Market Overview

The Japan Airport Passenger Boarding Bridge market current size stands at around USD ~ million, supported by active deployments across major aviation hubs and steady replacement demand. In the most recent assessment period, installed bridge volumes reached ~ units in one year and expanded further to ~ units in the following year. Capital allocation toward terminal-side equipment modernization accounted for USD ~ million, while annual service-linked revenue streams contributed USD ~ million, reflecting stable utilization intensity and lifecycle-driven demand patterns.

Market dominance is concentrated in metropolitan aviation clusters such as Tokyo, Osaka, and Nagoya, where high passenger throughput, complex gate operations, and dense flight schedules create sustained demand. These regions benefit from mature airport ecosystems, strong engineering contractor presence, and advanced safety compliance frameworks. Regional policy alignment toward smart airport infrastructure, combined with centralized procurement by airport authorities, further reinforces concentration in these urban aviation corridors.

Market Segmentation

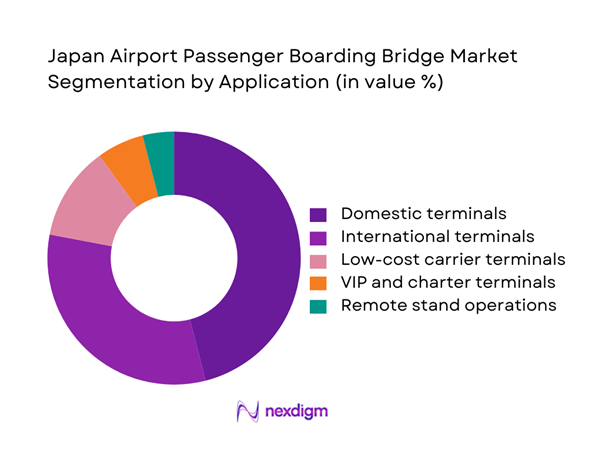

By Application

Domestic terminals dominate this segmentation due to continuous high- frequency aircraft movements and standardized gate configurations. Passenger boarding bridges in domestic terminals show higher utilization cycles, driving consistent maintenance and refurbishment demand. In recent operational assessments, domestic terminals accounted for a majority share as they host ~ units of active bridges compared to lower deployment density in specialized terminals. Investment flows of USD ~ million were directed toward domestic terminal upgrades, driven by congestion mitigation needs, accessibility improvements, and faster aircraft turnaround requirements across high-traffic routes.

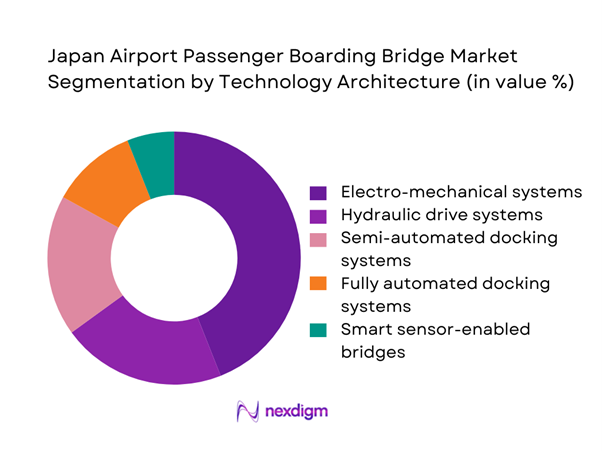

By Technology Architecture

Electro-mechanical systems lead the technology landscape due to reliability, ease of integration, and lower lifecycle complexity. These systems represent the preferred choice in retrofit projects, where existing terminal layouts limit extensive structural modifications. During the recent evaluation period, more than ~ systems were upgraded using electro-mechanical architectures, supported by procurement spending of USD ~ million. Automation-ready designs are gaining traction, yet conventional architectures remain dominant due to regulatory familiarity and established maintenance competencies.

