Market Overview

The Japan airport runway safety systems market is primarily driven by the continuous advancements in aviation technology, increasing airport safety concerns, and regulatory requirements. As the aviation sector continues to grow, especially with increasing air traffic and modern airport infrastructure, the demand for state-of-the-art safety systems has surged. Japan’s major airports, including Tokyo Narita and Osaka Kansai, are upgrading their runway safety equipment to meet international standards and enhance operational safety. This technological shift has resulted in a growing market size.

Several cities and airports in Japan dominate the runway safety systems market due to their strategic geographical locations and high passenger volumes. Tokyo Narita and Osaka Kansai stand out, serving as major international hubs with a large fleet of aircraft and high air traffic. These airports are equipped with advanced safety systems due to the demand for superior safety protocols, supported by both government regulations and international aviation safety standards. Japan’s commitment to improving aviation infrastructure further solidifies these cities as dominant players in the market.

Market Segmentation

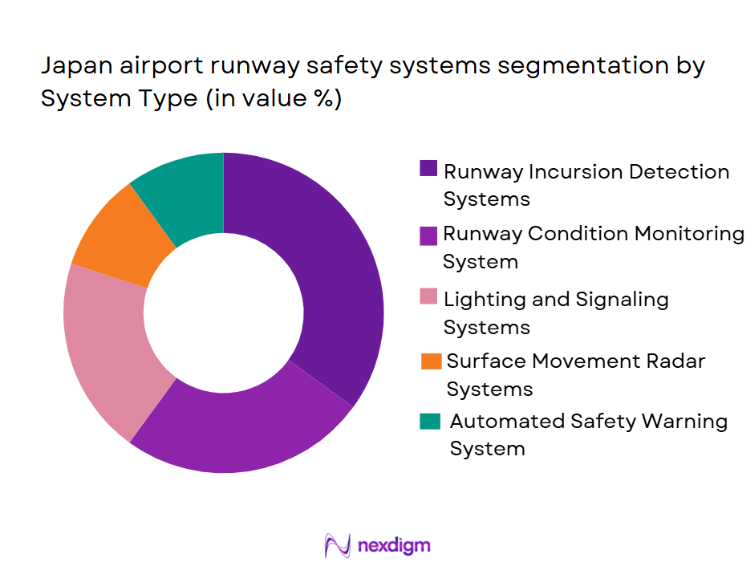

By System Type

The Japan airport runway safety systems market is segmented by system type into runway incursion detection systems, runway condition monitoring systems, lighting and signaling systems, surface movement radar systems, and automated safety warning systems. Among these, the runway incursion detection systems hold a dominant position in the market. This is primarily due to the increasing focus on preventing runway collisions, which has led to the widespread adoption of such systems. The growing complexity of air traffic at major airports in Japan, such as Tokyo Narita, has accelerated the implementation of these detection systems. Their ability to provide real-time data and alerts helps prevent accidents and enhances runway safety.

