Market Overview

The Japan airport snow removal vehicle and equipment market is a crucial segment within the broader airport infrastructure sector. The market size has seen steady growth due to Japan’s heavy snowfall regions, particularly in areas like Hokkaido and the northern part of Honshu. The increasing demand for efficient snow removal systems at both international and domestic airports has propelled the market forward. The key drivers of this market include stringent airport safety standards, the need for uninterrupted air traffic operations, and advancements in snow removal technologies. In 2024, the market reached a valuation of approximately USD ~, with projections for 2025 to reach approximately USD ~. The growth is primarily driven by infrastructure modernization at major airports and increasing investments in snow removal technologies.

Japan’s snow removal vehicle market is highly concentrated around airports in regions prone to heavy snowfall. Cities like Sapporo, Sendai, and Niigata, along with major airports like New Chitose Airport and Tokyo Narita, dominate the market. This dominance can be attributed to these regions’ heavy snowfall, which necessitates specialized snow removal vehicles and equipment. Additionally, airports in these regions face operational pressures to minimize flight delays caused by snow accumulation. The government’s proactive measures to maintain airport operations and safety, especially during peak winter months, have further contributed to the region’s dominance in the snow removal vehicle market.

Market Segmentation

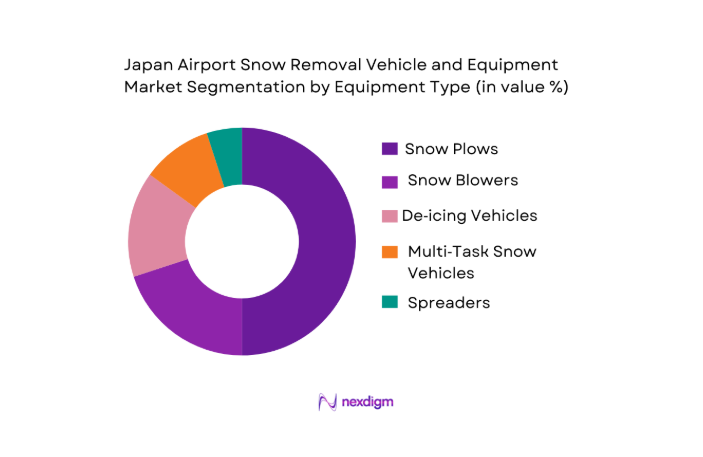

By Equipment Type

Japan’s airport snow removal vehicle market is segmented by equipment type into snow plows, rotary snow blowers, de‑icing vehicles, multi‑task snow removal vehicles, and spreaders. Snow plows have the largest market share, driven by their simplicity and essential function in maintaining runway and taxiway clearance during heavy snowfall. These vehicles are typically the first line of defense in snow removal operations. Rotary snow blowers, while less common, have seen increasing demand at airports with heavy snow accumulation, such as New Chitose Airport. De‑icing vehicles, often employed post-snow removal to prevent further snow and ice accumulation, dominate in airports with extreme temperatures.

