Market Overview

The Japan airport services market is valued at USD ~ in 2025. This market growth is primarily driven by increasing air passenger traffic, growth in e-commerce leading to higher cargo volumes, and the ongoing digitalization of airports. The rising number of inbound tourists, especially post-pandemic, combined with the Japanese government’s investment in airport modernization programs, is a key driver. Technological integration, including automation and robotics in handling services, plays a pivotal role in shaping the market’s expansion.

The Japanese airport services market is dominated by Tokyo and Osaka, with Tokyo’s Narita and Haneda airports being the key players. Haneda Airport, for instance, handled approximately ~ passengers in 2025. The dominance of these cities is driven by Japan’s central role as a global hub for both business and tourism, supported by government investments in infrastructure, cutting-edge technology, and a well-established transportation network. These airports also attract large numbers of international airlines and cargo operators.

Market Segmentation

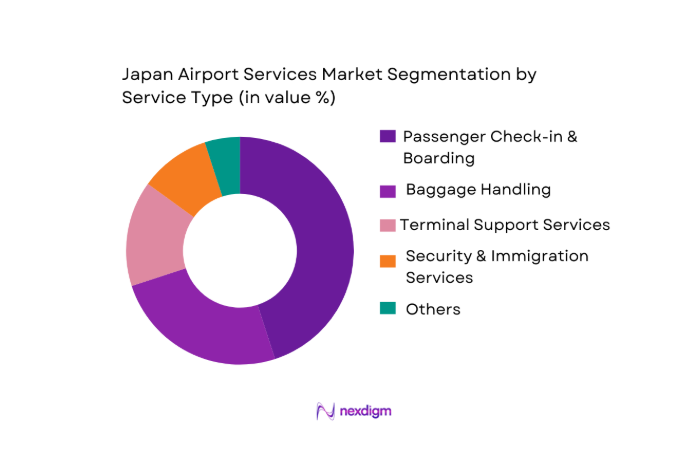

By Service Type

The Japanese airport services market is segmented into passenger handling services, ground handling services, baggage handling services, cargo & freight handling services, and ancillary terminal services.

Passenger Handling Services dominate the segment due to the large volume of air travel and the need for smooth customer experiences. Airlines and ground handlers focus on minimizing delays and improving check-in, boarding, and deplaning procedures. Furthermore, as international tourism increases, passenger handling services like VIP lounges and security check processes become more essential.

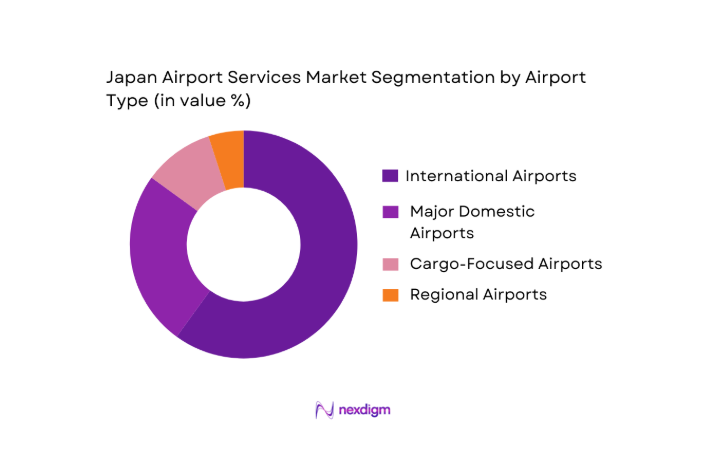

By Airport Type

The segmentation by airport type includes international airports, major domestic airports, regional airports, and cargo-focused airports.

International Airports dominate the segment, accounting for over ~ of the market share. Tokyo’s Narita and Haneda airports are major international hubs, facilitating high passenger and cargo throughput. International travel, particularly to and from the Asia-Pacific region, drives this dominance, as Japanese airports see substantial traffic from global airlines.