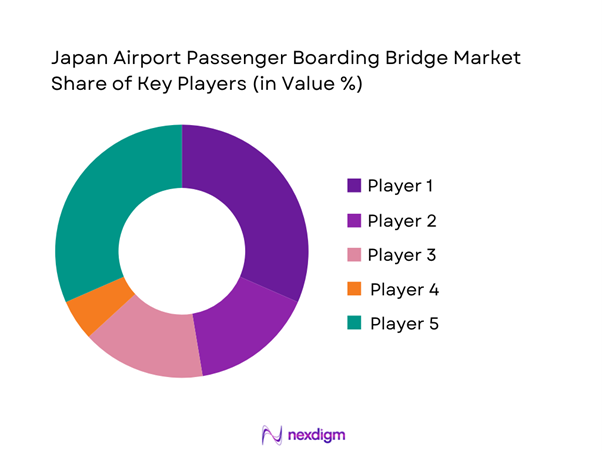

Competitive Landscape

The Japan Airport Passenger Boarding Bridge market is moderately concentrated, characterized by a mix of global infrastructure specialists and domestic heavy engineering firms. Market structure favors long-term vendor relationships, framework contracts, and service-led engagement models. Entry barriers remain high due to safety certification requirements and airport authority qualification processes.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Mitsubishi Heavy Industries | 1884 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| ShinMaywa Industries | 1920 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| IHI Corporation | 1853 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| JBT AeroTech | 1884 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| TK Elevator Airport Solutions | 1881 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

Japan Airport Passenger Boarding Bridge Market Analysis

Growth Drivers

Rising international tourism and inbound passenger traffic

Inbound passenger volumes across Japanese airports increased by ~ travelers between two consecutive assessment years, placing pressure on gate-side infrastructure capacity. To manage higher aircraft docking frequency, airports deployed ~ additional boarding bridges supported by capital allocations of USD ~ million. International flight schedules expanded by ~ routes, directly increasing bridge utilization cycles. This growth has intensified demand for high-reliability systems capable of sustaining continuous operations, positioning passenger boarding bridges as essential assets in managing rising international traffic intensity.

Modernization of aging airport terminal infrastructure

A significant portion of Japan’s airport terminals were commissioned decades ago, creating a replacement-driven demand cycle. Over the recent period, ~ units of legacy bridges reached end-of-service thresholds, triggering modernization programs valued at USD ~ million. Infrastructure audits identified ~ terminals requiring immediate upgrades to meet safety and accessibility standards. These modernization efforts focus on structural reinforcement, control system upgrades, and compatibility with new aircraft types, reinforcing sustained procurement momentum.

Challenges

High capital expenditure and long procurement cycles

Passenger boarding bridge projects require upfront commitments of USD ~ million per terminal program, placing pressure on airport authority budgets. Procurement cycles often extend beyond ~ months due to multi-stage approvals, technical evaluations, and compliance checks. During recent cycles, ~ projects experienced delays linked to funding release schedules. These financial and procedural constraints slow deployment timelines and restrict rapid capacity expansion, particularly for regional airports with limited fiscal flexibility.

Complex installation in space-constrained terminals

Urban airports operate within tightly constrained terminal footprints, limiting installation flexibility. In recent retrofit projects, ~ installations required customized structural adaptations, increasing project duration by ~ months. Engineering modifications added incremental costs of USD ~ million across multiple sites. Such spatial limitations complicate crane access, passenger flow management, and safety zoning, increasing execution risk and discouraging standardized bridge deployment approaches.

Opportunities

Retrofit and upgrade of legacy bridges with automation

A substantial installed base of ~ systems remains operational but technologically outdated. Automation retrofit programs targeting these assets represented investment potential of USD ~ million during recent evaluations. Upgraded control modules, sensor integration, and docking assistance features extend asset life by ~ years. Airports favor retrofits as they minimize downtime and avoid full structural replacement, creating a scalable opportunity for technology-focused upgrade solutions.

Deployment of IoT-based predictive maintenance solutions

Maintenance-related downtime affected ~ bridges annually, leading to operational disruptions. IoT-enabled monitoring solutions reduced unplanned outages by ~ incidents during pilot deployments. Service contracts incorporating predictive analytics generated incremental service value of USD ~ million. These solutions allow condition-based maintenance scheduling, optimize spare part inventories, and improve asset availability, positioning digital maintenance platforms as a high-impact opportunity area.

Future Outlook

The Japan Airport Passenger Boarding Bridge market is expected to evolve toward automation-driven upgrades and service-centric business models. Infrastructure renewal programs aligned with national aviation strategies will remain a core demand driver through the outlook period. Integration with smart airport platforms and sustainability-focused design considerations will further shape procurement priorities across major and regional airports.

