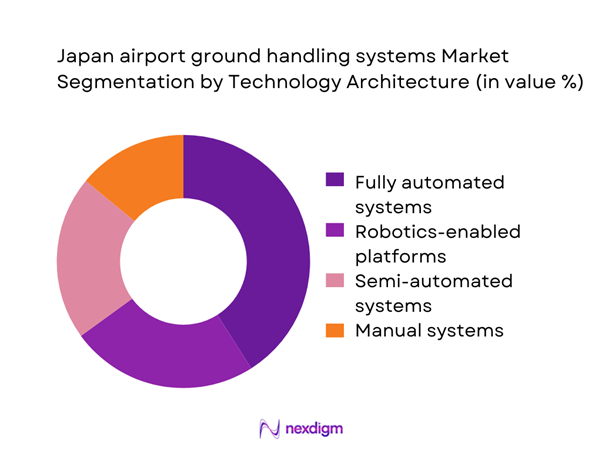

Fully automated and robotics-enabled systems lead technology adoption, driven by labor constraints and rising performance expectations at high-traffic airports. Investments nearing USD ~ million have been directed toward AI-assisted control platforms and automated guided vehicles to manage baggage, catering, and aircraft servicing workflows. Semi-automated systems remain relevant in regional facilities, but large hubs increasingly favor end-to-end automation to handle ~ units of luggage and cargo daily with minimal error rates. The growing integration of predictive analytics and digital twins further strengthens the dominance of advanced architectures, enabling operators to optimize resource allocation, reduce downtime, and extend equipment life cycles across ~ systems deployed nationwide.

Competitive Landscape

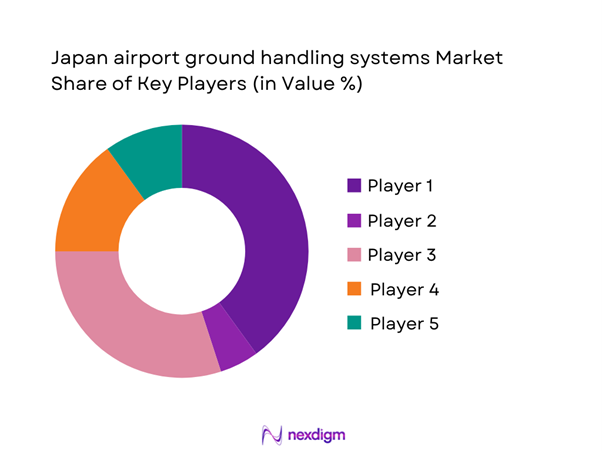

The market is moderately concentrated, characterized by the presence of established global solution providers alongside strong domestic engineering firms. Long-term service contracts, high switching costs, and regulatory compliance requirements reinforce incumbent advantages, while new entrants focus on niche automation and software-driven platforms.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Daifuku Co., Ltd. | 1937 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Vanderlande Industries | 1949 | Netherlands | ~ | ~ | ~ | ~ | ~ | ~ |

| BEUMER Group | 1935 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| JBT AeroTech | 1944 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| TLD Group | 1946 | France | ~ | ~ | ~ | ~ | ~ | ~ |

Japan airport ground handling systems Market Analysis

Growth Drivers

Rising air passenger traffic and airport capacity expansion

Between 2022 and 2025, airport operators allocated USD ~ million toward terminal upgrades and airside modernization to manage annual passenger volumes of ~ travelers. This expansion required deployment of ~ systems for baggage, ramp coordination, and aircraft servicing to maintain service reliability. Increased runway utilization and gate turnover also drove investments of USD ~ million in automated handling platforms, enabling faster processing of ~ flights per day. These developments directly stimulated procurement of integrated ground handling solutions that support high-frequency operations while maintaining safety and compliance across busy airport ecosystems.

Push for operational efficiency and faster aircraft turnaround

Airlines and service providers invested nearly USD ~ million from 2023 to 2025 in systems designed to cut turnaround cycles by handling ~ operations daily with fewer manual interventions. Deployment of ~ automated loaders and digital dispatch platforms enabled real-time coordination of crews, equipment, and aircraft servicing schedules. These efficiency-focused initiatives reduced idle time across ~ fleets, improved asset utilization, and strengthened on-time performance benchmarks. As a result, efficiency optimization emerged as a core driver shaping purchasing priorities and long-term technology partnerships in the ground handling systems market.

Challenges

High capital expenditure for system upgrades

Modern ground handling platforms require upfront spending of USD ~ million per major airport, creating financial pressure for operators managing ~ terminals nationwide. Between 2022 and 2025, several regional facilities deferred procurement of ~ systems due to budget constraints and competing infrastructure priorities. The need for specialized installation, testing, and certification further increases total deployment costs, often exceeding USD ~ million for fully automated environments. This financial burden limits adoption speed, particularly among secondary airports, and constrains market penetration despite clear operational benefits.

Integration complexity with legacy airport infrastructure

Many airports operate on infrastructure installed over ~ years ago, creating compatibility challenges when introducing advanced digital platforms. From 2022 to 2025, integration programs required deployment of ~ interface modules and middleware systems costing USD ~ million to connect new automation with existing controls. These projects often involved extended downtime across ~ operational zones, affecting service continuity. The technical complexity and resource intensity of such upgrades remain a significant barrier, slowing modernization cycles and increasing risk exposure for airport authorities and service providers.

Opportunities

Modernization of regional and secondary airports

Government-backed infrastructure programs between 2023 and 2025 allocated USD ~ million to upgrade ~ regional airports, creating strong demand for scalable and modular ground handling systems. These facilities collectively manage ~ flights annually and are increasingly adopting semi-automated baggage and ramp solutions to improve service reliability. The modernization push opens opportunities for vendors to deploy cost-efficient platforms across ~ terminals, establishing long-term service contracts and lifecycle management agreements that extend revenue visibility.