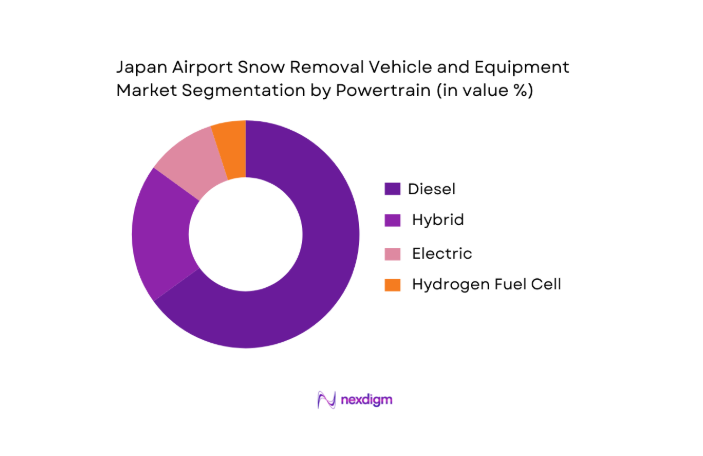

By Powertrain

The market for snow removal vehicles in Japan is further segmented based on powertrain type, including diesel, hybrid, electric, and hydrogen fuel-cell-powered vehicles. Diesel-powered vehicles still dominate the market, due to their robust performance and cost-effectiveness in snow removal. However, electric and hybrid vehicles are seeing increased adoption driven by Japan’s focus on sustainability and reducing carbon emissions, especially for environmental compliance at airports. Airports like Tokyo Narita and New Chitose are leading the transition to hybrid and electric snow removal vehicles as part of their green initiatives. Hydrogen fuel-cell-powered snow removal vehicles are still in the early stages of adoption but are expected to gain traction in the coming years as fuel cell technology becomes more cost-effective and available.

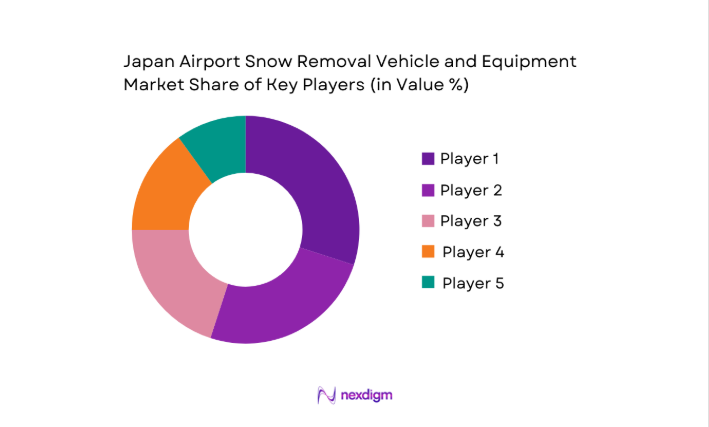

Competitive Landscape

The Japanese airport snow removal vehicle and equipment market is characterized by a highly competitive landscape, with both local and international players offering a wide range of snow removal solutions. The market is dominated by a few major players, including global manufacturers like Oshkosh, Aebi Schmidt, and Boschung. These companies provide a broad range of snow removal equipment with advanced features, such as enhanced snow clearing capacities, automation, and connectivity. Their market dominance is fueled by established relationships with airports, as well as their ability to provide after-sales services, maintenance, and spare parts support. Local Japanese manufacturers, such as Kato Works, also play a significant role, offering products that are tailored to the unique snow and weather conditions of Japan’s airports.

| Company | Establishment Year | Headquarters | Snow Clearing Capacity | Powertrain Options | Technology Integration | Maintenance Network | Key Airports Served | Market Focus |

| Oshkosh Corporation | 1917 | Wisconsin, USA | High | ~ | ~ | ~ | ~ | ~ |

| Aebi Schmidt Holding AG | 1993 | Switzerland | Medium | ~ | ~ | ~ | ~ | ~ |

| Boschung Group | 1945 | Switzerland | High | ~ | ~ | ~ | ~ | ~ |

| Kato Works | 1910 | Japan | High | ~ | ~ | ~ | ~ | ~ |

| Multihog Limited | 2005 | UK | Medium | ~ | ~ | ~ | ~ | ~ |

Japan Airport Snow Removal Vehicle and Equipment Market Analysis

Growth Drivers

Airport Expansion

Airport expansion plays a critical role in driving the demand for snow removal vehicles and equipment in Japan. The country is investing heavily in airport infrastructure, with a major focus on enhancing capacity to handle increasing air traffic. Japan’s Ministry of Land, Infrastructure, Transport, and Tourism (MLIT) has committed to a JPY 1 trillion investment plan to upgrade airport facilities between 2024 and 2026, which includes runway enhancements and the construction of new terminals. As Japan’s international flight traffic continues to grow, particularly post-pandemic, this will create a need for efficient snow removal equipment at both new and expanded airports. According to the International Civil Aviation Organization (ICAO), Japan’s airport traffic volume increased by ~ in 2024, and this trend is expected to continue as part of national plans to boost air traffic. Expanding airport infrastructure increases the demand for snow removal systems capable of handling larger areas and maintaining safe operations during the winter months.