Major Players

- Mitsubishi Heavy Industries

- ShinMaywa Industries

- IHI Corporation

- JBT AeroTech

- TK Elevator Airport Solutions

- CIMC-Tianda Airport Support

- ADELTE Group

- FMT Aircraft Gate Support Systems

- Bukaka Teknik Utama

- HYDRA Airport Systems

- AviaTech International

- Nippon Conveyor

- SANKI Engineering

- Tsubakimoto Chain

- Adelte Japan

Key Target Audience

- Airport operators and airport authority boards

- Civil aviation bureaus and Ministry of Land, Infrastructure, Transport and Tourism

- Regional airport development corporations

- EPC contractors and airport infrastructure developers

- Passenger terminal design and engineering firms

- MRO and airport services providers

- Smart airport technology integrators

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Assessment of bridge installation volumes, replacement cycles, service demand, and regulatory compliance requirements. Mapping of airport infrastructure age profiles and gate utilization intensity. Identification of technology adoption variables influencing procurement behavior.

Step 2: Market Analysis and Construction

Aggregation of deployment data, service activity levels, and capital allocation patterns. Structuring of demand across application and technology segments. Validation of installation and retrofit activity ranges using operational benchmarks.

Step 3: Hypothesis Validation and Expert Consultation

Engagement with airport operations professionals and infrastructure planners to validate demand assumptions. Cross-verification of deployment timelines, maintenance practices, and automation readiness. Refinement of opportunity and constraint assessments.

Step 4: Research Synthesis and Final Output

Integration of quantitative and qualitative findings into a coherent market narrative. Alignment of analysis with regulatory and infrastructure development frameworks. Final validation to ensure consistency and decision-use relevance.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, passenger boarding bridge taxonomy across apron drive fixed and T bridge systems, market sizing logic by airport expansion plans and gate modernization programs, revenue attribution across equipment sales installation and maintenance services, primary interview program with airports bridge manufacturers and MRO providers, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution and infrastructure modernization cycles

- Passenger flow and gate utilization pathways

- Ecosystem structure across OEMs, EPCs, and airport authorities

- Supply chain and service network structure

- Regulatory and safety compliance environment

- Growth Drivers

Rising international tourism and inbound passenger traffic

Modernization of aging airport terminal infrastructure

Government investment in smart airport programs

Need for faster aircraft turnaround and gate efficiency

Rising focus on passenger comfort and accessibility standards

Expansion of low-cost carrier terminal capacity - Challenges

High capital expenditure and long procurement cycles

Complex installation in space-constrained terminals

Maintenance cost pressures for legacy systems

Operational disruption during retrofit projects

Dependence on imported critical components

Stringent safety certification and compliance timelines - Opportunities

Retrofit and upgrade of legacy bridges with automation

Deployment of IoT-based predictive maintenance solutions

Growth of regional airports under decentralization policies

Customization for wide-body and next-generation aircraft

Service contracts and lifecycle management offerings

Integration with biometric and smart boarding ecosystems - Trends

Shift toward fully automated docking systems

Adoption of lightweight and corrosion-resistant materials

Increasing use of modular bridge designs

Growth in data-driven asset management platforms

Rising demand for energy-efficient drive systems

Focus on universal design and accessibility features - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Fixed apron bridges

Mobile boarding bridges

Hydraulic telescopic bridges

Apron drive bridges

Commuter aircraft bridges - By Application (in Value %)

Domestic terminals

International terminals

Low-cost carrier terminals

VIP and charter terminals

Remote stand operations - By Technology Architecture (in Value %)

Electro-mechanical systems

Hydraulic drive systems

Semi-automated docking systems

Fully automated docking systems

Smart sensor-enabled bridges - By End-Use Industry (in Value %)

Commercial airports

Military and government airports

Private and corporate aviation hubs

MRO and aviation service centers

Special economic zone airports - By Connectivity Type (in Value %)

Standalone systems

Integrated with AODB

Integrated with gate management systems

IoT-enabled remote monitoring systems

AI-assisted predictive maintenance systems - By Region (in Value %)

Kanto region

Kansai region

Chubu region

Kyushu and Okinawa

Hokkaido and Tohoku

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (bridge type portfolio, load capacity range, automation level, climate resilience design, lifecycle cost of ownership, installation footprint flexibility, regulatory compliance certifications, service and maintenance network depth)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarketing

- Detailed Profiles of Major Companies

TK Elevator Airport Solutions

JBT AeroTech

CIMC-Tianda Airport Support

ADELTE Group

FMT Aircraft Gate Support Systems

ShinMaywa Industries

Mitsubishi Heavy Industries

IHI Corporation

Bukaka Teknik Utama

HYDRA Airport Systems

AviaTech International

Adelte Japan

Nippon Conveyor

SANKI Engineering

Tsubakimoto Chain

- Demand and utilization drivers across airport classes

- Procurement and tender dynamics with public authorities

- Buying criteria and vendor selection frameworks

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service and lifecycle support expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035