Adoption of AI-driven predictive maintenance platforms

From 2022 to 2025, operators invested USD ~ million in predictive analytics solutions monitoring ~ systems to reduce downtime and maintenance costs. These platforms process ~ data points daily to forecast component failures and optimize service schedules. The ability to extend equipment life cycles and reduce emergency repair expenses positions AI-driven maintenance as a high-impact opportunity, encouraging airports and ground handlers to integrate advanced software layers into existing hardware ecosystems.

Future Outlook

The Japan airport ground handling systems market is set to advance steadily through the coming decade as automation, digital coordination, and sustainability initiatives reshape airport operations. Continued infrastructure investment and smart airport policies are expected to accelerate technology adoption across both major hubs and regional facilities. Collaboration between airport authorities, airlines, and solution providers will remain central to building resilient and efficient ground handling ecosystems through 2035.

Major Players

- Daifuku Co., Ltd.

- Vanderlande Industries

- BEUMER Group

- JBT AeroTech

- TLD Group

- Toyota Industries Corporation

- Mitsubishi Heavy Industries

- Hitachi, Ltd.

- Siemens Logistics

- SITA

- Textron GSE

- Mallaghan Engineering

- Charlatte Manutention

- Honeywell Aerospace

- Collins Aerospace

Key Target Audience

- Airport authorities and operators

- Commercial airlines and fleet managers

- Third-party ground handling service providers

- Cargo airlines and air logistics companies

- Investments and venture capital firms focused on infrastructure technology

- Ministry of Land, Infrastructure, Transport and Tourism Japan Civil Aviation Bureau

- Japan Airport Terminal Co. and regional airport management agencies

- Smart infrastructure and airport digitalization program offices

Research Methodology

Step 1: Identification of Key Variables

Key demand indicators were mapped across airport modernization programs, airline fleet activity, and technology adoption patterns. Operational efficiency metrics and safety compliance requirements were assessed to define system relevance. Procurement cycles and service lifecycle expectations were also evaluated to shape market boundaries.

Step 2: Market Analysis and Construction

Quantitative models were built around system deployment trends, investment flows, and replacement cycles. Supply chain structures and vendor capabilities were examined to understand competitive dynamics. Scenario modeling helped align infrastructure development timelines with technology demand.

Step 3: Hypothesis Validation and Expert Consultation

Industry specialists from airport operations, airline ground services, and systems integration were consulted. Assumptions on automation uptake and service outsourcing trends were validated through expert insights. Regulatory alignment and safety compliance perspectives refined adoption outlooks.

Step 4: Research Synthesis and Final Output

Findings were consolidated into coherent market narratives and strategic frameworks. Cross-segment comparisons ensured consistency across applications and technology architectures. Final outputs were structured to support decision-making for investors, operators, and policymakers.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, airport ground handling system taxonomy across ramp passenger and cargo operations, market sizing logic by airport traffic and GSE deployment, revenue attribution across equipment sales leasing and service contracts, primary interview program with airports ground handlers and MRO providers, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Operational and service usage pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory and safety environment

- Growth Drivers

Rising air passenger traffic and airport capacity expansion

Push for operational efficiency and faster aircraft turnaround

Increasing automation to address labor shortages

Stringent safety and compliance requirements at major hubs

Growth of air cargo and express logistics demand

Government support for smart airport initiatives - Challenges

High capital expenditure for system upgrades

Integration complexity with legacy airport infrastructure

Shortage of skilled technicians for advanced systems

Operational disruptions during system migration

Data security and cyber-risk concerns

Procurement delays in public sector airports - Opportunities

Modernization of regional and secondary airports

Adoption of AI-driven predictive maintenance platforms

Expansion of electric and low-emission ground support equipment systems

Growth of integrated airport operations control centers

Rising demand for modular and scalable handling solutions

Public–private partnerships for airport digitization - Trends

Shift toward fully automated baggage and cargo handling

Increased deployment of robotics for ramp operations

Use of digital twins for airport ground operations planning

Integration of real-time analytics for turnaround optimization

Standardization of interoperable ground handling platforms

Sustainability-driven investments in green ground systems - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Narrow-body aircraft support systems

Wide-body aircraft support systems

Regional aircraft support systems

Business jet and general aviation support systems - By Application (in Value %)

Passenger handling systems

Baggage handling and sorting systems

Ramp and apron service systems

Cargo and mail handling systems

Aircraft servicing and turnaround systems - By Technology Architecture (in Value %)

Manual and semi-automated systems

Fully automated ground handling systems

Robotics-enabled service platforms

AI-driven operational management systems - By End-Use Industry (in Value %)

Commercial airlines

Airport operators and authorities

Third-party ground handling service providers

Cargo airlines and logistics operators

Defense and government aviation - By Connectivity Type (in Value %)

Standalone systems

Airport LAN-integrated systems

Cloud-connected and IoT-enabled platforms

5G-enabled real-time operations systems - By Region (in Value %)

Kanto region

Kansai region

Chubu region

Kyushu and Okinawa

Tohoku and Hokkaido

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (system automation level, installation base at major airports, integration capability with airport IT, lifecycle service coverage, compliance with Japanese safety standards, pricing competitiveness, customization flexibility, after-sales support footprint)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Daifuku Co., Ltd.

Vanderlande Industries

BEUMER Group

Siemens Logistics

SITA

JBT AeroTech

TLD Group

Textron GSE

Mallaghan Engineering

Charlatte Manutention

Toyota Industries Corporation

Mitsubishi Heavy Industries

Hitachi, Ltd.

Honeywell Aerospace

Collins Aerospace

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035