Market Overview

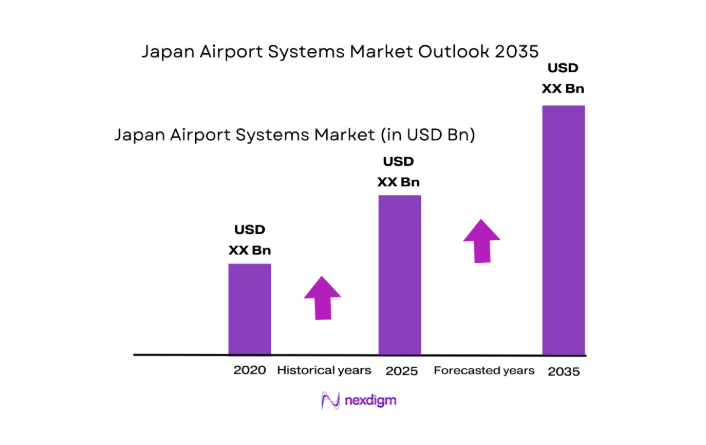

The Japan Airport Systems market is valued at approximately USD ~ in 2025, driven by an increase in both domestic and international passenger traffic, advancements in automation, and government initiatives to modernize airport infrastructure. Key technological upgrades, including biometric systems, automated baggage handling, and air traffic management solutions, are propelling this market’s growth. Additionally, the demand for enhanced passenger experience and improved operational efficiency is further contributing to this expanding market size. Investment from both private and public sectors is expected to continue fueling these trends in the coming years.

Japan’s airport systems market is primarily dominated by major hubs such as Tokyo (Haneda and Narita airports), Osaka (Kansai Airport), and Fukuoka. These airports have a significant share in both domestic and international air traffic, particularly with increasing tourism and business travel. The dominance of these cities is largely due to Japan’s central role in Asia’s transportation network, their advanced technological infrastructure, and strong government support for airport modernization. Furthermore, these airports lead in implementing innovative systems for baggage handling, security, and air traffic management.

Market Segmentation

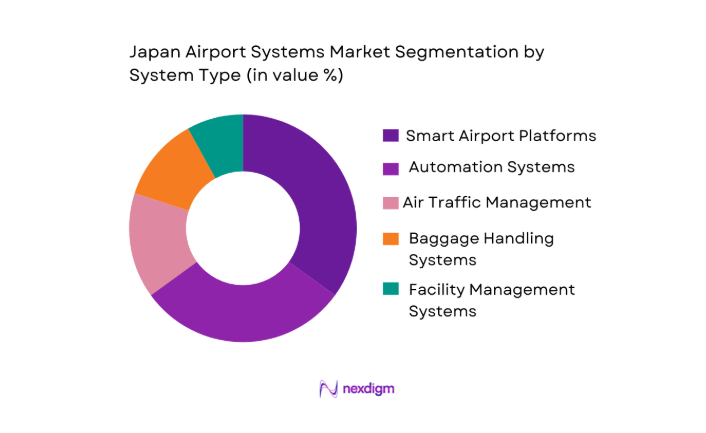

By System Type

The Japan Airport Systems market is segmented by system type into smart airport platforms, automation systems, air traffic management (ATM), baggage handling systems (BHS), and facility management systems. Recently, smart airport platforms have dominated the market, driven by the increasing demand for seamless passenger experiences, operational efficiency, and real-time data analytics. These platforms integrate various technologies, such as AI, IoT, and biometrics, to enhance security, streamline passenger flows, and optimize airport operations. Key players like Siemens and Vanderlande are leading this segment with innovations in integrated platforms.

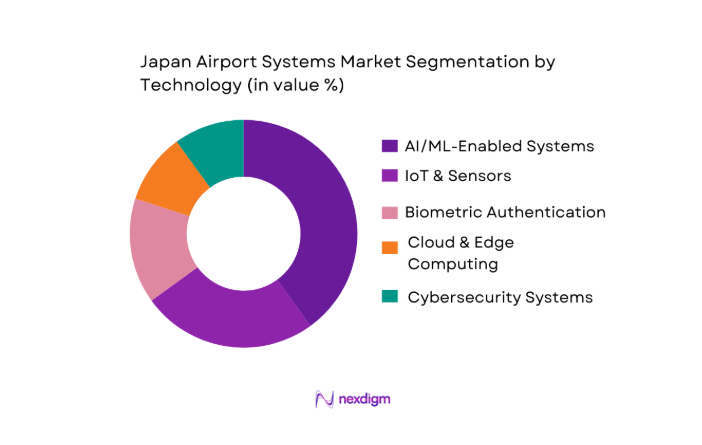

By Technology

In terms of technology, the market is divided into AI/ML-enabled systems, IoT & sensors, biometric authentication, cloud & edge computing, and cybersecurity systems. AI/ML-enabled systems are dominating the market, primarily due to their ability to optimize operations through predictive analytics and automation. The increasing deployment of AI for predictive maintenance, passenger flow management, and air traffic optimization has made AI-driven solutions integral to modern airports. Major players, including Honeywell and Thales, are pushing the adoption of AI in their airport system solutions.

