Market Overview

The Japan airport terminal operations market, valued at approximately USD ~ in 2025, is primarily driven by the significant growth in air travel, passenger spending, and advancements in airport technology. Japan’s airports, particularly Tokyo Haneda, Narita, and Kansai, continue to experience steady increases in passenger traffic, supported by the country’s status as a major international travel hub in Asia. The adoption of digital solutions like biometric check-ins, automated baggage handling, and self-service kiosks further enhances operational efficiency, contributing to market growth. Additionally, non-aeronautical revenue from retail, food and beverage services, and parking has become a major income generator, boosting the overall market size.

Japan dominates the airport terminal operations market, with Tokyo (Haneda and Narita) and Osaka (Kansai) being the key contributors. Tokyo remains a major international aviation gateway, with Haneda being one of the busiest airports globally in terms of passenger traffic, serving both domestic and international routes. The ongoing expansion and modernization of terminals, including the introduction of new technologies, solidify Japan’s dominance in this sector. The country’s continuous investment in infrastructure development, smart terminal projects, and airspace modernization keeps Japan at the forefront of global airport terminal operations.

Market Segmentation

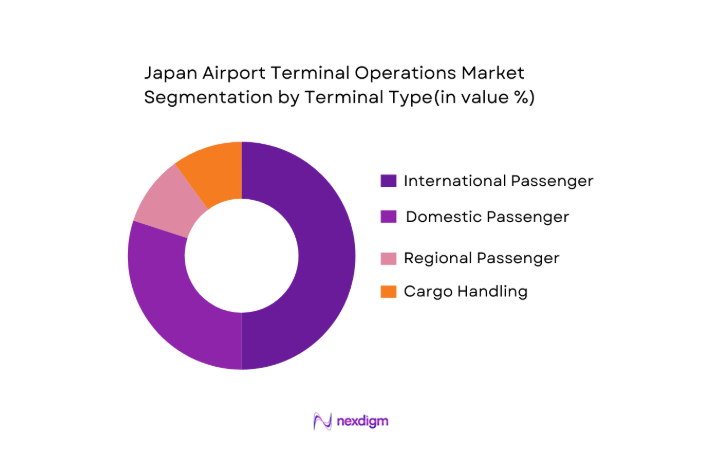

By Terminal Type

The Japanese airport terminal operations market is segmented by terminal type, including international passenger terminals, domestic passenger terminals, regional terminals, and cargo handling terminals. Among these, international passenger terminals dominate the market, largely due to the international hub status of airports like Tokyo Narita and Haneda. These terminals not only handle substantial passenger volumes but also boast advanced services that cater to a global audience, such as automated check-ins and duty-free shopping. The continuous development and expansion of international terminals to accommodate increasing global air travel have contributed to their dominance.

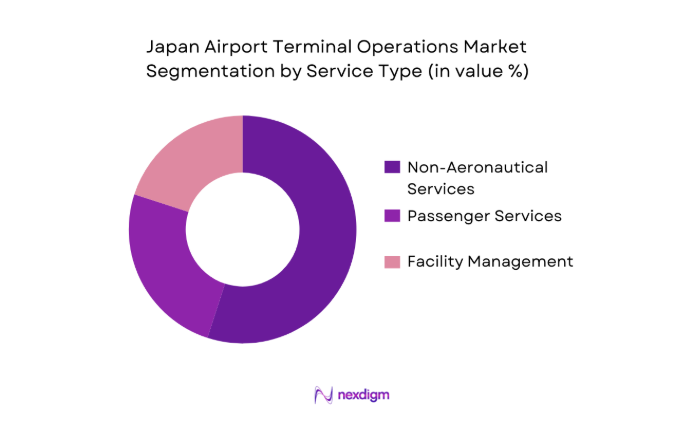

By Service Type

The Japanese airport terminal operations market is further divided by service type, which includes passenger services, non-aeronautical services, and facility management services. Non-aeronautical services lead the market in terms of revenue contribution, driven by the high demand for retail, food, and beverage services at major terminals. The integration of smart retail experiences, premium lounges, and an overall shift towards enhancing passenger experiences has positioned non-aeronautical services as the dominant segment. Furthermore, airports in Japan are investing in advanced technology to support and enhance these services, ensuring a seamless passenger experience that drives growth in this segment.