Winter Operations Reliability

The need for winter operations reliability is a critical growth driver for the snow removal vehicle market in Japan. Severe winter weather conditions, particularly in the northern and mountainous regions, demand highly efficient snow management systems at airports. For example, New Chitose Airport in Hokkaido, known for its frequent and heavy snowfalls, reported over 10 meters of snow in the winter of 2024, which significantly impacted airport operations. Japan’s airports are highly dependent on snow removal vehicles to ensure continuous air traffic flow, avoiding flight delays. According to Japan’s Meteorological Agency, the national average snowfall is projected to rise by 5-8% due to shifting climatic patterns, creating increasing pressure on airport operators to maintain reliable snow removal operations. This reinforces the demand for modern, high-performance snow removal vehicles and associated technologies.

Market Challenges

Capital Intensity

The capital-intensive nature of snow removal equipment is one of the significant challenges for airports in Japan. Snow removal vehicles such as rotary snow blowers, multi-task platforms, and de-icing vehicles require substantial upfront investments, making it difficult for smaller airports to procure and maintain such fleets. A recent report from the Japanese Ministry of Finance noted that airport infrastructure spending was expected to reach JPY ~ in 2024, but a significant portion of these funds would be allocated to capital-intensive equipment and technology integration, such as snow removal vehicles. Furthermore, maintenance costs for these high-performance systems are also substantial, with average annual maintenance costs for major equipment types exceeding JPY 10 million per unit, which can strain airport budgets. These financial hurdles hinder the growth of snow removal vehicle fleets at regional airports, where budgets are more constrained.

OEM Supply Constraints

Original Equipment Manufacturer (OEM) supply constraints pose a challenge to the market as snow removal vehicle suppliers are facing production delays and logistics bottlenecks. This has been exacerbated by global supply chain disruptions and labor shortages in manufacturing plants. In 2024, Japan’s Ministry of Economy, Trade and Industry (METI) reported that ~ of manufacturing companies in Japan faced difficulties in securing necessary components for heavy machinery, including those used in airport snow removal vehicles. This has led to delays in fleet replacements and increases in lead times for procurement, especially for advanced vehicles like electric or hydrogen-powered snow removal units. OEMs are also struggling to meet demand for eco-friendly models, which require additional R&D investments and specialized components that are not readily available.

Market Opportunities

EV Adoption

The adoption of electric vehicles for airport snow removal operations is a growing opportunity within the market. Japan has set ambitious goals for reducing carbon emissions, with the government pledging to achieve net-zero emissions by 2050. The push towards electrification in transportation is fueling the transition to electric snow removal vehicles at airports. For example, Tokyo Narita and New Chitose Airports are actively incorporating electric snow removal equipment into their fleets to comply with environmental regulations. According to the Japanese Ministry of the Environment, the total number of electric vehicles in operation across the country is expected to rise by ~ in 2024 alone. This growing EV adoption is likely to accelerate as airports aim to meet sustainability goals while maintaining operational efficiency. Furthermore, the cost of electric snow removal equipment is expected to decline over the next few years as battery technology improves and economies of scale are realized.

Autonomous/Remote Operations

The increasing interest in autonomous and remote-controlled snow removal vehicles presents a significant growth opportunity for the market. Japan is at the forefront of automation in various sectors, including transportation and machinery. Airports are increasingly adopting remote-operated snow clearing vehicles to reduce human labor costs and improve the efficiency of snow removal during harsh weather conditions. The Japanese government’s “Society 5.0” initiative, which promotes the integration of advanced technologies like automation and AI in infrastructure management, is expected to accelerate the adoption of autonomous snow removal vehicles at airports. In 2025, the Japanese Ministry of Internal Affairs and Communications reported that ~ of Japan’s airports are planning to introduce AI-powered snow removal technologies by 2026, further emphasizing the potential for this segment to drive market growth.