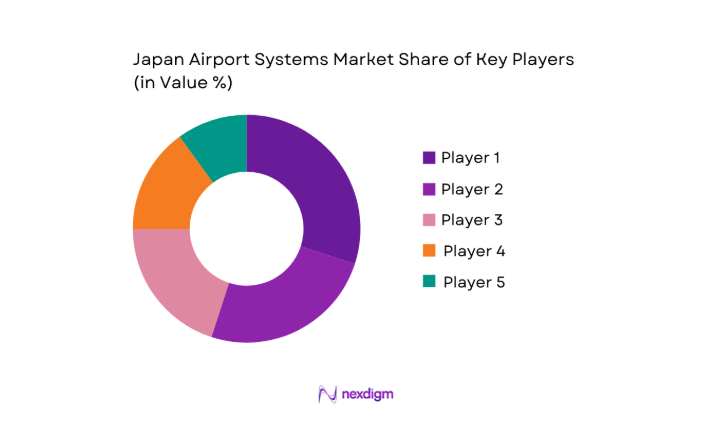

Competitive Landscape

The Japan Airport Systems market is dominated by a mix of global players and local manufacturers, with major companies such as Siemens, Vanderlande, and Honeywell leading the charge. These companies specialize in providing advanced technology solutions, including baggage handling systems, air traffic management systems, and smart airport solutions. The market is also witnessing strong competition from local Japanese firms such as Daifuku, which offers innovative material handling and automation solutions.

| Company Name | Establishment Year | Headquarters | Product Offering | Market Focus | Technological Capabilities | Strategic Partnerships |

| Siemens AG | 1847 | Germany | ~ | ~ | ~ | ~ |

| Vanderlande Industries | 1949 | Netherlands | ~ | ~ | ~ | ~ |

| Honeywell International | 1906 | USA | ~ | ~ | ~ | ~ |

| Thales S.A. | 2000 | France | ~ | ~ | ~ | ~ |

| Daifuku Co. Ltd. | 1937 | Japan | ~ | ~ | ~ | ~ |

Japan Airport Systems Market Analysis

Growth Drivers

Rising Inbound/Outbound Passenger Flows

Japan’s international passenger traffic continues to grow, driven by the country’s central role in Asia’s transportation and tourism networks. In 2025, Japan is expected to host over ~ international passengers, up from ~ in 2024. This increase in travel demand is supported by Japan’s robust tourism sector, which is forecasted to recover post-pandemic, contributing significantly to the country’s economy. Japan’s airports, particularly in Tokyo, Osaka, and Fukuoka, are experiencing increased traffic volumes as international travel resumes. In addition, the growth of the Asia-Pacific aviation market is projected to fuel this trend further, with the number of passengers expected to increase by 4.6% annually in the region.

National Smart Airport Initiatives & MLIT Support

Japan’s government has made significant strides in developing “smart airports” under national infrastructure initiatives. The Ministry of Land, Infrastructure, Transport and Tourism (MLIT) has committed to modernizing airports with high-tech solutions, including biometric systems, automated baggage handling, and AI-driven passenger flow management. Japan’s smart airport initiative aims to enhance efficiency and the passenger experience. In 2024, MLIT will continue its funding program for the adoption of digital technologies in airports, focusing on operational optimization and enhancing cybersecurity measures. With the country’s goal of maintaining a competitive edge in global aviation, the Japanese government is investing heavily in airport modernization, aligning with Japan’s increasing role in the global aviation market.

Market Challenges

High CAPEX vs. ROI Baseline

Despite the growing demand for advanced airport technologies, the market faces challenges related to high capital expenditure (CAPEX) and a relatively slow return on investment (ROI) for new infrastructure projects. In 2024, airport system investments are projected to be around USD ~ in Japan, but the ROI for these systems takes several years to materialize. With many projects requiring significant upfront costs for automation, baggage systems, and air traffic management technologies, airports must balance their financial capacity with long-term returns. The high costs associated with implementing new systems such as AI-driven predictive analytics or automated baggage handling pose a challenge for airport authorities that are already dealing with strained budgets and limited resources.

Complex Legacy Integration

The integration of new technologies with legacy systems is a complex and costly challenge for Japan’s airports. Many of the country’s major airports still operate on decades-old infrastructure, which was not designed to support modern, automated solutions. In 2025, nearly ~ of Japan’s major airports are still utilizing outdated air traffic management systems and baggage handling equipment, which causes inefficiencies and delays when integrating newer technologies. This complex legacy integration process often requires significant investments in retrofitting existing systems to be compatible with new automation solutions. Airports must tackle these issues to ensure that they remain competitive and provide efficient services in the face of increasing passenger demands.

Market Opportunities

AI-Driven Operational Predictive Analytics

The growing demand for operational efficiency in Japan’s airports has created an opportunity for AI-driven predictive analytics systems. In 2025, the Japanese government is expanding the use of AI in airports to enhance decision-making in areas such as air traffic management, baggage tracking, and passenger flow optimization. Currently, over ~ of Japan’s major airports have begun integrating AI-driven systems that predict equipment failures, optimize flight scheduling, and streamline resource allocation. As air traffic continues to grow, AI systems are seen as essential for reducing delays, enhancing safety, and improving the passenger experience.