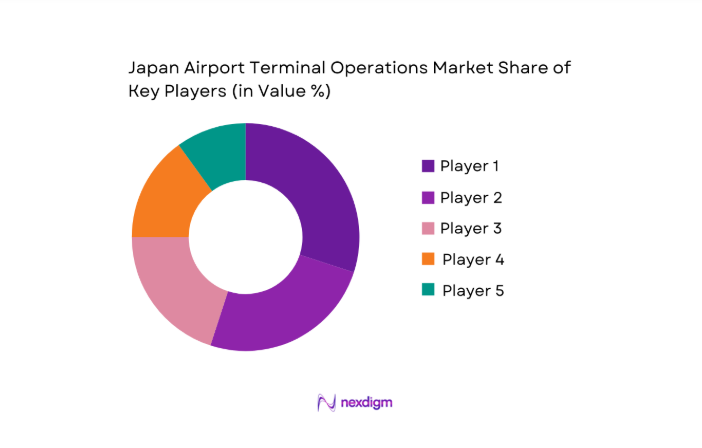

Competitive Landscape

The Japanese airport terminal operations market is characterized by the dominance of both public and private players, with a few major companies overseeing the operations of key terminals. These include Japan Airport Terminal Co. Ltd., Kansai Airports, Narita International Airport Corp., and Fukuoka Airport Terminal Co. The competition in this market revolves around increasing passenger throughput, adopting technological advancements, and maximizing revenue from non-aeronautical services.

The market landscape has seen consolidation in recent years, with companies focusing on infrastructure upgrades, service improvements, and sustainable airport operations. The significant market share held by these companies is attributed to their ability to leverage advanced technologies like biometrics and automated check-in systems, enhancing operational efficiency and passenger satisfaction.

| Player Name | Establishment Year | Headquarters | Annual Revenue (USD) | Key Services | Market Share Focus |

| Japan Airport Terminal Co., Ltd. | 1992 | Tokyo | ~ | ~ | ~ |

| Kansai Airports | 2006 | Osaka | ~ | ~ | ~ |

| Narita International Airport Corp. | 2004 | Narita | ~ | ~ | ~ |

| Fukuoka Airport Terminal Co. | 1998 | Fukuoka | ~ | ~ | ~ |

| Chubu Centrair International Airport | 2004 | Nagoya | ~ | ~ | ~ |

Japan Airport Terminal Operations Market Analysis

Growth Drivers

Passenger Traffic Demand

The passenger traffic demand in Japan has been increasing steadily, with air traffic recovery following the pandemic. As of 2024, Japan’s major airports like Haneda and Narita are projected to handle around ~ international passengers, reflecting the steady recovery of the aviation industry post-pandemic. Japan’s robust economy, a major hub for international business, and its global tourism appeal contribute to this demand. Additionally, Japan’s stable economic growth, with a GDP forecast of USD ~ in 2025 (IMF), continues to drive higher air travel volumes, boosting the need for efficient terminal operations.

International Tourism Policy

Japan’s international tourism policy has been playing a crucial role in increasing passenger numbers, driven by the government’s efforts to promote inbound tourism. In 2024, Japan is expected to welcome around 30 million international visitors, a substantial rebound from previous years. Government initiatives like the “Visit Japan” campaign, aimed at increasing tourism by streamlining visa processes and promoting cultural heritage, are key factors in driving this growth. This policy contributes directly to the rising demand for airport services, as increased tourist traffic leads to higher terminal throughput.

Market Challenges

Capacity Constraints

Capacity constraints are becoming a significant challenge for Japanese airports. As passenger traffic continues to grow, airports like Narita and Haneda are struggling to expand terminal capacity. Despite ongoing efforts to modernize facilities, both airports have reached near maximum passenger capacity. In 2025, Tokyo’s Narita airport is expected to handle over ~ passengers, surpassing its designed capacity. This growing congestion, particularly during peak seasons, has made it difficult to provide efficient services, resulting in longer wait times and slower turnaround times for aircraft. The lack of available land for expansion around major airports exacerbates this challenge.

High Operational Costs

Japan’s airport operations face increasing costs due to inflation and rising energy prices. In 2025, operational costs for major airports such as Haneda and Narita are expected to increase by ~ compared to previous years, driven primarily by the cost of energy, staffing, and maintenance. With Japan’s energy costs rising by ~ in 2025 (World Bank), these cost pressures are passed on to airport operators. Additionally, airports must invest heavily in technology and sustainability initiatives, increasing the overall operational expenditure. These rising costs are a significant challenge, particularly for smaller regional airports.

Opportunities

Smart Terminal Technology

Japan’s airports are increasingly embracing smart technologies to streamline operations, improve passenger experience, and reduce operational costs. In 2025, major airports such as Haneda and Narita are adopting biometrics for passenger identification and automated baggage handling systems, significantly improving throughput and reducing human error. The global shift towards smart terminals, which enhances both operational efficiency and customer experience, presents an opportunity for continued growth in the Japanese market. The demand for these technologies is expected to increase, with Japan continuing to lead the way in adopting cutting-edge solutions such as AI-powered systems and IoT-enabled terminals.