Future Outlook

Over the next 5 years, the Japan airport snow removal vehicle and equipment market is expected to experience significant growth driven by technological advancements, growing sustainability initiatives, and increased government support for airport infrastructure modernization. The trend towards electrification and hybrid powertrain solutions will likely become more pronounced, as Japan focuses on reducing carbon emissions and increasing fuel efficiency. Furthermore, the demand for more efficient and environmentally friendly snow removal equipment will be propelled by airport operators striving to comply with stricter environmental regulations and improve operational efficiency during winter months.

Major Players

- Oshkosh Corporation

- Aebi Schmidt Holding AG

- Boschung Group

- Kato Works

- Multihog Limited

- Alamo Group Inc.

- Dulevo International S.p.A.

- Terex Corporation

- SnowEx

- John Deere

- Kodiak America LLC

- Team Eagle Ltd.

- Harsco Corporation

- Cormac Engineering Ltd.

- Ziegler CAT

Key Target Audience

- Airport Operators

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Snow Removal Equipment OEMs

- Airport Maintenance Service Providers

- Public Infrastructure Development Agencies

- Private Aviation Operators

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Japan airport snow removal vehicle market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data will be compiled and analyzed, particularly focusing on the penetration rates of snow removal vehicles across airports in Japan. This will include assessing the ratio of existing fleets to annual procurement figures, as well as understanding the influence of technological upgrades on demand for newer vehicles.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through consultations with industry experts from major manufacturers, airport authorities, and maintenance service providers. These consultations will provide valuable insights into emerging trends and challenges faced by stakeholders, which will help refine the market data.

Step 4: Research Synthesis and Final Output

In the final phase, engagement with key airport operators and snow removal vehicle manufacturers will ensure the data’s accuracy. Direct feedback from industry participants, including fleet managers and procurement officers, will validate the research findings, ensuring a well-rounded market analysis.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

airport expansion

winter operations reliability

technology upgrades - Market Challenges

capital intensity

OEM supply constraints - Market Opportunities

EV adoption

autonomous/remote operations - Market Trends

digital/IoT telematics

predictive weather response - Government Policies & Aviation Safety Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2020-2025

- By volume, 2020-2025

- By average price, 2020-2025

- By Equipment Type (In Value %)

Snow Plows

Rotary Snow Blowers

De‑icing/Sprayers - By Powertrain (In Value %)

Diesel

Hybrid

Electric / Battery‑Powered - By Airport Category (In Value %)

Tier‑1 International Airports

Major Domestic Airports

Regional Airports

Military / Cargo Airports - By Procurement Mode (In Value %)

CAPEX

Leasing

Managed Service Contracts - By End‑Use Operational Function (In Value %)

Runway Clearing

Taxiway Clearing

Apron Maintenance

- Market Share of Major Players

- Cross‑Comparison Parameters (Snow Clearing Capacity, Typical Runway Throughput Efficiency, Fuel/Power Source Type Share, Telematics & Connectivity Features, Maintenance & Spare Parts Network Coverage, Warranty & Service Level Agreements)

- SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- Detailed Profiles of Key Players

Oshkosh Corporation

Aebi Schmidt Holding AG

Boschung Group

Alamo Group Inc.

Dulevo International S.p.A.

Terex Corporation

SnowEx

John Deere

Multihog Limited

Kodiak America LLC

Team Eagle Ltd.

Harsco Corporation

Cormac Engineering Ltd.

Kato Works Co., Ltd.

Ziegler CAT - Japan Market Future

- Procurement Drivers at Airports

- Fleet Replacement Cycles

- Operational Performance Metrics

- Compliance & Safety Standards

- By Value, 2026-2035

- By volume, 2026-2035

- By average price, 2026-2035