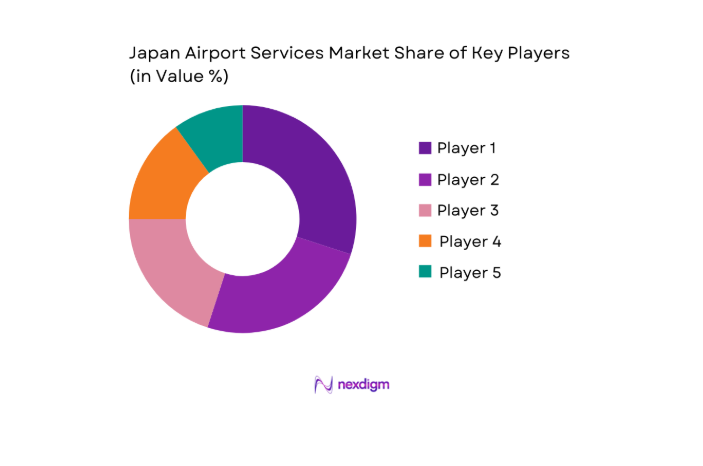

Competitive Landscape

The Japanese airport services market is competitive, with several domestic and international players providing a variety of services. The market is led by a combination of ground handlers, logistics providers, and technology firms specializing in automation and smart airport services.

| Company | Established Year | Headquarters | Service Focus | Revenue (2024) | Fleet Size | Global Reach | Technology Adoption |

| Japan Airport Terminal Co. | 1974 | Tokyo | ~ | ~ | ~ | ~ | ~ |

| Swissport Japan | 1996 | Tokyo | ~ | ~ | ~ | ~ | ~ |

| dnata Japan | 2000 | Tokyo | ~ | ~ | ~ | ~ | ~ |

| Menzies Aviation Japan | 1995 | Tokyo | ~ | ~ | ~ | ~ | ~ |

| ANA Ground Service Company | 1954 | Tokyo | ~ | ~ | ~ | ~ | ~ |

Japan Airport Services Market Analysis

Growth Drivers

Passenger Tourism

Passenger tourism is a significant driver for the Japan airport services market, fueled by the increasing number of international travelers to Japan. In 2023, Japan recorded approximately ~ inbound tourists, reflecting a strong recovery from the pandemic. With Japan’s position as a leading global tourism destination, the government has set a target of 40 million inbound tourists by 2025, supported by initiatives like the “Go To Travel” campaign, which promotes domestic and international tourism. The recovery in tourism is backed by increased flight frequencies and expanded services at major airports, especially Tokyo and Osaka.

Cargo E-commerce Growth

The growth of e-commerce has led to an increased demand for air cargo services in Japan. In 2024, Japan’s air cargo traffic rose by ~ compared to the previous year, reaching over ~ tons. The boom in e-commerce, especially cross-border retail, is one of the primary drivers. Japan is a major logistics hub for the Asia-Pacific region, with increasing air cargo volumes attributed to the booming e-commerce industry, which requires fast and reliable air transport to meet consumer demand for timely deliveries. This trend is expected to continue as online shopping volumes surge globally.

Market Challenges

Operational Safety Compliance

Safety remains a crucial challenge for Japan’s airport services industry, especially in light of the increased number of passengers and air traffic. In 2025, Japan reported ~ safety violations related to airport ground operations, highlighting the need for strict adherence to international aviation safety standards. The government’s aviation safety body, Japan Civil Aviation Bureau (JCAB), continues to enforce rigorous compliance measures, including routine safety audits and training programs for ground staff. Ensuring operational safety is paramount for maintaining Japan’s global standing as a safe travel destination, especially as passenger traffic continues to grow.

Workforce Turnover

The Japanese airport services market faces significant challenges regarding workforce turnover, particularly in ground handling and security services. In 2024, Japan’s aviation sector saw a turnover rate of ~ in ground handling staff, with many workers seeking higher-paying roles in other industries. This shortage has impacted airport operations, leading to delays and overburdened staff, especially during peak travel seasons. While the government is working to attract a younger workforce to the sector, a lack of qualified professionals and growing labor demands remain major hurdles. The ongoing labor shortage is a pressing concern as the aviation sector continues to scale.

Opportunities

AI/Biometrics

The rise of AI and biometric technologies presents a major opportunity for the Japanese airport services market, as these innovations significantly improve operational efficiency and passenger experience. In 2024, more than 15 airports in Japan introduced biometric boarding processes, reducing passenger processing times by up to ~. These technologies enable smoother and faster check-ins, baggage handling, and boarding procedures, contributing to improved customer satisfaction. Airports like Haneda and Narita are at the forefront of implementing AI-driven technologies, positioning Japan as a leader in digital airport solutions. With the global shift towards contactless travel, these technologies will be pivotal in shaping the future of the airport services industry.