Retail Monetization

The rise in non-aeronautical revenue, especially from retail services, presents a significant opportunity for Japan’s airport terminal operations market. Retail and food and beverage outlets in airports like Haneda have seen increasing revenues, with projections indicating retail revenues will grow significantly in the coming years. The surge in international travelers, coupled with a shift towards premium shopping experiences, has enhanced the potential for retail monetization in airport terminals. In 2024, retail spaces at major Japanese airports are projected to generate over USD ~ in non-aeronautical revenue, showcasing the substantial opportunity for expansion in this segment.

Future Outlook

Over the next decade, Japan’s airport terminal operations market is poised for significant growth driven by the rise in international tourism, increasing air passenger traffic, and the ongoing modernization of terminals. The integration of smart technology, including biometric identification, automation of baggage handling, and the use of AI for airport management, is expected to reshape the market. Additionally, the government’s continued investments in infrastructure and the implementation of sustainability measures will foster a more efficient and eco-friendly environment for terminal operations, enhancing the passenger experience.

Major Players

- Japan Airport Terminal Co., Ltd.

- Kansai Airports

- Narita International Airport Corp.

- Fukuoka Airport Terminal Co.

- Chubu Centrair International Airport

- New Chitose Airport Terminal

- Naha Airport Terminal Services

- Kobe Airport Terminal Operations

- Japan Airport Ground Support

- ANA Airport Services

- JAL Airport Services

- Swissport Japan

- dnata Japan

- Menzies Aviation Japan

- Local Retail Concession Network

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Airport Operators

- Airline Companies

- Technology Providers

- Retailers and Concessions Operators

- Logistics and Cargo Companies

- Sustainability and Environmental Agencies

Research Methodology

Step 1: Identification of Key Variables

In this phase, key stakeholders within Japan’s airport terminal operations market are identified, with a focus on major airport operators, government bodies, and technology providers. Secondary research is conducted to understand the overall market dynamics, passenger trends, and technological innovations shaping the industry.

Step 2: Market Analysis and Construction

We analyze historical data on passenger growth, terminal development, and technological adoption across major Japanese airports. This involves evaluating both aeronautical and non-aeronautical revenue streams and understanding their contribution to the market’s size.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding future market growth and trends are validated by engaging with industry experts through interviews and discussions. Insights from key players like airport operators, technology providers, and regulatory bodies help refine our understanding of the market.

Step 4: Research Synthesis and Final Output

Final insights are synthesized from both primary and secondary sources. We then compile a detailed market forecast, including the projected growth in terminal operations, non-aeronautical revenues, and the adoption of new technologies.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

Passenger Traffic Demand

International Tourism Policy

Airport Expansion Projects - Market Challenges

Capacity Constraints

High Operational Costs

Labor Shortages - Opportunities

Smart Terminal Tech

Retail Monetization

Sustainability Initiatives - Industry Trends

IoT Integration

Biometric Boarding

Contactless Experience - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2020-2025

- By volume, 2020-2025

- By average price, 2020-2025

- By Terminal Type (In Value %)

International Passenger Terminals

Domestic Passenger Terminals

Regional / Secondary Terminal Operations - By Service Vertical (In Value %)

Passenger Services

Non‑Aeronautical Services

Facility & Infrastructure Management - By Revenue Stream (In Value %)

Aeronautical

Non‑Aeronautical

Digital & Data Services - By Technology Adoption Stage (In Value %)

Legacy Operations

Digitally Augmented Terminals

Smart Airport Terminal Ecosystems - By Geographic Region (In Value %)

Greater Tokyo

Kansai Complex

Northern Japan

- Market Share of Major Players

- Cross Comparison Parameters (Terminal Operational Yield per Passenger, Terminal Capacity Utilization Rate, Smart Ops Adoption Level, Non‑Aeronautical Revenue Penetration, Passenger Satisfaction & NPS)

- SWOT Analysis of Key Players

- Pricing & Fee Structure Analysis Across Major Operators

- Detailed Profiles of Major Players

Japan Airport Terminal Co., Ltd.

Kansai Airports

Narita International Airport Corp.

Fukuoka Airport Terminal Co.

Chubu Centrair Terminal Services

New Chitose Airport Terminal

Naha Airport Terminal Services

Kobe Airport Terminal Operations

Japan Airport Ground Support

ANA Airport Services

JAL Airport Services

Swissport Japan

dnata Japan

Menzies Aviation Japan

Local Retail Concession Network

- Passenger Experience & Satisfaction Scores

- Airline Partnership & Slot Allocation Impact

- Retail & Ancillary Spend per Passenger

- Terminal Infrastructure Reliability & Operational KPIs

- By Value, 2026-2035

- By volume, 2026-2035

- By average price, 2026-2035