Next-Gen Baggage Traceability & RFID Adoption

With the increase in air travel, the need for efficient baggage handling has never been more pressing. Japan’s airports are expected to heavily invest in next-generation baggage handling systems, such as RFID-based traceability solutions. In 2025, the country is expected to install over 5,000 RFID tags across its major airports to track luggage in real time, ensuring quicker and more accurate baggage delivery. This technology not only helps in reducing baggage mismanagement but also plays a crucial role in improving passenger satisfaction. As international standards for baggage handling continue to evolve, Japan’s airports are keen on adopting cutting-edge systems to stay ahead of the curve in baggage management.

Future Outlook

Over the next 5 years, the Japan Airport Systems market is expected to show significant growth. Factors such as continued government investments in smart infrastructure, technological advancements in automation, and increasing passenger traffic will drive the market. Innovations in AI, IoT, and biometric technologies will play a key role in enhancing airport operations, improving passenger experience, and meeting regulatory compliance standards. Additionally, the integration of sustainable technologies and solutions to reduce carbon emissions will gain traction as the market evolves.

Major Players

- Siemens AG

- Vanderlande Industries

- Honeywell International

- Thales S.A.

- Daifuku Co. Ltd.

- Interroll Group

- BEUMER Group

- Pteris Global

- Fives Group

- Frequentis AG

- Leonardo S.p.A.

- NTT Data / NTT Facilities

- Japan Airport Terminal Co., Ltd.

- Civil Aviation Logistics Technology

- Airbus SE

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Airport Authorities

- Airlines

- Ground Handling Operators

- Airport Equipment Manufacturers

- System Integrators

- Technology Solution Providers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves creating a comprehensive ecosystem map, including airport authorities, technology providers, regulatory bodies, and end-users such as airlines and ground handling services. The key variables influencing the Japan Airport Systems market include technological adoption, regulatory policies, and passenger demand growth.

Step 2: Market Analysis and Construction

In this phase, historical data regarding system installations, technology advancements, and operational efficiencies at major airports will be compiled and analyzed. Market penetration for each technology and system type will be examined to forecast trends.

Step 3: Hypothesis Validation and Expert Consultation

To validate market hypotheses, we will conduct interviews with industry experts, including airport operators, system manufacturers, and government representatives. This will help gather insights into operational practices, technology integration challenges, and strategic priorities for key stakeholders.

Step 4: Research Synthesis and Final Output

The final output involves synthesizing findings from both primary and secondary data sources to construct a holistic view of the market. A deep dive into product and system adoption trends will provide actionable insights into the growth and future opportunities in the Japan Airport Systems market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and scope

- Market dynamics

- Historical overview

- Timeline

- Growth drivers

Rising inbound/outbound passenger flows

National smart airport initiatives & MLIT support

Automation & labour optimization - Market challenges

High CAPEX vs. ROI baseline

Complex legacy integration

Regulatory compliance complexity - Opportunities

AI‑driven operational predictive analytics

Next‑gen baggage traceability & RFID adoption

Integrated ATM modernization - Trends

Contact‑less solutions & biometrics

Sustainability‑oriented systems - Government regulations

- SWOT analysis

- Porter’s 5 Forces

- By Value, 2020-2025

- By Volume , 2020-2025

- By Average Price, 2020-2025

- By System Type (In Value %)

Smart Airport Platforms

Airport Automation Systems

Air Traffic Management - By Technology Stack (In Value %)

AI/ML Enabled Systems

IoT & Sensors

Biometric Authentication

Cloud & Edge Platforms

Cybersecurity & Data Protection - By Deployment Mode (In Value %)

Greenfield Implementation

Retrofit & Modernization

Managed Services / Outsourced O&M - By Airport Class (In Value %)

Tier‑1 International Hubs

Tier‑2 Regional Airports

Tier‑3 Local Airfields - By End‑User (In Value %)

Airport Authorities

Airlines & Ground Handlers

Government & Regulatory Bodies

Third‑Party Service Providers

- Market share of major players

- Cross comparison parameters (System reliability, Integration readiness, Technology differentiation, Certification & Compliance footprint, Service & Support footprint, Cost per throughput unit)

- SWOT analysis of key players

- Pricing analysis of major players

- Detailed profile of major players

Siemens AG

Vanderlande Industries NV

Interroll Group

BEUMER Group

Daifuku Co., Ltd.

Pteris Global

Fives Group

Thales S.A.

Honeywell Intl Inc.

Frequentis AG

Leonardo S.p.A.

NTT Data / NTT Facilities

Japan Airport Terminal Co., Ltd.

Civil Aviation Logistics Technology

Airbus SE

- Operational KPIs influencing decisions

- Cost factors affecting procurement

- Compliance & certification ecosystem

- Service Level Agreements & performance guarantees

- By Value, 2026-2035

- By Volume, 2026-2035

- By Average Price, 2026-2035