Smart Airports

Smart airport solutions are a growing opportunity within the Japan airport services market. The ongoing integration of IoT devices, AI, and automated systems is enhancing operational efficiency and passenger convenience. In 2024, Japan’s Narita Airport began expanding its use of smart technologies, such as self-service kiosks, mobile apps for real-time flight tracking, and predictive analytics for baggage handling. These technologies not only enhance the passenger experience but also streamline airport operations, reducing overhead costs and improving turnaround times. As Japan’s airports continue to embrace smart technology, it is expected that these innovations will drive significant improvements in airport service quality.

Future Outlook

Over the next decade, the Japan airport services market is expected to witness strong growth, with a projected CAGR of ~ from 2026 to 2035. This growth will be driven by advancements in airport technology, including the integration of AI and robotics to enhance operational efficiency and improve passenger experience. Furthermore, the expansion of e-commerce and air cargo services will continue to fuel demand for handling services. Investment in “smart airports,” with IoT-enabled solutions, will also drive the adoption of digital services. With government support in infrastructure modernization and a continued focus on sustainability, the market is poised for significant evolution.

Major Players

- Japan Airport Terminal Co.

- Swissport Japan

- dnata Japan

- Menzies Aviation Japan

- ANA Ground Service Company

- Tokyo International Air Terminal Services

- Osaka Airport Service Providers

- Kinki Nippon Tourist Airport Services

- Kawasaki Kisen Kaisha Airport Logistics

- Airbiz Co., Ltd.

- Japan Airport Ground Support Co.

- SATS Japan

- Haneda Robotics & Automation Ltd.

- NTT Facilities, Inc.

- JALUX Inc.

Key Target Audience

- Airlines

- Airport Authorities

- Cargo Operators

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Technology Providers

- Facility Management Companies

Research Methodology

Step 1: Identification of Key Variables

The first step in the research methodology involves mapping key stakeholders and variables that influence the Japan airport services market. This is achieved through comprehensive desk research using secondary and proprietary databases to understand industry dynamics such as passenger traffic, cargo volumes, and airport services.

Step 2: Market Analysis and Construction

This phase involves gathering and analyzing historical data to understand market trends, focusing on passenger and cargo handling volumes. Key metrics like service cost per passenger, per ton of cargo, and growth in digital services are evaluated.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated via direct consultations with industry experts, including government officials, airport service providers, and technology experts. This validation provides insights into market forecasts and future growth.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all collected data into comprehensive market insights, validating the findings with industry stakeholders to ensure accuracy and completeness in the market analysis.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

Passenger Tourism

Cargo E‑commerce Growth

Infrastructure Investment - Market Challenges

Operational Safety Compliance

Workforce Turnover - Opportunities

AI/Biometrics

Smart Airports

Non‑Aeronautical Revenue - Trends

Robotics

Sustainability

Contactless Services - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2020-2025

- By volume, 2020-2025

- By average price, 2020-2025

- By Service Type (In Value %)

Passenger Handling Services

Ground Handling Services

Baggage Handling Services

Cargo & Freight Handling Services

Ancillary Terminal Services - By Airport Type (In Value %)

International Airports

Major Domestic Airports

Regional Airports

Cargo‑Focused Airports - By Deployment Technology (In Value %)

Manual Service Delivery

Semi‑Automated Service

Fully Digital / AI‑Enabled Services

IoT Connected Operations - By End User (In Value %)

Airlines

Low‑Cost Carriers

International Cargo Operators

Airport Authorities

- Market Share of Major Players

- Cross Comparison Parameters (Service Coverage Index, Technology Adoption Score, Operational Performance, Customer Satisfaction Ratings, Regulatory Compliance Index)

- SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- Detailed Profiles of Major Players

Japan Airport Terminal Co., Ltd.

Swissport Japan

dnata Japan

Menzies Aviation Japan

JALUX Inc.

ANA Ground Service Company

NTT Facilities, Inc.

Tokyo International Air Terminal Services

Osaka Airport Service Providers

Kinki Nippon Tourist Airport Services

Kawasaki Kisen Kaisha Airport Logistics

Airbiz Co. Ltd.

Japan Airport Ground Support Co.

SATS Japan

Haneda Robotics & Automation Ltd.

- Service Cost Sensitivity

- Service Performance & Turn Time Expectations

- Passenger Experience Requirements

- Cargo Timeliness & Reliability Standards

- By Value, 2026-2035

- By volume, 2026-2035

- By average price, 2026-2035