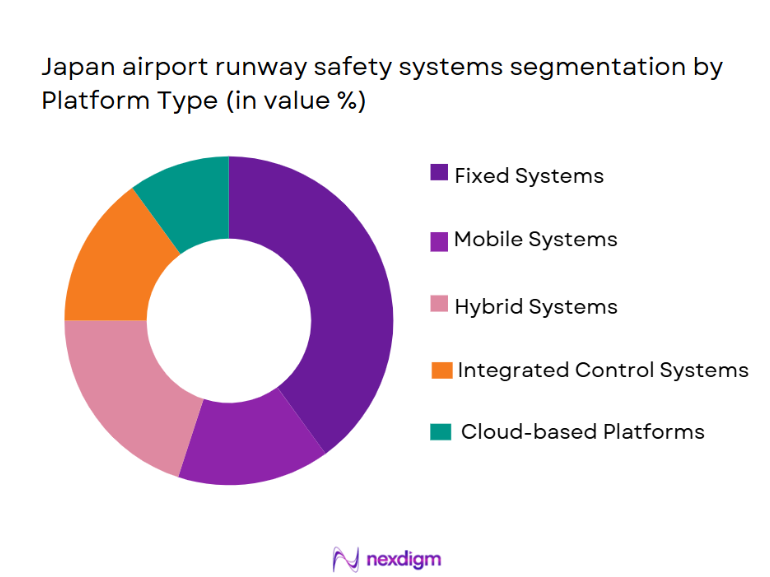

By Platform Type

Platform types in the Japan airport runway safety systems market are divided into fixed systems, mobile systems, hybrid systems, integrated control systems, and cloud-based platforms. Fixed systems are currently the most dominant due to their ability to provide consistent and reliable safety monitoring. These systems are already widely implemented at major airports, offering long-term operational reliability and ease of maintenance. As Japan focuses on enhancing airport infrastructure, the demand for fixed systems is further heightened to accommodate high air traffic volume and to ensure compliance with stringent safety regulations.

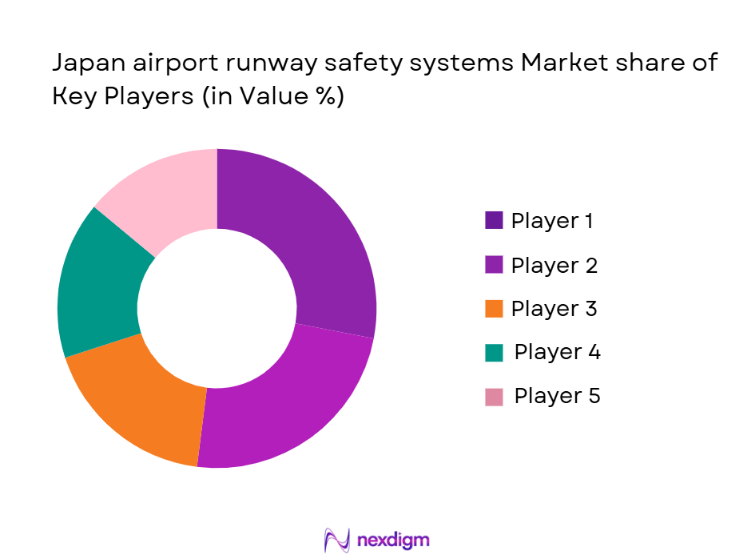

Competitive Landscape

The Japan airport runway safety systems market is dominated by both local and international players. Leading players include Thales Group, Honeywell International Inc., and L3 Technologies, which provide advanced technological solutions that meet the stringent requirements set by international aviation authorities. The consolidation of these key companies highlights their significant influence in shaping the market, as they dominate both the production of high-quality systems and the implementation of innovative solutions. Moreover, these players have established strong partnerships with government and regulatory bodies, enhancing their foothold in Japan’s rapidly expanding airport safety landscape.

| Company Name | Establishment Year | Headquarters | System Type Focus | Technological Advancements | Government Contracts | Revenue (Estimation) | Market Reach |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ |

| Honeywell International Inc. | 1906 | USA | ~ | ~ | ~ | ~ | ~ |

| L3 Technologies | 1997 | USA | ~ | ~ | ~ | ~ | ~ |

| Indra Sistemas S.A. | 1986 | Spain | ~ | ~ | ~ | ~ | ~ |

| Rohde & Schwarz GmbH & Co. KG | 1933 | Germany | ~ | ~ | ~ | ~ | ~ |

Japan Airport Runway Safety Systems Market Analysis

Growth Drivers

Regulatory-driven airport safety modernization mandates

Japan Airport Runway Safety Systems Market growth is fundamentally driven by mandatory compliance with international aviation safety frameworks enforced through national aviation authorities, requiring airports to upgrade runway safety infrastructure to meet evolving operational standards. These mandates prioritize runway incursion prevention, low-visibility operation capability, and real-time situational awareness, compelling airport operators to invest consistently in certified systems. Regulatory audits and safety assessments create non-discretionary capital expenditure cycles that sustain demand regardless of passenger traffic fluctuations. The alignment of national transport policy with global aviation standards further accelerates system replacement timelines. Centralized funding mechanisms reduce financial risk for airport operators, enabling large-scale deployments. Compliance-driven procurement also favors proven vendors with certified technologies, reinforcing continuous market activity. The structured regulatory environment ensures predictable project pipelines across major and regional airports. This regulatory certainty underpins long-term market stability and sustained technology adoption.

Rising air traffic density and operational complexity

Increasing aircraft movements across Japan’s major airports significantly elevate runway congestion, directly increasing the risk profile of ground operations and necessitating advanced safety systems. High-frequency takeoffs, landings, and taxiing operations demand precise coordination and real-time monitoring to prevent incursions and delays. Airports are compelled to deploy integrated runway safety platforms that combine lighting, surveillance, and decision-support technologies. Operational complexity is further amplified by mixed aircraft types, adverse weather exposure, and limited runway expansion options. Safety systems become essential tools for maintaining throughput without compromising compliance. As traffic density increases, airports prioritize automation to reduce human error and enhance situational awareness. This operational pressure sustains investment momentum across safety-critical infrastructure. The direct link between traffic growth and safety system necessity positions complexity management as a core growth driver.

Market Challenges

High capital expenditure and long procurement cycles

Japan Airport Runway Safety Systems Market faces challenges from substantial upfront investment requirements associated with certified safety technologies and infrastructure installation. Airports must allocate significant budgets for equipment, system integration, testing, and regulatory approval, which can delay adoption timelines. Public procurement frameworks often involve extended tendering processes, increasing project lead times. Budgetary constraints at smaller regional airports further limit rapid deployment. The requirement for redundancy and system reliability adds additional cost layers. Long approval cycles slow market velocity and restrict vendor flexibility. These financial and procedural barriers can postpone modernization initiatives. Capital intensity remains a structural challenge impacting market scalability.

Complex system integration with legacy infrastructure

Many Japanese airports operate with layered legacy systems that complicate the integration of modern runway safety technologies. Compatibility issues arise when integrating digital platforms with older lighting, radar, or communication infrastructure. System downtime during upgrades poses operational risks, discouraging rapid transitions. Airports must invest in phased implementation strategies, extending project timelines. Integration complexity also increases dependence on specialized vendors and system integrators. Technical risk management becomes a critical concern during deployment. These challenges elevate project costs and technical uncertainty. Legacy infrastructure constraints continue to limit seamless modernization.

Opportunities

Adoption of integrated digital runway management platforms

Japan Airport Runway Safety Systems Market presents strong opportunities through the adoption of integrated digital platforms that unify lighting control, surveillance, and safety analytics. Airports increasingly seek centralized systems that enhance decision-making and reduce operational silos. Digital integration enables predictive safety management and real-time alerts. Such platforms improve efficiency while meeting regulatory requirements. The shift toward data-driven airport operations supports long-term technology upgrades. Vendors offering interoperable solutions gain competitive advantage. This transition creates opportunities for software-centric safety systems. Integrated platforms align with broader smart airport initiatives.

Expansion of safety systems at regional and secondary airports

Government-supported regional airport revitalization initiatives create opportunities for runway safety system deployment beyond major hubs. Upgrades at secondary airports aim to improve operational reliability and emergency preparedness. These airports increasingly require standardized safety systems to support tourism and regional connectivity. Cost-optimized solutions tailored to smaller facilities gain traction. Regional deployment expands the addressable market for suppliers. Public funding reduces investment barriers. This expansion supports balanced national aviation development. Regional airports represent an underpenetrated growth segment.

Future Outlook

Over the next 5 years, the Japan airport runway safety systems market is expected to show continued growth driven by advancements in safety technology and increasing government support for infrastructure upgrades. As the Japanese government prioritizes aviation safety, airports across the country will continue to invest in modernizing runway safety systems. Furthermore, the rising air traffic, coupled with stringent international safety regulations, will contribute to the growing demand for state-of-the-art safety systems to mitigate runway accidents.

Major Players

- Thales Group

- Honeywell International Inc.

- L3 Technologies

- Indra Sistemas S.A.

- Rohde & Schwarz GmbH & Co. KG

- Siemens AG

- Aviation Safety Management Systems

- Rockwell Collins

- SITA

- Boeing

- Airbus

- Raytheon Technologies

- Zodiac Aerospace

- AeroVironment, Inc.

- Saab AB

Key Target Audience

- Investment and venture capitalist firms

- Government and regulatory bodies

- Airports and aviation authorities

- Airport infrastructure developers

- Airlines and fleet operators

- Airport safety equipment manufacturers

- Aviation consultants and safety experts

- Airport management and operations teams

Research Methodology

Step 1: Identification of Key Variables

The initial phase of this research includes the identification of key market variables related to Japan’s airport runway safety systems, such as system types, platform types, regulatory frameworks, and market growth drivers. This is achieved by gathering data from industry reports, government publications, and expert interviews.

Step 2: Market Analysis and Construction

In this phase, we analyze historical market data to understand the penetration of different runway safety systems and their respective platforms in Japan. We assess their contribution to market growth, focusing on technological advancements and market saturation to generate accurate forecasts for the period 2024-2030.

Step 3: Hypothesis Validation and Expert Consultation

This phase involves validating market hypotheses through consultations with industry experts, including technology providers, government regulators, and airport authorities. Their insights will offer a deeper understanding of the factors influencing market dynamics, allowing for a more accurate market forecast.

Step 4: Research Synthesis and Final Output

The final step synthesizes data gathered through primary and secondary research to provide a comprehensive market report. We will validate our findings by comparing with existing industry reports, ensuring the market data’s accuracy and reliability. Additionally, direct consultations with key players will enhance the robustness of the analysis.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for airport safety systems due to rising air traffic in Japan

Government initiatives and regulatory requirements enhancing runway safety

Technological advancements in runway safety systems driving adoption - Market Challenges

High cost of implementing advanced runway safety systems

Complex integration with existing airport infrastructure

Lack of skilled personnel to operate and maintain safety systems - Market Opportunities

Growing investment in airport modernization projects in Japan

Expansion of low-cost carriers creating the need for improved safety systems

Rising awareness about runway safety driving demand for new technologies - Trends

Increasing integration of AI and machine learning in runway safety systems

Shift towards fully automated runway safety solutions

Adoption of predictive analytics to enhance operational efficiency

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Runway Incursion Detection Systems

Runway Condition Monitoring Systems

Lighting and Signaling Systems

Surface Movement Radar Systems

Automated Safety Warning Systems - By Platform Type (In Value%)

Fixed Systems

Mobile Systems

Hybrid Systems

Integrated Control Systems

Cloud-Based Platforms - By Fitment Type (In Value%)

OEM Fitment

Retrofit Solutions

Upgraded Fitment

Modular Fitment

Custom Solutions - By EndUser Segment (In Value%)

Commercial Airports

Military Airports

Cargo Airports

Private Airports

Government Entities - By Procurement Channel (In Value%)

Direct Sales

Distributors

E-commerce

Government Tenders

B2B Sales

- Market Share Analysis

- CrossComparison Parameters (Technology Integration, Regulatory Compliance, Market Reach, Product Portfolio, Cost-Effectiveness)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Thales Group

Honeywell International Inc.

L3 Technologies

Aviation Safety Management Systems

Siemens AG

Boeing

Airbus

Raytheon Technologies

Indra Sistemas S.A.

Rohde & Schwarz GmbH & Co. KG

Saab AB

Rockwell Collins

SITA

AeroVironment, Inc.

Zodiac Aerospace

- Commercial airports seeking advanced safety technology to handle growing traffic

- Military airports focusing on enhanced security and control systems

- Cargo airports requiring specialized systems for smooth operations

- Government entities pushing for stricter safety regulations and adoption

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035